干货来啦!ACCAer们需要的考试科目和报考规定

发布时间:2019-12-29

想要报考2020年ACCA考试的考生要抓紧时间报名了哦!51题库考试学习网帮助大家汇总了ACCA官网上发布的部分内容,来看看是不是你所需要的呢?

按照规定,学员在每个考季最多可报考4个科目(包括重考科目和新科目)并且每年报考不超过8门新科目,保证每门课程都有充足的学习时间。另外,学员必须按照以下3个阶段的顺序来报考ACCA科目。

知识模块的科目:F1-F3;

技能模块的科目:F4-F9(F4ENG/GLO 开启随时机考);

专业阶段的科目:P1, P2, P3 (and any two from P4, P5, P6 and P7)。

以上3个阶段内的考试科目可不分先后顺序报考,但如前一阶段有未通过的科目,将不能跳开此科目仅报后阶段科目。

ACCA每年会根据会计准则及事实的需要调整教学大纲,当年的考试会以最新的教学大纲作为考核内容,ACCA考官也会不定期的在ACCA官方网站上发表考官文章,帮助学生解析考试当中的一些难点和重点,ACCA教材也应随着考试大纲的不断变化,每年出最新版本,历年考题答案应随着教材变更后,调整最新答案。

学生在拿到最新教材后可以进行逐章逐节的学习,在掌握了每章节知识点后,将历年考题作为复习重点,充分的加以练习,达到熟练的程度,以保证考试的顺利通过。

与此同时,学生可以按照自身的需求,选择一些与教材紧密结合的辅导课程,由讲师为同学们总结考试重点及难点,深入分析、拓展思维,为学生节省时间,并且带领同学们一起做历年考题,学习考官文章,共同克服备课过程当中出现的各种困难增加学习效率及通过率。

除了认真备考熟练掌握知识点以外,ACCA对考试技巧,答题速度及考场的应试技巧也有很高的要求,很多同学复习阶段已经熟练的掌握知识点,但是考场应变能力差,考试时间没能合理分配,最终也很容易造成考试失败,正确的备考、应考方法也因此成为了考试顺利通过的关键,因此在备考经验不是很丰富的同学可以选择相关课程跟随老师一同学习。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

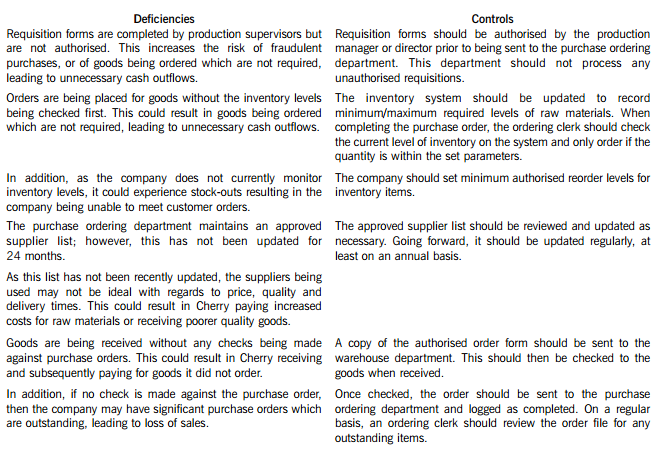

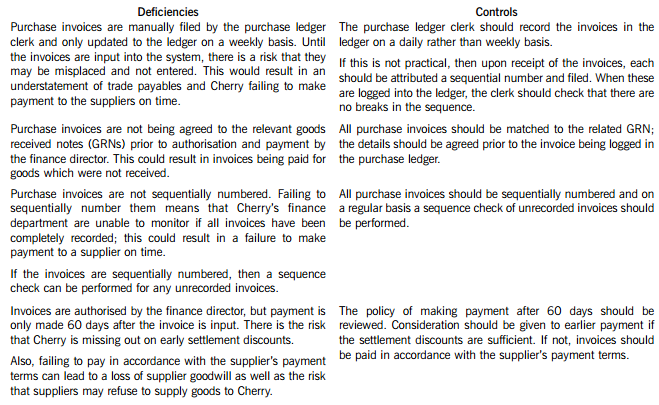

Cherry Blossom Co (Cherry) manufactures custom made furniture and its year end is 30 April. The company purchases its raw materials from a wide range of suppliers. Below is a description of Cherry’s purchasing system.

When production supervisors require raw materials, they complete a requisition form. and this is submitted to the purchase ordering department. Requisition forms do not require authorisation and no reference is made to the current inventory levels of the materials being requested. Staff in the purchase ordering department use the requisitions to raise sequentially numbered purchase orders based on the approved suppliers list, which was last updated 24 months ago. The purchasing director authorises the orders prior to these being sent to the suppliers.

When the goods are received, the warehouse department verifies the quantity to the suppliers despatch note and checks that the quality of the goods received are satisfactory. They complete a sequentially numbered goods received note (GRN) and send a copy of the GRN to the finance department.

