如何挑选ACCA培训班呢?

发布时间:2021-03-29

如何挑选ACCA培训班呢?

最佳答案

培训机构的服务质量和水平。比如,有没有承诺不到位的,有没有随便更改时间却不通知学员的,有没有很多信息都不跟学员沟通的,封锁学员和外界接触渠道的等等,都属于服务质量低劣的表现。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(c) Software Supply Co. (4 marks)

(c) Software Supply Co

Here it seems that Smith & Co has referred the provision of bespoke accounting software to an external provider – Software

Supply Co, and that a commission is being paid to Smith & Co for these referrals. It is common for audit firms to recommend

other providers to their audit clients.

This could be perceived as an objectivity and self-interest threat, as the audit firm is benefiting financially through

recommending clients to a particular provider of goods and services. However, if appropriate safeguards are in place, the

referrals and receipt of commissions can continue.

Action to be taken:

– Verification from all personnel involved with the audit of clients to whom Software Supply Co has provided a service that

they have no financial or personal interest in Software Supply Co.

– Smith & Co must ensure that:

For each client where a referral is made, full disclosure has been made to the client regarding the arrangement

Written acknowledgement that Smith & Co is to receive a referral fee should be obtained from the client.

– Procedures must be put into place to monitor the quality of goods and services provided by Software Supply Co to audit

clients.

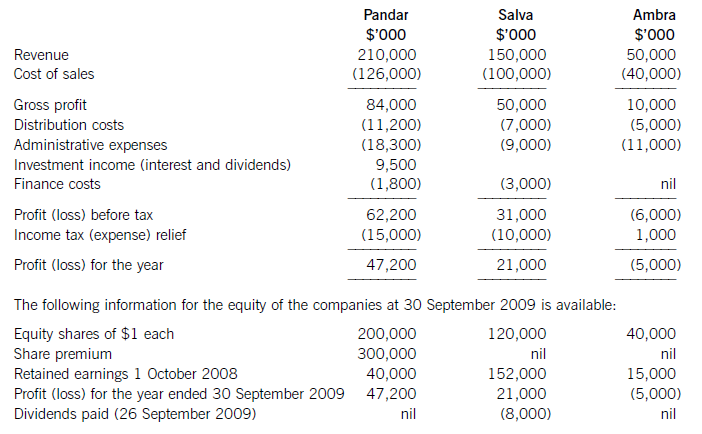

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

The following information is relevant for questions 9 and 10

A company’s draft financial statements for 2005 showed a profit of $630,000. However, the trial balance did not agree,

and a suspense account appeared in the company’s draft balance sheet.

Subsequent checking revealed the following errors:

(1) The cost of an item of plant $48,000 had been entered in the cash book and in the plant account as $4,800.

Depreciation at the rate of 10% per year ($480) had been charged.

(2) Bank charges of $440 appeared in the bank statement in December 2005 but had not been entered in the

company’s records.

(3) One of the directors of the company paid $800 due to a supplier in the company’s payables ledger by a personal

cheque. The bookkeeper recorded a debit in the supplier’s ledger account but did not complete the double entry

for the transaction. (The company does not maintain a payables ledger control account).

(4) The payments side of the cash book had been understated by $10,000.

9 Which of the above items would require an entry to the suspense account in correcting them?

A All four items

B 3 and 4 only

C 2 and 3 only

D 1, 2 and 4 only

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-02-15

- 2021-05-09

- 2021-03-12

- 2021-03-10

- 2021-06-28

- 2021-04-15

- 2021-04-21

- 2021-06-12

- 2021-03-11

- 2021-06-02

- 2021-03-11

- 2021-06-16

- 2021-05-13

- 2021-03-12

- 2021-03-10

- 2021-01-05

- 2021-03-11

- 2021-04-16

- 2021-01-12

- 2021-03-11

- 2021-03-10

- 2021-06-12

- 2021-04-16

- 2021-05-09

- 2021-03-11

- 2021-04-23

- 2021-01-01

- 2021-11-06

- 2021-03-10

- 2021-04-17