2020年ACCA考试P7科目考点清单

发布时间:2020-03-13

P7科目是选修阶段的最后一个科目,与其他几个选修科目一样,考试难度比较高,其课程名称为Advanced Audit and Assurance,即高级审计与认证业务,科目内容主要是涉及审计方面。那么,这一科目又有哪些考点呢?下面,51题库考试学习网为大家带来ACCA考试中P7科目考点的相关信息,以供参考。

从内容来看,P7这门课是F8的高阶,但是对考生的能力要求提高了不少。如果说,F8是站在一个普通审计师的角度考察大家,涉及的大多基础性内容。比如说考察具体审计程序。那么,P7则是站在审计项目经理或者合伙人的角度考察,所以P7的考点也变得更加宏观,其中最核心的部分在于识别和评估风险。所以,小伙伴们在备考P7时也需要去熟悉P2中的IAS和IFRS准则。值得注意的是,P7考试时间很紧张,因此准备选择这门科目的小伙伴们要注重时间管理以及平时对思维敏捷度的培养。最好是在平常练习时,就养成合理安排时间的习惯。

以上就是关于ACCA考试中P7科目考点的相关情况。51题库考试学习网提醒:P7要求考生要具有全局观念,因此小伙伴们在平常练习时就要注意多去思考,发散自己的思维。最后,51题库考试学习网预祝准备参加2020年ACCA考试的小伙伴都能顺利通过。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(c) The inheritance tax payable by Adam in respect of the gift from his aunt. (4 marks)

Additional marks will be awarded for the appropriateness of the format and presentation of the memorandum and

the effectiveness with which the information is communicated. (2 marks)

Note: you should assume that the tax rates and allowances for the tax year 2006/07 will continue to apply for the

foreseeable future.

(c) Inheritance tax payable by Adam

The gift by AS’s aunt was a potentially exempt transfer. No tax will be due if she lives until 1 June 2014 (seven years after

the date of the gift).

The maximum possible liability, on the assumption that there are no annual exemptions or nil band available, is £35,216

(£88,040 x 40%). This will only arise if AS’s aunt dies before 1 June 2010.

The maximum liability will be reduced by taper relief of 20% for every full year after 31 May 2010 for which AS’s aunt lives.

The liability will also be reduced if the chargeable transfers made by the aunt in the seven years prior to 1 June 2007 are

less than £285,000 or if the annual exemption for 2006/07 and/or 2007/08 is/are available.

Moonstar Co is a property development company which is planning to undertake a $200 million commercial property development. Moonstar Co has had some difficulties over the last few years, with some developments not generating the expected returns and the company has at times struggled to pay its finance costs. As a result Moonstar Co’s credit rating has been lowered, affecting the terms it can obtain for bank finance. Although Moonstar Co is listed on its local stock exchange, 75% of the share capital is held by members of the family who founded the company. The family members who are shareholders do not wish to subscribe for a rights issue and are unwilling to dilute their control over the company by authorising a new issue of equity shares. Moonstar Co’s board is therefore considering other methods of financing the development, which the directors believe will generate higher returns than other recent investments, as the country where Moonstar Co is based appears to be emerging from recession.

Securitisation proposals

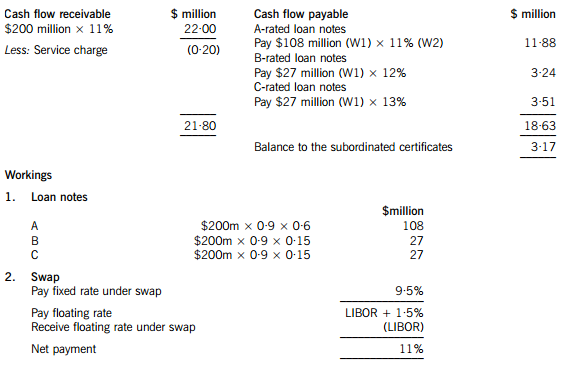

One of the non-executive directors of Moonstar Co has proposed that it should raise funds by means of a securitisation process, transferring the rights to the rental income from the commercial property development to a special purpose vehicle. Her proposals assume that the leases will generate an income of 11% per annum to Moonstar Co over a ten-year period. She proposes that Moonstar Co should use 90% of the value of the investment for a collateralised loan obligation which should be structured as follows:

– 60% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 150 basis points

– 15% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 12%

– 15% of the collateral value to support a tranche of C-rated fixed rate loan notes offering investors 13%

– 10% of the collateral value to support a tranche as subordinated certificates, with the return being the excess of receipts over payments from the securitisation process

The non-executive director believes that there will be sufficient demand for all tranches of the loan notes from investors. Investors will expect that the income stream from the development to be low risk, as they will expect the property market to improve with the recession coming to an end and enough potential lessees to be attracted by the new development.

The non-executive director predicts that there would be annual costs of $200,000 in administering the loan. She acknowledges that there would be interest rate risks associated with the proposal, and proposes a fixed for variable interest rate swap on the A-rated floating rate notes, exchanging LIBOR for 9·5%.

However the finance director believes that the prediction of the income from the development that the non-executive director has made is over-optimistic. He believes that it is most likely that the total value of the rental income will be 5% lower than the non-executive director has forecast. He believes that there is some risk that the returns could be so low as to jeopardise the income for the C-rated fixed rate loan note holders.

Islamic finance

Moonstar Co’s chief executive has wondered whether Sukuk finance would be a better way of funding the development than the securitisation.

Moonstar Co’s chairman has pointed out that a major bank in the country where Moonstar Co is located has begun to offer a range of Islamic financial products. The chairman has suggested that a Mudaraba contract would be the most appropriate method of providing the funds required for the investment.

Required:

(a) Calculate the amounts in $ which each of the tranches can expect to receive from the securitisation arrangement proposed by the non-executive director and discuss how the variability in rental income affects the returns from the securitisation. (11 marks)

(b) Discuss the benefits and risks for Moonstar Co associated with the securitisation arrangement that the non-executive director has proposed. (6 marks)

(c) (i) Discuss the suitability of Sukuk finance to fund the investment, including an assessment of its appeal to potential investors. (4 marks)

(ii) Discuss whether a Mudaraba contract would be an appropriate method of financing the investment and discuss why the bank may have concerns about providing finance by this method. (4 marks)

(a) An annual cash flow account compares the estimated cash flows receivable from the property against the liabilities within the securitisation process. The swap introduces leverage into the arrangement.

The holders of the certificates are expected to receive $3·17million on $18 million, giving them a return of 17·6%. If the cash flows are 5% lower than the non-executive director has predicted, annual revenue received will fall to $20·90 million, reducing the balance available for the subordinated certificates to $2·07 million, giving a return of 11·5% on the subordinated certificates, which is below the returns offered on the B and C-rated loan notes. The point at which the holders of the certificates will receive nothing and below which the holders of the C-rated loan notes will not receive their full income will be an annual income of $18·83 million (a return of 9·4%), which is 14·4% less than the income that the non-executive director has forecast.

(b) Benefits

The finance costs of the securitisation may be lower than the finance costs of ordinary loan capital. The cash flows from the commercial property development may be regarded as lower risk than Moonstar Co’s other revenue streams. This will impact upon the rates that Moonstar Co is able to offer borrowers.

The securitisation matches the assets of the future cash flows to the liabilities to loan note holders. The non-executive director is assuming a steady stream of lease income over the next 10 years, with the development probably being close to being fully occupied over that period.

The securitisation means that Moonstar Co is no longer concerned with the risk that the level of earnings from the properties will be insufficient to pay the finance costs. Risks have effectively been transferred to the loan note holders.

Risks

Not all of the tranches may appeal to investors. The risk-return relationship on the subordinated certificates does not look very appealing, with the return quite likely to be below what is received on the C-rated loan notes. Even the C-rated loan note holders may question the relationship between the risk and return if there is continued uncertainty in the property sector.