Purchase invoices are sent directly to the purchase ledger clerk, who stores them in a manual file until the end of each week. He then inputs them into the purchase ledger using batch controls and gives each invoice a unique number based on the supplier code. The invoices are reviewed and authorised for payment by the finance director, but the actual payment is only made 60 days after the invoice is input into the system.

Required:

In respect of the purchasing system of Cherry Blossom Co:

(i) Identify and explain FIVE deficiencies; and

(ii) Recommend a control to address each of these deficiencies.

Note: The total marks will be split equally between each part.

Cherry Blossom Co’s (Cherry) purchasing system deficiencies and controls

(b) You are the audit manager of Johnston Co, a private company. The draft consolidated financial statements for

the year ended 31 March 2006 show profit before taxation of $10·5 million (2005 – $9·4 million) and total

assets of $55·2 million (2005 – $50·7 million).

Your firm was appointed auditor of Tiltman Co when Johnston Co acquired all the shares of Tiltman Co in March

2006. Tiltman’s draft financial statements for the year ended 31 March 2006 show profit before taxation of

$0·7 million (2005 – $1·7 million) and total assets of $16·1 million (2005 – $16·6 million). The auditor’s

report on the financial statements for the year ended 31 March 2005 was unmodified.

You are currently reviewing two matters that have been left for your attention on the audit working paper files for

the year ended 31 March 2006:

(i) In December 2004 Tiltman installed a new computer system that properly quantified an overvaluation of

inventory amounting to $2·7 million. This is being written off over three years.

(ii) In May 2006, Tiltman’s head office was relocated to Johnston’s premises as part of a restructuring.

Provisions for the resulting redundancies and non-cancellable lease payments amounting to $2·3 million

have been made in the financial statements of Tiltman for the year ended 31 March 2006.

Required:

Identify and comment on the implications of these two matters for your auditor’s reports on the financial

statements of Johnston Co and Tiltman Co for the year ended 31 March 2006. (10 marks)

(b) Tiltman Co

Tiltman’s total assets at 31 March 2006 represent 29% (16·1/55·2 × 100) of Johnston’s total assets. The subsidiary is

therefore material to Johnston’s consolidated financial statements.

Tutorial note: Tiltman’s profit for the year is not relevant as the acquisition took place just before the year end and will

therefore have no impact on the consolidated income statement. Calculations of the effect on consolidated profit before

taxation are therefore inappropriate and will not be awarded marks.

(i) Inventory overvaluation

This should have been written off to the income statement in the year to 31 March 2005 and not spread over three

years (contrary to IAS 2 ‘Inventories’).

At 31 March 2006 inventory is overvalued by $0·9m. This represents all Tiltmans’s profit for the year and 5·6% of

total assets and is material. At 31 March 2005 inventory was materially overvalued by $1·8m ($1·7m reported profit

should have been a $0·1m loss).

Tutorial note: 1/3 of the overvaluation was written off in the prior period (i.e. year to 31 March 2005) instead of $2·7m.

That the prior period’s auditor’s report was unmodified means that the previous auditor concurred with an incorrect

accounting treatment (or otherwise gave an inappropriate audit opinion).

As the matter is material a prior period adjustment is required (IAS 8 ‘Accounting Policies, Changes in Accounting

Estimates and Errors’). $1·8m should be written off against opening reserves (i.e. restated as at 1 April 2005).

(ii) Restructuring provision

$2·3m expense has been charged to Tiltman’s profit and loss in arriving at a draft profit of $0·7m. This is very material.

(The provision represents 14·3% of Tiltman’s total assets and is material to the balance sheet date also.)

The provision for redundancies and onerous contracts should not have been made for the year ended 31 March 2006

unless there was a constructive obligation at the balance sheet date (IAS 37 ‘Provisions, Contingent Liabilities and

Contingent Assets’). So, unless the main features of the restructuring plan had been announced to those affected (i.e.

redundancy notifications issued to employees), the provision should be reversed. However, it should then be disclosed

as a non-adjusting post balance sheet event (IAS 10 ‘Events After the Balance Sheet Date’).

Given the short time (less than one month) between acquisition and the balance sheet it is very possible that a

constructive obligation does not arise at the balance sheet date. The relocation in May was only part of a restructuring

(and could be the first evidence that Johnston’s management has started to implement a restructuring plan).

There is a risk that goodwill on consolidation of Tiltman may be overstated in Johnston’s consolidated financial

statements. To avoid the $2·3 expense having a significant effect on post-acquisition profit (which may be negligible

due to the short time between acquisition and year end), Johnston may have recognised it as a liability in the

determination of goodwill on acquisition.

However, the execution of Tiltman’s restructuring plan, though made for the year ended 31 March 2006, was conditional

upon its acquisition by Johnston. It does not therefore represent, immediately before the business combination, a

present obligation of Johnston. Nor is it a contingent liability of Johnston immediately before the combination. Therefore

Johnston cannot recognise a liability for Tiltman’s restructuring plans as part of allocating the cost of the combination

(IFRS 3 ‘Business Combinations’).

