山西省考生:ACCA国际注册会计师的缴费流程是怎么样的呢?

发布时间:2020-01-10

为了犒劳经历了一场“恶战”的ACCAer们,也为了犒劳沉浸在2020年新年到来的喜悦中但还想报名ACCA机考的你,51题库考试学习网帮你们准备了关于一些ACCA缴费流程,大家通常会遇到的部分问题:

ACCA证书是什么?

ACCA在国内被称为"国际注册会计师",是全球含金量高的财会金融领域的证书之一,在国际上的认可范围很广的财务人员资格证书。ACCA全称:英国特许公认会计师公会(The Association of Chartered

Certified Accountants)。

ACCA证书的优点是什么?

他的优点分为以下几类:首先是在报名条件上门槛不高,不像国内其他类似的高级会计师一样有报考专业和工作年限的要求,它的报考并无专业限制;

其次,它的知识架构完整且基础,即便是无财会背景人士通过学习可以了解财务领域所有知识与技能;

最后,ACCA证书认可雇主皆为全球五百强企业。

拥有ACCA认证,就拥有了全球求职"通行证"

(一)ACCA考试费用分为哪几个部分?

1、 ACCA注册费

首先要注册成为ACCA的学员,此项有一个需要一次性即时缴纳的注册费用,2019年首次注册费和重新注册费均为£79。

2、 ACCA年费

注册成ACCA学员后,您需要每年缴纳年费,以保持学员/会员身份。2019年官网公布的学员年费为£105,以后年费以ACCA官网的公布为准,可能会有调整(2019年5月10日后注册的学生可以免除2019年的年费)。 2019年年底,您需要缴纳2020年的年费,以保持学员/会员身份。同时,此后每年年底,您都需要缴纳下一年的年费了,您如果没有在规定时间内及时付清所欠的任何费用(年费、免试费等)都将被除名。请您登录ACCA全球官网在MY ACCA中查看自己是否有任何欠费账单并及时支付。

3、 ACCA考试费用

考试费用根据考生报考时间不同,有所区别。报考时段分为提前报名时段,常规报名时段和后期报名时段。具体费用敬请参照费用标准。免试课程要交纳免试费,免试费与提前报名时段考试费相同;补考需另交费,费用与考试费用相同。由于每人免试科目不同,所以教材和培训费用因人而异。

4、ACCA学习的费用

1. 各机构的教材及练习册(ACCA官方只有大纲,没有官方教材)

2. 网课。

3. 按科目划分,每门科目几百至几千不等,总计学费约2-4万。主要还是在必须缴纳的费用、课本费,在校生的学费或是网课费用。

(二) 为什么MyACCA登陆不上?为什么网页老是无法跳转到支付页面?

答:因为官网会自动识别您的IP地址并跳转到ACCA中国官网。但缴费和完成CPD的提交必须在ACCA全球官网登录MyACCA后进行操作

(三) 没有及时缴纳年费会有什么影响?

答:如果会员没有在规定时间内及时支付所欠的费用(包括年费、会员申请费等),ACCA将会锁定你的个人账号,无法登录,收回你的ACCA学员或会员资格。

(四)缴费过程中,系统经常出现Bug,导致不能顺利付费,这种情况下该怎么处理?

答:建议使用Chrome或者火狐浏览器并清空历史记录和浏览器的Cookies,或者使用手机等移动设备登陆MyACCA,尽可能避开网络繁忙时段,提高支付的成功率。同时,您也可致电英国总部24小时服务热线+44 141 582 2000提供个人相关信息直接通过电话进行缴费。

(五)我的支付宝/银行卡显示已扣款,但是在MyACCA系统上显示没有支付成功,怎么办?

答:支付宝/银行卡扣款成功不一定表示年费已成功支付。成功完成缴费后MyACCA的Account balance应该显示为0。 你的个人账户被成功扣款后,有可能需要等1-3天才能在ACCA系统上显示到账。如果超过3天以上您的Account balance仍然显示有欠费,则表示支付没有成功,相关费用会在2-15个工作日内退回到您的信用卡或支付宝。您可以再收到退款后,再次尝试支付即可。

(六)支付未成功,被退还的费用显示和原支付金额不同,为什么?

答:由于支付金额和退回金额都会按照当天汇率转化为英镑支付或退款,每天的汇率波动会导致费用的差异。

(七)不交年费是否会影响考试?

答:年费的缴纳一般是在年底11月-12月,在此期间,可正常进行12月考试,不过如果逾期未缴纳年费,ACCA官方将会锁定你的个人账号,无法登录。

(八)如果忘交年费ACCA资格被取消怎么办?

已被除名的会员/学员可以向协会写封邮件,表明自己的意愿并索要电子版的重新注册表格。 ACCA学员需要缴纳当年所欠的ACCA考试费用以及重新注册费,并填写重新注册表后,传真或致电英国总部;ACCA会员则需要缴纳过往欠费及重新注册费,并填写重新注册表后,传真或致电英国总部。 更多疑问,可致电ACCA中国代表处。

以上就是关于ACCA缴费遇到哪些问题的相关内容。想了解更多关于2019年ACCA培训课程,欢迎加入关注51题库考试学习网

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

Hindberg is a car retailer. On 1 April 2014, Hindberg sold a car to Latterly on the following terms:

The selling price of the car was $25,300. Latterly paid $12,650 (half of the cost) on 1 April 2014 and would pay the remaining $12,650 on 31 March 2016 (two years after the sale). Hindberg’s cost of capital is 10% per annum.

