2020年宁夏ACCA考试准考证打印时间考前两周

发布时间:2020-08-15

2020年宁夏ACCA考试准考证打印时间及考试注意事项,大家都了解吗?下面51题库考试学习网就带领大家一起来看看,关于宁夏2020年ACCA考试准考证打印相关内容,想要了解的小伙伴赶紧来围观吧。

ACCA考试准考证打印步骤:

(1)ACCA考试学员需登陆www.accaglobal.com

(2)点击MYACCA后登入您的学员号和密码进入

(3)点击左侧栏里EXAM ENTRY&RESULTS进入

(4)点击EXAM ATTENDANCE DOCKET生成页面打印即可

请仔细阅读准考证上EXAMINATION REGULATIONS和EXAMINATION

GUIDELINES,务必严格遵守。ACCA考试学员请仔细核对的考试地点,仔细看准考证上的地址,以免走错考场。

考生特别注意:

在考前两周,可以登陆MYACCA里打印准考证(准考证是学员考试必带的证明,请重视;打印准考证数量须和考试科数相同)。因邮寄的准考证收到时间较晚,建议提前打印好准考证,仔细核对报考科目和考试地点有无错误。

考试注意事项:

1.考前必带证件:身份证、准考证。

考试科目必须与准考证一致,考试中心编号必须与准考证一致,不可以在准考证上乱涂乱写。考场中的每一个桌子上都标有编号,必须确认自己的桌子编号与准考证上的编号相同,如果参加了多科考试,必须注意每一科考试的考场桌子编号的变化,如果没有坐在正确编号的桌子上考试,那么答题册将被宣告无效。

2.考试必备文具:黑色圆珠笔、小尺、铅笔、橡皮、计算器(单功能)、手表等(笔试)。

3.请考试学员尽量提前半小时到场(开考后一个小时后不允许进入考场)。

4.进入考场请仔细听考官所讲的考试规则,以免在考试中出现问题。在监考官宣布考试开始前,请勿打开试卷。请确认所发试卷是否正确。每位学员将会收到:试卷、答题本、机读卡、坐标纸(若有画图题),若有任何问题,请举手示意监考官。

5.规定ACCA考试学员进入考场后,必须把通讯设备及所携带的资料、书包等一并放置在监考官指定的位置并按照准考证上标明的考场及座位号就座。请注意不能携带手机到座位上,即使已经关机也不行。

6.考试正式开始前,必须用黑色圆珠笔填写答题册前面的具体信息:

学员ID和名字

桌子编号

考场编号

考试科目编号和版本

在考试结束前,必须在答题册封皮及答题页上方辨明已答题目的题号。

考生必须确认考试中所有答题册中的详细信息都填写完毕,考试结束后都不会再有多余时间填写以上信息。

以上是关于2020年宁夏ACCA考试准考证打印相关内容,小伙伴们都清楚了吗?如果想要了解更多关于ACCA 的资讯,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

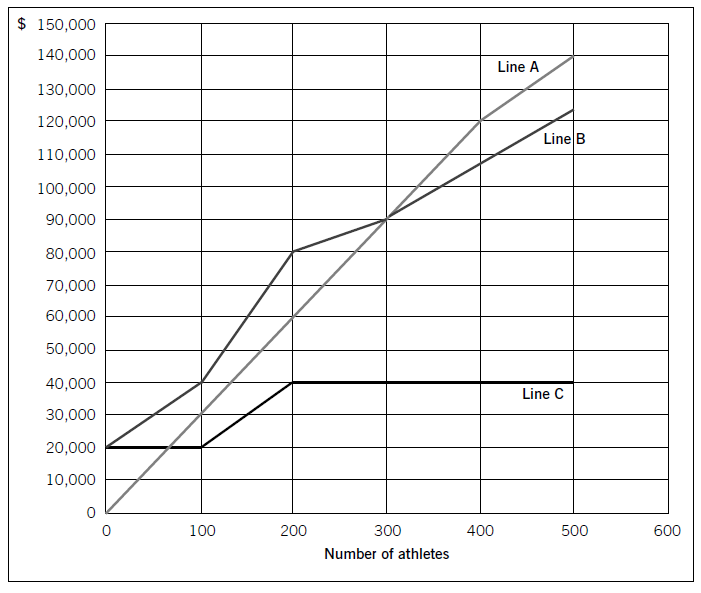

Swim Co offers training courses to athletes and has prepared the following breakeven chart:

