关于英国税法2020年6月考试大纲最新变化说明

发布时间:2020-03-10

相信大家都或多或少的听说过ACCA。那么什么是ACCA呢?由51题库考试学习网为您进行解答。ACCA是目前财经领域认可度最高的资格证书,也是世界上拥有学员和会员最多的,为此还被我国称之为“国际注册会计师”。 2020年6月ACCA考试大纲已经出来了,不清楚的朋友们可以继续看下去哦!

2020年6月考季的英国税法科目考试将就2019财政法案进行考核。与2020年3月考试大纲相比,主要涉及到常规税率和减免额度的调整,部分变化是由于相关法规的分阶段引入。大多数新税率和减免额度在考试时会提供给学员,ACCA建议学员按照最新调整多加练习。同时,ACCA官方特别邀请ACCA资深讲师分享2020年6月考季TX-UK考试大纲最新变化以及备考建议,大家到时候可以进行观看!

关于考试大纲的内容大家已经看完了,还想知道ACCA考试其他内容的请看看下面的内容吧!

报考条件

1.凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;

2.教育部认可的高等院校在校生,顺利完成大一的课程考试,即可报名成为ACCA的正式学员;

3.未符合1、2项报名资格的申请者,也可以先申请参加FIA基础财务资格考试。在完成基础商业会计、基础管理会计、基础财务会计3门课程,并完成ACCA基础职业模块,可获得ACCA商业会计师资格证书,资格证书后可豁免ACCAF1-F3三门课程的考试,直接进入技能课程的考试。

报考好处

1.学习的知识更深,且广泛

ACCA考试是以国际会计准则为标准而设计的,通过ACCA的学习,可以让学员更加了解和掌握国际会计准则,拥有国际视野。

2.更有竞争力

在大家手上都只有初级证书的时候,你手里握着ACCA证书,国际类的证书不仅仅证明了你的专业能力,还有一定的外语基础,毕竟是英文类的考试,这方面就比同类型的应届生多了很多优势,加上考ACCA花费的时间多,也能从侧面证明是很有韧性的人。而且,报考ACCA的过程中,除ACCA证书之外我们还可以申请海外名牌大学的学士、硕士学位,对于想要留学、移民,或者想要入职到某海外或者合资企业的人来说,非常有助益。

3.面试时不会胆怯

很多考生在面试时会有点胆怯,其实多是因为在面对考官询问专业知识的时候,回答不上来导致的,学习了ACCA的知识,能拓宽思路,还能分析国内和国外的不同的会计法律体系和专业知识的不同点,肚子里有墨水,是能够增强一个人的自信心的。

今天51题库考试学习网给大家分享的关于ACCA考试相关内容就到这里了,如果还想了解更多内容请持续关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

9 Which of the following items must be disclosed in a company’s published financial statements (including notes)

if material, according to IAS1 Presentation of financial statements?

1 Finance costs.

2 Staff costs.

3 Depreciation and amortisation expense.

4 Movements on share capital.

A 1 and 3 only

B 1, 2 and 4 only

C 2, 3 and 4 only

D All four items

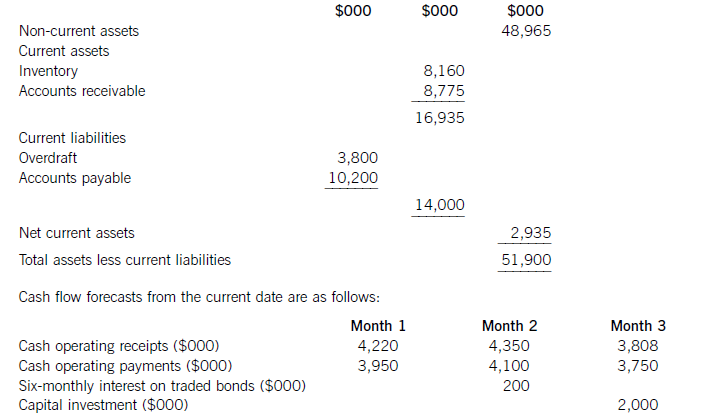

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action.

(10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced.

