2020年广东省7月ACCA考试成绩查询时间

发布时间:2020-08-12

考试结束后,大家最关心的莫过于考试成绩,那么2020年广东省7月ACCA考试成绩查询时间大家清楚吗?下面51题库考试学习网就带领大家一起来了解看看,关于2020年广东省ACCA考试成绩查询相关内容,感兴趣的小伙伴赶紧来围观吧。

根据官网消息,2020年7月ACCA考试成绩预计将于8月1日公布。

2020ACCA成绩查询方式与流程

ACCA成绩查询方式

1.电子邮件(e-mail)---您可在MYACCA内选择通过e-mail接收考试成绩。

2.短信通知---ACCA可采用短信通知考试成绩,但由于跨国服务较为复杂,可能不能接收短信。

3.网站查看考试成绩—在ACCA官网注册过的所有学生都能登录官网查看自己的成绩。

官网成绩查询的步骤:

1、登录

点击myACCA,输入学员账ID和密码,

2、点击exam entry,

查看自己的考试报名结果。

3、下载

确认好考试报名的信息后,一定要确认自己的身份信息,考试科目以及考试地点。点击“Download”j进行准考证的下载。

ACCA成绩查询结果显示:

到ACCA全球官方网站http://www.accaglobal.com/;点击Myacca登陆,点左面框架里的“EXAMS”进入页面,中间有一段:

EXAM STATUS REPORT Your

status report provides details of the ACCA exams you have already passed and

those you have still to complete

EXAM STATUS REPORT Your

status report provides details of the ACCA exams you have already passed and

those you have still to complete

View your status

report————这个是超级链接,点进去就是你全部的考试分数记录了。

2020年ACCA成绩合格标准:

ACCA考试是百分制,50分为及格线。这意味着考生需要单科考试分数至少需要达到50分才算通过了考试。

成绩有效期:

ACCA

应用课程(F阶段)成绩有效期为无限期,战略课程(P阶段)成绩有效期为7年

ACCA考试期限跟CPA一样实行轮废制,即需要在一定的时间里面考完规定的科目,否则成绩将会无效。

时间计算:

根据以前的规则,学员必须在首次报名注册后10年内通过所有考试,否则将注销其学员资格。而后ACCA对时限做出了重要调整即:F段成绩永久有效,P段要在7年内考完。根据新规则,专业阶段考试的时限将为7年。因此,国际财会基础资格(Foundations in Accountancy,简称FIA)的考试以及ACCA资格考试的基础阶段F1-F9考试将不再有通过时限。

“7年政策”意味着从你通过P阶段的第一门科目开始,7年内需完成P阶段所要求的所有ACCA考试科目。否则,从第8年开始,你第1年所考过的P阶段科目成绩将会被视为过期作废,须重新考试。

另外,需要说明的是——此政策实行滚动式废除,也就是说不会在第8年时把你之前7年所有考过的P阶段科目成绩都废除,只会废除你第1年考过的P阶段科目成绩,第9年会废除你前2年所通过的P阶段科目成绩,以此类推。

以上是关于广东省2020年7月ACCA考试成绩查询相关内容,小伙伴们都了解了吗?如果大家对于ACCA考试还有别的问题,可以多多关注51题库考试学习网,我们将继续为大家答疑解惑!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

2 Clifford and Amanda, currently aged 54 and 45 respectively, were married on 1 February 1998. Clifford is a higher

rate taxpayer who has realised taxable capital gains in 2007/08 in excess of his capital gains tax annual exemption.

Clifford moved into Amanda’s house in London on the day they were married. Clifford’s own house in Oxford, where

he had lived since acquiring it for £129,400 on 1 August 1996, has been empty since that date although he and

Amanda have used it when visiting friends. Clifford has been offered £284,950 for the Oxford house and has decided

that it is time to sell it. The house has a large garden such that Clifford is also considering an offer for the house and

a part only of the garden. He would then sell the remainder of the garden at a later date as a building plot. His total

sales proceeds will be higher if he sells the property in this way.

Amanda received the following income from quoted investments in 2006/07:

£

Dividends in respect of quoted trading company shares 1,395

Dividends paid by a Real Estate Investment Trust out of tax exempt property income 485

On 1 May 2006, Amanda was granted a 22 year lease of a commercial investment property. She paid the landlord

a premium of £6,900 and also pays rent of £2,100 per month. On 1 June 2006 Amanda granted a nine year

sub-lease of the property. She received a premium of £14,700 and receives rent of £2,100 per month.

On 1 September 2006 Amanda gave quoted shares with a value of £2,200 to a registered charity. She paid broker’s

fees of £115 in respect of the gift.