Required:

(a) State the breakeven sales revenue for Swim Co and estimate, to the nearest $10,000, the company’s profit if 500 athletes attend a training course. (2 marks)

(b) Using the chart above, explain the cost and revenue structure of the company. (8 marks)

(a)ThebreakevensalesrevenueforSwimCois$90,000.Thecompany’sprofit,tothenearest$10,000,if500athletesattendthecourseis$20,000($140,000–$120,000).(Fromthegraph,itisclearthatthepreciseamountwillbenearer$17,000,i.e.$140,000–approximately$123,000.)(b)CoststructureFromthechart,itisclearthatLineCrepresentsfixedcosts,LineBrepresentstotalcostsandLineArepresentstotalrevenue.LineCshowsthatinitially,fixedcostsare$20,000evenifnoathletesattendthecourse.Thisleveloffixedcostsremainsthesameif100athletesattendbutoncethenumberofattendeesincreasesabovethislevel,fixedcostsincreaseto$40,000.LineBrepresentstotalcosts.If100athletesattend,totalcostsare$40,000($400perathlete).Since$20,000ofthisrelatestofixedcosts,thevariablecostperathletemustbe$200.Whenfixedcostsstepupbeyondthispointatthelevelof200athletes,totalcostsobviouslyincreaseaswellandLineBconsequentlygetsmuchsteeper.However,sincetherearenow200athletestoabsorbthefixedcosts,thecostperathleteremainsthesameat$400perathlete($80,000/200),eventhoughfixedcostshavedoubled.If300athletesattendthecourse,totalcostperathletebecomes$300each($90,000/300).Sincefixedcostsaccountfor$40,000ofthistotalcost,variablecoststotal$50,000,i.e.$166·67perathlete.So,economiesofscaleariseatthislevel,asdemonstratedbythefactthatLineBbecomesflatter.At400athletes,thegradientofthetotalcostslineisunchangedfrom300athleteswhichindicatesthatthevariablecostshaveremainedthesame.Thereisnofurtherchangeat500athletes;fixedandvariablecostsremainsteady.RevenuestructureAsregardstherevenuestructure,itcanbeseenfromLineAthatfor100–400athletesthepriceremainsthesameat$300perathlete.However,if500athletesattend,thepricehasbeenreducedasthetotalrevenuelinebecomesflatter.$140,000/500meansthatthepricehasgonedownto$280perathlete.Thiswasobviouslynecessarytoincreasethenumberofattendeesandatthispoint,profitismaximised.1

(b) Describe the content of a reference. (5 marks)

Part (b)

A simple standard form. to be completed by the referee is acceptable to provide all the required details. A standard form. should

ask about the existing job title, the main duties and responsibilities of the current job, period of employment, present pay or salary

and the attendance record.

(b) State the immediate tax implications of the proposed gift of the share portfolio to Avril and identify an

alternative strategy that would achieve Crusoe’s objectives whilst avoiding a possible tax liability in the

future. State any deadline(s) in connection with your proposed strategy. (5 marks)

(b) Gift of the share portfolio to Avril

Inheritance tax

The gift would be a potentially exempt transfer at market value. No inheritance tax would be due at the time of the gift.

Capital gains tax

The gift would be a disposal by Crusoe deemed to be made at market value for the purposes of capital gains tax. No gain

would arise as the deemed proceeds will equal Crusoe’s base cost of probate value.

Stamp duty

There is no stamp duty on a gift of shares for no consideration.

Strategy to avoid a possible tax liability in the future

Crusoe should enter into a deed of variation directing the administrators to transfer the shares to Avril rather than to him. This

will not be regarded as a gift by Crusoe. Instead, provided the deed states that it is intended to be effective for inheritance tax

purposes, it will be as if Noland had left the shares to Avril in a will.

This strategy is more tax efficient than Crusoe gifting the shares to Avril as such a gift would be a potentially exempt transfer

and inheritance tax may be due if Crusoe were to die within seven years.

The deed of variation must be entered into by 1 October 2009, i.e. within two years of the date of Noland’s death.

4 The International Accounting Standards Board (IASB) has begun a joint project to revisit its conceptual framework for

financial accounting and reporting. The goals of the project are to build on the existing frameworks and converge them

into a common framework.

Required:

(a) Discuss why there is a need to develop an agreed international conceptual framework and the extent to which

an agreed international conceptual framework can be used to resolve practical accounting issues.

