想知道什么职业能让你一夜暴富吗?

发布时间:2020-04-30

最近有很多小伙伴问51题库考试学习网有没有什么可以让自己一夜暴富的职业?今天51题库考试学习网就跟大家说一说吧!

近几年年轻人们的一个普遍的梦想:暴富。只要是能让人们暴富的岗位都是好岗位,ACCA作为国际注册会计师,有着很高的含金量,那么这样一个高大上的证书能不能满足我们这个朴实无华的梦想呢?其实,你离暴富只隔了一个ACCA。

51题库考试学习网带你先来看看ACCA持证人近年来的薪资水平:

具有ACCA资格的财会人员,年薪在10万元以下----4.30%

具有ACCA资格的财会人员,年薪在10万至30万元之间----36.5%

具有ACCA资格的财会人员,年薪在30万至50万元之间----29.5%

具有ACCA资格的财会人员,年薪在50万至200万元之间----29.0%

这是ACCA特许公认会计师公会开展一年一度的薪酬与技能调查。内容涵盖招聘、技能、培训与薪酬四部分。薪酬与技能调查面向全国ACCA会员、准会员、学员,以及ACCA的企业合作伙伴。总的来看,ACCA持证人的薪资水平还是比较可观的,10万---50万的人群比较集中,做得好的话也可以冲击200万薪资,成为年薪百万的成功人士,做到财务自由。

但并不是说,一旦拿到ACCA的证书就立刻会有高薪职位,这其中还需要一个工作经验的累计过程,仔细查阅各个招聘网站就会发现,尽管需要应聘者有ACCA的证书,但是对于工作经验也是有要求的。但是拥有ACCA的证书就代表你已经具备了这种能力和资格,ACCA带给我们的优势虽不是立竿见影,但是对于长远发展和个人的职业规划来说,ACCA都是一个非常值得考虑的选择。所以中华会计网校小编告诉你,如果想要提升自己的个人财会管理能力,获得更好的职业发展,ACCA是一个不错的选择哦。

ACCA是国际会计准则委员会成员和创始人之一;2005年1月1日起,欧盟已经起用国际会计准则(IAS);2006年1月1日全世界94个国家开始承认并起用IAS;2006年11月,中国遵照WTO约定全面开放银行、保险、投资等金融业务,国内涉外的专业金融人才缺口几十万。现在选择ACCA绝对是一个非常好的选择。ACCA认可雇主遍布全球,拥有ACCA能够帮你找到一个非常好的工作。即便是已经工作的朋友们,获得ACCA证书也是你升职加薪的有力筹码。

以上就是51题库考试学习网为各位小伙伴带来的相关资料,希望能给各位小伙伴带来帮助

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(a) An assistant of yours has been criticised over a piece of assessed work that he produced for his study course for giving the definition of a non-current asset as ‘a physical asset of substantial cost, owned by the company, which will last longer than one year’.

Required:

Provide an explanation to your assistant of the weaknesses in his definition of non-current assets when

compared to the International Accounting Standards Board’s (IASB) view of assets. (4 marks)

(b) The same assistant has encountered the following matters during the preparation of the draft financial statements of Darby for the year ending 30 September 2009. He has given an explanation of his treatment of them.

(i) Darby spent $200,000 sending its staff on training courses during the year. This has already led to an

improvement in the company’s efficiency and resulted in cost savings. The organiser of the course has stated that the benefits from the training should last for a minimum of four years. The assistant has therefore treated the cost of the training as an intangible asset and charged six months’ amortisation based on the average date during the year on which the training courses were completed. (3 marks)

(ii) During the year the company started research work with a view to the eventual development of a new

processor chip. By 30 September 2009 it had spent $1·6 million on this project. Darby has a past history

of being particularly successful in bringing similar projects to a profitable conclusion. As a consequence the

assistant has treated the expenditure to date on this project as an asset in the statement of financial position.

