ACCA考试注册报名常见问题!

发布时间:2021-10-14

ACCA专业资格考试是最具权威性的国际认证资格考试之一,近年来ACCA考试成为会计热门考试之一,有小伙伴最近在报考的时候遇到很多注册的问题,今天51题库考试学习网为大家带来了ACCA注册报名常见问题及答疑,一起来看看吧。

登录ACCA全球官网(https://www.accaglobal.com/hk/en.html)进行报名。

ACCA12月报名时间

提前报名开始:2021年5月4日

提前报名截止:2021年8月16日

常规报名截止:2021年11月1日

晚期报名截止:2021年11月8日

考试时间:2021年12月6日-12月10日

ACCA注册报名常见问题:

1、“Confirm availability”过程中提示“Open registration”

答:点击页面左侧的小房子 logo 回到报考系统“Your plan”页面,点击要预定的科目旁的“x”符号删除还未成功预定的科目,退出 myACCA。

务必把浏览器的缓存清空后再打开浏览器登录 myACCA 访问报考系统,添加考试后(如有多门考试想进行预定,也请先单科考试确认付款后再进行下一科的考试预定),进入第二步的“Confirm availability”进行考位确认时,请点击“Select exam”下方显示的科目标题,按照页面提示完成考位确认。

如依然无法完成,请把页面的全屏截图(需包含网址、日期时间信息)发送到ACCA中文客服邮箱,在邮件正文以中文描述网页/系统故障。

ACCA中文客服邮箱:customerservicechina@accaglobal.com

2、报考 SP 阶段考试日历中选哪一天?

答:每一科 SP 阶段考试都只在考试周的某一天有考试,具体的考试日期请通过官网查看:

https://www.accaglobal.com/uk/en/student/examentry-and-administration/exam-timetables.html

3、考点没有考位,考点显示“None availability”

答:遇到以上提示,请致电ACCA中文客服,ACCA客服会协助学员确认是否的确是没考位还是报考系统 issue。

ACCA中文客服电话:4008333338

4、无法使用支付宝付费怎么办?

答:可以尝试清除浏览历史记录、更换其它浏览器、关闭VPN或者链接手机网络的热点,如果依旧无法支付,可以通过电话进行付款,请联系: +44 (0)141 582 2000

5、扣钱了但没有定上考试怎么办?

答:完成扣费后有可能缴费仍在到账过程中,费用到账后,考试预定才会完成。通常情况下,立刻到账或 5 日内到账都正常都有可能,所以小伙伴们请耐心等候。

费用成功到账完成考试预定您的邮箱将收到报考确认信;付款不成功的话,考试费用会原路退回,收到退费后可以登陆报考系统重新预定考试。

好的,以上就是今天51题库考试学习网为大家分享的全部内容,大家是否清楚了呢?想了解更多关于ACCA考试的内容,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) The use of the trading loss of Tethys Ltd for the year ending 31 December 2008; (6 marks)

(ii) Tethys Ltd – Use of trading loss

– The two companies will not be in a group relief group as Saturn Ltd will not own 75% of Tethys Ltd.

– For a consortium to exist, 75% of the ordinary share capital of Tethys Ltd must be held by companies which each

hold at least 5%. Accordingly, Tethys Ltd will be a consortium company if the balance of its share capital is owned

by Clangers Ltd but not if it is owned by Edith Clanger.

– If Tethys Ltd qualifies as a consortium company: 65% of its trading losses in the period from 1 August 2008 to

31 December 2008 can be surrendered to Saturn Ltd, i.e. £21,667 (£80,000 x 5/12 x 65%).

– If Tethys Ltd does not qualify as a consortium company: none of its loss can be surrendered to Saturn Ltd.

– The acquisition of 65% of Tethys Ltd is a change in ownership of the company. If there is a major change in the

nature or conduct of the trade of Tethys Ltd within three years of 1 August 2008, the loss arising prior to that date

cannot be carried forward for relief in the future.

Further information required:

– Ownership of the balance of the share capital of Tethys Ltd.

(b) Explain the meaning of the term ‘Efficient Market Hypothesis’ and discuss the implications for a company if

the stock market on which it is listed has been found to be semi-strong form. efficient. (9 marks)

(b) The term ‘Efficient Market Hypothesis’ (EMH) refers to the view that share prices fully and fairly reflect all relevant available

information1. There are other kinds of capital market efficiency, such as operational efficiency (meaning that transaction costs

are low enough not to discourage investors from buying and selling shares), but it is pricing efficiency that is especially

important in financial management.

