怎么缴纳ACCA考试会员费?忘记缴纳怎么办?

发布时间:2020-03-29

ACCA会员费是指什么?怎么缴纳?忘记缴纳怎么办?接下来,51题库考试学习网来给大家解答一下。

ACCA会员费,是ACCA官方要求每个持证会员自申请成为ACCA会员之日起,每年都需要缴纳的一项会员费用。 且一直需要缴纳直到无需ACCA持证会员资格时,换言之,只要我们需要保持ACCA会员资格的有效性,就要按照官方的规定按时缴纳ACCA会员费。那么,ACCA会员年费是多少?

目前官方公布的费用标准为258英镑。忘记缴纳年费怎么办?

ACCA年费一般都需要在每年12月份缴纳,例如2020年12月开始缴纳2021年的年费。届时官方会以邮件的形式提醒各位会员进行缴费。但由于各种原因而没有在ACCA规定时间内完成缴费的,ACCA会暂时取消你的证书有效性。但假如真的被取消了,那也不要着急,只要发邮件给ACCA官方,补交之前未缴的年费和一定数额的罚金,即可让官方帮你重新激活你的ACCA会员有效性了。

ACCA会员除了要缴纳会员费,还需要缴纳ACCA年费。一般情况下在当年的12月份缴纳下一年度的年费。

2020年ACCA年费标准:

ACCA学员:112英镑 ;ACCA准会员:129英镑 ;ACCA会员:首次成功申请ACCA会员,费用为246英镑,之后费用为258英镑 。

那么,如何缴纳ACCA年费呢?

第一步:登录ACCA官网,点击my ACCA;

第二步:输入自己的ACCA ID和密码,点击Login;

第三步:在右边菜单点击Administer your account and pay your fees选项;

第四步:在左边菜单选择Account/Payments/Benevolent;

第五步:选择您所需缴费项目并点击Pay;

第六步:点击左下角Pay;

第七步:选择您所需的缴费方式;

第八步:在以下界面找到所需的支付记录后点击Print;

第九步:弹出账单后,请选择保存至本地或直接打印;

前面介绍了三阶段的年费缴纳及缴纳流程,如果不交或忘交年费有什么后果?

年费顾名思义是一年一交,每年必须缴纳,如果不交,ACCA将会收回你的ACCA学员或会员资格。如果因为某些原因没有按时交纳,可以申请补缴。具体的情况你可以发邮件给ACCA协会,补缴年费并支付一定的罚金,即可重新激活学员/会员资格。

好了,以上就是今天的内容,相信小伙伴们对于ACCA会员如何缴纳会员费、年费及缴纳流程等内容有了更多的认识,如果还想了解更多信息,可以关注51题库考试学习网的哦!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

2 Your audit client, Prescott Co, is a national hotel group with substantial cash resources. Its accounting functions are

well managed and the group accounting policies are rigorously applied. The company’s financial year end is

31 December.

Prescott has been seeking to acquire a construction company for some time in order to bring in-house the building

and refurbishment of hotels and related leisure facilities (e.g. swimming pools, squash courts and restaurants).

Prescott’s management has recently identified Robson Construction Co as a potential target and has urgently requested

that you undertake a limited due diligence review lasting two days next week.

Further to their preliminary talks with Robson’s management, Prescott has provided you with the following brief on

Robson Construction Co:

The chief executive, managing director and finance director are all family members and major shareholders. The

company name has an established reputation for quality constructions.

Due to a recession in the building trade the company has been operating at its overdraft limit for the last 18

months and has been close to breaching debt covenants on several occasions.

Robson’s accounting policies are generally less prudent than those of Prescott (e.g. assets are depreciated over

longer estimated useful lives).

Contract revenue is recognised on the percentage of completion method, measured by reference to costs incurred

to date. Provisions are made for loss-making contracts.

The company’s management team includes a qualified and experienced quantity surveyor. His main

responsibilities include:

(1) supervising quarterly physical counts at major construction sites;

(2) comparing costs to date against quarterly rolling budgets; and

(3) determining profits and losses by contract at each financial year end.

Although much of the labour is provided under subcontracts all construction work is supervised by full-time site

managers.

In August 2005, Robson received a claim that a site on which it built a housing development in 2002 was not

properly drained and is now subsiding. Residents are demanding rectification and claiming damages. Robson

has referred the matter to its lawyers and denied all liability, as the site preparation was subcontracted to Sarwar

Services Co. No provisions have been made in respect of the claims, nor has any disclosure been made.