Darby was also commissioned by a customer to research and, if feasible, produce a computer system to

install in motor vehicles that can automatically stop the vehicle if it is about to be involved in a collision. At

30 September 2009, Darby had spent $2·4 million on this project, but at this date it was uncertain as to

whether the project would be successful. As a consequence the assistant has treated the $2·4 million as an

expense in the income statement. (4 marks)

(iii) Darby signed a contract (for an initial three years) in August 2009 with a company called Media Today to

install a satellite dish and cabling system to a newly built group of residential apartments. Media Today will

provide telephone and television services to the residents of the apartments via the satellite system and pay

Darby $50,000 per annum commencing in December 2009. Work on the installation commenced on

1 September 2009 and the expenditure to 30 September 2009 was $58,000. The installation is expected

to be completed by 31 October 2009. Previous experience with similar contracts indicates that Darby will

make a total profit of $40,000 over the three years on this initial contract. The assistant correctly recorded

the costs to 30 September 2009 of $58,000 as a non-current asset, but then wrote this amount down to

$40,000 (the expected total profit) because he believed the asset to be impaired.

The contract is not a finance lease. Ignore discounting. (4 marks)

Required:

For each of the above items (i) to (iii) comment on the assistant’s treatment of them in the financial

statements for the year ended 30 September 2009 and advise him how they should be treated under

International Financial Reporting Standards.

Note: the mark allocation is shown against each of the three items above.

