福建省2019年12月ACCA考试成绩公布时间定了!

发布时间:2020-01-10

2019年ACCA最后一次考试(12月考季)已然落下帷幕,很多同学都在关注着自己的考试结果。据悉,ACCA官方将于2020年1月13日(明天)公布本次考试成绩。届时,大家可以在第一时间查询到自己的成绩。下面的ACCA成绩查询方法及流程希望对你有所帮助。

ACCA考试成绩查询方法

1.电子邮件(e-mail)

您可以在 MY ACCA 内选择通过 E-mail 接收考试成绩。

2.短信接收(SMS)

您可以在 MY ACCA 内选择通过 SMS 接收考试成绩。

3.在线查看考试成绩

所有在ACCA全球网站上登记的考生都可以在线查看自己的考试成绩。

在线查询成绩具体操作流程指导

(1)进入ACCA官网点击右上角My ACCA进行登录;

(2)输入账号、密码登录后进入主页面,点击 Exam status & Results;

(3)跳转页面后选择View your status report;

以上就是关于ACCA成绩查询的相关信息,51题库考试学习网在这里祝大家欧皇附体,成功通过考试!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(c) Risk committee members can be either executive or non-executive.

Required:

(i) Distinguish between executive and non-executive directors. (2 marks)

(c) Risk committee members can be either executive on non-executive.

(i) Distinguish between executive and non-executive directors

Executive directors are full time members of staff, have management positions in the organisation, are part of the

executive structure and typically have industry or activity-relevant knowledge or expertise, which is the basis of their

value to the organisation.

Non-executive directors are engaged part time by the organisation, bring relevant independent, external input and

scrutiny to the board, and typically occupy positions in the committee structure.

(b) The directors of Carver Ltd are aware that some of the company’s shareholders want to realise the value in their

shares immediately. Accordingly, instead of investing in the office building or the share portfolio they are

considering two alternative strategies whereby, following the sale of the company’s business, a payment will be

made to the company’s shareholders.

(i) Liquidate the company. The payment by the liquidator would be £126 per share.

(ii) The payment of a dividend of £125 per share following which a liquidator will be appointed. The payment

by the liquidator to the shareholders would then be £1 per share.

The company originally issued 20,000 £1 ordinary shares at par value to 19 members of the Cutler family.

Following a number of gifts and inheritances there are now 41 shareholders, all of whom are family members.

The directors have asked you to attend a meeting to set out the tax implications of these two alternative strategies

for each of the two main groups of shareholders: adults with shareholdings of more than 500 shares and children

with shareholdings of 200 shares or less.

Required:

Prepare notes explaining:

– the amount chargeable to tax; and

– the rates of tax that will apply

in respect of each of the two strategies for each of the two groups of shareholders ready for your meeting

with the directors of Carver Ltd. You should assume that none of the shareholders will have any capital

losses either in the tax year 2007/08 or brought forward as at 5 April 2007. (10 marks)

Note:

You should assume that the rates and allowances for the tax year 2006/07 will continue to apply for the

foreseeable future.

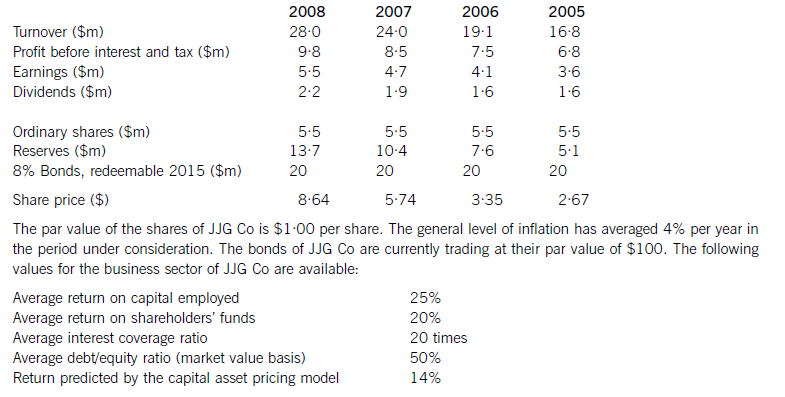

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2019-03-20

- 2019-01-05

- 2021-01-08

- 2020-09-05

- 2020-09-05

- 2020-09-05

- 2020-01-10

- 2020-09-04

- 2020-08-12

- 2020-01-10

- 2021-04-04

- 2021-01-06

- 2020-01-10

- 2020-09-05

- 2021-01-21

- 2020-09-05

- 2019-03-20

- 2020-01-01

- 2020-08-12

- 2021-04-08

- 2020-09-05

- 2021-04-04

- 2020-01-10

- 2020-08-12

- 2021-04-04

- 2019-01-05

- 2019-03-20

- 2019-03-20

- 2021-04-07

- 2021-05-22