ACCA证书和考研哪个对未来帮助更大

发布时间:2022-05-10

相信很多小伙伴们不论选择考研还是考ACCA证书,都只有一个目的:那就是为了一份高薪工作。那么考研和考ACCA证书哪个选择对个人帮助更大?下面就让51题库考试学习网为你解答一下吧!

一、对于特别注重文凭的同学来说,除了出国还可以选择考研。

一般来说,考研从大三开始着手准备即可。但前提是知道自己想要获得什么,如果能凭借研究生文凭为自己打开更好的局面,考研是不错的选择。如果自己都不知道为什么要考研,建议还是不要浪费时间。身边就有这样的例子:大三的时候室友纷纷考研,问过其中一位室友考研的目标为何,她说不想提早进入社会,还想再享受几年校园生活。如果抱有这样的态度,是万万不可的,校园生活虽然很美好,但安逸的环境极易消磨一个人的斗智,对未来的就业并无好处。

二、对于毕业就想工作的同学来说,考取ACCA证书是最佳选择之一。

对很多同学来讲,考取ACCA是证明自己能力的途径,其高含金量还有助于自己获得更多优质雇主的青睐。因此对毕业即想参加工作的同学来说,考取ACCA认证能为自己打开更好的局面。

如果你是会计、金融之类专业的同学,具备一定的基础,学习ACCA会相对轻松,甚至还可以免试部分科目。如果你是非相关专业的同学,ACCA能够帮你构建起一套全新的知识体系。如果你全科通过了ACCA,还可以获得英国牛津布鲁克斯大学会计学学士学位,这样相当于没考研但取得了双学士学位的学历。

当然,根据个人学习能力不同,全科通过ACCA大约需要2年左右的时间。因此想在毕业前就获得ACCA认证的同学,建议大一、大二期间着手备考。

三、安排好主次

如果只考研或者只考ACCA无法达到你的预期,想要两者兼得就要考验你的学习效率和时间安排把控能力了。

因为大学期间业余时间较充裕,英语基础又比较扎实的同学,十分适合学习ACCA。因此建议同学们可以在本科期间努力学习ACCA,争取考过更多科目。如果到了大三还有未通过的科目,建议不妨先放一放,以最大的精力投入到考研当中。在考研结束后,约有几个月的空闲时期,期间继续抓紧学习ACCA,有利于重新点燃学习热情。

对于考研和考ACCA哪个对个人求职作用帮助更大的问题,一般认为,ACCA认证是专业技能和个人能力的证明,研究生是一份学历认证,关键还是看同学们的个人规划,如果想要进四大,ACCA的优势更大一些,想进体制内工作,研究生文凭更得领导们的认可。

以上就是51题库考试学习网为大家分享的全部内容,希望能够帮到大家!请大家持续关注51题库考试学习网,51题库考试学习网将会为大家带来最新、最热的考试资讯!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

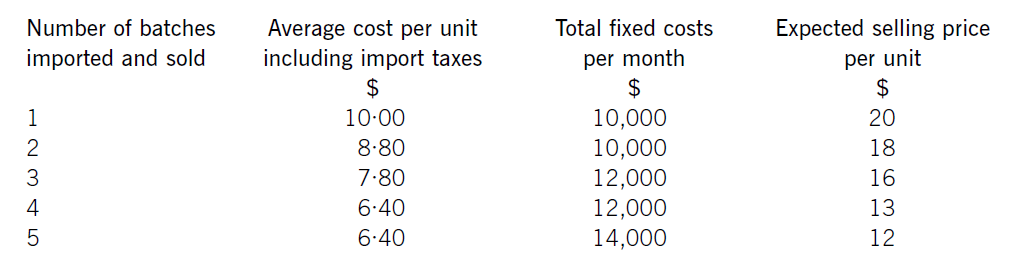

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion.

(c) At a recent meeting of the board of directors, the managing director of Envico Ltd said that he considered it

essential to be able to assess the ‘value for money’ of each seminar. He suggested that the quality of the speakers

and the comfort of the seminar rooms were two assessment criteria that should be used in order to assess the

‘value for money’ of each seminar.

Required:

Discuss SIX separate and distinct assessment criteria (including those suggested by the managing director),

that would enable the management of Envico Ltd to assess the ‘value for money’ of each seminar.

(6 marks)

(c) The following are six separate and distinct assessment criteria (including those suggested by the managing director), that

would enable the management of Envico Ltd to assess the ‘value for money’ of each seminar. The assessment criteria are

presented as questions that would comprise the contents of a questionnaire but other presentations would have been equally

acceptable.

(1) Did the course meet your objectives?