(8 marks)

(a)Whenconsideringthefinancingofworkingcapital,itisusefultodividecurrentassetsintofluctuatingcurrentassetsandpermanentcurrentassets.Fluctuatingcurrentassetsrepresentchangesinthelevelofcurrentassetsduetotheunpredictabilityofbusinessactivity.Permanentcurrentassetsrepresentthecorelevelofinvestmentincurrentassetsneededtosupportagivenlevelofturnoverorbusinessactivity.Asturnoverorlevelofbusinessactivityincreases,thelevelofpermanentcurrentassetswillalsoincrease.Thisrelationshipcanbemeasuredbytheratioofturnovertonetcurrentassets.Thefinancingchoiceasfarasworkingcapitalisconcernedisbetweenshort-termandlong-termfinance.Short-termfinanceismoreflexiblethanlong-termfinance:anoverdraft,forexample,isusedbyabusinessorganisationastheneedarisesandvariableinterestischargedontheoutstandingbalance.Short-termfinanceisalsomoreriskythanlong-termfinance:anoverdraftfacilitymaybewithdrawn,orashort-termloanmayberenewedonlessfavourableterms.Intermsofcost,thetermstructureofinterestratessuggeststhatshort-termdebtfinancehasalowercostthanlong-termdebtfinance.Thematchingprinciplesuggeststhatlong-termfinanceshouldbeusedforlong-terminvestment.Applyingthisprincipletoworkingcapitalfinancing,long-termfinanceshouldbematchedwithpermanentcurrentassetsandnon-currentassets.Afinancingpolicywiththisobjectiveiscalleda‘matchingpolicy’.HGRCoisnotusingthisfinancingpolicy,sinceofthe$16,935,000ofcurrentassets,$14,000,000or83%isfinancedfromshort-termsources(overdraftandtradepayables)andonly$2,935,000or17%isfinancedfromalong-termsource,inthiscaseequityfinance(shareholders’funds)ortradedbonds.ThefinancingpolicyorapproachtakenbyHGRCotowardsthefinancingofworkingcapital,whereshort-termfinanceispreferred,iscalledanaggressivepolicy.Relianceonshort-termfinancemakesthisriskierthanamatchingapproach,butalsomoreprofitableduetothelowercostofshort-termfinance.Followinganaggressiveapproachtofinancingcanleadtoovertrading(undercapitalisation)andthepossibilityofliquidityproblems.(b)Bankbalanceinthreemonths’timeifnoactionistaken:Workings:ReductioninaccountsreceivabledaysCurrentaccountsreceivabledays=(8,775/49,275)x365=65daysReductionindaysoversixmonths=65–53=12daysMonthlyreduction=12/6=2daysEachreceivablesdayisequivalentto8,775,000/65=$135,000(Alternatively,eachreceivablesdayisequivalentto49,275,000/365=$135,000)Monthlyreductioninaccountsreceivable=2x135,000=$270,000ReductionininventorydaysCurrentinventorydays=(8,160/37,230)x365=80daysEachinventorydayisequivalentto8,160,000/80=$102,000(Alternatively,eachinventoryday=37,230,000/365=$102,000)Monthlyreductionininventory=102,000x2=$204,000OverdraftinterestcalculationsMonthlyoverdraftinterestrate=1·06171/12=1·005or0·5%Ifnoactionistaken:Period1interest=3,800,000x0·005=$19,000Period2interest=3,549,000x0·005=$17,745or$18,000Period3interest=3,517,000x0·005=$17,585or$18,000Ifactionistaken:Period1interest=3,800,000x0.005=$19,000Period2interest=3,075,000x0.005=$15,375or$15,000Period3interest=2,566,000x0.005=$12,830or$13,000DiscussionIfnoactionistaken,thecashflowforecastshowsthatHGRCowillexceeditsoverdraftlimitof$4millionby$1·48millioninthreemonths’time.Ifthefinancedirector’sproposalsareimplemented,thereisapositiveeffectonthebankbalance,buttheoverdraftlimitisstillexceededinthreemonths’time,althoughonlyby$47,000ratherthanby$1·47million.Ineachofthethreemonthsfollowingthat,thecontinuingreductioninaccountsreceivabledayswillimprovethebankbalanceby$270,000permonth.Withoutfurtherinformationonoperatingreceiptsandpayments,itcannotbeforecastwhetherthebankbalancewillreturntolessthanthelimit,orevencontinuetoimprove.Themainreasonfortheproblemwiththebankbalanceisthe$2millioncapitalexpenditure.Purchaseofnon-currentassetsshouldnotbefinancedbyanoverdraft,butalong-termsourceoffinancesuchasequityorbonds.Ifthecapitalexpenditurewereremovedfromtheareaofworkingcapitalmanagement,theoverdraftbalanceattheendofthreemonthswouldbe$3·48millionifnoactionweretakenand$2·05millionifthefinancedirector’sproposalswereimplemented.GiventhatHGRCohasalmost$50millionofnon-currentassetsthatcouldpossiblybeusedassecurity,raisinglong-termdebtthrougheitherabankloanorabondissueappearstobesensible.Assumingabondinterestrateof10%peryear,currentlong-termdebtintheform.oftradedbondsisapproximately($200mx2)/0·1=$4m,whichismuchlessthantheamountofnoncurrentassets.AsuitablecourseofactionforHGRCotofollowwouldthereforebe,firstly,toimplementthefinancedirector’sproposalsand,secondly,tofinancethecapitalexpenditurefromalong-termsource.Considerationcouldalsobegiventousingsomelong-termdebtfinancetoreducetheoverdraftandtoreducethelevelofaccountspayable,currentlystandingat100days.(c)Whencreditisgrantedtoforeigncustomers,twoproblemsmaybecomeespeciallysignificant.First,thelongerdistancesoverwhichtradetakesplaceandthemorecomplexnatureoftradetransactionsandtheirelementsmeansforeignaccountsreceivableneedmoreinvestmentthantheirdomesticcounterparts.Longertransactiontimesincreaseaccountsreceivablebalancesandhencetheleveloffinancingandfinancingcosts.Second,theriskofbaddebtsishigherwithforeignaccountsreceivablethanwiththeirdomesticcounterparts.Inordertomanageandreducecreditrisks,therefore,exportersseektoreducetheriskofbaddebtandtoreducethelevelofinvestmentinforeignaccountsreceivable.Manyforeigntransactionsareon‘openaccount’,whichisanagreementtosettletheamountoutstandingonapredetermineddate.Openaccountreflectsagoodbusinessrelationshipbetweenimporterandexporter.Italsocarriesthehighestriskofnon-payment.Onewaytoreduceinvestmentinforeignaccountsreceivableistoagreeearlypaymentwithanimporter,forexamplebypaymentinadvance,paymentonshipment,orcashondelivery.Thesetermsoftradeareunlikelytobecompetitive,however,anditismorelikelythatanexporterwillseektoreceivecashinadvanceofpaymentbeingmadebythecustomer.Onewaytoacceleratecashreceiptsistousebillfinance.Billsofexchangewithasignedagreementtopaytheexporteronanagreedfuturedate,supportedbyadocumentaryletterofcredit,canbediscountedbyabanktogiveimmediatefunds.Thisdiscountingiswithoutrecourseifbillsofexchangehavebeencountersignedbytheimporter’sbank.Documentarylettersofcreditareapaymentguaranteebackedbyoneormorebanks.Theycarryalmostnorisk,providedtheexportercomplieswiththetermsandconditionscontainedintheletterofcredit.Theexportermustpresentthedocumentsstatedintheletter,suchasbillsoflading,shippingdocuments,billsofexchange,andsoon,whenseekingpayment.Aseachsupportingdocumentrelatestoakeyaspectoftheoveralltransaction,lettersofcreditgivesecuritytotheimporteraswellastheexporter.Companiescanalsomanageandreduceriskbygatheringappropriateinformationwithwhichtoassessthecreditworthinessofnewcustomers,suchasbankreferencesandcreditreports.Insurancecanalsobeusedtocoversomeoftherisksassociatedwithgivingcredittoforeigncustomers.Thiswouldavoidthecostofseekingtorecovercashduefromforeignaccountsreceivablethroughaforeignlegalsystem,wheretheexportercouldbeatadisadvantageduetoalackoflocalorspecialistknowledge.Exportfactoringcanalsobeconsidered,wheretheexporterpaysforthespecialistexpertiseofthefactorasawayofreducinginvestmentinforeignaccountsreceivableandreducingtheincidenceofbaddebts.

