内蒙古考生注意:2020年ACCA国际会计师考试准考证打印预计时间

发布时间:2020-01-09

目前,距离2020年3月份的ACCA考试已经仅剩下2个月左右的时间了,近期不少萌新ACCAer来咨询51题库考试学习网,想知道ACCA考试今年3月份准考证打印的时间以及打印的步骤是什么?那么接下来,51题库考试学习网就这一问题为大家解答相关的困惑,“老手”ACCAer也可以看一下,看看是否和记忆中的打印流程是一样的呢?

目前2020年3月份的ACCA考试打印的通道暂未开通,但近些年,准考证的打印流程变化其实不大的,因此大家可以借鉴一下2019年12月份的打印流程,差别不算很大的。

ACCA考试准考证打印流程:

1.打开ACCA英国官网:http://www.uk.accaglobal.com/,点击右上角的MY

ACCA

2.在登录界面,Username处输入ACCA学员号、Password处输入密码,进行登录

3.登录后点击左侧的Docket。

4.点击 Access you docket。

5.这时会弹出一个调查页面,请按上课情况进行选择:(主要是以学员的学习方式来进行选择的)

(1)周末/寒暑假上面授的学员:请在Part time -face to face后面的Other-Provider填写Beijing ZBCT International

Financial Education co. , Ltd-guangzhou,点击SAVE & CONFIRM后会自动跳转下载准考证;

(2)方向班(周一到周五在学校上课)的学员请在Full time -face to face后面的Learning Provider 选择你学校的名字;如果选项里没有你的学校,请在后面的Other-Provider 填写学校的英文名,点击 SAVE & CONFIRM后会自动跳转下载准考证;

(3)网课的学员请在Distance/Online learning后面的Other-Provider填写Beijing ZBCT International Financial Education co. , Ltd-guangzhou,点击 SAVE & CONFIRM后会自动跳转下载准考证;

以上历年来ACCA准考证打印的流程,若与上面描述的内容有误差,建议参考ACCA官网,一切以官网发布的消息为主。

准考证是考试必备的验证自己身份的东西,因此考生要重视准考证的打印,不要等到临近考试的时候才发现准考证没有打印而导致没有成功参加考试,这样就得不偿失了。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

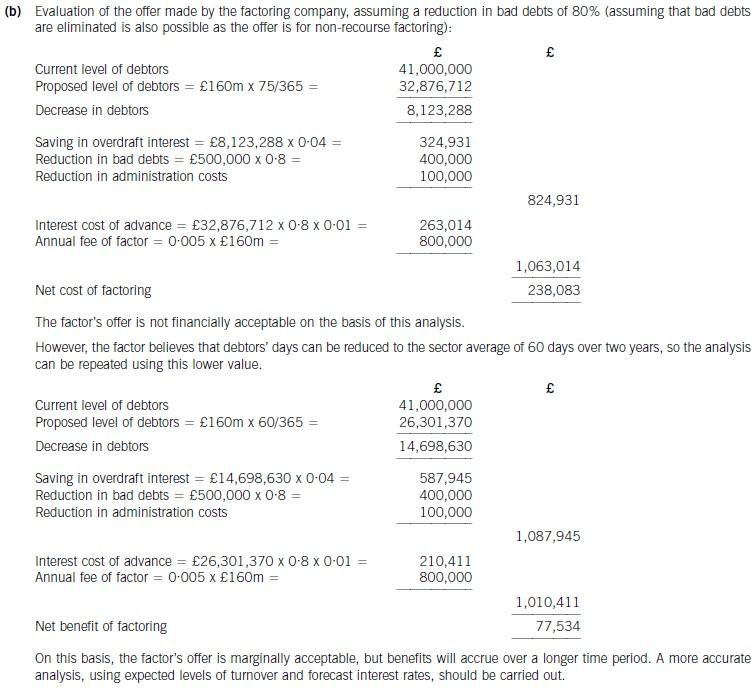

(b) Determine whether the factoring company’s offer can be recommended on financial grounds. Assume a

working year of 365 days and base your analysis on financial information for 2006. (8 marks)

(iii) cheese. (4 marks)

(iii) Cheese

■ Examine the terms of sales to Abingdon Bank – confirm the bank’s legal title (e.g. if GVF were to cease to trade

and so could not exercise buy-back option).

■ Obtain a direct confirmation from the bank of the cost of inventory sold by GVF to Abingdon Bank and the amount

re-purchased as at 30 September 2005 (the net amount being the outstanding loan).

■ Inspect the cheese as at 30 September 2005 (e.g. during the physical inventory count) paying particular attention

to the factors which indicate the age (and strength) of the cheese (e.g. its location or physical appearance).

■ Observe how the cheese is stored – if on steel shelves discuss with GVF’s management whether its net realisable

value has been reduced below cost.

■ Test check, on a sample basis, the costing records supporting the cost of batches of cheese.