‘Value for money’ may, in part, be assessed by reference to the ‘effectiveness’ of the service provision. Effectiveness may

be viewed in this context as meeting the objectives of attendees. All attendees have similar but varying objectives and

hence it is vital that Envico Ltd meets the objectives of all attendees if seminars are to constitute ‘value for money’.

(2) How would you rate the quality of the speakers?

A primary resource of Envico Ltd is its speakers and thus it is important to gauge how they were perceived to perform

by the attendees.

(3) How would you rate comfort, cleanliness and facilities of the seminar rooms?

Again, a principal resource, which is consumed when providing the service, is the seminar room and the facilities

contained within it. Attendees will find a clean and ergonomically designed room more conducive for education and

training activities.

(4) How would you assess the quality of the course materials?

Since Envico Ltd undertakes the provision of educational and training seminars then the quality of course materials

provided assumes critical significance as they represent the ‘raison d’être’ of Envico Ltd. If they are perceived to be of

high quality they may act as a good advertisement for the company. Conversely, poor quality course materials will cause

Envico Ltd to be perceived poorly.

(5) How strongly would you recommend Envico courses to friends and colleagues?

This is a very important consideration since ‘word of mouth’ may represent the best means of advertising the services

provided by Envico Ltd and is indicative of whether attendees consider that they have received ‘value for money’ from

Envico Ltd.

(6) Do you consider that you could have achieved your objectives in attending the course in a more expedient manner? If

so, please detail below.

This question acknowledges that the time of attendees is a scarce resource and hence there may well be an opportunity

cost in attending seminars in addition to the explicit costs such as course fees, travel and subsistence costs etc. It is

essential that Envico Ltd is flexible in its approach to meeting the needs of clients where attendance at seminars is either

impracticable or undesirable. Perhaps a series of interactive CDs and/or video tuition may be more appropriate in certain

instances.

You are an audit manager at Rockwell & Co, a firm of Chartered Certified Accountants. You are responsible for the audit of the Hopper Group, a listed audit client which supplies ingredients to the food and beverage industry worldwide.

The audit work for the year ended 30 June 2015 is nearly complete, and you are reviewing the draft audit report which has been prepared by the audit senior. During the year the Hopper Group purchased a new subsidiary company, Seurat Sweeteners Co, which has expertise in the research and design of sugar alternatives. The draft financial statements of the Hopper Group for the year ended 30 June 2015 recognise profit before tax of $495 million (2014 – $462 million) and total assets of $4,617 million (2014: $4,751 million). An extract from the draft audit report is shown below:

Basis of modified opinion (extract)

In their calculation of goodwill on the acquisition of the new subsidiary, the directors have failed to recognise consideration which is contingent upon meeting certain development targets. The directors believe that it is unlikely that these targets will be met by the subsidiary company and, therefore, have not recorded the contingent consideration in the cost of the acquisition. They have disclosed this contingent liability fully in the notes to the financial statements. We do not feel that the directors’ treatment of the contingent consideration is correct and, therefore, do not believe that the criteria of the relevant standard have been met. If this is the case, it would be appropriate to adjust the goodwill balance in the statement of financial position.

We believe that any required adjustment may materially affect the goodwill balance in the statement of financial position. Therefore, in our opinion, the financial statements do not give a true and fair view of the financial position of the Hopper Group and of the Hopper Group’s financial performance and cash flows for the year then ended in accordance with International Financial Reporting Standards.

Emphasis of Matter Paragraph

We draw attention to the note to the financial statements which describes the uncertainty relating to the contingent consideration described above. The note provides further information necessary to understand the potential implications of the contingency.

Required:

(a) Critically appraise the draft audit report of the Hopper Group for the year ended 30 June 2015, prepared by the audit senior.

Note: You are NOT required to re-draft the extracts from the audit report. (10 marks)

(b) The audit of the new subsidiary, Seurat Sweeteners Co, was performed by a different firm of auditors, Fish Associates. During your review of the communication from Fish Associates, you note that they were unable to obtain sufficient appropriate evidence with regard to the breakdown of research expenses. The total of research costs expensed by Seurat Sweeteners Co during the year was $1·2 million. Fish Associates has issued a qualified audit opinion on the financial statements of Seurat Sweeteners Co due to this inability to obtain sufficient appropriate evidence.

Required:

Comment on the actions which Rockwell & Co should take as the auditor of the Hopper Group, and the implications for the auditor’s report on the Hopper Group financial statements. (6 marks)

(c) Discuss the quality control procedures which should be carried out by Rockwell & Co prior to the audit report on the Hopper Group being issued. (4 marks)

(a) Critical appraisal of the draft audit report

Type of opinion

When an auditor issues an opinion expressing that the financial statements ‘do not give a true and fair view’, this represents an adverse opinion. The paragraph explaining the modification should, therefore, be titled ‘Basis of Adverse Opinion’ rather than simply ‘Basis of Modified Opinion’.

