2020年黑龙江ACCA考试准考证打印时间考前两周

发布时间:2020-09-04

黑龙江的小伙伴请注意了!2020年12月份的ACCA考试时间已经确定了,那么,大家知道ACCA考试的准考证打印时间是在什么时候吗?51题库考试学习网为大家带来了考试相关内容,让我们一起来看看吧!

2020年ACCA考试准考证打印时间:

在考前两周,可以登陆MYACCA里打印准考证。因邮寄的准考证收到时间较晚,建议提前打印好准考证,仔细核对报考科目和考试地点有无错误。

2020年ACCA考试准考证打印步骤如下:

(1)ACCA考试学员需登录www.accaglobal.com。

(2)点击MYACCA后输入自己的学员号和密码进入。

(3)点击左侧栏里EXAM ENTRY&RESULTS进入。

(4)点击EXAM ATTENDANCE DOCKET生成页面打印即可。

请仔细阅读准考证上EXAMINATION REGULATIONS和EXAMINATION GUIDELINES,务必严格遵守。

考试注意事项:

1.要明确考试的具体时间和地点。尽量提前(至少半小时)到达考场,以避免出现意外时(如临时更换考试教室)造成的紧张。尤其对于首次参加考试或在不熟悉城市参加考试的学员,在考试之前务必将考点具体位置落实。

2.带齐考试所需文具(铅笔若干支,其中一支用于涂圈;墨水笔;直尺;橡皮;计算器(不允许带有编程功能的)等)及证件(学员注册卡或身份证)。

3.选题。进入考场后,要确认封面上的答题要求。通读试题,一般应在5分钟内确定题目。确定后别忘了在答卷的封面上标明所选的题目编号。选题时主要看最后问的问题,看是否是自己比较熟悉的内容。 一般选择问题长的题,因为这些题目信息提示多,不容易跑题。尽量选择小题多的题,因为答对每一步都会得分,根据自己专长选择以计算为主还是以论述为主的题目。论述题对分析的深度和广度要求较高,不易答全,但答题时间容易控制,阅读时可以在试题上做标记,但不要在上面答题,切忌一道题答到一半,再换题的情况。

4.开始考试后,合理分配考试时间。留出读题和最后浏览试卷的时间。考试过程中注意时间,不要在某一题上超时。每一道题的所有部分都尽力回答,因为每一个小点都可能给分。

5.切忌紧张。如果在某一题陷入困境,可以先做下面的题目。等再回去做时,思路可能会开阔起来。

6.答题。充分简洁地说明自己的观点,尽量把每一个观点都列上,但不要花太多时间阐述。 要做到卷面整洁、格式明了、重点突出、逻辑清晰。要点之间留一些空间以利于补充,重要部分可以用下划线。在答题纸上注明考题编号,不必重复写出问题。 尽量按照Revision的Past Paper的标准答案格式和步骤答题,尽量在有限的时间里答完所有题目。重要的计算过程要求列出公式,计算过程和公式都能得分,计算过程要列写清楚。答卷纸不够时,可以提前向监考老师索要。

以上就是今天分享的全部内容了,各位小伙伴根据自己的情况进行查阅,希望本文对各位有所帮助,预祝各位取得满意的成绩,如需了解更多相关内容,请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

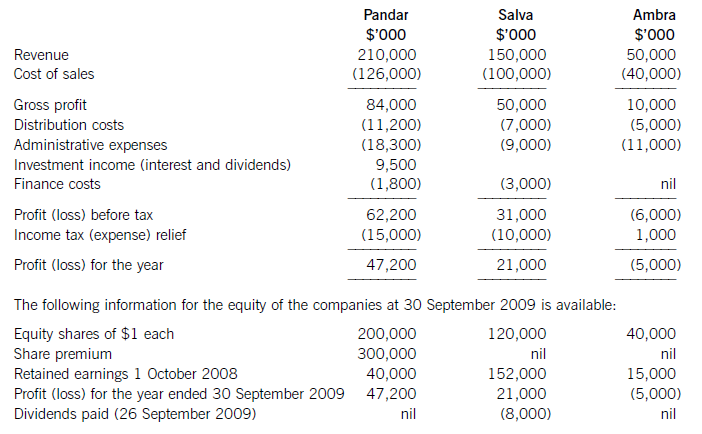

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

(b) Misson has purchased goods from a foreign supplier for 8 million euros on 31 July 2006. At 31 October 2006,

the trade payable was still outstanding and the goods were still held by Misson. Similarly Misson has sold goods

to a foreign customer for 4 million euros on 31 July 2006 and it received payment for the goods in euros on

