速来查看!关于2020年考完ACCA需要花费多少钱

发布时间:2020-03-04

很多想报考ACCA却又担心承担不起那么昂贵的考试费用。那么,考完ACCA究竟要花费多少钱呢?想自己的考试成本有一个大概的预期的话,可以参考下面51题库考试学习网为各位同学分享的各项ACCA费用。

ACCA的费用包括很多,包含有各科考试费,年费,注册费,教材费用,每一项都必不可少,但又因人而异。有些同学有免考科目,那么教材费和培训费上的支出就会少一些,这里需要知道的是就算免考,考试费还是必须要交,所以考试费基本上是省不下来多少的,一般ACCA考下来的费用1.6-1.8万。接下来就给大家具体地算一算。

首次注册费:

首次一次性缴纳注册年费79英镑;

ACCA学员年费:

ACCA年费112英镑,每年缴纳年费。

考试费:

ACCA总共要考13门,每门科目的考试费用都不大相同,具体如下表:

按照早期报名时段的价格来算的话,ACCA考试报名需要的所有费用为(按提前报名给你算的费用,这样最节省):79+112+(F1-F4费用)+114*5(F5-F9)+188(SBL)+147*3(SBR+2门选修课)=1700-1800英镑,这样下来,你所缴纳的ACCA官方报名费用约在人民币一万六到一万八左右。

另外,ACCA教材也是一笔费用:

教材+练习册费用,按正版每门350人民币*13=4550元,实际上可能会有出入,因为市场价格在变动,这是参照以往的售价。

挂科的费用,自己预估下每年挂几科,做最低风险。

注:

1、只计算考试期间费用

2、由于个人备考时间延长造成的年费成本并未涉及。

3、以上费用不包含考不过重考的费用。

3、计量单位为英镑,此处按英镑对人民币1:9的汇率来大致计算。

关于获取了ACCA证书的个人发展

相比较国内已经趋于饱和的技术型会计,ACCA考试更偏重于财务管理以及财务统筹、预算以及规划企业走向和未来发展。这和中国传统的应试教育是非常不同的,但又正好是个非常好的互补,获取知识之后用来解决实际的财务问题,这对于学习传统财会技能的学生来说是一次开阔逻辑思维和宏观视野的绝佳机会。

据调查发现,在招聘工作中,大部分招聘职位如财务总监、总经理助理、董事长助理以及CFO等都可能附加ACCA的资格要求。而这些职位则要求求职者不仅需要具备财务方面的基础专业知识,同时还需要具备财务分析能力、财务管理能力、做出专业的财务报告让非财务人员理解并执行的能力等。

希望本篇文章能够帮助到大家,如果大家还遇到其他不能解决的问题,可以反馈给51题库考试学习网,我们会尽快帮您解决。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) the directors agree to disclose the note. (4 marks)

(ii) If the directors agree to disclose the note, it should be reviewed by the auditors to ensure that it is sufficiently detailed.

In evaluating the adequacy of the disclosure in the note, the auditor should consider whether the disclosure explicitly

draws the reader’s attention to the possibility that the entity may not be able to continue as a going concern in the

foreseeable future. The note should include a description of conditions giving rise to significant doubt, and the directors’

plans to deal with the conditions. If the note provided contains adequate information then there is no breach of financial

reporting standards, and so no disagreement with the directors.

If the disclosure is considered adequate, then the opinion should not be qualified. The auditors should consider a

modification by adding an emphasis of matter paragraph to highlight the existence of the material uncertainties, and to

draw attention to the note to the financial statements. The emphasis of matter paragraph should firstly contain a brief

description of the uncertainties, and also refer explicitly to the note to the financial statements where the situation has

been fully described. The emphasis of matter paragraph should re-iterate that the audit opinion is not qualified.

However, it could be the case that a note has been given in the financial statements, but that the details are inadequate

and do not fully explain the significant uncertainties affecting the going concern status of the company. In this situation

the auditors should express a qualified opinion, disagreeing with the preparation of the financial statements, as the

disclosure requirements of IAS 1 have not been followed.

(c) Prepare brief notes for the proposed meeting with Charles and Jane. Clearly identify the further information

you would need in order to advise them more fully and suggest appropriate personal financial planning

protection products, in respect of both death and serious illness. (9 marks)

You should assume that the income tax rates and allowances for the tax year 2005/06 and the corporation tax

rates for the financial year 2005 apply throughout this question.