Amanda began working for Shearer plc, a quoted company, on 1 June 2006 having had a two year break from her

career. She earns an annual salary of £38,600 and was paid a bonus of £5,750 in August 2006 for agreeing to

come and work for the company. On 1 August 2006 Amanda was provided with a fully expensed company car,

including the provision of private petrol, which had a list price when new of £23,400 and a CO2 emissions rate of

187 grams per kilometre. Amanda is required to pay Shearer plc £22 per month in respect of the private use of the

car. In June and July 2006 Amanda used her own car whilst on company business. She drove 720 business miles

during this two month period and was paid 34 pence per mile. Amanda had PAYE of £6,785 deducted from her gross

salary in the tax year 2006/07.

After working for Shearer plc for a full year, Amanda becomes entitled to the following additional benefits:

– The opportunity to purchase a large number of shares in Shearer plc on 1 July 2007 for £3·30 per share. It is

anticipated that the share price on that day will be at least £7·50 per share. The company will make an interestfree

loan to Amanda equal to the cost of the shares to be repaid in two years.

– Exclusive free use of the company sailing boat for one week in August 2007. The sailing boat was purchased by

Shearer plc in January 2005 for use by its senior employees and costs the company £1,400 a week in respect

of its crew and other running expenses.

Required:

(a) (i) Calculate Clifford’s capital gains tax liability for the tax year 2007/08 on the assumption that the Oxford

house together with its entire garden is sold on 31 July 2007 for £284,950. Comment on the relevance

to your calculations of the size of the garden; (5 marks)

(b) ‘opinion shopping’; (5 marks)

(b) ‘Opinion shopping’

Explanation of term

‘Opinion shopping’ occurs when management approach auditing firms (other than their incumbent auditors) to ask their views

on the application of accounting standards or principles to specific circumstances or transactions.

Ethical risks

The reasons for ‘opinion shopping’ may be:

■ to find alternative auditors; or

■ to get advice on a matter of contention with the incumbent auditor.

The member who is not the entity’s auditor must be alert to the possibility that their opinion – if it differs from that of the

incumbent auditor – may create undue pressure on the incumbent auditor’s judgement and so threaten the objectivity of the

audit.

Furthermore, by aligning with the interests of management when negotiating taking on an engagement, an incoming auditor

may compromise their objectivity even before the audit work commences. There is a risk that the audit fee might be seen to

be contingent upon a ‘favourable’ opinion (that is, the audit judgement coinciding with management’s preferences).

Employed professional accountants (accountants in industry) who support their company’s management in seeking second

opinions may call into question their integrity and professional behaviour.

Sufficiency of current ethical guidance

Current ethical guidance requires that when asked to provide a ‘second opinion’ a member should seek to minimise the risk

of giving inappropriate guidance, by ensuring that they have access to all relevant information.

The member should therefore:

■ ascertain why their opinion is being sought;

■ contact the auditor to provide any relevant facts;

■ with the entity’s permission, provide the auditor with a copy of their opinion.

The member’s opinion is more likely to differ if it is based on information which is different (or incomplete) as compared with

that available to the incumbent auditor. The member should therefore decline to act if permission to communicate with the

auditor is not given.

‘Opinion shopping’ might be less prevalent if company directors had no say in the appointment and remuneration of auditors.

If audit appointments were made by an independent body ‘doubtful accounting practices’ would (arguably) be less of a

negotiating factor. However, to be able to appoint auditors to multi-national/global corporations, such measures would require

the backing of regulatory bodies worldwide.

Statutory requirements in this area could also be more stringent. For example, an auditor may be required to deposit a

‘statement of circumstances’ (or a statement of ‘no circumstances’) in the event that they are removed from office or resign.

However, disclosure could be made more public if, when a change in accounting policy coincides with a change of auditors,

the financial statements and auditor’s report highlight the change and the auditors state their concurrence (or otherwise) with

the change. This could be made a statutory requirement and International Standards on Auditing (ISAs) amended to give

guidance on how auditors should report on changes.

Further, if the incoming auditor were to have a statutory right of access to the files and working papers of the outgoing auditors

they would be able to make a better and informed assessment of the desirability of the client and also appreciate the validity

(or otherwise) of any ‘statement’ issued by the outgoing auditor.