What is the total amount which Hindberg should credit to profit or loss in respect of this transaction in the year ended 31 March 2015?

A.$23,105

B.$23,000

C.$20,909

D.$24,150

At 31 March 2015, the deferred consideration of $12,650 would need to be discounted by 10% for one year to $11,500 (effectively deferring a finance cost of $1,150). The total amount credited to profit or loss would be $24,150 (12,650 + 11,500).

22 Which of the following statements about limited liability companies’ accounting is/are correct?

1 A revaluation reserve arises when a non-current asset is sold at a profit.

2 The authorised share capital of a company is the maximum nominal value of shares and loan notes the company

may issue.

3 The notes to the financial statements must contain details of all adjusting events as defined in IAS10 Events after

the balance sheet date.

A All three statements

B 1 and 2 only

C 2 and 3 only

D None of the statements

(iii) Whether or not you agree with the statement of the marketing director in note (9) above. (5 marks)

Professional marks for appropriateness of format, style. and structure of the report. (4 marks)

(iii) The marketing director is certainly correct in recognising that success is dependent on levels of service quality provided

by HFG to its clients. However, whilst the number of complaints is an important performance measure, it needs to be

used with caution. The nature of a complaint is, very often, far more indicative of the absence, or a lack, of service

quality. For example, the fact that 50 clients complained about having to wait for a longer time than they expected to

access gymnasium equipment is insignificant when compared to an accident arising from failure to maintain properly a

piece of gymnasium equipment. Moreover, the marketing director ought to be aware that the absolute number of

complaints may be misleading as much depends on the number of clients serviced during any given period. Thus, in

comparing the number of complaints received by the three centres then a relative measure of complaints received per

1,000 client days would be far more useful than the absolute number of complaints received.

The marketing director should also be advised that the number of complaints can give a misleading picture of the quality

of service provision since individuals have different levels of willingness to complain in similar situations.

The marketing director seems to accept the current level of complaints but is unwilling to accept any increase above this

level. This is not indicative of a quality-oriented organisation which would seek to reduce the number of complaints over

time via a programme of ‘continuous improvement’.

From the foregoing comments one can conclude that it would be myopic to focus on the number of client complaints

as being the only performance measure necessary to measure the quality of service provision. Other performance

measures which may indicate the level of service quality provided to clients by HFG are as follows:

– Staff responsiveness assumes critical significance in service industries. Hence the time taken to resolve client

queries by health centre staff is an important indicator of the level of service quality provided to clients.

– Staff appearance may be viewed as reflecting the image of the centres.

– The comfort of bedrooms and public rooms including facilities such as air-conditioning, tea/coffee-making and cold

drinks facilities, and office facilities such as e-mail, facsimile and photocopying.

– The availability of services such as the time taken to gain an appointment with a dietician or fitness consultant.

– The cleanliness of all areas within the centres will enhance the reputation of HFG. Conversely, unclean areas will

potentially deter clients from making repeat visits and/or recommendations to friends, colleagues etc.

– The presence of safety measures and the frequency of inspections made regarding gymnasium equipment within

the centres and compliance with legislation are of paramount importance in businesses like that of HFG.

– The achievement of target reductions in weight that have been agreed between centre consultants and clients.

(Other relevant measures would be acceptable.)

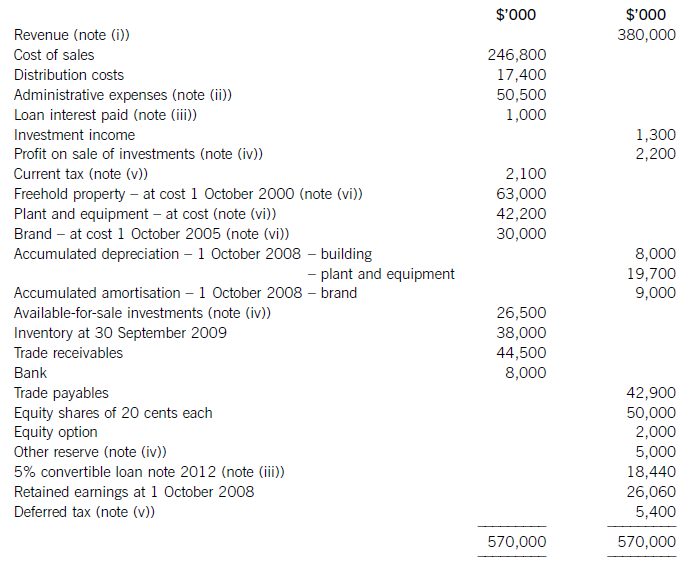

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-10-03

- 2021-04-09

- 2020-02-20

- 2020-08-12

- 2020-01-08

- 2020-01-08

- 2020-08-13

- 2020-04-30

- 2020-01-09

- 2020-01-09

- 2021-04-04

- 2020-03-22

- 2020-01-09

- 2020-01-09

- 2020-02-27

- 2020-08-13

- 2020-01-09

- 2020-01-08

- 2020-08-15

- 2020-09-03

- 2020-01-09

- 2020-04-15

- 2020-02-28

- 2020-01-09

- 2021-04-22

- 2020-01-10

- 2020-01-08

- 2021-04-09

- 2021-02-25

- 2020-01-10