香港cpa和acca互免吗?免几门呢?

发布时间:2021-05-09

香港cpa和acca互免吗?免几门呢?

最佳答案

目前不互免。ACCA与HKICPA自05年协议到期加之HKICPA改革后,二者已经不再互认了,在此之前,ACCA只要加2门考试就可以成为HKICPA。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

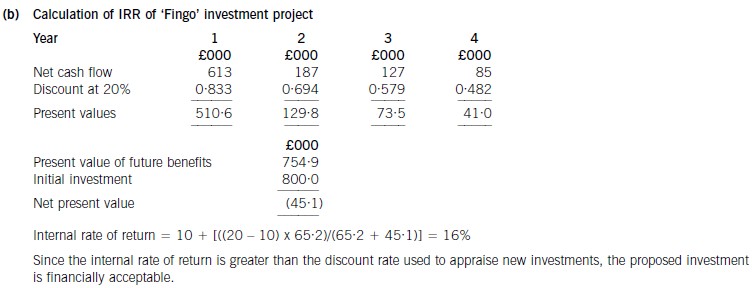

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

(iii) The effect of the restructuring on the group’s ability to recover directly and non-directly attributable input

tax. (6 marks)

You are required to prepare calculations in respect of part (ii) only of this part of this question.

Note: – You should assume that the corporation tax rates and allowances for the financial year 2006 apply

throughout this question.

(iii) The effect of the restructuring on the group’s ability to recover its input tax

Prior to the restructuring

Rapier Ltd and Switch Ltd make wholly standard rated supplies and are in a position to recover all of their input tax

other than that which is specifically blocked. Dirk Ltd and Flick Ltd are unable to register for VAT as they do not make

taxable supplies. Accordingly, they cannot recover any of their input tax.

Following the restructuring

Rapier Ltd will be carrying on four separate trades, two of which involve the making of exempt supplies such that it will

be a partially exempt trader. Its recoverable input tax will be calculated as follows.

– Input tax in respect of inputs wholly attributable to taxable supplies is recoverable.

– Input tax in respect of inputs wholly attributable to exempt supplies cannot be recovered (subject to the de minimis

limits below).

– A proportion of the company’s residual input tax, i.e. input tax in respect of inputs which cannot be directly

attributed to particular supplies, is recoverable. The proportion is taxable supplies (VAT exclusive) divided by total

supplies (VAT exclusive). This proportion is rounded up to the nearest whole percentage where total residual input

tax is no more than £400,000 per quarter.

The balance of the residual input tax cannot be recovered (subject to the de minimis limits below).

– If the de minimis limits are satisfied, Rapier Ltd will be able to recover all of its input tax (other than that which is

specifically blocked) including that which relates to exempt supplies. The de minimis limits are satisfied where the

irrecoverable input tax:

– is less than or equal to £625 per month on average; and

– is less than or equal to 50% of total input tax.

The impact of the restructuring on the group’s ability to recover its input tax will depend on the level of supplies made

by the different businesses and the amounts of input tax involved. The restructuring could result in the group being able

to recover all of its input tax (if the de minimis limits are satisfied). Alternatively the amount of irrecoverable input tax

may be more or less than the amounts which cannot be recovered by Dirk Ltd and Flick Ltd under the existing group

structure.

(b) The CEO of Oceania National Airways (ONA) has already strongly rejected the re-positioning of ONA as a ‘no

frills’ low-cost budget airline.

(i) Explain the key features of a ‘no frills’ low-cost strategy. (4 marks)

(b) (i) A ‘no frills’ strategy combines low price with low perceived benefits of the product or service. It is primarily associated

with commodity goods and services where customers do not discern or value differences in the products or services

offered by competing suppliers. In some circumstances the customer cannot afford the better quality product or service

of a particular supplier. ‘No frills’ strategies are particularly attractive in price-sensitive markets. Within the airline sector,

the term ‘no frills’ is associated with a low cost pricing strategy. In Europe, at the time of writing, easyJet and Ryanair

are the two dominant ‘no frills’ low-cost budget airlines. In Asia, AirAsia and Tiger Airways are examples of ‘no frills’ lowcost

budget carriers. ‘No frills’ strategies usually exist in markets where buyers have high power coupled with low

switching costs and so there is little brand loyalty. It is also prevalent in markets where there are few providers with

similar market shares. As a result of this the cost structure of each provider is similar and new product and service

initiatives are quickly copied. Finally a ‘no frills’ strategy might be pursued by a company entering the market, using thisas a strategy to gain market share before progressing to alternative strategies.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-06-03

- 2021-05-08

- 2021-03-12

- 2021-01-01

- 2021-06-10

- 2021-01-03

- 2021-03-11

- 2021-03-11

- 2021-05-22

- 2021-03-11

- 2021-04-22

- 2021-01-04

- 2021-04-23

- 2021-06-02

- 2021-06-15

- 2021-04-25

- 2021-06-08

- 2021-03-10

- 2021-03-11

- 2021-04-24

- 2021-03-12

- 2021-06-11

- 2021-01-01

- 2021-04-14

- 2021-03-12

- 2021-03-12

- 2021-03-11

- 2021-01-02

- 2021-03-12

- 2021-04-15