考ACCA难度大吗?

发布时间:2020-03-07

ACCA属于国际性会计师组织,受到世界上多个国家的认可。因此,一些ACCA学员都将ACCA会员证书作为进入“四大”的敲门砖。如此高的含金量,自然是吸引了不少人的目光,其中部分小伙伴在心动之余也在担心考试难度会很大。鉴于此,51题库考试学习网在下面为大家带来有关2020年ACCA考试难度的相关情况,以供参考。

总的来说,ACCA考试难度很大程度上是来自于英语和坚持,学员在英语过关的情况下,一般平时认真看书,做题还是很容易通过的。根据相关数据显示,ACCA全球单科通过率基本在30-40%左右,中国学员通过率为50-60%。单从通过率来看,ACCA考试难度并不算太高。

或许通过率不能说明什么,我们以英国大学学位考试的难度为标准来分析ACCA考试难度。具体而言,第一、第二部分的难度分别相当于学士学位高年级课程的考试难度,第三部分的考试相当于硕士学位最后阶段的考试。从这里来看,ACCA考试难度实际上并不算低。

从内容上来说,第一部分的每门考试只是测试本门课程所包含的知识,主要是为了给后两个部分中实务性的课程所要运用的理论和技能打下基础。因此,第一部分考试虽然难度不算高,但是很重要。

而第二部分的考试除了本门课程的内容之外,还会考到第一部分的一些知识,着重培养学生的分析能力。这一部分的考生已经脱离单纯的知识学习,进入能力培养阶段。

最后一部分的考试要求学生综合运用学到的知识、技能和决断力。不仅会考到以前的课程内容,还会考到邻近科目的内容。这就需要考生能够灵活掌握所有课程的内容,成为能力全面的高级财务管理人才。

以上就是关于ACCA考试难度的相关情况。51题库考试学习网提醒:ACCA考试难度是循序渐进的,基础打得越牢固,最后的考试就越轻松,因此小伙伴们要脚踏实地的去学习哦。最后,51题库考试学习网预祝准备参加2020年ACCA考试的小伙伴都能顺利通过。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

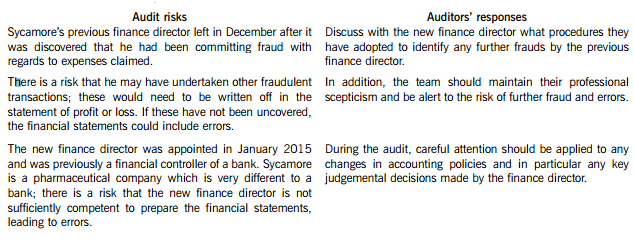

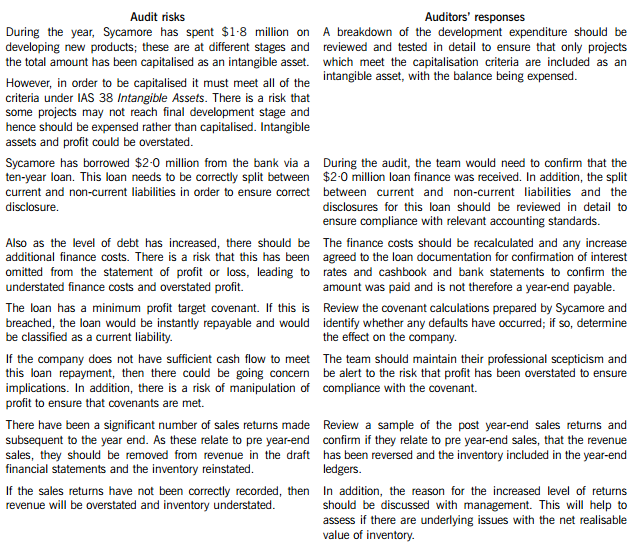

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

(ii) ‘job description’. (4 marks)

(ii) On the other hand, the job description is based on information gathered from a job analysis and defines the position and role

that has to be fulfilled. It is a statement of the component tasks, duties, objectives and standards. It describes the purpose

and relationships of the specific job together with the physical, social and economic factors which affect it. Fundamentally, it

describes the job to be done.

(ii) Explain why the disclosure of voluntary information in annual reports can enhance the company’s

accountability to equity investors. (4 marks)

(ii) Accountability to equity investors

Voluntary disclosures are an effective way of redressing the information asymmetry that exists between management and

investors. In adding to mandatory content, voluntary disclosures give a fuller picture of the state of the company.

More information helps investors decide whether the company matches their risk, strategic and ethical criteria, and

expectations.

Makes the annual report more forward looking (predictive) whereas the majority of the numerical content is backward

facing on what has been.

Helps transparency in communicating more fully thereby better meeting the agency accountability to investors,

particularly shareholders.

There is a considerable amount of qualitative information that cannot be conveyed using statutory numbers (such as

strategy, ethical content, social reporting, etc).

Voluntary disclosure gives a more rounded and more complete view of the company, its activities, strategies, purposes

and values.

Voluntary disclosure enables the company to address specific shareholder concerns as they arise (such as responding

to negative publicity).

[Tutorial note: other valid points will attract marks]

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-03-07

- 2020-01-09

- 2019-03-23

- 2020-01-09

- 2020-03-19

- 2020-01-31

- 2020-02-29

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-05-07

- 2020-05-20

- 2020-08-15

- 2020-03-07

- 2020-01-10

- 2020-02-11

- 2020-01-10

- 2021-05-14

- 2020-03-05

- 2020-01-10

- 2020-01-09

- 2020-03-22

- 2020-03-04

- 2021-09-12

- 2020-01-09

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-04-24

- 2020-01-10