31 October 2006. Additionally Misson had purchased an investment property on 1 November 2005 for

28 million euros. At 31 October 2006, the investment property had a fair value of 24 million euros. The company

uses the fair value model in accounting for investment properties.

Misson would like advice on how to treat these transactions in the financial statements for the year ended 31

October 2006. (7 marks)

Required:

Discuss the accounting treatment of the above transactions in accordance with the advice required by the

directors.

(Candidates should show detailed workings as well as a discussion of the accounting treatment used.)

(b) Inventory, Goods sold and Investment property

The inventory and trade payable initially would be recorded at 8 million euros ÷ 1·6, i.e. $5 million. At the year end, the

amount payable is still outstanding and is retranslated at 1 dollar = 1·3 euros, i.e. $6·2 million. An exchange loss of

$(6·2 – 5) million, i.e. $1·2 million would be reported in profit or loss. The inventory would be recorded at $5 million at the

year end unless it is impaired in value.

The sale of goods would be recorded at 4 million euros ÷ 1·6, i.e. $2·5 million as a sale and as a trade receivable. Payment

is received on 31 October 2006 in euros and the actual value of euros received will be 4 million euros ÷ 1·3,

i.e. $3·1 million.

Thus a gain on exchange of $0·6 million will be reported in profit or loss.

The investment property should be recognised on 1 November 2005 at 28 million euros ÷ 1·4, i.e. $20 million. At

31 October 2006, the property should be recognised at 24 million euros ÷ 1·3, i.e. $18·5 million. The decrease in fair value

should be recognised in profit and loss as a loss on investment property. The property is a non-monetary asset and any foreign

currency element is not recognised separately. When a gain or loss on a non-monetary item is recognised in profit or loss,

any exchange component of that gain or loss is also recognised in profit or loss. If any gain or loss is recognised in equity ona non-monetary asset, any exchange gain is also recognised in equity.

(c) (i) Provide three examples of personal financial planning protection products that would be of use in

Henry’s situation. Justify your selections by reference to the type of protection provided. (6 marks)

(c) (i) Protection products

Henry is still working and has a mortgage to support. He therefore needs to protect not only his assets but also cover

any debt, or the ability to repay. The following protection policies are relevant to Henry’s situation.

Life assurance

This is a form. of insurance that pays out on a chargeable event, usually death. The main types are:

– Term Assurance which provides cover for a fixed term with the sum assured payable only on death. No investment

benefits or payments arise on survival.

– Whole of Life Assurance where the policy provides life protection. The sum assured is payable on death at any time

and usually some form. of investment benefit will accrue in the form. of a surrender value.

A qualifying policy will give a tax-free lump sum that could, for example, be used to repay the mortgage.

Permanent health insurance

Permanent health insurance policies are designed to provide the policyholder with a benefit if s/he is unable to work

through sickness or if s/he needs medical expenses or long-term care.

This would provide Henry with an income in the event of illness – again useful given his mortgage, and would avoid

the need to liquidate other assets to pay the mortgage or ongoing costs.

Critical illness insurance

These policies provide a capital sum where a critical illness (from a large range listed in the policy) is diagnosed.

For the same reasons above, Henry should consider this in conjunction with permanent health insurance.

Note: Marks will also be given for other relevant protection products, e.g. specific mortgage protection insurance linked

to an event other than death.

4 Global Imaging is a fast growing high tech company with some 100 employees which aims to double in size over the

next three years. The company was set up as a spin out company by two research professors from a major university

hospital who now act as joint managing directors. They are likely to leave the company once the growth objective is

achieved.

Global Imaging’s products are sophisticated imaging devices facing a growing demand from the defence and health

industries. These two markets are very different in terms of customer requirements but share a related technology.

