如果你是新疆考生,教你几招,轻松让你在ACCA考试中保持专注!

发布时间:2020-01-10

不管是职场,生活,你都不可能在一长段时间内只专注一件事。而在面对ACCA考试有那么多门考试科目,怎样才能不手忙脚乱呢?因此,51题库考试学习网在这里教大家如何在考场中能够高度专注的考试,不会被其他琐事影响,从而影响考试成绩的小技巧。

首先,我们要消除一个思维误区。

人是不能进行真正的“多线程工作”的。你的大脑不可能像电脑那样,开着好几个后台,例如:一边放着音乐,一边让你聊微信,一边下载电影

你必须在某个时间段只专注一件事。

回想一下,你复习高数的时候,想着A考,看似是一心二用,但实际上你是复习了一会儿高数,然后想了一会儿A考,你努力把神思拉回来,又复习了一会儿高数,然后思维又切换到A考……

实际上你的大脑在某个时间点只集中在一件事情上,但因为它的重点在不停切换,造成了你大脑一片混沌,手忙脚乱的错觉。

有一个小实验是这样的:

所以复习效率低,也是因为你的思维在不停切换,浪费了大量不必要的时间。并且忙了大半天也没有任何一科有明显进展,这时沮丧挫败灰心自责一系列负面情绪都扑过来了,会让学习陷入恶性循环。

那到底要如何从容面对考试呢?

多线程任务,不是同时做多件事,而是将一个时间段划分好几份,来分配给不同任务。所以多线程学习的核心其实是任务管理。

我们只需要确定哪个时间段要做哪个任务,然后保证一段时间只做一件事。

比如上午集中复习高数,下午集中复习思修,晚上集中复习A考,甚至,也可以先集中复习期末,再专心复习A考。

这里51题库考试学习网提供几个方法:

1. 对时间进行规划。

比如3天以后要考思修,那么你就需要规划这3天,你每天要花多少时间来复(yu)习(xi)思修。你将每一科的计划按紧急程度列出来,写下每天每一科需要进行到什么进度。

这时你就有了每天的小目标。

2. 每天总结自己的进度条更新到哪里了。

建议还是要每天列出to do list,将目标尽量细化,然后在完成每个小任务之后打个勾。

这个习惯看上去非常鸡肋没用,其实超级有必要。这就像你在电脑上完成了一项工作,然后点击了保存。这样的仪式感会提醒我们,让我们的大脑更清楚:这件事已经做完了,可以松一口气不用再想它了。

3. 不一定要先做最紧急的事,先做最重要的事。

甚至,如果你的大脑坚持要每五分钟就从高数切换到思修,那建议你先背一会儿思修,将进度条拉长一点,消除你的焦虑以后再去安心刷高数。

4. 接受自己的不完美。

考A的同学一般都比较有上进心,对自己要求比较高。

一方面这是好事,能让你不断督促自己努力,进步;一方面这样的性格也容易让你苛责自己,产生自责感。所以经常会有同学,一遇到没有头绪的时候就开始心态崩坏,结局通常是越做越糟。

这里学姐要说的就是,偶尔发挥失常,进入状态困难是每个人都会出现的状况。如果遇到这种情况,不要轻易否定自己的能力。首先我们要相信自己可以应对,这样我们才能真正做到有条理,少出错。

如何保持长时间的专注?

除了手忙脚乱之外,很多同学还有一个问题,就是备考的时候忍不住玩手机。看书五分钟,聊八卦两小时,这种现象实在非常普遍。

很多狠人会采取最简单粗暴的方法:不带手机去图书馆。

但是如果我要查单词,信息检索,甚至要联络别人怎么办?况且以后大家工作要提高效率,也不可能使用关掉手机拒绝诱惑这种方法。

所以我们要如何在干扰的情况下,做到长时间的专注呢?

