ACCA考试机考澳门预约流程是怎么样的?

发布时间:2020-01-10

这个世上没有任何事是天上掉馅饼的,就算是有,也是你一直坚持的结果。各位ACCAer们,温馨提示大家,现在ACCA考试可以提前预约啦,不知道具体的操作步骤也没关系,51题库考试学习网为大家讲述提前预约的步骤:

2020年ACCA机考考位如何预约?

通常情况下,常规报名时段开启时,学员就可以进行考位的预约了,考位的预约、更改和取消也均在常规报名阶段进行。因此,如果需要进行考位的预约,笔者提醒广大学员,一定要尽早地预约,以防万一。

考生可以一次性预约两个考季的考试。也就是说:

(1)目前尚未参加任何考试的学员,可以连续预约接下来的两个考季。

(2)目前正在参加当季考试或正在等待考试成绩的学员,可以连续预约随后举行的两个考季。

(3)所有考试报名均可在统一的截止日期之前撤销,考试费也会退回考生的myACCA账户(适用情况下)。

(4)连续考季是指两个相邻的考季,例如3月和6月,不能是3月和9月。

ACCA考试预约流程:

1、进入ACCA官网登录myACCA账号;

2、选择 EXAM ENTRY 然后进入报名页面;

3、选择下方的机考栏目中的 China,点击Book a session CBE ,进入到后续报名页面;

4、然后在后续页面中选择科目等信息,机考报名的操作流程非常简单清晰,一般不会弄错;

5、点击下方考试科目自动弹出考试地点的选择,填写合适的城市就会自动生成考试报名信息,只要添加到考试计划中缴费确认即可报名成功。

温馨提示:

ACCA是有机考的,这个主要是要看考位情况,当月考位预定完了你也是不能再考了,提前时间尽量早点,先提前约好。做好提前规划的考生可以尽早报名考试,并享受最低考试费用优惠。

ACCA的前四门考试,F1到F4,都是找机考中心预约ACCA考试的。意思是说,这几门考试,不是一个季度统一考一次的。你要考,随时都可以,只要预约上就行。

不过有一个小问题,机构的ACCA机考中心会优先供给他们自己的学生考试,所以如果你要在机构预约最好提早一个月。大城市会有很多非机构考试中心和小机构的机考中心,这些地方人相对会少些,自学的同学可以优先跟他们联系。

有些事情不是看到希望才坚持,而是坚持了才看到希望,要时刻铭记自己的目标,永不放弃,坚持不懈。备考ACCA考试这条路是一条不平凡的道路,坚持下去,你就是胜利者!加油!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) The sales director has suggested to Damian, that to encourage the salesmen to accept the new arrangement,

the company should increase the value of the accessories of their own choice that can be fitted to the low

emission cars.

State, giving reasons, whether or not Damian should implement the sales director’s suggestion.

(2 marks)

(ii) Damian should not agree to the sales director’s suggestion. The salesmen will each make a significant annual income

tax saving under the proposal, whereas the company will also be offset (at least partly) by the reduction in the dealer’s

bulk discount. Further, 100% first year allowance tax incentive for low emission cars is not guaranteed beyond 31 March

2008, and it is unlikely that any change in policy with regards to the provision of additional accessories will, once

implemented, be easily reversible.

22 Which of the following items may appear in a company’s statement of changes in equity, according to IAS 1 Presentation of financial statements?

1 Unrealised revaluation gains.

2 Dividends paid.

3 Proceeds of equity share issue.

4 Profit for the period.

A 2, 3 and 4 only

B 1, 3 and 4 only

C All four items

D 1, 2 and 4 only

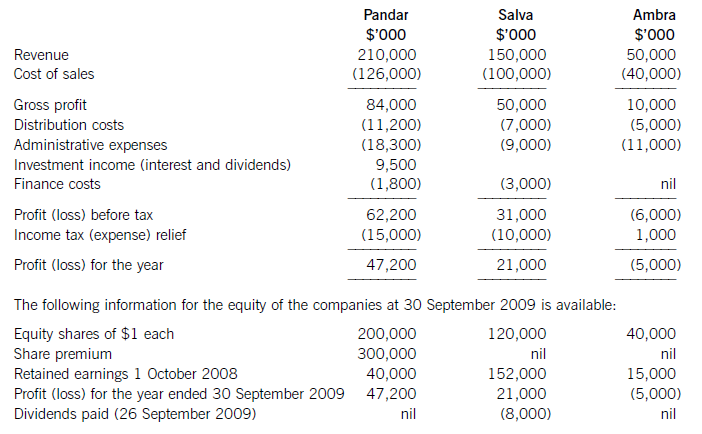

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

6 Alasdair, aged 42, is single. He is considering investing in property, as he has heard that this represents a good

investment. In order to raise the funds to buy the property, he wants to extract cash from his personal company, Beezer

Limited, whose year end is 31 December.

Beezer Limited was formed on 1 May 1998 with £1,000 of capital issued as 1,000 £1 ordinary shares, and traded

until 1 January 2005 when Alasdair sold the trade and related assets. The company’s only asset is cash of

£120,000. Alasdair wants to extract this cash from the company with the minimum amount of tax payable. He is

considering either, paying himself a dividend of £120,000, on 31 March 2006, after which the company would have

no assets and be wound up or, leaving the cash in the company and then liquidating the company. Costs of liquidation

of £5,000 would then be incurred.

Since Beezer Limited ceased trading, Alasdair has been taken on as a partner at a marketing firm, Gallus & Co. He

estimates his profit share for the year of assessment 2005/06 will be £30,000. He has not made any capital disposals

in the current tax year.

Alasdair wishes to reinvest the cash extracted from Beezer Limited in property but is not sure whether he should invest

directly in residential or commercial property, or do so via some form. of collective investment. He is aware that Gallus

& Co are looking to rent a new warehouse which could be bought for £200,000. Alasdair thinks that he may be able

to buy the warehouse himself and lease it to his firm, but only if he can borrow the additional money to buy the

property.

Alasdair has a 25% shareholding in another company, Glaikit Limited, whose year end is 31 March. The remaining

shares in this company are held by his friend, Gill. Alasdair is considering borrowing £15,000 from Glaikit Limited

on 1 January 2006. He does not intend to pay any interest on the loan, which is likely to be written off some time

in 2007. Alasdair does not have any connection with Glaikit Limited other than his shareholding.

Required:

(a) Advise Alasdair whether or not a dividend payment will result in a higher after-tax cash sum than the

liquidation of Beezer Limited. Assume that either the dividend would be paid on 31 March 2006 or the

liquidation would take place on 31 March 2006. (9 marks)

Assume that Beezer Limited has always paid corporation tax at or above the small companies rate of 19%

and that the tax rates and allowances for 2004/05 apply throughout this part.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-03-22

- 2020-04-18

- 2020-01-10

- 2019-07-21

- 2019-08-01

- 2020-04-03

- 2020-03-06

- 2020-01-09

- 2020-03-14

- 2020-03-04

- 2020-01-08

- 2020-01-10

- 2020-03-13

- 2020-01-10

- 2020-08-15

- 2020-05-20

- 2020-01-10

- 2020-02-11

- 2020-03-14

- 2020-03-25

- 2020-01-09

- 2020-01-10

- 2021-05-08

- 2020-02-22

- 2020-01-08

- 2020-01-09

- 2019-07-21

- 2020-01-10

- 2020-01-10

- 2020-01-10