信息!关于ACCA考试成绩有效期是多少时间呢?

发布时间:2020-05-20

大家想知道ACCA证书吗?那么关于ACCA考试成绩有效期是多少时间呢?带着这个问题,我们一起来了解下吧!

对于ACCA成绩并不是永久有效的,据官方发布的政策来看,原F阶段的课程成绩永久有效,但P阶段成绩却是在7年内才有效。

在通过第一次战略专业考试之日起,您将有七年时间通过战略专业考试。如果未在七年内通过所有战略专业考试并达到联盟会员身份,则将失去七年后达到的任何战略专业级别考试。这些将需要重新进行以完成资格认证。

比如在2013年12月通过了高级财务管理考试,则将在2020年12月之前获得“失效日期”。

如果在2020年12月之前尚未完成所有战略专业考试,则高级财务管理考试将会过期,需要重新考试。

在会计考试中通过任何基础会议没有时间限制,也没有任何应用知识和应用技能考试作为ACCA资格认证的一部分。

ACCA是专为会计师设立的ACCA 作为一种资格认证正在全球范围内迅速发展,学员和会员遍及 180多个国家。

这个认证给雇主一个保证,你有资格在一个企业的财务相关工作任职。它会给你带来更好的工作前景和更高的高级管理职位。它是全球最大、增长最快的会计机构,

在世界各地拥有逾 3200万名成员和学生。最重要的是,它能让你在学习商业技能时获得个人满足感。ACCA 的这些认证标准,给了你非常强烈的理由想要获得它,即使你必须投入大量的金钱和时间。

那么你的付出和牺牲究竟值不值呢?

ACCA在国内称为"国际注册会计师",实际上是英国的注册会计师协会之一,但它是英国具有特许头衔的4家注册会计师协会之一,也是当今知名的国际性会计师组织之一。

对于ACCA会员从事审计、投资顾问和破产执行的工作,但在中国只有中国注册会计师获得法律认可。

ACCA是世界上大多数国家都承认的,只是由于地方保护主义,也就是保护本国的会计师,目前中国法律不承认ACCA 会员资格,即ACCA 会员不能替代中注协会员签署中国企业的审计报告。

关于签字权,执业的CICPA 在中国大陆有签署 PRC GAAP 审计报告的资格。

ACCA 会员资格在国际上得到广泛认可,尤其是得到欧盟立法以及许多国家公司法的承认。ACCA 的会员可以在工商企业财务部门。

好了,以上就是今天所要分享的内容,到这里就结束了,看完本篇内容是不是更加了解考试了,如果还有其他疑问,也可到帮考官网或者相关网站去搜索看看吧。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

2 David Gould set up his accounting firm, providing accounting services to small businesses, in 2001. Within three

years his fee income was in excess of £100K a year and he had nearly 100 clients most of whom had been gained

through word of mouth. David recognised that these small or micro businesses, typically employing ten or fewer

people, were receiving less than satisfactory service from their current accountants. These accounting firms typically

had between five and ten partners and operated regionally and not nationally. Evidence of poor service included

limited access to their particular accountant, poor response time to clients’ enquiries and failure to identify

opportunities to save clients money. In addition bad advice, lack of interest in business development opportunities for

the client and poor internal communication between the partners and their staff contributed to client dissatisfaction.

David has deliberately kept the costs of the business down by employing three part-time accountants and relying on

his wife to run the office.

David had recently met Ian King who ran a similar sized accounting firm. The personal chemistry between the two

and complementary skills led to a partnership being proposed. Gould and King Associates, subject to securing the

necessary funding, is to be launched in September 2006. David is to focus on the business development side of the

partnership and Ian on the core services provided. Indicative of their creative thinking is David’s conviction that

accounting services are promoted very inadequately with little attempt to communicate with clients using the Internet.

He is also convinced that there are real opportunities for the partnership to move into new areas such as providing

accountancy services for property developers, both at home and abroad. Ian feels that the partnership should set up

its own subsidiary in India, enjoying the benefits of much cheaper accountancy staff and avoiding the costs and

complications of outsourcing their core accounting services. Ian sees fee income growing to £2 million in five years’

time.

David has been asked by his bank to provide it with a business plan setting out how the partnership intends to grow

and develop.

Required:

(a) Write a short report for David giving the key features that you consider to be important and that you would

expect to see in the business plan for the Gould and King partnership that David has to present to his bank.

(12 marks)

(a) To: David Gould

From:

Writing a business plan is a critical stage in moving an idea for a business into a reality. The reality includes presenting a

convincing case to potential financers of the business, be they banks or venture capitalists. The key ingredients include clearly

saying what you plan to do and why people should want to buy your particular service. Experts warn of starting with a detailed

cash flow and then working backwards to make the numbers fit. You should regard the business plan as a management tool

and not simply a sales document. Again, the advice is to make credible and achievable projections; it is better to exceed low

targets than fail to achieve over-ambitious ones. Many business plans are based on deeply flawed research. Key to your

business success will be the size of your target market. There is much evidence to suggest that it is the make-up of the team

presenting the plan and their commitment rather than the business idea itself that will determine whether the necessary

financial support is made.