■ Confirm that the cost of inventory sold to the bank is included in inventory as at 30 September 2005 and the

nature of the bank security adequately disclosed.

■ Agree the repurchase of cheese which has reached maturity at cost plus 7% per six months to purchase invoices

(or equivalent contracts) and cash book payments.

■ Test check GVF’s inventory-ageing records to production records. Confirm the carrying amount of inventory as at

30 September 2005 that will not be sold until after 30 September 2006, and agree to the amount disclosed in

the notes to inventory as a ‘non-current’ portion.

(c) To correct the problems at Flavours Fine Foods, explain to Alan Jones:

(i) the need for delegation; (3 marks)

(c) (i) Without delegation, formal organisations could not exist. Without allocation of authority, responsibility and delegation, a formal organisation cannot be effective. They are critical aspects. Managers must delegate because of the size and complexity of the organisation (certainly an issue for Flavours Fine Foods). Delegation can help overcome the physical and mental limitations of staff, managers and supervisors and it allows management to attend to other matters since routine tasks and decision making can be passed down. However, superiors must call subordinates to account and coordinate their activities.

(b) Discuss the view that fair value is a more relevant measure to use in corporate reporting than historical cost.

(12 marks)

(b) The main disagreement over a shift to fair value measurement is the debate over relevance versus reliability. It is argued that

historical cost financial statements are not relevant because they do not provide information about current exchange values

for the entity’s assets which to some extent determine the value of the shares of the entity. However, the information provided

by fair values may be unreliable because it may not be based on arm’s-length transactions. Proponents of fair value

accounting argue that this measurement is more relevant to decision makers even if it is less reliable and would produce

balance sheets that are more representative of a company’s value. However it can be argued that relevant information that is

unreliable is of no use to an investor. One advantage of historical cost financial information is that it produces earnings

numbers that are not based on appraisals or other valuation techniques. Therefore, the income statement is less likely to be

subject to manipulation by management. In addition, historical cost balance sheet figures comprise actual purchase prices,

not estimates of current values that can be altered to improve various financial ratios. Because historical cost statements rely

less on estimates and more on ‘hard’ numbers, it can be said that historical cost financial statements are more reliable than

fair value financial statements. Furthermore, fair value measurements may be less reliable than historical costs measures

because fair value accounting provides management with the opportunity to manipulate the reported profit for the period.

Developing reliable methods of measuring fair value so that investors trust the information reported in financial statements is

critical.

Fair value measurement could be said to be more relevant than historical cost as it is based on market values and not entity

specific measurement on initial recognition, so long as fair values can be reliably measured. Generally the fair value of the

consideration given or received (effectively historical cost) also represents the fair value of the item at the date of initial

recognition. However there are many cases where significant differences between historical cost and fair value can arise on

initial recognition.

Historical cost does not purport to measure the value received. It cannot be assumed that the price paid can be recovered in

the market place. Hence the need for some additional measure of recoverable value and impairment testing of assets.

Historical cost can be an entity specific measurement. The recorded historical cost can be lower or higher than its fair value.

For example the valuation of inventory is determined by the costing method adopted by the entity and this can vary from

entity to entity. Historical cost often requires the allocation of costs to an asset or liability. These costs are attributed to assets,

liabilities and expenses, and are often allocated arbitrarily. An example of this is self constructed assets. Rules set out in

accounting standards help produce some consistency of historical cost measurements but such rules cannot improve

representational faithfulness.

Another problem with historical cost arises as regards costs incurred prior to an asset being recognised. Historical costs

recorded from development expenditure cannot be capitalised if they are incurred prior to the asset meeting the recognition

criteria in IAS38 ‘Intangible Assets’. Thus the historical cost amount does not represent the fair value of the consideration

given to create the asset.

The relevance of historical cost has traditionally been based on a cost/revenue matching principle. The objective has been to

expense the cost of the asset when the revenue to which the asset has contributed is recognised. If the historical cost of the

asset differs from its fair value on initial recognition then the matching process in future periods becomes arbitrary. The

measurement of assets at fair value will enhance the matching objective. Historical cost may have use in predicting future

net reported income but does not have any necessary implications for future cash flows. Fair value does embody the market’s

expectations for those future cash flows.

However, historical cost is grounded in actual transaction amounts and has existed for many years to the extent that it is

supported by practical experience and familiarity. Historical cost is accepted as a reliable measure especially where no other

relevant measurement basis can be applied.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-09-04

- 2020-01-10

- 2020-08-19

- 2020-01-10

- 2020-08-14

- 2020-08-14

- 2020-01-10

- 2020-01-08

- 2020-08-19

- 2020-01-10

- 2021-01-03

- 2020-09-04

- 2021-04-17

- 2020-01-10

- 2020-01-09

- 2021-01-01

- 2020-01-10

- 2020-01-08

- 2020-09-04

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-08

- 2020-01-10

- 2021-01-01

- 2020-08-14

- 2020-08-15