(d) There is considerable evidence to suggest that as a result of implementation problems less than 50% of all

acquisitions achieve their objectives and actually end up reducing shareholder value.

Required:

Provide Ken with a brief report on the most likely sources of integration problems and describe the key

performance indicators he should use to measure progress towards acquisition objectives. (15 marks)

(d) Many academic studies, together with actual managerial experience, point to the post-acquisition integration phase as being

the key to an acquirer achieving their acquisition objectives. In particular, the creation (or destruction) of shareholder value

rests most heavily on the success of the integration phase, which in turn helps determine whether the acquirer has chosen

the ‘right’ target company and paid the right price for it. One source strongly argues that the capability to manage the

integration of the two organisational sturctures, in particular the conversion of information systems and retention and

motivation of key employees, determines how much value can be extracted from the combined entities. The ability to manage

the integration process will therefore affect the success of the prior phases of the acquisition process – the search for and

screening of potential candidates, the effective carrying out of due diligence, financial evaluation and successful negotiation

of the deal.

Unfortunately, the failure to develop the necessary integration skills dooms many firms to continued failure with their

acquisitions, though some firms are conspicuously successful in developing such a capability and they gain significant

competitive advantage over their less successful competitors and create value for the stakeholders. One explanation for this

conspicuous inability to learn from past acquisition experience, compared with other activities in the value chain, lies with

their infrequency and variety. ‘No acquisition is like another.’ Much of the difficulty however lies in the complex

interrelationship and interdependency between the activities being integrated and a consequent difficulty of knowing what is

causing performance problems. Thus, it is no good communicating all the positives to the customer if there is a failure to

retain and motivate the sales force. To this complexity of integrating different processes is added the problem of developing

appropriate measures of and accurate monitoring of the integration processes. In one study of US bank acquirers, only 40%

had developed specific performance measures for the systems conversion process, despite the critical importance of systems

integration to efficient operation of the combined banks. Key performance indicators need to be set in the areas previously

identified as offering major opportunities for synergies. These synergies will affect both the cost and revenue side of the

business. Real cost reductions are clearly a major reason for the proposed acquisition in view of the competitive environment

faced. Equally relevant are appropriate measures of customer service. Each area will need appropriate key performance

indicators showing priorities and relevant timescales for achievement.

Therefore, there is a critical need to learn from previous experience and the relationship between decisions made, actions

taken and performance outcomes. This knowledge and experience needs to be effectively recorded and shared. It can then

influence the earlier phases of the acquisition referred to above, thus leading to a virtuous circle of better integration and

acquisitions that actually enhance value. In so doing, acquisitions can lead to faster growth and better performance.

(c) Pinzon, a limited liability company and audit client, is threatening to sue your firm in respect of audit fees charged

for the year ended 31 December 2004. Pinzon is alleging that Bartolome billed the full rate on air fares for audit

staff when substantial discounts had been obtained by Bartolome. (4 marks)

Required:

Comment on the ethical and other professional issues raised by each of the above matters and their implications,

if any, for the continuation of each assignment.

NOTE: The mark allocation is shown against each of the three issues.

(c) Threatened legal action

Ethical and professional issues

■ An advocacy threat has arisen as Bartolome and Pinzon are in opposition concerning the fee note for the 2004 audit.

■ If Pinzon’s allegations are true this may cast serious doubt on the integrity of Bartolome. Pinzon should be advised to

take their claims first to ACCA’s Disciplinary Committee.

■ If Bartolome has indeed charged full air fares when substantial discounts had been obtained this could be due to:

– Bartolome incorrectly believing this to be an acceptable industry practice; or

– a billing error/oversight.

In either case Bartolome should issue a credit note, although this may be insufficient to make amends and salvage the

auditor-client relationship.

■ Bartolome may have legitimately claimed for full airfares if this was agreed in its contract (i.e. the terms of engagement)

with Pinzon.

Implications for continuation with assignment

Unless the threat of legal action is amicably resolved very quickly (which is perhaps unlikely) Pinzon and Bartolome are in

conflict. Bartolome cannot therefore be seen to be independent and so should tender their resignation as auditor for the year

ending 31 December 2005 (assuming they were re-appointed and have not already been removed from office).

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2019-01-05

- 2020-03-04

- 2021-05-23

- 2020-03-13

- 2019-07-19

- 2020-03-13

- 2020-03-13

- 2020-08-15

- 2020-02-03

- 2019-07-19

- 2019-07-19

- 2020-03-13

- 2019-07-19

- 2019-07-19

- 2019-07-19

- 2020-03-08

- 2020-03-04

- 2019-07-19

- 2020-05-20

- 2020-03-14

- 2019-01-05

- 2020-03-13

- 2020-03-13

- 2020-08-08

- 2020-03-13

- 2020-03-01

- 2020-03-14

- 2020-01-02

- 2019-12-29

- 2020-04-19