(1)先从能够快速集中注意力的事情做起。

备考时,每天在备考前抄一遍字帖。

一方面,这样难度不高又不那么吸引注意力的工作会让我的心静下来

ACCAer们也可以想想有什么类似的事情是可以让自己平静专注下来,又不容易沉迷的。在每天复习前先做一遍这件事,有一个良好的开端。

(2)尽量让手参与进来。

如果实在很难集中注意力,就采取抄书的方式。因为光看书,你很容易就跳过内容,尤其是那些很难的重点。而手写的速度慢,并且需要输出,所以你的大脑一定会对信息进行处理的。

但这个方法只在你发现心思非常浮躁的时候有效,大多数时候,你还是需要一边理解一边输出。

这时候就不要只是把内容照抄下来而已了。你需要做的,就是将书本上的重点语句换一种表达方式写下来。这时候你的大脑才会去主动思考。

此外,画思维导图也是很好的方法,寻找每个知识点之间的联系,并对下一节知识内容进行预期。

最后,提醒大家要适当地拒绝舒适。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

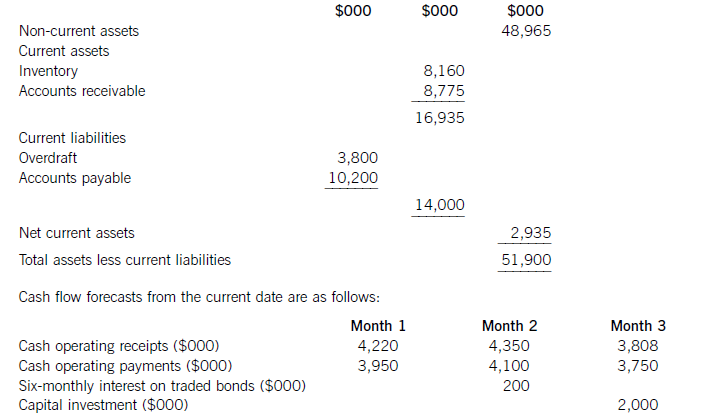

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action.

(10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced.

(8 marks)