If Moonstar Co seeks funding from other sources for other developments, transferring out a lower risk income stream means that the residual risks associated with the rest of Moonstar Co’s portfolio will be higher. This may affect the availability and terms of other borrowing.

It appears that the size of the securitisation should be large enough for the costs to be bearable. However Moonstar Co may face unforeseen costs, possibly unexpected management or legal expenses.

(c) (i) Sukuk finance could be appropriate for the securitisation of the leasing portfolio. An asset-backed Sukuk would be the same kind of arrangement as the securitisation, where assets are transferred to a special purpose vehicle and the returns and repayments are directly financed by the income from the assets. The Sukuk holders would bear the risks and returns of the relationship.

The other type of Sukuk would be more like a sale and leaseback of the development. Here the Sukuk holders would be guaranteed a rental, so it would seem less appropriate for Moonstar Co if there is significant uncertainty about the returns from the development.

The main issue with the asset-backed Sukuk finance is whether it would be as appealing as certainly the A-tranche of the securitisation arrangement which the non-executive director has proposed. The safer income that the securitisation offers A-tranche investors may be more appealing to investors than a marginally better return from the Sukuk. There will also be costs involved in establishing and gaining approval for the Sukuk, although these costs may be less than for the securitisation arrangement described above.

(ii) A Mudaraba contract would involve the bank providing capital for Moonstar Co to invest in the development. Moonstar Co would manage the investment which the capital funded. Profits from the investment would be shared with the bank, but losses would be solely borne by the bank. A Mudaraba contract is essentially an equity partnership, so Moonstar Co might not face the threat to its credit rating which it would if it obtained ordinary loan finance for the development. A Mudaraba contract would also represent a diversification of sources of finance. It would not require the commitment to pay interest that loan finance would involve.

Moonstar Co would maintain control over the running of the project. A Mudaraba contract would offer a method of obtaining equity funding without the dilution of control which an issue of shares to external shareholders would bring. This is likely to make it appealing to Moonstar Co’s directors, given their desire to maintain a dominant influence over the business.

The bank would be concerned about the uncertainties regarding the rental income from the development. Although the lack of involvement by the bank might appeal to Moonstar Co's directors, the bank might not find it so attractive. The bank might be concerned about information asymmetry – that Moonstar Co’s management might be reluctant to supply the bank with the information it needs to judge how well its investment is performing.

11 The following information is available for Orset, a sole trader who does not keep full accounting records:

$

Inventory 1 July 2004 138,600

30 June 2005 149,100

Purchases for year ended 30 June 2005 716,100

Orset makes a standard gross profit of 30 per cent on sales.

Based on these figures, what is Orset’s sales figure for the year ended 30 June 2005?

A $2,352,000

B $1,038,000

C $917,280

D $1,008,000

19 Which of the following statements about intangible assets in company financial statements are correct according

to international accounting standards?

1 Internally generated goodwill should not be capitalised.

2 Purchased goodwill should normally be amortised through the income statement.

3 Development expenditure must be capitalised if certain conditions are met.

A 1 and 3 only

B 1 and 2 only

C 2 and 3 only

D All three statements are correct

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-03-04

- 2021-06-19

- 2020-05-16

- 2020-03-05

- 2020-03-13

- 2020-03-13

- 2020-04-16

- 2019-07-19

- 2019-07-19

- 2020-03-13

- 2019-12-29

- 2020-01-02

- 2020-03-12

- 2020-03-13

- 2020-01-03

- 2020-05-16

- 2020-03-02

- 2020-03-08

- 2020-01-01

- 2020-03-13

- 2020-05-03

- 2019-07-19

- 2020-03-01

- 2020-08-05

- 2020-03-13

- 2020-03-13

- 2019-07-19

- 2020-02-21

- 2020-03-13

- 2020-03-13