An adverse opinion means that the auditor considers the misstatement to be material and pervasive to the financial statements of the Hopper Group. According to ISA 705 Modifications to Opinions in the Independent Auditor’s Report, pervasive matters are those which affect a substantial proportion of the financial statements or fundamentally affect the users’ understanding of the financial statements. It is unlikely that the failure to recognise contingent consideration is pervasive; the main effect would be to understate goodwill and liabilities. This would not be considered a substantial proportion of the financial statements, neither would it be fundamental to understanding the Hopper Group’s performance and position.

However, there is also some uncertainty as to whether the matter is even material. If the matter is determined to be material but not pervasive, then a qualified opinion would be appropriate on the basis of a material misstatement. If the matter is not material, then no modification would be necessary to the audit opinion.

Wording of opinion/report

The auditor’s reference to ‘the acquisition of the new subsidiary’ is too vague; the Hopper Group may have purchased a number of subsidiaries which this phrase could relate to. It is important that the auditor provides adequate description of the event and in these circumstances it would be appropriate to name the subsidiary referred to.

The auditor has not quantified the amount of the contingent element of the consideration. For the users to understand the potential implications of any necessary adjustments, they need to know how much the contingent consideration will be if it becomes payable. It is a requirement of ISA 705 that the auditor quantifies the financial effects of any misstatements, unless it is impracticable to do so.

In addition to the above point, the auditor should provide more description of the financial effects of the misstatement, including full quantification of the effect of the required adjustment to the assets, liabilities, incomes, revenues and equity of the Hopper Group.

The auditor should identify the note to the financial statements relevant to the contingent liability disclosure rather than just stating ‘in the note’. This will improve the understandability and usefulness of the contents of the audit report.

The use of the term ‘we do not feel that the treatment is correct’ is too vague and not professional. While there may be some interpretation necessary when trying to apply financial reporting standards to unique circumstances, the expression used is ambiguous and may be interpreted as some form. of disclaimer by the auditor with regard to the correct accounting treatment. The auditor should clearly explain how the treatment applied in the financial statements has departed from the requirements of the relevant standard.

Tutorial note: As an illustration to the above point, an appropriate wording would be: ‘Management has not recognised the acquisition-date fair value of contingent consideration as part of the consideration transferred in exchange for the acquiree, which constitutes a departure from International Financial Reporting Standards.’

The ambiguity is compounded by the use of the phrase ‘if this is the case, it would be appropriate to adjust the goodwill’. This once again suggests that the correct treatment is uncertain and perhaps open to interpretation.

If the auditor wishes to refer to a specific accounting standard they should refer to its full title. Therefore instead of referring to ‘the relevant standard’ they should refer to International Financial Reporting Standard 3 Business Combinations.

The opinion paragraph requires an appropriate heading. In this case the auditors have issued an adverse opinion and the paragraph should be headed ‘Adverse Opinion’.

As with the basis paragraph, the opinion paragraph lacks authority; suggesting that the required adjustments ‘may’ materially affect the financial statements implies that there is a degree of uncertainty. This is not the case; the amount of the contingent consideration will be disclosed in the relevant purchase agreement, so the auditor should be able to determine whether the required adjustments are material or not. Regardless, the sentence discussing whether the balance is material or not is not required in the audit report as to warrant inclusion in the report the matter must be considered material. The disclosure of the nature and financial effect of the misstatement in the basis paragraph is sufficient.

Finally, the emphasis of matter paragraph should not be included in the audit report. An emphasis of matter paragraph is only used to draw attention to an uncertainty/matter of fundamental importance which is correctly accounted for and disclosed in the financial statements. An emphasis of matter is not required in this case for the following reasons:

– Emphasis of matter is only required to highlight matters which the auditor believes are fundamental to the users’ understanding of the business. An example may be where a contingent liability exists which is so significant it could lead to the closure of the reporting entity. That is not the case with the Hopper Group; the contingent liability does not appear to be fundamental.

– Emphasis of matter is only used for matters where the auditor has obtained sufficient appropriate evidence that the matter is not materially misstated in the financial statements. If the financial statements are materially misstated, in this regard the matter would be fully disclosed by the auditor in the basis of qualified/adverse opinion paragraph and no emphasis of matter is necessary.

(b) Communication from the component auditor

The qualified opinion due to insufficient evidence may be a significant matter for the Hopper Group audit. While the possible adjustments relating to the current year may not be material to the Hopper Group, the inability to obtain sufficient appropriate evidence with regard to a material matter in Seurat Sweeteners Co’s financial statements may indicate a control deficiency which the auditor was not aware of at the planning stage and it could indicate potential problems with regard to the integrity of management, which could also indicate a potential fraud. It could also indicate an unwillingness of management to provide information, which could create problems for future audits, particularly if research and development costs increase in future years. If the group auditor suspects that any of these possibilities are true, they may need to reconsider their risk assessment and whether the audit procedures performed are still appropriate.