The auditor’s report on Robson’s financial statements for the year to 30 June 2005 was signed, without

modification, in March 2006.

Required:

(a) Identify and explain the specific matters to be clarified in the terms of engagement for this due diligence

review of Robson Construction Co. (6 marks)

2 PRESCOTT CO

(a) Terms of engagement – matters to be clarified

Tutorial note: This one-off assignment requires a separate letter of engagement. Note that, at this level, a standard list of

contents will earn few, if any, marks. Any ‘ideas list’ must be tailored to generate answer points specific to the due diligence

review of this target company.

■ Objective of the review: for example, to find and report facts relevant to Prescott’s decision whether to acquire Robson.

The terms should confirm whether Prescott’s interest is in acquiring the company (i.e. the share capital) or its trading

assets (say), as this will affect the nature and scope of the review.

Tutorial note: This is implied as Prescott ‘has been seeking to acquire ... to bring building … in-house’.

■ Prescott’s management will be solely responsible for any decision made (e.g. any offer price made to purchase Robson).

■ The nature and scope of the review and any standards/guidelines in accordance with which it will be conducted. That

investigation will consist of enquiry (e.g. of the directors and the quantity surveyor) and analytical procedures (e.g. on

budgeted information and prior period financial statements).

Tutorial note: This is not going to be a review of financial statements. The prior year financial statements have only

recently been audited and financial statements for the year end 30 June 2006 will not be available in time for the

review.

■ The level of assurance will be ‘negative’. That is, that the material subject to review is free of material misstatement. It

should be stated that an audit is not being performed and that an audit opinion will not be expressed.

■ The timeframe. for conducting the investigation (two days next week) and the deadline for reporting the findings.

■ The records, documentation and other information to which access will be unrestricted. This will be the subject of

agreement between Prescott and Robson.

■ A responsibility/liability disclaimer that the engagement cannot be relied upon to disclose errors, illegal acts or other

irregularities (e.g. fraudulent financial reporting or misappropriations of Robson’s assets).

Tutorial note: Third party reliance on the report seems unlikely as Prescott has ‘substantial cash resources’ and may not

need to obtain loan finance.

(d) Wader has decided to close one of its overseas branches. A board meeting was held on 30 April 2007 when a

detailed formal plan was presented to the board. The plan was formalised and accepted at that meeting. Letters

were sent out to customers, suppliers and workers on 15 May 2007 and meetings were held prior to the year

end to determine the issues involved in the closure. The plan is to be implemented in June 2007. The company

wish to provide $8 million for the restructuring but are unsure as to whether this is permissible. Additionally there

was an issue raised at one of the meetings. The operations of the branch are to be moved to another country

from June 2007 but the operating lease on the present buildings of the branch is non-cancellable and runs for

another two years, until 31 May 2009. The annual rent of the buildings is $150,000 payable in arrears on

31 May and the lessor has offered to take a single payment of $270,000 on 31 May 2008 to settle the

outstanding amount owing and terminate the lease on that date. Wader has additionally obtained permission to

sublet the building at a rental of $100,000 per year, payable in advance on 1 June. The company needs advice

on how to treat the above under IAS37 ‘Provisions, Contingent Liabilities and Contingent Assets’. (7 marks)

Required:

Discuss the accounting treatments of the above items in the financial statements for the year ended 31 May

2007.

Note: a discount rate of 5% should be used where necessary. Candidates should show suitable calculations where

necessary.

(d) A provision under IAS37 ‘Provisions, Contingent Liabilities and Contingent assets’ can only be made in relation to the entity’s

restructuring plans where there is both a detailed formal plan in place and the plans have been announced to those affected.

The plan should identify areas of the business affected, the impact on employees and the likely cost of the restructuring and

the timescale for implementation. There should be a short timescale between communicating the plan and starting to

implement it. A provision should not be recognised until a plan is formalised.

A decision to restructure before the balance sheet date is not sufficient in itself for a provision to be recognised. A formal plan

should be announced prior to the balance sheet date. A constructive obligation should have arisen. It arises where there has

been a detailed formal plan and this has raised a valid expectation in the minds of those affected. The provision should only

include direct expenditure arising from the restructuring. Such amounts do not include costs associated with ongoing business

operations. Costs of retraining staff or relocating continuing staff or marketing or investment in new systems and distribution

networks, are excluded. It seems as though in this case a constructive obligation has arisen as there have been detailed formal

plans approved and communicated thus raising valid expectations. The provision can be allowed subject to the exclusion of

the costs outlined above.