(a)Whenconsideringthefinancingofworkingcapital,itisusefultodividecurrentassetsintofluctuatingcurrentassetsandpermanentcurrentassets.Fluctuatingcurrentassetsrepresentchangesinthelevelofcurrentassetsduetotheunpredictabilityofbusinessactivity.Permanentcurrentassetsrepresentthecorelevelofinvestmentincurrentassetsneededtosupportagivenlevelofturnoverorbusinessactivity.Asturnoverorlevelofbusinessactivityincreases,thelevelofpermanentcurrentassetswillalsoincrease.Thisrelationshipcanbemeasuredbytheratioofturnovertonetcurrentassets.Thefinancingchoiceasfarasworkingcapitalisconcernedisbetweenshort-termandlong-termfinance.Short-termfinanceismoreflexiblethanlong-termfinance:anoverdraft,forexample,isusedbyabusinessorganisationastheneedarisesandvariableinterestischargedontheoutstandingbalance.Short-termfinanceisalsomoreriskythanlong-termfinance:anoverdraftfacilitymaybewithdrawn,orashort-termloanmayberenewedonlessfavourableterms.Intermsofcost,thetermstructureofinterestratessuggeststhatshort-termdebtfinancehasalowercostthanlong-termdebtfinance.Thematchingprinciplesuggeststhatlong-termfinanceshouldbeusedforlong-terminvestment.Applyingthisprincipletoworkingcapitalfinancing,long-termfinanceshouldbematchedwithpermanentcurrentassetsandnon-currentassets.Afinancingpolicywiththisobjectiveiscalleda‘matchingpolicy’.HGRCoisnotusingthisfinancingpolicy,sinceofthe$16,935,000ofcurrentassets,$14,000,000or83%isfinancedfromshort-termsources(overdraftandtradepayables)andonly$2,935,000or17%isfinancedfromalong-termsource,inthiscaseequityfinance(shareholders’funds)ortradedbonds.ThefinancingpolicyorapproachtakenbyHGRCotowardsthefinancingofworkingcapital,whereshort-termfinanceispreferred,iscalledanaggressivepolicy.Relianceonshort-termfinancemakesthisriskierthanamatchingapproach,butalsomoreprofitableduetothelowercostofshort-termfinance.Followinganaggressiveapproachtofinancingcanleadtoovertrading(undercapitalisation)andthepossibilityofliquidityproblems.(b)Bankbalanceinthreemonths’timeifnoactionistaken:Workings:ReductioninaccountsreceivabledaysCurrentaccountsreceivabledays=(8,775/49,275)x365=65daysReductionindaysoversixmonths=65–53=12daysMonthlyreduction=12/6=2daysEachreceivablesdayisequivalentto8,775,000/65=$135,000(Alternatively,eachreceivablesdayisequivalentto49,275,000/365=$135,000)Monthlyreductioninaccountsreceivable=2x135,000=$270,000ReductionininventorydaysCurrentinventorydays=(8,160/37,230)x365=80daysEachinventorydayisequivalentto8,160,000/80=$102,000(Alternatively,eachinventoryday=37,230,000/365=$102,000)Monthlyreductionininventory=102,000x2=$204,000OverdraftinterestcalculationsMonthlyoverdraftinterestrate=1·06171/12=1·005or0·5%Ifnoactionistaken:Period1interest=3,800,000x0·005=$19,000Period2interest=3,549,000x0·005=$17,745or$18,000Period3interest=3,517,000x0·005=$17,585or$18,000Ifactionistaken:Period1interest=3,800,000x0.005=$19,000Period2interest=3,075,000x0.005=$15,375or$15,000Period3interest=2,566,000x0.005=$12,830or$13,000DiscussionIfnoactionistaken,thecashflowforecastshowsthatHGRCowillexceeditsoverdraftlimitof$4millionby$1·48millioninthreemonths’time.Ifthefinancedirector’sproposalsareimplemented,thereisapositiveeffectonthebankbalance,buttheoverdraftlimitisstillexceededinthreemonths’time,althoughonlyby$47,000ratherthanby$1·47million.Ineachofthethreemonthsfollowingthat,thecontinuingreductioninaccountsreceivabledayswillimprovethebankbalanceby$270,000permonth.Withoutfurtherinformationonoperatingreceiptsandpayments,itcannotbeforecastwhetherthebankbalancewillreturntolessthanthelimit,orevencontinuetoimprove.Themainreasonfortheproblemwiththebankbalanceisthe$2millioncapitalexpenditure.Purchaseofnon-currentassetsshouldnotbefinancedbyanoverdraft,butalong-termsourceoffinancesuchasequityorbonds.Ifthecapitalexpenditurewereremovedfromtheareaofworkingcapitalmanagement,theoverdraftbalanceattheendofthreemonthswouldbe$3·48millionifnoactionweretakenand$2·05millionifthefinancedirector’sproposalswereimplemented.GiventhatHGRCohasalmost$50millionofnon-currentassetsthatcouldpossiblybeusedassecurity,raisinglong-termdebtthrougheitherabankloanorabondissueappearstobesensible.Assumingabondinterestrateof10%peryear,currentlong-termdebtintheform.oftradedbondsisapproximately($200mx2)/0·1=$4m,whichismuchlessthantheamountofnoncurrentassets.AsuitablecourseofactionforHGRCotofollowwouldthereforebe,firstly,toimplementthefinancedirector’sproposalsand,secondly,tofinancethecapitalexpenditurefromalong-termsource.Considerationcouldalsobegiventousingsomelong-termdebtfinancetoreducetheoverdraftandtoreducethelevelofaccountspayable,currentlystandingat100days.(c)Whencreditisgrantedtoforeigncustomers,twoproblemsmaybecomeespeciallysignificant.First,thelongerdistancesoverwhichtradetakesplaceandthemorecomplexnatureoftradetransactionsandtheirelementsmeansforeignaccountsreceivableneedmoreinvestmentthantheirdomesticcounterparts.Longertransactiontimesincreaseaccountsreceivablebalancesandhencetheleveloffinancingandfinancingcosts.Second,theriskofbaddebtsishigherwithforeignaccountsreceivablethanwiththeirdomesticcounterparts.Inordertomanageandreducecreditrisks,therefore,exportersseektoreducetheriskofbaddebtandtoreducethelevelofinvestmentinforeignaccountsreceivable.Manyforeigntransactionsareon‘openaccount’,whichisanagreementtosettletheamountoutstandingonapredetermineddate.Openaccountreflectsagoodbusinessrelationshipbetweenimporterandexporter.Italsocarriesthehighestriskofnon-payment.Onewaytoreduceinvestmentinforeignaccountsreceivableistoagreeearlypaymentwithanimporter,forexamplebypaymentinadvance,paymentonshipment,orcashondelivery.Thesetermsoftradeareunlikelytobecompetitive,however,anditismorelikelythatanexporterwillseektoreceivecashinadvanceofpaymentbeingmadebythecustomer.Onewaytoacceleratecashreceiptsistousebillfinance.Billsofexchangewithasignedagreementtopaytheexporteronanagreedfuturedate,supportedbyadocumentaryletterofcredit,canbediscountedbyabanktogiveimmediatefunds.Thisdiscountingiswithoutrecourseifbillsofexchangehavebeencountersignedbytheimporter’sbank.Documentarylettersofcreditareapaymentguaranteebackedbyoneormorebanks.Theycarryalmostnorisk,providedtheexportercomplieswiththetermsandconditionscontainedintheletterofcredit.Theexportermustpresentthedocumentsstatedintheletter,suchasbillsoflading,shippingdocuments,billsofexchange,andsoon,whenseekingpayment.Aseachsupportingdocumentrelatestoakeyaspectoftheoveralltransaction,lettersofcreditgivesecuritytotheimporteraswellastheexporter.Companiescanalsomanageandreduceriskbygatheringappropriateinformationwithwhichtoassessthecreditworthinessofnewcustomers,suchasbankreferencesandcreditreports.Insurancecanalsobeusedtocoversomeoftherisksassociatedwithgivingcredittoforeigncustomers.Thiswouldavoidthecostofseekingtorecovercashduefromforeignaccountsreceivablethroughaforeignlegalsystem,wheretheexportercouldbeatadisadvantageduetoalackoflocalorspecialistknowledge.Exportfactoringcanalsobeconsidered,wheretheexporterpaysforthespecialistexpertiseofthefactorasawayofreducinginvestmentinforeignaccountsreceivableandreducingtheincidenceofbaddebts.

