你知道2020年甘肃12月ACCA考试报名时间吗?

发布时间:2020-08-13

2020年甘肃12月ACCA考试报名时间,小伙伴们都知道吗?还不知道的小伙伴赶紧跟随51题库考试学习网一起来看看吧。

12月ACCA考试报名截止时间:

提前报名截止:2020年8月10日

常规报名截止:2020年10月26日

后期报名截止:2020年11月02日

参加ACCA考试,需要先注册ACCA学员。

ACCA考试注册流程

注册报名:

1、准备注册所需材料

2、在全球官方网站进行注册

–2.1在线上传注册资料扫描文件

–2.2采用纸质材料将注册资料递交ACCA代表处

3、支付注册费用

注:采用在线上传资料方式的必须在线支付

4、查询注册进度

–4.1线上完成全部注册的约2周

–4.2纸质注册约6周

在校学生所需准备的注册材料:

中英文在校证明(原件必须为彩色扫描件)

中英文成绩单(均需为加盖所在学校或学校教务部门公章的彩色扫描件)

中英文个人身份证件或护照(原件必须为彩色扫描件、英文件必须为加盖所在学校或学校教务部门公章的彩色扫描件)

2寸彩色护照用证件照一张

用于支付注册费用的国际双币信用卡或国际汇票(推荐使用Visa)

非在校学生所需准备的注册资料(符合学历要求):

中英文个人身份证件或护照(原件必须为彩色扫描件、英文件必须为加盖翻译公司翻译专用章的彩色扫描件)

中英文学历证明(原件必须为彩色扫描件、英文件必须为加盖翻译公司翻译专用章的彩色扫描件MPAcc专业,需提供中英文成绩单*国外学历均需提供成绩单)

2寸彩色护照证件照一张

用于支付注册费用的国际双币信用卡或国际汇票(推荐使用Visa)

如何进行ACCA考位预约?

1、进入ACCA官网登录myACCA账号;

2、选择 EXAM

ENTRY 然后进入报名页面;

3、选择下方的机考栏目中的 China,点击Book a session CBE ,进入到后续报名页面;

4、然后在后续页面中选择科目等信息,机考报名的操作流程非常简单清晰,一般不会弄错;

5、点击下方考试科目自动弹出考试地点的选择,填写合适的城市就会自动生成考试报名信息,只要添加到考试计划中缴费确认即可报名成功。

以上是本次51题库考试学习网带给大家的全部内容,小伙伴都清楚了吗?如果大家对于ACCA考试还有其他问题,可以多多关注51题库考试学习网,我们将继续为大家答疑解惑。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Describe the principal matters that should be included in your firm’s submission to provide internal audit

services to RBG. (10 marks)

(b) Principal matters to be included in submission to provide internal audit services

■ Introduction/background – details about York including its organisation (of functions), offices (locations) and number of

internal auditors working within each office. The office that would be responsible for managing the contract should be

stated.

■ A description of York’s services most relevant to RBG’s needs (e.g. in the areas of risk management, IT audits, value for

money (VFM) and corporate governance).

■ Client-specific issues identified. For example, revenue audits will be required routinely for control purposes and to

substantiate the contingent rents due. Other areas of expertise that RBG may be interested in taking advantage of, for

example, special projects such as acquisitions and mergers.

■ York’s approach to assessing audit needs including the key stages and who will be involved. For example:

(1) Preliminary – review of business, industry and the entity’s operating characteristics

(2) Planning – including needs analysis and co-ordination with external audit plan

(3) Post-Audit – assurance that activities were effectively and efficiently executed

(4) Review – of services provided, reports issued and management’s responses.

■ A description of internal audit tools used and methodologies/approach to audit fieldwork including use of embedded

audit software and programs developed by York.

■ A description of York’s systems-based audit, the IT issues to be addressed and the technological support that can be

provided.

■ Any training that will be offered to RBG’s managers and staff, for example, in a risk management approach.

■ A description and quantity of resources, in particular the number of full-time staff, to be deployed in providing services

to RBG. An outline of RBG’s track record in human resource retention and development.

■ Relevant experience – e.g. in internal and external audit in the retail industry. The relative qualifications and skills of

each grade of audit staff and the contract manager in particular.

■ Insurance certifications covering, for example, public liability and professional indemnity insurance.

■ Work ethic policies relating to health and safety, equal opportunities’ and race relations.