Research has been carried out to discover whether capital markets are weak form. efficient (share prices reflect all past or

historic information), semi-strong form. efficient (share prices reflect all publicly available information, including past

information), or strong form. efficient (share prices reflect all information, whether publicly available or not). This research has

shown that well-developed capital markets are weak form. efficient, so that it is not possible to generate abnormal profits by

studying and analysing past information, such as historic share price movements. This research has also shown that

well-developed capital markets are semi-strong form. efficient, so that it is not possible to generate abnormal profits by studying

publicly available information such as company financial statements or press releases. Capital markets are not strong form

efficient, since it is possible to use insider information to buy and sell shares for profit.

If a stock market has been found to be semi-strong form. efficient, it means that research has shown that share prices on the

market respond quickly and accurately to new information as it arrives on the market. The share price of a company quickly

responds if new information relating to that company is released. The share prices quoted on a stock exchange are therefore

always fair prices, reflecting all information about a company that is relevant to buying and selling. The share price will factor

in past company performance, expected company performance, the quality of the management team, the way the company

might respond to changes in the economic environment such as a rise in interest rate, and so on.

There are a number of implications for a company of its stock market being semi-strong form. efficient. If it is thinking about

acquiring another company, the market value of the potential target company will be a fair one, since there are no bargains

to be found in an efficient market as a result of shares being undervalued. The managers of the company should focus on

making decisions that increase shareholder wealth, since the market will recognise the good decisions they are making and

the share price will increase accordingly. Manipulating accounting information, such as ‘window dressing’ annual financial

statements, will not be effective, as the share price will reflect the underlying ‘fundamentals’ of the company’s business

operations and will be unresponsive to cosmetic changes. It has also been argued that, if a stock market is efficient, the timing

of new issues of equity will be immaterial, as the price paid for the new equity will always be a fair one.

(c) Risk committee members can be either executive or non-executive.

Required:

(i) Distinguish between executive and non-executive directors. (2 marks)

(c) Risk committee members can be either executive on non-executive.

(i) Distinguish between executive and non-executive directors

Executive directors are full time members of staff, have management positions in the organisation, are part of the

executive structure and typically have industry or activity-relevant knowledge or expertise, which is the basis of their

value to the organisation.

Non-executive directors are engaged part time by the organisation, bring relevant independent, external input and

scrutiny to the board, and typically occupy positions in the committee structure.

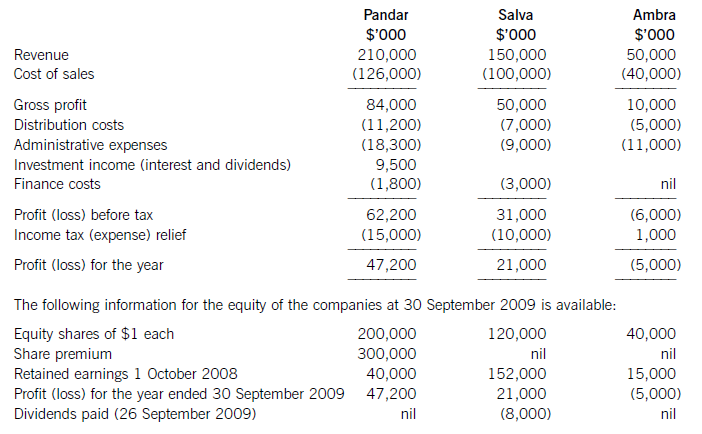

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-04-21

- 2020-03-14

- 2020-01-09

- 2020-04-30

- 2020-04-16

- 2020-01-10

- 2020-04-25

- 2020-01-10

- 2020-04-08

- 2020-04-08

- 2020-01-10

- 2020-04-19

- 2020-05-02

- 2020-01-13

- 2020-04-28

- 2020-01-10

- 2020-03-08

- 2020-02-20

- 2020-01-10

- 2022-02-08

- 2020-09-03

- 2020-01-10

- 2021-08-29

- 2020-05-08

- 2020-01-10

- 2020-01-09

- 2020-04-21

- 2020-02-19

- 2020-04-21

- 2020-01-10