关于不是财会专业可不可以自学ACCA?

发布时间:2020-01-13

如果不是财会专业可不可以自学ACCA?不知道的小伙伴快跟着51题库考试学习网一起来了解一下吧!

随着世界经济的不断发展,越来越多的国内企业开始寻求与国际接轨。也正因如此,作为国际比较领先的专业会计师资格,ACCA资格也越来越受到国内会计人的认可。很多非财会专业的大学生因为本专业就业难问题,而转型,ACCA就是他们最常选择的路。那么,作为一门专业的会计体系,ACCA对于那些并没有财会基础的人来讲是否可以靠自学通过所有考试呢?

ACCA课程设置是由浅入深的,如果能够付出一定的精力和时间,打好基础,那么考下ACCA也并非不可能。ACCA虽说是可以自学,但是根据每个人的情况不同,自学的程度也是不同的。由于ACCA科目众多,再加上每个人的毅力不一样,所以为了能够确保更快地通过ACCA考试,因此建议大家条件允许的情况可以报班学习。

ACCA考试难度如何?有哪些考试科目?

ACCA考试的前半部分是F阶段,也就是ACCA考试基础阶段,主要包括一些基础知识和技能课程。要求考生学习并掌握财务会计和管理会计方面的核心知识,以及一名专业ACCA需要了解和熟悉的知识领域以及必须掌握的技能。

ACCA的第二阶段是P阶段,也就是专业阶段,这一阶段的课程难度相当于会计硕士阶段的课程难度,是在F阶段科目内容上的拓展和延伸。这里ACCA考生需要学习的是一名高级会计师必须具备的更高级的职业财务技能,或者是从事高级管理咨询、金融投资等所必需的技能。具体科目如下:

以上就是51题库考试学习网带给大家的内容,如果遇到其他不能解决的问题,请及时反馈给51题库考试学习网,我们会尽快帮你解答。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(c) (i) Explain how Messier Ltd can assist Galileo with the cost of relocating to the UK and/or provide him with

interest-free loan finance for this purpose without increasing his UK income tax liability; (3 marks)

(c) (i) Relocation costs

Direct assistance

Messier Ltd can bear the cost of certain qualifying relocation costs of Galileo up to a maximum of £8,000 without

increasing his UK income tax liability. Qualifying costs include the legal, professional and other fees in relation to the

purchase of a house, the costs of travelling to the UK and the cost of transporting his belongings. The costs must be

incurred before the end of the tax year following the year of the relocation, i.e. by 5 April 2010.

Assistance in the form. of a loan

Messier Ltd can provide Galileo with an interest-free loan of up to £5,000 without giving rise to any UK income tax.

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

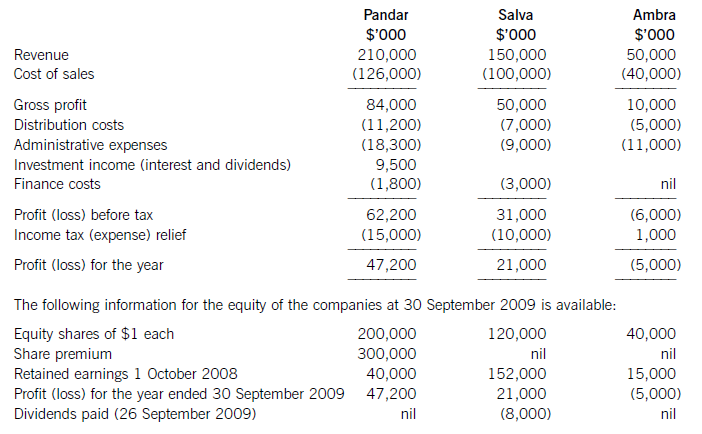

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

(ii) Recommend which of the refrigeration systems should be purchased. You should state your reasons

which must be supported by relevant calculations. (3 marks)

(d) Comment on THREE factors other than NPV that the directors of ITL should consider when deciding whether

to manufacture the Snowballer. (3 marks)

(d) Factors that should be considered by the directors of ITL include:

(i) The cash flows are estimated. How accurate they are requires detailed consideration.

(ii) The cost of capital used by the finance director might be inappropriate. For example if the Snowballer proposal is less

risky than other projects undertaken by ITL then a lower cost of capital should be used.

(iii) The rate of inflation may vary from the anticipated rate of 4% per annum.

(iv) How strong is the Olympic brand name? The directors are proposing to pay royalties equivalent to 6% of sales revenue

during the six years of the anticipated life of the project. Should they market the Snowballer themselves?

(v) Would competitors enter the market and what would be the likely effect on sales volumes and selling prices?

N.B: Only three factors were required.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-05-08

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2019-12-29

- 2020-04-22

- 2020-01-10

- 2020-01-10

- 2019-12-06

- 2020-01-10

- 2020-01-09

- 2021-07-23

- 2020-01-09

- 2020-01-14

- 2020-04-29

- 2020-03-14

- 2019-04-17

- 2020-02-22

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-03-03

- 2020-01-09

- 2019-07-20

- 2020-02-19

- 2020-03-07

- 2020-01-10

- 2020-01-10

- 2020-01-09