■ How York ensures quality throughout the internal audit process including standards to be followed (e.g. Institute of

Internal Auditors’ standards).

■ Sample report templates – e.g. for reporting the results of risk analysis, audit plans and quarterly reporting of findings

to the Audit and Risk Management Committee.

■ Current clients to whom internal audit services are provided from whom RBG will be able to take up references, by

arrangement, if York is short-listed.

■ Any work currently carried out/competed for that could cause a conflict of interest (and the measures to avoid such

conflicts).

■ Fees (daily rates) for each grade of staff and travel and other expenses to be reimbursed. An indication of price increases,

if any, over the three-year contract period. Invoicing terms (e.g. on presentation of reports) and payment terms (e.g. the

end of the month following receipt of the invoice).

■ Performance targets to be met such as deadlines for completing work and submitting and issuing reports.

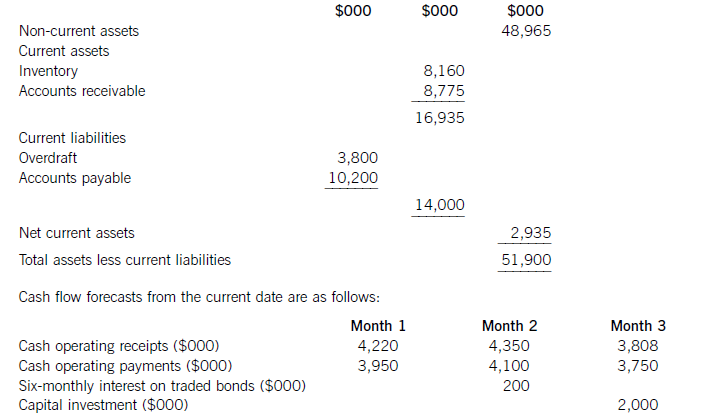

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action.

(10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced.

(8 marks)