Clearly, you need to say how much money you require and why. Again the advice is not to be afraid to ask for large amounts

if your business requires it. Linked to how much you want is a clear statement of the return the investor or lender will get –

how much of the equity are you willing to give or what security can you offer the lender? Figure are important and you need

projected cash flows, profit and loss accounts and balance sheets for at least three years ahead. Potential investors and/or

lenders are likely to be impressed by a plan which clearly indicates where the major risks are to be found and the strategies

available to handle such risks.

There needs to be a clear statement of the major steps and milestones on the way to achieving your goals. Where are you

now, where do you intend to be and how are you going to get there. One expert argues there are three elements of the plan

itself – an executive summary pulling together the key points in your proposal, secondly the plan itself and finally an ‘elevator

pitch’, a one paragraph description that explains the business in the time it takes to go up in a lift.

In summary, your business plan should contain an executive summary as explained above, the objectives of the business,

including key financial targets and the philosophy of the business, the target market and relevant forecasts, the range of

products/services, the marketing strategy linked to the target markets, resource availability, people and organisation involved,

performance measurement to measure progress towards stated objectives and a summary of financial information.

One final point is to remember that no business plan ever was carried out exactly! In many ways it is the quality of the thinking

the plan includes and the actual process through which it is developed that will determine success.

Yours,

(b) Given his recent diagnosis, advise Stuart as to which of the two proposed investments (Omikron plc/Omega

plc) would be the more tax efficient alternative. Give reasons for your choice. (3 marks)

(b) Both companies are listed. The only difference will be in the availability of inheritance tax relief – specifically business property

relief (BPR). If Stuart and Rebecca jointly hold in excess of 50% of the share capital of a listed company, BPR will apply at

the rate of 50%. Otherwise, no BPR is available.

Stuart can only buy 1,005,000 (£422,100/£0·42) shares in Omikron plc. This represents a shareholding of 2·00%

(1,005,000/50,250,000). As the shares in Omikron plc are listed, a 2% holding will not qualify for BPR.

At the moment, both Stuart and Rebecca own 2,400,000 shares in Omega plc. Their shareholdings are amalgamated for

IHT purposes under the related property rules. With a joint holding of 48%, BPR is not available. A further 200,001 shares

will be required to attain a 50% holding. Assuming Stuart and Rebecca can buy these shares, they must then hold their 50%

interest in the company for the period of at least two years in order to ensure that BPR applies.

On the basis that Stuart is expected to survive for two to three years, he should therefore buy further shares in Omega plc in

order to take advantage of the BPR available.

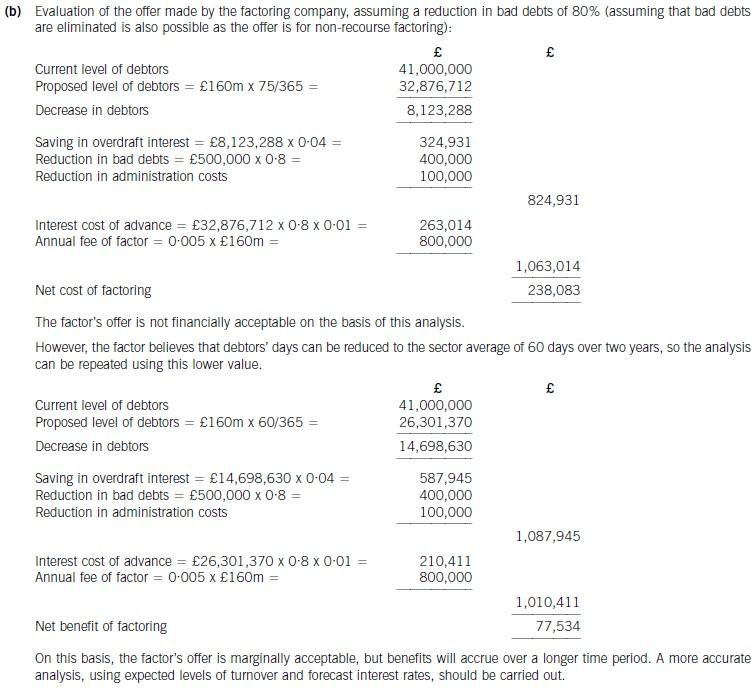

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-01-06

- 2020-01-10

- 2019-03-20

- 2021-05-22

- 2020-01-10

- 2021-05-22

- 2021-01-06

- 2021-01-06

- 2020-10-19

- 2020-08-12

- 2020-04-12

- 2021-04-07

- 2020-01-10

- 2020-10-19

- 2021-04-07

- 2019-01-05

- 2021-04-07

- 2020-01-10

- 2020-10-18

- 2020-05-20

- 2020-10-18

- 2021-04-07

- 2019-03-20

- 2021-01-08

- 2020-01-10

- 2021-01-08

- 2019-01-05

- 2020-01-10

- 2019-01-05

- 2020-09-05