Although executory contracts are outside IAS37, it is permissible to recognise a provision that is onerous. Onerous contracts

can result from restructuring plans or on a stand alone basis. A provision should be made for the best estimate of the excess

unavoidable costs under the onerous contract. This estimate should assess any likely level of future income from new sources.

Thus in this case, the rental income from sub-letting the building should be taken into account. The provision should be

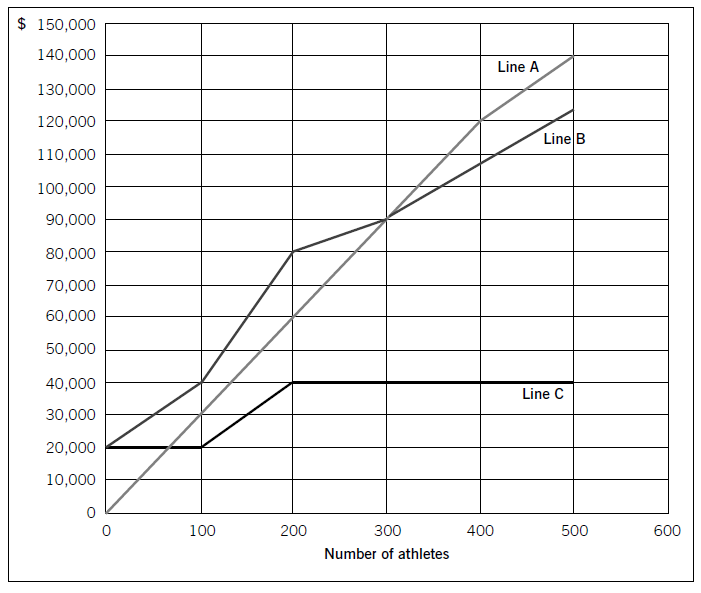

Swim Co offers training courses to athletes and has prepared the following breakeven chart:

Required:

(a) State the breakeven sales revenue for Swim Co and estimate, to the nearest $10,000, the company’s profit if 500 athletes attend a training course. (2 marks)

(b) Using the chart above, explain the cost and revenue structure of the company. (8 marks)

(a)ThebreakevensalesrevenueforSwimCois$90,000.Thecompany’sprofit,tothenearest$10,000,if500athletesattendthecourseis$20,000($140,000–$120,000).(Fromthegraph,itisclearthatthepreciseamountwillbenearer$17,000,i.e.$140,000–approximately$123,000.)(b)CoststructureFromthechart,itisclearthatLineCrepresentsfixedcosts,LineBrepresentstotalcostsandLineArepresentstotalrevenue.LineCshowsthatinitially,fixedcostsare$20,000evenifnoathletesattendthecourse.Thisleveloffixedcostsremainsthesameif100athletesattendbutoncethenumberofattendeesincreasesabovethislevel,fixedcostsincreaseto$40,000.LineBrepresentstotalcosts.If100athletesattend,totalcostsare$40,000($400perathlete).Since$20,000ofthisrelatestofixedcosts,thevariablecostperathletemustbe$200.Whenfixedcostsstepupbeyondthispointatthelevelof200athletes,totalcostsobviouslyincreaseaswellandLineBconsequentlygetsmuchsteeper.However,sincetherearenow200athletestoabsorbthefixedcosts,thecostperathleteremainsthesameat$400perathlete($80,000/200),eventhoughfixedcostshavedoubled.If300athletesattendthecourse,totalcostperathletebecomes$300each($90,000/300).Sincefixedcostsaccountfor$40,000ofthistotalcost,variablecoststotal$50,000,i.e.$166·67perathlete.So,economiesofscaleariseatthislevel,asdemonstratedbythefactthatLineBbecomesflatter.At400athletes,thegradientofthetotalcostslineisunchangedfrom300athleteswhichindicatesthatthevariablecostshaveremainedthesame.Thereisnofurtherchangeat500athletes;fixedandvariablecostsremainsteady.RevenuestructureAsregardstherevenuestructure,itcanbeseenfromLineAthatfor100–400athletesthepriceremainsthesameat$300perathlete.However,if500athletesattend,thepricehasbeenreducedasthetotalrevenuelinebecomesflatter.$140,000/500meansthatthepricehasgonedownto$280perathlete.Thiswasobviouslynecessarytoincreasethenumberofattendeesandatthispoint,profitismaximised.1

Explain the grounds upon which a person may be disqualified under the Company Directors Disqualification Act 1986.(10 marks)

The Company Directors Disqualification Act (CDDA) 1986 was introduced to control individuals who persistently abused the various privileges that accompany incorporation, most particularly the privilege of limited liability. The Act applies to more than just directors and the court may make an order preventing any person (without leave of the court) from being:

(i) a director of a company;

(ii) a liquidator or administrator of a company;

(iii) a receiver or manager of a company’s property; or

(iv) in any way, whether directly or indirectly, concerned with or taking part in the promotion, formation or management of a company.

