ACCA特许公认会计师都需要那些考试

发布时间:2021-04-14

ACCA特许公认会计师都需要那些考试

最佳答案

在国内,注册会计师已经是最高的等级的,但是在国际上,特许公认会计师要比注册会计师要好和受欢迎。

中国注册会计师上面没有更高级别,在国内是最高等级,难度最大。中国的注册会计师考试(CertifiedPublicAccountant,简称CPA)是一项被业内人士视为“不胜其难”的考试,虽然我国已经举办了11次考试,但是全国仅有7万余人取得了执业资格。不过,由于取得这一资格的人可以从事注册会计师职业,每年参加该项考试者呈几何级数递增,2002年报名人数较2001年增长了8.88%。

ACCA(The Association of charterd certified

在英国本土有六个会计师协会ACCA、ICAEW、ICAI、ICAF、CIMA、CIPFA。ACCA是最大的,前四种性质类似,是注册会计师有签字权。后两者则是管理会计师无签字权。在英国本土,ACCA工作领域没有限制,会员统计,在工商企业和会计师事务所都占30%-40%,不是概念中认为的只能在事务所工作。剩下的是在**、公用事业单位、教育机构。ACCA工作领域就像其他那几个会计师事务所的交集。年薪多集中在15~30万。从考试的难度来看,ACCA高于CAT,CAT侧重基础操作性较强的会计基本知识,而ACCA则是偏向于管理技能和相关知识的综合运用。总体来说CAT是ACCA的基础,ACCA是CAT的延伸和发展,两者体系相同,相辅相成。

CAT(Certified Accounting

Technician)即国际注册《会计技师》资格认证,从属于ACCA系列,被人们喻为“国际型企业中高级财务管理人员的摇篮”。CAT资格考试以国际会计准则和惯例(IAS)为依据,内容涵盖会计、办公室实务、财务管理、人力资源管理和IT等领域,在英联邦国家盛行。加入WTO后的中国,也急需大量这种国际化复合型中级财务管理专业人才。而作为引进的“职业锚”——CAT又具有起步条件少、入门速度快、知识覆盖面广的特点。年薪在10万元以上 。

英国财务会计师公会(The Institute of Financial

Accountants,简称IFA)创立于1916年,是世界上历史最长的专业会计团体之一。IFA在全世界80多个国家拥有35000多名会员和学员,IFA认证进入中国的时间比较晚,2001年才开始正式在中国的认证工作。据了解,持有IFA资格的会员相当于英国大学本科学历,在英联邦国家及香港特别行政区**均承认IFA资格,持有IFA资格的会员,可从事财务会计、管理会计、会计经理及税务等工作,并可申请英国工作签证。凡获IFA基本会员资格(AFA)的人士均可免试申请成为澳大利亚国家会计师公会基本会员(ANIA)。

中国金融界6大含金量最高证书:

一、注册会计师(CPA)证书

难度指数:★★★★★

二、会计专业技术资格证书

难度指数:★★★

三、注册税务师(CTA)证书

难度指数:★★★

四、注册资产评估师(CPV)证书

难度指数:★★★★

五、特许公认会计师(ACCA)证书

难度指数:★★★★★

六、国际注册内部审计师(CIA)证书

难度指数:★★★★

可见,注册会计师证书在金融界还是具有较高含金量和影响力的。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

3 The directors of The Healthy Eating Group (HEG), a successful restaurant chain, which commenced trading in 1998,

have decided to enter the sandwich market in Homeland, its country of operation. It has set up a separate operation

under the name of Healthy Sandwiches Co (HSC). A management team for HSC has been recruited via a recruitment

consultancy which specialises in food sector appointments. Homeland has very high unemployment and the vast

majority of its workforce has no experience in a food manufacturing environment. HSC will commence trading on

1 January 2008.

The following information is available:

(1) HSC has agreed to make and supply sandwiches to agreed recipes for the Superior Food Group (SFG) which

owns a chain of supermarkets in all towns and cities within Homeland. SFG insists that it selects the suppliers

of the ingredients that are used in making the sandwiches it sells and therefore HSC would be unable to reduce

the costs of the ingredients used in the sandwiches. HSC will be the sole supplier for SFG.

(2) The number of sandwiches sold per year in Homeland is 625 million. SFG has a market share of 4%.

(3) The average selling price of all sandwiches sold by SFG is $2·40. SFG wishes to make a mark-up of 331/3% on

all sandwiches sold. 90% of all sandwiches sold by SFG are sold before 2 pm each day. The majority of the

remaining 10% are sold after 8 pm. It is the intention that all sandwiches are sold on the day that they are

delivered into SFG’s supermarkets.

(4) The finance director of HSC has estimated that the average cost of ingredients per sandwich is $0·70. All

sandwiches are made by hand.

(5) Packaging and labelling costs amount to $0·15 per sandwich.

(6) Fixed overheads have been estimated to amount to $5,401,000 per annum. Note that fixed overheads include

all wages and salaries costs as all employees are subject to fixed term employment contracts.

(7) Distribution costs are expected to amount to 8% of HSC’s revenue.

(8) The finance director of HSC has stated that he believes the target sales margin of 32% can be achieved, although

he is concerned about the effect that an increase in the cost of all ingredients would have on the forecast profits

(assuming that all other revenue/cost data remains unchanged).

