ACCA考试 2022_06_24 每日一练

(c) At 1 June 2006, Router held a 25% shareholding in a film distribution company, Wireless, a public limited

company. On 1 January 2007, Router sold a 15% holding in Wireless thus reducing its investment to a 10%

holding. Router no longer exercises significant influence over Wireless. Before the sale of the shares the net asset

value of Wireless on 1 January 2007 was $200 million and goodwill relating to the acquisition of Wireless was

$5 million. Router received $40 million for its sale of the 15% holding in Wireless. At 1 January 2007, the fair

value of the remaining investment in Wireless was $23 million and at 31 May 2007 the fair value was

$26 million. (6 marks)

Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.

(ii) Write a letter to Donald advising him on the most tax efficient manner in which he can relieve the loss

incurred in the year to 31 March 2007. Your letter should briefly outline the types of loss relief available

and explain their relative merits in Donald’s situation. Assume that Donald will have no source of income

other than the business in the year of assessment 2006/07 and that any income he earned on a parttime

basis while at university was always less than his annual personal allowance. (9 marks)

Assume that the corporation tax rates and allowances for the financial year 2004 and the income tax rates

and allowances for 2004/05 apply throughout this question.

Relevant retail price index figures are:

January 1998 159·5

April 1998 162·6

(c) Describe the main stages of a formal grievance procedure that Oliver should now pursue. (10 marks)

(c) Issue of bond

The club proposes to issue a 7% bond with a face value of $50 million on 1 January 2007 at a discount of 5%

that will be secured on income from future ticket sales and corporate hospitality receipts, which are approximately

$20 million per annum. Under the agreement the club cannot use the first $6 million received from corporate

hospitality sales and reserved tickets (season tickets) as this will be used to repay the bond. The money from the

bond will be used to pay for ground improvements and to pay the wages of players.

The bond will be repayable, both capital and interest, over 15 years with the first payment of $6 million due on

31 December 2007. It has an effective interest rate of 7·7%. There will be no active market for the bond and

the company does not wish to use valuation models to value the bond. (6 marks)

Required:

Discuss how the above proposals would be dealt with in the financial statements of Seejoy for the year ending

31 December 2007, setting out their accounting treatment and appropriateness in helping the football club’s

cash flow problems.

(Candidates do not need knowledge of the football finance sector to answer this question.)

11 The following information is available for Orset, a sole trader who does not keep full accounting records:

$

Inventory 1 July 2004 138,600

30 June 2005 149,100

Purchases for year ended 30 June 2005 716,100

Orset makes a standard gross profit of 30 per cent on sales.

Based on these figures, what is Orset’s sales figure for the year ended 30 June 2005?

A $2,352,000

B $1,038,000

C $917,280

D $1,008,000

(b) Explain how the adoption of residual income (RI) using the annuity method of depreciation might prove to

be a superior basis for the management incentive plan operated by NCL plc.

(N.B. No illustrative calculations should be incorporated into your explanation). (4 marks)

(c) Assess the advantages and disadvantages to Datum Paper Products taking the greenfield option as opposed

to the acquisition of Papier Presse. (15 marks)

Susan is aware of benchmarking as a useful input into performance measurement and strategic change.

(b) Assess the contribution benchmarking could make to improving the position of the Marlow Fashion Group

and any limitations to its usefulness. (8 marks)

(c) Prepare brief notes for the proposed meeting with Charles and Jane. Clearly identify the further information

you would need in order to advise them more fully and suggest appropriate personal financial planning

protection products, in respect of both death and serious illness. (9 marks)

You should assume that the income tax rates and allowances for the tax year 2005/06 and the corporation tax

rates for the financial year 2005 apply throughout this question.

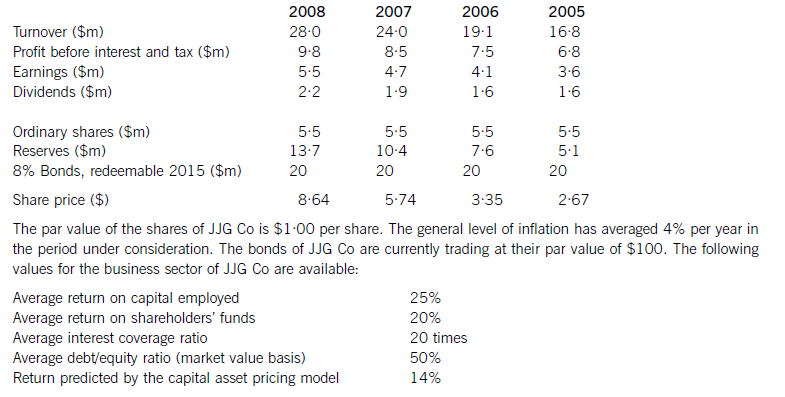

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)