Over 90% of sales are from exports and the current strategic plan anticipates a foreign manufacturing plant being set

up during the existing three-year strategic plan. Current management positions are largely filled by staff who joined in

the early years of the company and reflect the heavy reliance on research and development to generate the products

to grow the business. Further growth will require additional staff in all parts of the business, particularly in

manufacturing and sales and marketing.

Paul Simpson, HR manager at Global Imaging is annoyed. This stems from the fact that HR is the one management

function not involved in the strategic planning process shaping the future growth and direction of the company. He

feels trapped in a role traditionally given to HR specialists, that of simply reacting to the staffing needs brought about

by strategic decisions taken by other parts of the business. He feels even more threatened by one of the joint managing

directors arguing that HR issues should be the responsibility of the line managers and not a specialist HR staff

function. Even worse, Paul has become aware of the increasing number of companies looking to outsource some or

all of their HR activities.

Paul wants to develop a convincing case why HR should not only be retained as a core function in Global Imaging’s

activities, but also be directly involved in the development of the current growth strategy.

Required:

Paul has asked you to prepare a short report to present to Global Imaging’s board of directors:

(a) Write a short report for Paul Simpson on the way a Human Resource Plan could link effectively with Global

Imaging’s growth strategy. (12 marks)

(a) To: Paul Simpson – HR Manager

From:

Human Resource Planning and Global Imaging’s future growth

I will use this report to highlight the main phases in HR (human resource) planning and then deal with the specific HR

activities, which will be needed to support the achievement of the growth strategy.

There are four major stages in creating a human resource plan. Firstly, auditing the current HR resources in Global Imaging,

as a relatively young company one could anticipate it having a relatively young labour force many of whom will be

professionally qualified. Secondly, the planned growth will require a forecast of both the number and type of people who will

be needed to implement the strategy. Thirdly, planning will be needed on how to meet the needs identified in the forecast –

how do we fill the gap in between the human reources we currently have and those needed to fulfil the plan? Finally, there

will be the need to control those resources in terms of measuring performance against the goals set.

The key activities to achieve the growth goals will be:

Recruitment, selection and staffing – here the key issues will be to recruit the necessary additional staff and mix of suitably

qualified workers. The growth of the company will create management succession issues including the two managing

directors, who are looking to exit the business in the foreseeable future. The rate of growth will also make it necessary to

manage significant internal transfers of people in the company as new positions and promotion opportunities are created.

Compensation and benefits – the start up phase of a company’s life is often a stage where a formal reward structure has not

been created. It also may be necessary to meet or exceed the labour market rates in order to attract the necessary talent. As

the firm grows there will be a need to ensure that the firm is competitive in terms of the rewards offered, but there is an

increasing need to ensure equity between newcomers and staff already employed in the firm. These pressures will normally

lead to the creation of a formal compensation structure.

Employee training and development – here there is a need to create an effective management team through management

development and organisational development.

Political

Global stability

Free trade

No wars

Economic

Growth

High disposable incomes

Stable fuel prices

Low inflation

No tax increases

AIRTITE

Social

More travel

Pensioners living longer

– travelling more

More working abroad

More second homes

Technological

Engines more efficent

Larger aircraft

Less pollution

Environmental

No global emission policy

No global warming threat

Legal

Free trade

No emission controls

No wars

Labour employee relations – here there is a need to establish harmonious labour relations and employee motivation and

morale.

Overall, the HR implications of the proposed growth strategy are profound and there is a significant danger that failure to linkstrategy and the consequent HR needs will act as a major constraint on achieving the strategy.

Yours,

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-01-10

- 2021-01-01

- 2020-01-10

- 2021-04-17

- 2020-01-09

- 2020-01-10

- 2020-09-04

- 2020-08-15

- 2020-01-08

- 2020-01-08

- 2020-01-10

- 2021-01-03

- 2020-08-15

- 2021-04-17

- 2020-01-09

- 2020-01-09

- 2020-01-09

- 2020-09-04

- 2021-01-03

- 2020-01-09

- 2021-01-03

- 2020-09-04

- 2020-01-10

- 2020-08-14

- 2020-01-10

- 2020-01-09

- 2020-08-15

- 2020-09-04

- 2020-08-15