Tiltman’s auditor’s report

The following adjustments are required to the financial statements:

■ restructuring provision, $2·3m, eliminated;

■ adequate disclosure of relocation as a non-adjusting post balance sheet event;

■ current period inventory written down by $0·9m;

■ prior period inventory (and reserves) written down by $1·8m.

Profit for the year to 31 March 2006 should be $3·9m ($0·7 + $0·9 + $2·3).

If all these adjustments are made the auditor’s report should be unmodified. Otherwise, the auditor’s report should be

qualified ‘except for’ on grounds of disagreement. If none of the adjustments are made, the qualification should still be

‘except for’ as the matters are not pervasive.

Johnston’s auditor’s report

If Tiltman’s auditor’s report is unmodified (because the required adjustments are made) the auditor’s report of Johnston

should be similarly unmodified. As Tiltman is wholly-owned by Johnston there should be no problem getting the

adjustments made.

If no adjustments were made in Tiltman’s financial statements, adjustments could be made on consolidation, if

necessary, to avoid modification of the auditor’s report on Johnston’s financial statements.

The effect of these adjustments on Tiltman’s net assets is an increase of $1·4m. Goodwill arising on consolidation (if

any) would be reduced by $1·4m. The reduction in consolidated total assets required ($0·9m + $1·4m) is therefore

the same as the reduction in consolidated total liabilities (i.e. $2·3m). $2·3m is material (4·2% consolidated total

assets). If Tiltman’s financial statements are not adjusted and no adjustments are made on consolidation, the

consolidated financial position (balance sheet) should be qualified ‘except for’. The results of operations (i.e. profit for

the period) should be unqualified (if permitted in the jurisdiction in which Johnston reports).

Adjustment in respect of the inventory valuation may not be required as Johnston should have consolidated inventory

at fair value on acquisition. In this case, consolidated total liabilities should be reduced by $2·3m and goodwill arising

on consolidation (if any) reduced by $2·3m.

Tutorial note: The effect of any possible goodwill impairment has been ignored as the subsidiary has only just been

acquired and the balance sheet date is very close to the date of acquisition.

(ii) From the information provided above, recommend the matters which should be included as ‘findings

from the audit’ in your report to those charged with governance, and explain the reason for their

inclusion. (7 marks)

(ii) Control weakness

ISA 260 contains guidance on the type of issues that should be communicated. One of the matters identified is a control

weakness in the capital expenditure transaction cycle. The assets for which no authorisation was obtained amount to

0·3% of total assets (225,000/78 million x 100%), which is clearly immaterial. However, regardless of materiality, the

auditor should ensure that the weakness is brought to the attention of the management, with a clear indication of the

implication of the weakness, and recommendations as to how the control weakness should be eliminated.

The auditor is providing information to help those charged with governance improve the internal systems and controls

and ultimately reduce business risk. In this case there is a high risk of fraud, as the lack of authorisation for purchase

of office equipment could allow expenditure on assets not used for bona fide business purposes.

Disagreement with accounting treatment of brand

Audit procedures have revealed a breach of IAS 38 Intangible Assets, in which internally generated brand names are

specifically prohibited from being recognised. Blod Co has recognised an internally generated brand name which is

material to the statement of financial position (balance sheet) as it represents 12·8% of total assets (10/78 x 100%).

The statement of financial position (balance sheet) therefore contains a material misstatement.

The report to those charged with governance should clearly explain the rules on recognition of internally generated brand

names, to ensure that the management has all relevant technical facts available. In the report the auditors should

request that the financial statements be corrected, and clarify that if the brand is not derecognised, then the audit opinion

will be qualified on the grounds of a material disagreement – an ‘except for’ opinion would be provided. Once the breach

of IAS 38 is made clear to the management in the report, they then have the opportunity to discuss the matter and

decide whether to amend the financial statements, thereby avoiding a qualified audit opinion.

Audit inefficiencies

Documentation relating to inventories was not always made readily available to the auditors. This seems to be due to

poor administration by the client rather than a deliberate attempt to conceal information. The report should contain a

brief description of the problems encountered by the audit team. The management should be made aware that

significant delay to the receipt of necessary paperwork can cause inefficiencies in the audit process. This may seem a

relatively trivial issue, but it could lead to an increase in audit fee. Management should react to these comments by

ensuring as far as possible that all requested documentation is made available to the auditors in a timely fashion.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-05-16

- 2019-07-19

- 2020-03-05

- 2020-03-08

- 2020-02-23

- 2019-07-19

- 2020-03-12

- 2020-03-13

- 2020-02-23

- 2019-07-19

- 2020-01-03

- 2019-07-19

- 2020-03-01

- 2021-05-14

- 2020-03-05

- 2019-07-19

- 2019-07-19

- 2021-05-12

- 2020-08-05

- 2020-03-12

- 2021-05-02

- 2020-03-01

- 2019-07-19

- 2019-07-19

- 2020-03-12

- 2019-07-19

- 2019-07-19

- 2019-07-19

- 2020-01-03

- 2021-05-12