If the detail provided in the communication from the component auditor is insufficient, the group auditor should first discuss the matter with the component auditor to see whether any further information can be provided. The group auditor can request further working papers from the component auditor if this is necessary. However, if Seurat Sweeteners has not been able to provide sufficient appropriate evidence, it is unlikely that this will be effective.

If the discussions with the component auditor do not provide satisfactory responses to evaluate the potential impact on the Hopper Group, the group auditor may need to communicate with either the management of Seurat Sweeteners or the Hopper Group to obtain necessary clarification with regard to the matter.

Following these procedures, the group auditor needs to determine whether they have sufficient appropriate evidence to draw reasonable conclusions on the Hopper Group’s financial statements. If they believe the lack of information presents a risk of material misstatement in the group financial statements, they can request that further audit procedures be performed, either by the component auditor or by themselves.

Ultimately the group engagement partner has to evaluate the effect of the inability to obtain sufficient appropriate evidence on the audit opinion of the Hopper Group. The matter relates to research expenses totalling $1·2 million, which represents 0·2% of the profit for the year and 0·03% of the total assets of the Hopper Group. It is therefore not material to the Hopper Group’s financial statements. For this reason no modification to the audit report of the Hopper Group would be required as this does not represent a lack of sufficient appropriate evidence with regard to a matter which is material to the Group financial statements.

Although this may not have an impact on the Hopper Group audit opinion, this may be something the group auditor wishes to bring to the attention of those charged with governance. This would be particularly likely if the group auditor believed that this could indicate some form. of fraud in Seurat Sweeteners Co, a serious deficiency in financial reporting controls or if this could create problems for accepting future audits due to management’s unwillingness to provide access to accounting records.

(c) Quality control procedures prior to issuing the audit report

ISA 220 Quality Control for an Audit of Financial Statements and ISQC 1 Quality Control for Firms that Perform. Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Agreements require that an engagement quality control reviewer shall be appointed for audits of financial statements of listed entities. The audit engagement partner then discusses significant matters arising during the audit engagement with the engagement quality control reviewer.

The engagement quality control reviewer and the engagement partner should discuss the failure to recognise the contingent consideration and its impact on the auditor’s report. The engagement quality control reviewer must review the financial statements and the proposed auditor’s report, in particular focusing on the conclusions reached in formulating the auditor’s report and consideration of whether the proposed auditor’s opinion is appropriate. The audit documentation relating to the acquisition of Seurat Sweeteners Co will be carefully reviewed, and the reviewer is likely to consider whether procedures performed in relation to these balances were appropriate.

Given the listed status of the Hopper Group, any modification to the auditor’s report will be scrutinised, and the firm must be sure of any decision to modify the report, and the type of modification made. Once the engagement quality control reviewer has considered the necessity of a modification, they should consider whether a qualified or an adverse opinion is appropriate in the circumstances. This is an important issue, given that it requires judgement as to whether the matters would be material or pervasive to the financial statements.

The engagement quality control reviewer should ensure that there is adequate documentation regarding the judgements used in forming the final audit opinion, and that all necessary matters have been brought to the attention of those charged with governance.

The auditor’s report must not be signed and dated until the completion of the engagement quality control review.

Tutorial note: In the case of the Hopper Group’s audit, the lack of evidence in respect of research costs is unlikely to be discussed unless the audit engagement partner believes that the matter could be significant, for example, if they suspected the lack of evidence is being used to cover up a financial statements fraud.

5 Which of the following factors could cause a company’s gross profit percentage on sales to fall below the expected

level?

1 Understatement of closing inventories.

2 The incorrect inclusion in purchases of invoices relating to goods supplied in the following period.

3 The inclusion in sales of the proceeds of sale of non-current assets.

4 Increased cost of carriage charges borne by the company on goods sent to customers.

A 3 and 4

B 2 and 4

C 1 and 2

D 1 and 3

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-05-20

- 2020-04-11

- 2020-01-10

- 2020-03-22

- 2020-02-11

- 2020-03-22

- 2019-07-21

- 2020-03-13

- 2020-01-09

- 2020-01-08

- 2019-07-21

- 2020-03-13

- 2020-03-12

- 2020-03-11

- 2020-03-15

- 2020-02-29

- 2020-04-16

- 2020-01-08

- 2020-01-09

- 2020-01-10

- 2020-01-08

- 2020-03-18

- 2020-03-12

- 2020-02-28

- 2020-05-24

- 2020-04-05

- 2020-03-04

- 2020-03-21

- 2020-04-09

- 2020-03-04