(9) The existing management information system of HEG was purchased at the time that HEG commenced trading.

The directors are now considering investing in an enterprise resource planning system (ERPS).

Required:

(a) Using only the above information, show how the finance director of HSC reached his conclusion regarding

the expected sales margin and also state whether he was correct to be concerned about an increase in the

price of ingredients. (5 marks)

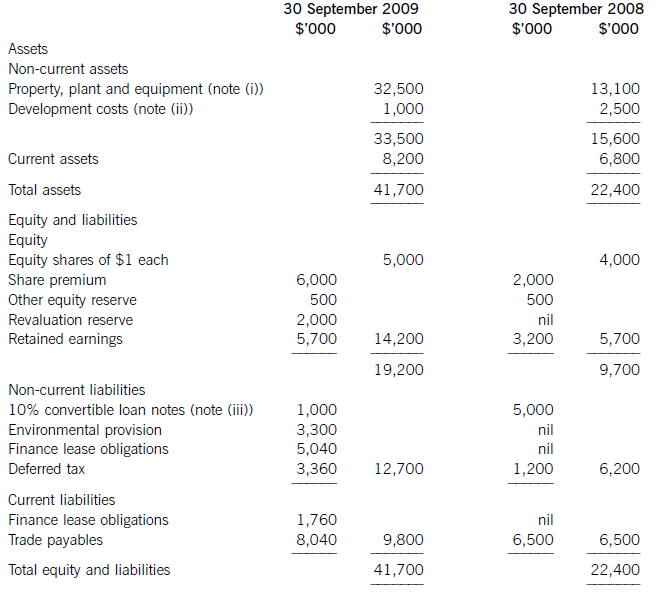

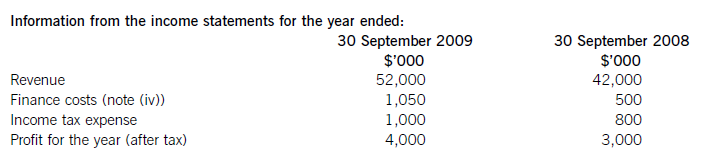

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

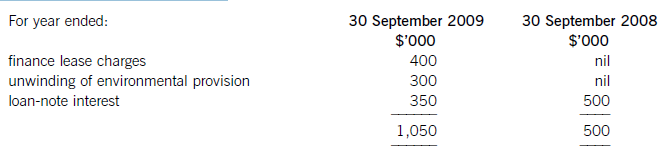

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced.

(b) Explain how growth may be assessed, and critically discuss the advantages and issues that might arise as a

result of a decision by the directors of CSG to pursue the objective of growth. (8 marks)

(b) Growth may be measured in a number of ways which are as follows:

Cash flow

This is a very important measure of growth as it ultimately determines the amount of funds available for re-investment by any

business.

Sales revenue

Growth in sales revenues generated is only of real value to investors if it precipitates growth in profits.

Profitability

There are many measures relating to profit which include sales margin, earnings before interest, taxation, depreciation and

amortisation (EBITDA) and earnings per share. More sophisticated measures such as return on capital employed and residual

income consider the size of the investment relative to the level of profits earned. In general terms, measures of profitability

are only meaningful if they are used as a basis for comparisons over time or in conjunction with other measures of

performance. Growth rate in profitability are useful when compared with other companies and also with other industries.

Return on investment

A growing return upon invested capital suggests that capital is being used more and more productively. Indicators of a growing

return would be measured by reference to dividend payment and capital growth.

Market share

Growth in market share is generally seen as positive as it can generate economies of scale.

Number of products/service offerings

Growth is only regarded as useful if products and services are profitable.

Number of employees

Measures of productivity such as value added per employee and profit per employee are often used by shareholders in

assessing growth. Very often an increased headcount is a measure of success in circumstances where more people are

needed in order to deliver a service to a required standard. However it is incumbent on management to ensure that all

employees are utilised in an effective manner.

It is a widely held belief that growth requires profits and that growth produces profits. Profits are essential in order to prevent

a company which has achieved growth from becoming a target for a take-over or in a worse case scenario goes into

liquidation. Hence it is fundamental that a business is profitable throughout its existence. Growth accompanied by growth in

profits is also likely to aid the long-term survival of an organisation. CSG operates in Swingland which experiences fluctuations

in its economic climate and in this respect the exploitation of profitable growth opportunities will help CSG to survive at the

expense of its competitors who do not exploit such opportunities.

Note: Alternative relevant discussion and examples would be accepted.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-03-11

- 2021-01-05

- 2021-04-15

- 2021-03-12

- 2021-11-06

- 2021-03-10

- 2021-06-02

- 2021-05-09

- 2021-04-23

- 2021-01-01

- 2021-05-28

- 2021-03-12

- 2021-11-06

- 2021-05-20

- 2021-12-30

- 2021-01-03

- 2021-11-13

- 2021-04-24

- 2021-03-11

- 2021-03-11

- 2021-02-15

- 2021-06-08

- 2021-07-01

- 2021-05-06

- 2021-03-11

- 2021-04-24

- 2021-05-08

- 2021-06-28

- 2021-01-01

- 2021-03-11