(b) Discuss the relevance of each of the following actions as steps in trying to remedy performance measurement

problems relating to the ‘365 Sports Complex’ and suggest examples of specific problem classifications that

may be reduced or eliminated by each action:

(i) Focusing on and improving the measurement of customer satisfaction

(ii) Involving staff at all levels in the development and implementation of performance measures

(iii) Being flexible in the extent to which formal performance measures are relied on

(iv) Giving consideration to the auditing of the performance measurement system. (8 marks)

(b) Trying to focus on and improve the measurement of customer satisfaction.

This is a vital goal. Without monitoring and improvement of levels of customer satisfaction, an organisation will tend to

underachieve and is likely to have problems with its future effectiveness. Positive signals from performance measures made

earlier in the value chain are only relevant if they contribute to the ultimate requirement of customer satisfaction. Tunnel vision

and sub-optimisation are examples of measurement problems that may be reduced through recognition of the need for a

management focus on customer satisfaction. For example undue focus on the importance of maximising opening hours may

lead to lack of focus on other quality issues seen as important by customers.

Involving staff at all levels in the development and implementation of performance measures.

People are involved in the achievement of performance measures at all levels and in all aspects of an organisation. It is

important that all staff are willing to accept and work towards any performance measures that are developed to monitor their

part in the operation of the organisation and in the achievement of its objectives. This should help, for example, to reduce

gaming. At the sports complex an example of gaming might be, a deliberate attempt to understate the potential benefits of

maintaining the buildings in order to ensure that funds would be used for other purposes such as an increased advertising

budget. The directors of Astrodome Sports Ltd must recognise that leisure facilities that appear dated and in a poor state of

repair will cause customers to look for more aesthetically appealing alternatives.

Being flexible in the extent to which formal performance measures are relied on.

It is best to acknowledge that measures should not be relied on exclusively for control. A performance measure may give a

short-term signal that does not relate directly to actions that are taking place to improve the level of performance in the longer

term. To some extent, improved performance may be achieved through the informal interaction between individuals and

groups. This flexibility should help to reduce measure fixation and misrepresentation. For example the percentage increase in

the quantity of bowling equipment purchased is seen as necessarily implying increased demand for use of the bowling greens.

Giving consideration to the audit of the performance measurement system.

Actions that may be taken may include:

– Seeking expert interpretation of the performance measures in place. It is important that any audit is ‘free from bias’ and

conducted independently on an ‘arm’s length’ basis. Thus it is essential that such audits should be ‘free from the

influence’ of those personnel involved in the operation of the system.

– Maintaining a careful audit of the data used. Any assessment scheme is only as good as the data on which it is founded

and how this data is analysed and interpreted.

The above actions should help, in particular, to reduce the incidence and impact of measure fixation, misinterpretation and

gaming.

For example, an audit may show that the directors of Astrodome Sports Ltd are fixated on equipment availability and

misinterpret this as being the key to customer volume and high profitability. The audit may also provide evidence of gaming

such as a deliberate attempt to underplay the benefits of one course of action in order to release funds for use on some

alternative.

(ii) analytical procedures, (6 marks)

might appropriately be used in the due diligence review of MCM.

(ii) Analytical procedures

Tutorial note: The range of valid answer points is very broad for this part.

■ Review the trend of MCM’s profit (gross and net) for the last five years (say). Similarly earnings per share and

gearing.

■ For both the National and International businesses compare:

– gross profit, net profit, and return on assets for the last five years (say);

– actual monthly revenue against budget for the last 18 months (say). Similarly, for major items of expenditure

such as:

– full-time salaries;

– freelance consultancy fees;

– premises costs (e.g. depreciation, lease rentals, maintenance, etc);

– monthly revenue (also costs and profit) by centre.

■ Review projections of future profitability of MCM against net profit percentage at 31 December 2004 for:

– the National business (10·4%);

– the International business (38·1%); and

– overall (19·9%).

■ Review of disposal value of owned premises against book values.

■ Compare actual cash balances with budget on a monthly basis and compare borrowings against loan and overdraft

facilities.

■ Compare the average collection period for International’s trade receivables month on month since 31 December

2004 (when it was nearly seven months, i.e.

$3·7

–––– × 365 days) and compare with the National business.

$6·3

■ Compare financial ratios for each of the national centres against the National business overall (and similarly for the

International Business). For example:

– gross and net profit margins;

– return on centre assets;

– average collection period;

– average payment period;

– liquidity ratio.

■ Compare key performance indicators across the centres for the year to 31 December 2004 and 2005 to date. For

example:

– number of corporate clients;

– number of delegates;

– number of training days;

– average revenue per delegate per day;

– average cost per consultancy day.

(ii) Calculate Paul’s tax liability if he exercises the share options in Memphis plc and subsequently sells the

shares in Memphis plc immediately, as proposed, and show how he may reduce this tax liability.

(4 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-01-09

- 2020-01-10

- 2020-03-12

- 2020-04-15

- 2020-03-04

- 2020-05-09

- 2020-01-11

- 2020-01-15

- 2020-01-10

- 2020-05-06

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-04-28

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-04-30

- 2020-01-10

- 2021-04-24

- 2020-01-10

- 2020-03-20

- 2020-05-16

- 2021-08-05

- 2020-01-29

- 2019-07-20