(a)Therearefourelementstotheassistant’sdefinitionofanon-currentassetandheissubstantiallyincorrectinrespectofallofthem.Thetermnon-currentassetswillnormallyincludeintangibleassetsandcertaininvestments;theuseoftheterm‘physicalasset’wouldbespecifictotangibleassetsonly.Whilstitisusuallythecasethatnon-currentassetsareofrelativelyhighvaluethisisnotadefiningaspect.Awastepaperbinmayexhibitthecharacteristicsofanon-currentasset,butonthegroundsofmaterialityitisunlikelytobetreatedassuch.Furthermorethepastcostofanassetmaybeirrelevant;nomatterhowmuchanassethascost,itistheexpectationoffutureeconomicbenefitsflowingfromaresource(normallyintheform.offuturecashinflows)thatdefinesanassetaccordingtotheIASB’sFrameworkforthepreparationandpresentationoffinancialstatements.Theconceptofownershipisnolongeracriticalaspectofthedefinitionofanasset.Itisprobablythecasethatmostnoncurrentassetsinanentity’sstatementoffinancialpositionareownedbytheentity;however,itistheabilityto‘control’assets(includingpreventingothersfromhavingaccesstothem)thatisnowadefiningfeature.Forexample:thisisanimportantcharacteristicintreatingafinanceleaseasanassetofthelesseeratherthanthelessor.Itisalsotruethatmostnon-currentassetswillbeusedbyanentityformorethanoneyearandapartofthedefinitionofproperty,plantandequipmentinIAS16Property,plantandequipmentreferstoanexpectationofuseinmorethanoneperiod,butthisisnotnecessarilyalwaysthecase.Itmaybethatanon-currentassetisacquiredwhichprovesunsuitablefortheentity’sintendeduseorisdamagedinanaccident.Inthesecircumstancesassetsmaynothavebeenusedforlongerthanayear,butneverthelesstheywerereportedasnon-currentsduringthetimetheywereinuse.Anon-currentassetmaybewithinayearoftheendofitsusefullifebut(unlessasaleagreementhasbeenreachedunderIFRS5Non-currentassetsheldforsaleanddiscontinuedoperations)wouldstillbereportedasanon-currentassetifitwasstillgivingeconomicbenefits.Anotherdefiningaspectofnon-currentassetsistheirintendedusei.e.heldforcontinuinguseintheproduction,supplyofgoodsorservices,forrentaltoothersorforadministrativepurposes.(b)(i)TheexpenditureonthetrainingcoursesmayexhibitthecharacteristicsofanassetinthattheyhaveandwillcontinuetobringfutureeconomicbenefitsbywayofincreasedefficiencyandcostsavingstoDarby.However,theexpenditurecannotberecognisedasanassetonthestatementoffinancialpositionandmustbechargedasanexpenseasthecostisincurred.Themainreasonforthislieswiththeissueof’control’;itisDarby’semployeesthathavethe‘skills’providedbythecourses,buttheemployeescanleavethecompanyandtaketheirskillswiththemor,throughaccidentorinjury,maybedeprivedofthoseskills.AlsothecapitalisationofstafftrainingcostsisspecificallyprohibitedunderInternationalFinancialReportingStandards(specificallyIAS38Intangibleassets).(ii)Thequestionspecificallystatesthatthecostsincurredtodateonthedevelopmentofthenewprocessorchipareresearchcosts.IAS38statesthatresearchcostsmustbeexpensed.Thisismainlybecauseresearchistherelativelyearlystageofanewprojectandanyfuturebenefitsaresofarinthefuturethattheycannotbeconsideredtomeetthedefinitionofanasset(probablefutureeconomicbenefits),despitethegoodrecordofsuccessinthepastwithsimilarprojects.Althoughtheworkontheautomaticvehiclebrakingsystemisstillattheresearchstage,thisisdifferentinnaturefromthepreviousexampleastheworkhasbeencommissionedbyacustomer,Assuch,fromtheperspectiveofDarby,itisworkinprogress(acurrentasset)andshouldnotbewrittenoffasanexpense.Anoteofcautionshouldbeaddedhereinthatthequestionsaysthatthesuccessoftheprojectisuncertainwhichpresumablymeansitmaynotbecompleted.ThisdoesnotmeanthatDarbywillnotreceivepaymentfortheworkithascarriedout,butitshouldbecheckedtothecontracttoensurethattheamountithasspenttodate($2·4million)willberecoverable.Intheeventthatsay,forexample,thecontractstatedthatonly$2millionwouldbeallowedforresearchcosts,thiswouldplacealimitonhowmuchDarbycouldtreatasworkinprogress.Ifthiswerethecasethen,forthisexample,Darbywouldhavetoexpense$400,000andtreatonly$2millionasworkinprogress.(iii)Thequestionsuggeststhecorrecttreatmentforthiskindofcontractistotreatthecostsoftheinstallationasanon-currentassetand(presumably)depreciateitoveritsexpectedlifeof(atleast)threeyearsfromwhenitbecomesavailableforuse.Inthiscasetheassetwillnotcomeintouseuntilthenextfinancialyear/reportingperiodandnodepreciationneedstobeprovidedat30September2009.Thecapitalisedcoststodateof$58,000shouldonlybewrittendownifthereisevidencethattheassethasbecomeimpaired.Impairmentoccurswheretherecoverableamountofanassetislessthanitscarryingamount.Theassistantappearstobelievethattherecoverableamountisthefutureprofit,whereas(inthiscase)itisthefuture(net)cashinflows.Thusanyimpairmenttestat30September2009shouldcomparethecarryingamountof$58,000withtheexpectednetcashflowfromthesystemof$98,000($50,000perannumforthreeyearslessfuturecashoutflowstocompletiontheinstallationof$52,000(seenotebelow)).Asthefuturenetcashflowsareinexcessofthecarryingamount,theassetisnotimpairedanditshouldnotbewrittendownbutshownasanon-currentasset(underconstruction)atcostof$58,000.Note:asthecontractisexpectedtomakeaprofitof$40,000onincomeof$150,000,thetotalcostsmustbe$110,000,withcoststodateat$58,000thisleavescompletioncostsof$52,000.