(13 marks)

(a) The IASB wish their standards to be ‘principles-based’ and in order for this to be the case, the standards must be based on

fundamental concepts. These concepts need to constitute a framework which is sound, comprehensive and internally

consistent. Without agreement on a framework, standard setting is based upon the personal conceptual frameworks of the

individual standard setters which may change as the membership of the body changes and results in standards that are not

consistent with each other. Such a framework is designed not only to assist standard setters, but also preparers of financial

statements, auditors and users.

A common goal of the IASB is to converge their standards with national standard setters. The IASB will encounter difficulties

converging their standards if decisions are based on different frameworks. The IASB has been pursuing a number of projects

that are aimed at achieving short term convergence on certain issues with national standard setters as well as major projects

with them. Convergence will be difficult if there is no consistency in the underlying framework being used.

Frameworks differ in their authoritative status. The IASB’s Framework requires management to expressly consider the

Framework if no standard or interpretation specifically applies or deals with a similar and related issue. However, certain

frameworks have a lower standing. For example, entities are not required to consider the concepts embodied in certain

national frameworks in preparing financial statements. Thus the development of an agreed framework would eliminate

differences in the authoritative standing of conceptual frameworks and lead to greater consistency in financial statements

internationally.

The existing concepts within most frameworks are quite similar. However, these concepts need revising to reflect changes in

markets, business practices and the economic environment since the concepts were developed. The existing frameworks need

developing to reflect these changes and to fill gaps in the frameworks. For example, the IASB’s Framework does not contain

a definition of the reporting entity. An agreed international framework could deal with this problem, especially if priority was

given to the issues likely to give short-term standard setting benefits.

Many standard setting bodies attempted initially to resolve accounting and reporting problems by developing accounting

standards without an accepted theoretical frame. of reference. The result has been inconsistency in the development of

standards both nationally and internationally. The frameworks were developed when several of their current standards were

in existence. In the absence of an agreed conceptual framework the same theoretical issues are revisited on several occasions

by standard setters. The result is inconsistencies and incompatible concepts. Examples of this are substance over form. and

matching versus prudence. Some standard setters such as the IASB permit two methods of accounting for the same set of

circumstances. An example is the accounting for joint ventures where the equity method and proportionate consolidation are

allowed.

Additionally there have been differences in the way that standard setters have practically used the principles in the framework.

Some national standard setters have produced a large number of highly detailed accounting rules with less emphasis on

general principles. A robust framework might reduce the need for detailed rules although some companies operate in a

different legal and statutory context than other entities. It is important that a framework must result in standards that account

appropriately for actual business practice.

An agreed framework will not solve all accounting issues, nor will it obviate the need for judgement to be exercised in resolving

accounting issues. It can provide a framework within which those judgements can be made.

A framework provides standard setters with both a foundation for setting standards, and concepts to use as tools for resolving

accounting and reporting issues. A framework provides a basic reasoning on which to consider the merits of alternatives. It

does not provide all the answers, but narrows the range of alternatives to be considered by eliminating some that are

inconsistent with it. It, thereby, contributes to greater efficiency in the standard setting process by avoiding the necessity of

having to redebate fundamental issues and facilitates any debate about specific technical issues. A framework should also

reduce political pressures in making accounting judgements. The use of a framework reduces the influence of personal biases

in accounting decisions.

However, concepts statements are by their nature very general and theoretical in their wording, which leads to alternative

conclusions being drawn. Whilst individual standards should be consistent with the Framework, in the absence of a specific

standard, it does not follow that concepts will provide practical solutions. IAS8 ‘Accounting Policies, Changes in Accounting

Estimates and Errors’ sets out a hierarchy of authoritative guidance that should be considered in the absence of a standard.

In this case, management can use its judgement in developing and applying an accounting policy, albeit by considering the

IASB framework, but can also use accounting standards issued by other bodies. Thus an international framework may nottotally provide solutions to practical accounting problems.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-09-04

- 2020-09-04

- 2020-01-10

- 2021-04-17

- 2020-01-10

- 2020-01-09

- 2020-01-09

- 2020-01-02

- 2019-12-29

- 2020-01-08

- 2020-09-04

- 2020-01-10

- 2020-01-08

- 2020-08-14

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-08-14

- 2020-01-10

- 2020-01-10

- 2020-08-14

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-08

- 2020-01-10