The CDDA 1986 identifies three distinct categories of conduct, which may, and in some circumstances must, lead the court to disqualify certain persons from being involved in the management of companies.

(a) General misconduct in connection with companies

This first category involves the following:

(i) A conviction for an indictable offence in connection with the promotion, formation, management or liquidation of a company or with the receivership or management of a company’s property (s.2 of the CDDA 1986). The maximum period for disqualification under s.2 is five years where the order is made by a court of summary jurisdiction, and 15 years in any other case.

(ii) Persistent breaches of companies legislation in relation to provisions which require any return, account or other document to be filed with, or notice of any matter to be given to, the registrar (s.3 of the CDDA 1986). Section 3 provides that a person is conclusively proved to be persistently in default where it is shown that, in the five years ending with the date of the application, he has been adjudged guilty of three or more defaults (s.3(2) of the CDDA 1986). This is without prejudice to proof of persistent default in any other manner. The maximum period of disqualification under this section is five years.

(iii) Fraud in connection with winding up (s.4 of the CDDA 1986). A court may make a disqualification order if, in the course of the winding up of a company, it appears that a person:

(1) has been guilty of an offence for which he is liable under s.993 of the CA 2006, that is, that he has knowingly been a party to the carrying on of the business of the company either with the intention of defrauding the company’s creditors or any other person or for any other fraudulent purpose; or

(2) has otherwise been guilty, while an officer or liquidator of the company or receiver or manager of the property of the company, of any fraud in relation to the company or of any breach of his duty as such officer, liquidator, receiver or manager (s.4(1)(b) of the CDDA 1986).

The maximum period of disqualification under this category is 15 years.(b) Disqualification for unfitness

The second category covers:

(i) disqualification of directors of companies which have become insolvent, who are found by the court to be unfit to be directors (s.6 of the CDDA 1986). Under s. 6, the minimum period of disqualification is two years, up to a maximum of 15 years;

(ii) disqualification after investigation of a company under Pt XIV of the CA 1985 (it should be noted that this part of the previous Act still sets out the procedures for company investigations) (s.8 of the CDDA 1986). Once again, the maximum period of disqualification is 15 years.

Schedule 1 to the CDDA 1986 sets out certain particulars to which the court is to have regard in deciding whether a person’s conduct as a director makes them unfit to be concerned in the management of a company. In addition, the courts have given indications as to what sort of behaviour will render a person liable to be considered unfit to act as a company director. Thus, in Re Lo-Line Electric Motors Ltd (1988), it was stated that:

‘Ordinary commercial misjudgment is in itself not sufficient to justify disqualification. In the normal case, the conduct complained of must display a lack of commercial probity, although . . . in an extreme case of gross negligence or total incompetence, disqualification could be appropriate.’

(c) Other cases for disqualification

This third category relates to:

(i) participation in fraudulent or wrongful trading under s.213 of the Insolvency Act (IA)1986 (s.10 of the CDDA 1986);

(ii) undischarged bankrupts acting as directors (s.11 of the CDDA 1986); and

(iii) failure to pay under a county court administration order (s.12 of the CDDA 1986).

For the purposes of most of the CDDA 1986, the court has discretion to make a disqualification order. Where, however, a person has been found to be an unfit director of an insolvent company, the court has a duty to make a disqualification order (s.6 of the CDDA 1986). Anyone who acts in contravention of a disqualification order is liable:

(i) to imprisonment for up to two years and/or a fine, on conviction on indictment; or

(ii) to imprisonment for up to six months and/or a fine not exceeding the statutory maximum, on conviction summarily (s.13 of the CDDA 1986).

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-04-22

- 2020-01-14

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-31

- 2020-08-16

- 2021-02-14

- 2020-03-29

- 2020-03-11

- 2020-01-10

- 2020-04-08

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-04-21

- 2020-01-09

- 2020-01-10

- 2020-02-14

- 2020-01-11

- 2019-07-20

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2019-03-16

- 2020-01-10

- 2020-03-03

- 2020-05-15