(a)Whenconsideringthefinancingofworkingcapital,itisusefultodividecurrentassetsintofluctuatingcurrentassetsandpermanentcurrentassets.Fluctuatingcurrentassetsrepresentchangesinthelevelofcurrentassetsduetotheunpredictabilityofbusinessactivity.Permanentcurrentassetsrepresentthecorelevelofinvestmentincurrentassetsneededtosupportagivenlevelofturnoverorbusinessactivity.Asturnoverorlevelofbusinessactivityincreases,thelevelofpermanentcurrentassetswillalsoincrease.Thisrelationshipcanbemeasuredbytheratioofturnovertonetcurrentassets.Thefinancingchoiceasfarasworkingcapitalisconcernedisbetweenshort-termandlong-termfinance.Short-termfinanceismoreflexiblethanlong-termfinance:anoverdraft,forexample,isusedbyabusinessorganisationastheneedarisesandvariableinterestischargedontheoutstandingbalance.Short-termfinanceisalsomoreriskythanlong-termfinance:anoverdraftfacilitymaybewithdrawn,orashort-termloanmayberenewedonlessfavourableterms.Intermsofcost,thetermstructureofinterestratessuggeststhatshort-termdebtfinancehasalowercostthanlong-termdebtfinance.Thematchingprinciplesuggeststhatlong-termfinanceshouldbeusedforlong-terminvestment.Applyingthisprincipletoworkingcapitalfinancing,long-termfinanceshouldbematchedwithpermanentcurrentassetsandnon-currentassets.Afinancingpolicywiththisobjectiveiscalleda‘matchingpolicy’.HGRCoisnotusingthisfinancingpolicy,sinceofthe$16,935,000ofcurrentassets,$14,000,000or83%isfinancedfromshort-termsources(overdraftandtradepayables)andonly$2,935,000or17%isfinancedfromalong-termsource,inthiscaseequityfinance(shareholders’funds)ortradedbonds.ThefinancingpolicyorapproachtakenbyHGRCotowardsthefinancingofworkingcapital,whereshort-termfinanceispreferred,iscalledanaggressivepolicy.Relianceonshort-termfinancemakesthisriskierthanamatchingapproach,butalsomoreprofitableduetothelowercostofshort-termfinance.Followinganaggressiveapproachtofinancingcanleadtoovertrading(undercapitalisation)andthepossibilityofliquidityproblems.(b)Bankbalanceinthreemonths’timeifnoactionistaken:Workings:ReductioninaccountsreceivabledaysCurrentaccountsreceivabledays=(8,775/49,275)x365=65daysReductionindaysoversixmonths=65–53=12daysMonthlyreduction=12/6=2daysEachreceivablesdayisequivalentto8,775,000/65=$135,000(Alternatively,eachreceivablesdayisequivalentto49,275,000/365=$135,000)Monthlyreductioninaccountsreceivable=2x135,000=$270,000ReductionininventorydaysCurrentinventorydays=(8,160/37,230)x365=80daysEachinventorydayisequivalentto8,160,000/80=$102,000(Alternatively,eachinventoryday=37,230,000/365=$102,000)Monthlyreductionininventory=102,000x2=$204,000OverdraftinterestcalculationsMonthlyoverdraftinterestrate=1·06171/12=1·005or0·5%Ifnoactionistaken:Period1interest=3,800,000x0·005=$19,000Period2interest=3,549,000x0·005=$17,745or$18,000Period3interest=3,517,000x0·005=$17,585or$18,000Ifactionistaken:Period1interest=3,800,000x0.005=$19,000Period2interest=3,075,000x0.005=$15,375or$15,000Period3interest=2,566,000x0.005=$12,830or$13,000DiscussionIfnoactionistaken,thecashflowforecastshowsthatHGRCowillexceeditsoverdraftlimitof$4millionby$1·48millioninthreemonths’time.Ifthefinancedirector’sproposalsareimplemented,thereisapositiveeffectonthebankbalance,buttheoverdraftlimitisstillexceededinthreemonths’time,althoughonlyby$47,000ratherthanby$1·47million.Ineachofthethreemonthsfollowingthat,thecontinuingreductioninaccountsreceivabledayswillimprovethebankbalanceby$270,000permonth.Withoutfurtherinformationonoperatingreceiptsandpayments,itcannotbeforecastwhetherthebankbalancewillreturntolessthanthelimit,orevencontinuetoimprove.Themainreasonfortheproblemwiththebankbalanceisthe$2millioncapitalexpenditure.Purchaseofnon-currentassetsshouldnotbefinancedbyanoverdraft,butalong-termsourceoffinancesuchasequityorbonds.Ifthecapitalexpenditurewereremovedfromtheareaofworkingcapitalmanagement,theoverdraftbalanceattheendofthreemonthswouldbe$3·48millionifnoactionweretakenand$2·05millionifthefinancedirector’sproposalswereimplemented.GiventhatHGRCohasalmost$50millionofnon-currentassetsthatcouldpossiblybeusedassecurity,raisinglong-termdebtthrougheitherabankloanorabondissueappearstobesensible.Assumingabondinterestrateof10%peryear,currentlong-termdebtintheform.oftradedbondsisapproximately($200mx2)/0·1=$4m,whichismuchlessthantheamountofnoncurrentassets.AsuitablecourseofactionforHGRCotofollowwouldthereforebe,firstly,toimplementthefinancedirector’sproposalsand,secondly,tofinancethecapitalexpenditurefromalong-termsource.Considerationcouldalsobegiventousingsomelong-termdebtfinancetoreducetheoverdraftandtoreducethelevelofaccountspayable,currentlystandingat100days.(c)Whencreditisgrantedtoforeigncustomers,twoproblemsmaybecomeespeciallysignificant.First,thelongerdistancesoverwhichtradetakesplaceandthemorecomplexnatureoftradetransactionsandtheirelementsmeansforeignaccountsreceivableneedmoreinvestmentthantheirdomesticcounterparts.Longertransactiontimesincreaseaccountsreceivablebalancesandhencetheleveloffinancingandfinancingcosts.Second,theriskofbaddebtsishigherwithforeignaccountsreceivablethanwiththeirdomesticcounterparts.Inordertomanageandreducecreditrisks,therefore,exportersseektoreducetheriskofbaddebtandtoreducethelevelofinvestmentinforeignaccountsreceivable.Manyforeigntransactionsareon‘openaccount’,whichisanagreementtosettletheamountoutstandingonapredetermineddate.Openaccountreflectsagoodbusinessrelationshipbetweenimporterandexporter.Italsocarriesthehighestriskofnon-payment.Onewaytoreduceinvestmentinforeignaccountsreceivableistoagreeearlypaymentwithanimporter,forexamplebypaymentinadvance,paymentonshipment,orcashondelivery.Thesetermsoftradeareunlikelytobecompetitive,however,anditismorelikelythatanexporterwillseektoreceivecashinadvanceofpaymentbeingmadebythecustomer.Onewaytoacceleratecashreceiptsistousebillfinance.Billsofexchangewithasignedagreementtopaytheexporteronanagreedfuturedate,supportedbyadocumentaryletterofcredit,canbediscountedbyabanktogiveimmediatefunds.Thisdiscountingiswithoutrecourseifbillsofexchangehavebeencountersignedbytheimporter’sbank.Documentarylettersofcreditareapaymentguaranteebackedbyoneormorebanks.Theycarryalmostnorisk,providedtheexportercomplieswiththetermsandconditionscontainedintheletterofcredit.Theexportermustpresentthedocumentsstatedintheletter,suchasbillsoflading,shippingdocuments,billsofexchange,andsoon,whenseekingpayment.Aseachsupportingdocumentrelatestoakeyaspectoftheoveralltransaction,lettersofcreditgivesecuritytotheimporteraswellastheexporter.Companiescanalsomanageandreduceriskbygatheringappropriateinformationwithwhichtoassessthecreditworthinessofnewcustomers,suchasbankreferencesandcreditreports.Insurancecanalsobeusedtocoversomeoftherisksassociatedwithgivingcredittoforeigncustomers.Thiswouldavoidthecostofseekingtorecovercashduefromforeignaccountsreceivablethroughaforeignlegalsystem,wheretheexportercouldbeatadisadvantageduetoalackoflocalorspecialistknowledge.Exportfactoringcanalsobeconsidered,wheretheexporterpaysforthespecialistexpertiseofthefactorasawayofreducinginvestmentinforeignaccountsreceivableandreducingtheincidenceofbaddebts.