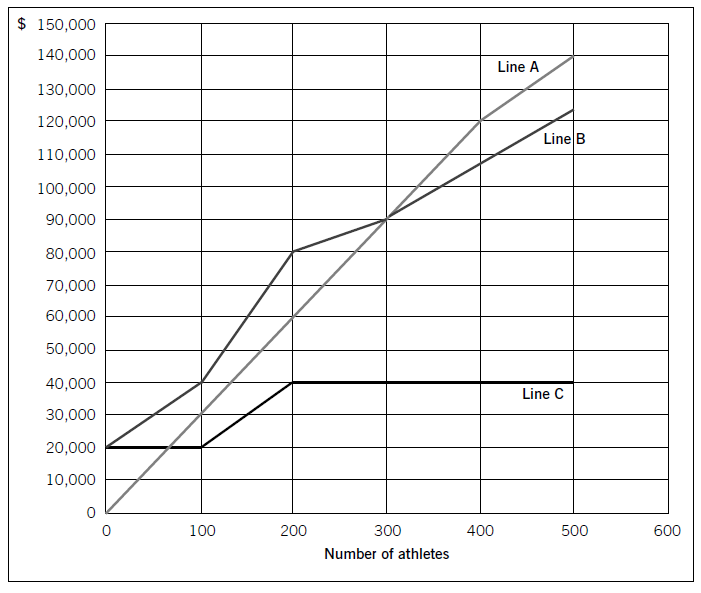

Swim Co offers training courses to athletes and has prepared the following breakeven chart:

Required:

(a) State the breakeven sales revenue for Swim Co and estimate, to the nearest $10,000, the company’s profit if 500 athletes attend a training course. (2 marks)

(b) Using the chart above, explain the cost and revenue structure of the company. (8 marks)

(a)ThebreakevensalesrevenueforSwimCois$90,000.Thecompany’sprofit,tothenearest$10,000,if500athletesattendthecourseis$20,000($140,000–$120,000).(Fromthegraph,itisclearthatthepreciseamountwillbenearer$17,000,i.e.$140,000–approximately$123,000.)(b)CoststructureFromthechart,itisclearthatLineCrepresentsfixedcosts,LineBrepresentstotalcostsandLineArepresentstotalrevenue.LineCshowsthatinitially,fixedcostsare$20,000evenifnoathletesattendthecourse.Thisleveloffixedcostsremainsthesameif100athletesattendbutoncethenumberofattendeesincreasesabovethislevel,fixedcostsincreaseto$40,000.LineBrepresentstotalcosts.If100athletesattend,totalcostsare$40,000($400perathlete).Since$20,000ofthisrelatestofixedcosts,thevariablecostperathletemustbe$200.Whenfixedcostsstepupbeyondthispointatthelevelof200athletes,totalcostsobviouslyincreaseaswellandLineBconsequentlygetsmuchsteeper.However,sincetherearenow200athletestoabsorbthefixedcosts,thecostperathleteremainsthesameat$400perathlete($80,000/200),eventhoughfixedcostshavedoubled.If300athletesattendthecourse,totalcostperathletebecomes$300each($90,000/300).Sincefixedcostsaccountfor$40,000ofthistotalcost,variablecoststotal$50,000,i.e.$166·67perathlete.So,economiesofscaleariseatthislevel,asdemonstratedbythefactthatLineBbecomesflatter.At400athletes,thegradientofthetotalcostslineisunchangedfrom300athleteswhichindicatesthatthevariablecostshaveremainedthesame.Thereisnofurtherchangeat500athletes;fixedandvariablecostsremainsteady.RevenuestructureAsregardstherevenuestructure,itcanbeseenfromLineAthatfor100–400athletesthepriceremainsthesameat$300perathlete.However,if500athletesattend,thepricehasbeenreducedasthetotalrevenuelinebecomesflatter.$140,000/500meansthatthepricehasgonedownto$280perathlete.Thiswasobviouslynecessarytoincreasethenumberofattendeesandatthispoint,profitismaximised.1

(b) Describe the advantages of external recruitment. (5 marks)

(b) External recruitment describes the situation where the organisation decides to fill a staff vacancy and recruit from outside the organisation.

It may be essential if particular skills or expertise are not already available within the organisation and is necessary to restore depleted staffing levels or when for some reason the organisation urgently needs new employees. New staff members bring new ideas and novel approaches to the organisation and to the specific task, often providing experience and work methods from other employers.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-01-08

- 2020-01-10

- 2020-01-01

- 2020-09-05

- 2019-03-20

- 2020-08-12

- 2020-10-18

- 2020-08-12

- 2021-04-04

- 2020-01-10

- 2021-04-04

- 2019-03-20

- 2020-01-10

- 2020-01-10

- 2021-01-06

- 2019-01-05

- 2020-08-12

- 2020-01-10

- 2021-04-08

- 2020-10-18

- 2020-09-05

- 2020-10-18

- 2021-01-07

- 2021-01-08

- 2020-09-04

- 2020-10-19

- 2020-01-10

- 2019-01-05

- 2020-01-10

- 2019-01-05