(b) Using models where appropriate, what are likely to be the critical success factors (CSFs) as the business

grows and develops? (10 marks)

(b) David even at this early stage needs to identify the critical success factors and related performance indicators that will show

that the concept is turning into a business reality. Many of the success factors will be linked to customer needs and

expectations and therefore where David’s business must excel in order to outperform. the competition. As an innovator one of

the critical success factors will be the time taken to develop and launch the new vase. Being first-to-market will be critical for

success. His ability to generate sales from demanding corporate customers will be a real indicator of that success. David will

need to ensure that he has adequate patent protection for the product and recognise that it will have a product life cycle.

There look to be a number of alternative markets and the ability to customise the product may be a CSF. Greiner indicates

the different stages a growing business goes through and the different problems associated with each stage. One of David’s

key problems will be to decide what type of business he wants to be. From the scenario it looks as if he is aiming to carry

out most of the functions himself and there is a need to decide what he does and what he gets others to do for him. Indeed

the skills he has may be as an innovator rather than as someone who carries out manufacture, distribution, etc. Gift Designs

may develop most quickly as a firm that creates new products and then licences them to larger firms with the skills to

penetrate the many market opportunities that are present. It is important for David to recognise that turning the product

concept into a viable and growing business may result in a business and a business model very different to what he

anticipated. Gift Designs needs to have the flexibility and agility to take advantage of the opportunities that will emerge over

time.

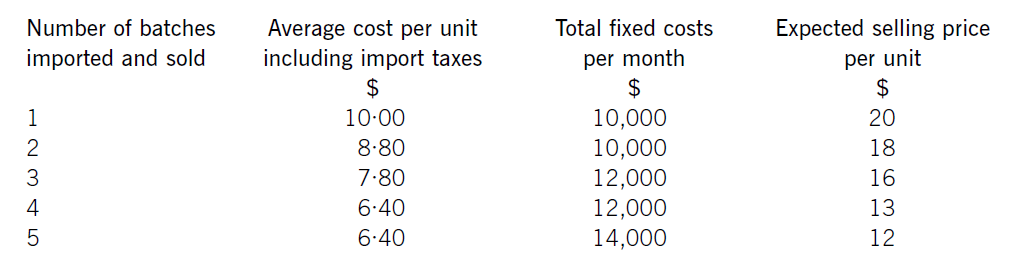

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion.

(b) Given his recent diagnosis, advise Stuart as to which of the two proposed investments (Omikron plc/Omega

plc) would be the more tax efficient alternative. Give reasons for your choice. (3 marks)

(b) Both companies are listed. The only difference will be in the availability of inheritance tax relief – specifically business property

relief (BPR). If Stuart and Rebecca jointly hold in excess of 50% of the share capital of a listed company, BPR will apply at

the rate of 50%. Otherwise, no BPR is available.

Stuart can only buy 1,005,000 (£422,100/£0·42) shares in Omikron plc. This represents a shareholding of 2·00%

(1,005,000/50,250,000). As the shares in Omikron plc are listed, a 2% holding will not qualify for BPR.

At the moment, both Stuart and Rebecca own 2,400,000 shares in Omega plc. Their shareholdings are amalgamated for

IHT purposes under the related property rules. With a joint holding of 48%, BPR is not available. A further 200,001 shares

will be required to attain a 50% holding. Assuming Stuart and Rebecca can buy these shares, they must then hold their 50%

interest in the company for the period of at least two years in order to ensure that BPR applies.

On the basis that Stuart is expected to survive for two to three years, he should therefore buy further shares in Omega plc in

order to take advantage of the BPR available.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-03-06

- 2020-01-10

- 2020-01-14

- 2020-01-09

- 2020-02-21

- 2020-04-09

- 2020-05-15

- 2020-05-14

- 2020-05-09

- 2020-03-07

- 2020-01-01

- 2020-01-10

- 2020-02-08

- 2021-07-23

- 2020-01-10

- 2020-01-10

- 2020-03-29

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-05-08

- 2020-01-10

- 2020-01-10

- 2020-02-20

- 2020-01-09

- 2020-04-25

- 2020-01-10

- 2020-04-25

- 2020-05-09

- 2019-07-20