ACCA考试F6《税务》每日一练(2019-01-04)

发布时间:2019-01-04

Question:There are a number of tests that HMRC use to determine whether an individual is trading. These tests are known as the 'Badges of Trade'.

Which 2 of the following indicate someone

is trading?

A.Ownership of the asset for a long time

prior to sale.

B.A large number of similar transactions.

C.Work done to an asset prior to sale.

D.Existence of a profit.

The correct answers are: A large number of

similar transactions; Work done to an asset prior to sale.

【解析】Where an individual undertakes a large

number of similar transactions this may indicate there is a trade whereas a one

off transaction is more likely to be treated as capital in nature.

Where work is done to an asset prior to

sale (i.e. to make it more marketable) this will usually indicate there is a

trade.

The existence of a profit is not sufficient

to indicate trading. It is the motive to make a profit that points to trading.

Ownership of an asset for a long time prior

to sale will usually indicate an investment rather than a trade.

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

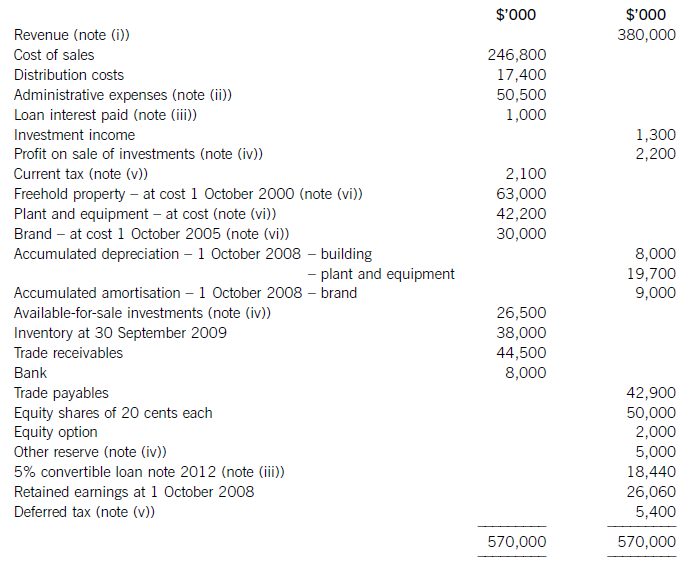

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

(c) (i) Explain the inheritance tax (IHT) implications and benefits of Alvaro Pelorus varying the terms of his

father’s will such that part of Ray Pelorus’s estate is left to Vito and Sophie. State the date by which a

deed of variation would need to be made in order for it to be valid; (3 marks)

(c) (i) Variation of Ray’s will

The variation by Alvaro of Ray’s will, such that assets are left to Vito and Sophie, will not be regarded as a gift by Alvaro.

Instead, provided the deed states that it is intended to be effective for IHT purposes, it will be as if Ray had left the assets

to the children in his will.

This strategy, known as skipping a generation, will have no effect on the IHT due on Ray’s death but will reduce the

assets owned by Alvaro and thus his potential UK IHT liability. A deed of variation is more tax efficient than Alvaro

making gifts to the children as such gifts would be PETs and IHT may be due if Alvaro were to die within seven years.

The deed of variation must be entered into by 31 January 2009, i.e. within two years of the date of Ray’s death.

(c) Wader is reviewing the accounting treatment of its buildings. The company uses the ‘revaluation model’ for its

buildings. The buildings had originally cost $10 million on 1 June 2005 and had a useful economic life of

20 years. They are being depreciated on a straight line basis to a nil residual value. The buildings were revalued

downwards on 31 May 2006 to $8 million which was the buildings’ recoverable amount. At 31 May 2007 the

value of the buildings had risen to $11 million which is to be included in the financial statements. The company

is unsure how to treat the above events. (7 marks)

Required:

Discuss the accounting treatments of the above items in the financial statements for the year ended 31 May

2007.

Note: a discount rate of 5% should be used where necessary. Candidates should show suitable calculations where

necessary.

(b) Advise Sergio on the appropriateness of investing in a domestic rental property in view of his personal

circumstances and recommend suitable alternative investments giving reasons for your advice. (4 marks)

(b) Sergio’s investments

Sergio aims to leave a substantial asset to his family on his death. Accordingly, in view of his age, he is right to be considering

investing in an asset whose value is unlikely to fall suddenly, such as a domestic rental property. However, it must be

recognised that although the value of land and buildings can usually be relied on to increase over a long period of time, its

value may fall over a shorter period. The only investments that cannot fall in value are cash deposits, although they do, of

course, fall in real terms due to the effects of inflation.

Sergio should consider whether or not he wishes to increase his annual income. The return on capital invested in a domestic

rental property is unlikely to be very high due to the recent increases in property values in the UK. Also, there are likely to be

periods when the house is unoccupied during which no income will be generated. If it is important to Sergio to generate

additional income he should consider other low-risk investments with a more reliable and higher rate of return, for example,

gilt edged stocks, unit trusts and cash deposits.

Sergio must also decide whether it is important to him to be able to access capital quickly, as it is usually not possible to

realise the capital invested in land and buildings at short notice. If this is important, Sergio should consider holding some of

his capital in cash deposits or other liquid investments, eg unit trusts.

Sergio could invest up to £7,000 each year in an individual savings account (ISA). A maximum of £3,000 can be held as a

cash deposit with the balance invested in quoted shares. The income and gains arising on the funds invested would be

exempt from both income tax and capital gains tax. This would be a relatively low-risk investment and would also be

accessible quickly if required.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2019-01-04

- 2019-03-16

- 2019-03-14

- 2019-01-04

- 2019-03-09

- 2019-03-10

- 2019-03-16

- 2019-03-10

- 2019-01-04

- 2019-03-09

- 2019-03-14

- 2019-01-04

- 2019-01-04

- 2019-01-04

- 2019-03-10

- 2019-03-09

- 2019-03-14

- 2019-03-16