When considering the shortfall

– The family’s expenditure is likely to increase as the children get older, particularly if there is a need for school fees.

– There will be a need for some cash immediately to pay for the cost of the funeral.

– It is assumed that the whole of Jane’s estate has been left to Charles such that there will be no inheritance tax on her

death.

– The shortfall may be reduced by:

(i) State benefits and tax credits.

(ii) Expenditure on non-essential items, e.g. holidays and entertainment included in the annual expenditure of

£45,500.

(iii) The income generated by Charles if he were to return to work.

– The shortfall may be increased by additional child-care costs due to Charles being a single parent, particularly if he

returns to work full-time.

Further information required

– The level of state benefits and tax credits available to Charles.

– The current level of expenditure on non-essential items.

– The costs of child-care if Charles were to return to work.

– Details of any wills made by Charles or Jane.

– Whether Charles’ investment properties could be sold and the proceeds invested in assets with a higher annual return.

– Whether there is any value in Speak Write Ltd independent of Jane, such that the company could be sold after Jane’s

death.

Other related issues

– The couple should consider making provision for their retirement via pension contributions or some other form. of long

term investment plan.

– The couple should recognise that there would be significant financial problems if Jane were to become seriously ill. In

addition to the family’s income falling as set out above, its expenditure would probably increase.

Protection products

– Term life assurance

A qualifying life policy would pay out a tax-free lump sum on Jane’s death.

– Permanent health insurance

Would provide a regular income if Jane were unable to work due to illness.

– Critical illness insurance

Would provide a capital sum in the event of Jane being diagnosed with an insured illness.

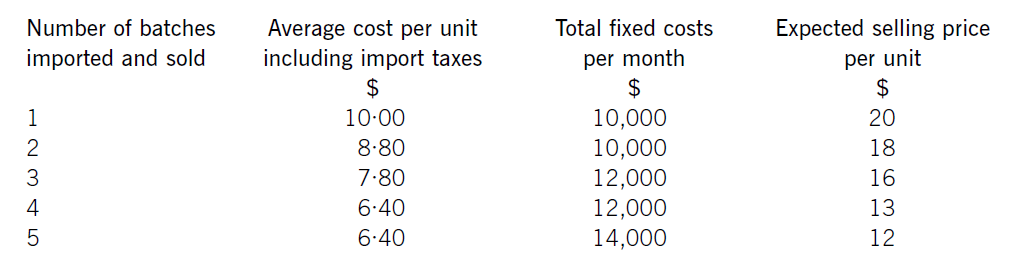

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion.

(ii) The use of the trading loss of Tethys Ltd for the year ending 31 December 2008; (6 marks)

(ii) Tethys Ltd – Use of trading loss

– The two companies will not be in a group relief group as Saturn Ltd will not own 75% of Tethys Ltd.

– For a consortium to exist, 75% of the ordinary share capital of Tethys Ltd must be held by companies which each

hold at least 5%. Accordingly, Tethys Ltd will be a consortium company if the balance of its share capital is owned

by Clangers Ltd but not if it is owned by Edith Clanger.

– If Tethys Ltd qualifies as a consortium company: 65% of its trading losses in the period from 1 August 2008 to

31 December 2008 can be surrendered to Saturn Ltd, i.e. £21,667 (£80,000 x 5/12 x 65%).

– If Tethys Ltd does not qualify as a consortium company: none of its loss can be surrendered to Saturn Ltd.

– The acquisition of 65% of Tethys Ltd is a change in ownership of the company. If there is a major change in the

nature or conduct of the trade of Tethys Ltd within three years of 1 August 2008, the loss arising prior to that date

cannot be carried forward for relief in the future.

Further information required:

– Ownership of the balance of the share capital of Tethys Ltd.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-01-10

- 2020-01-04

- 2020-04-25

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2021-06-03

- 2020-03-07

- 2020-01-09

- 2020-04-24

- 2020-04-28

- 2020-01-10

- 2021-07-31

- 2020-03-31

- 2020-05-14

- 2020-05-19

- 2020-05-20

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2021-07-28

- 2020-01-10

- 2020-01-10

- 2020-04-05

- 2020-02-21

- 2020-01-09

- 2020-01-10

- 2020-01-09

- 2020-04-25