(b) Describe the potential benefits for Hugh Co in choosing to have a financial statement audit. (4 marks)

(b) There are several benefits for Hugh Co in choosing a voluntary financial statement audit.

An annual audit will ensure that any material mistakes made by the part-qualified accountant in preparing the year end

financial statements will be detected. This is important as the directors will be using the year end accounts to review their

progress in the first year of trading and will need reliable figures to assess performance. An audit will give the directors comfort

that the financial statements are a sound basis for making business decisions.

Accurate first year figures will also enable more effective budgeting and forecasting, which will be crucial if rapid growth is to

be achieved.

The auditors are likely to use the quarterly management accounts as part of normal audit procedures. The auditors will be

able to advise Monty Parkes of any improvements that could be made to the management accounts, for example, increased

level of detail, more frequent reporting. Better quality management accounts will help the day-to-day running of the business

and enable a speedier response to any problems arising during the year.

As a by-product of the audit, a management letter (report to those charged with governance) will be produced, identifying

weaknesses and making recommendations on areas such as systems and controls which will improve the smooth running of

the business.

It is likely that Hugh Co will require more bank funding in order to expand, and it is likely that the bank would like to see

audited figures for review, before deciding on further finance. It will be easier and potentially cheaper to raise finance from

other providers with an audited set of financial statements.

As the business deals in cash sales, and retails small, luxury items there is a high risk of theft of assets. The external audit

can act as both a deterrent and a detective control, thus reducing the risk of fraud and resultant detrimental impact on the

financial statements.

Accurate financial statements will be the best basis for tax assessment and tax planning. An audit opinion will enhance the

credibility of the figures.

If the business grows rapidly, then it is likely that at some point in the future, the audit exemption limit will be exceeded and

thus an audit will become mandatory.

Choosing to have an audit from the first year of incorporation will reduce potential errors carried down to subsequent periods

and thus avoid qualifications of opening balances.

18 How should interest charged on partners’ drawings appear in partnership financial statements?

A As income in the income statement

B Added to net profit and charged to partners in the division of profit

C Deducted from net profit and charged to partners in the division of profit

D Deducted from net profit in the division of profit and credited to partners

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2021-04-10

- 2020-01-10

- 2020-09-03

- 2021-01-13

- 2020-01-10

- 2020-07-04

- 2020-09-03

- 2020-02-22

- 2020-01-10

- 2020-01-09

- 2021-01-13

- 2021-01-16

- 2020-02-26

- 2020-02-02

- 2019-03-08

- 2020-01-08

- 2021-02-02

- 2020-01-10

- 2021-04-22

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-09-03

- 2020-01-02

- 2020-04-16

- 2020-01-08

- 2020-01-09

- 2021-01-16

- 2020-01-30