ACCA F2知识点:成本分类

发布时间:2021-02-14

很多考生对于ACCA考试F2的知识点不是很了解,接下来就和51题库考试学习网一起去了解下吧!

Cost classification是acca F2的基础章节,对于刚刚接触F2的学员来说至关重要,它是成本会计和管理会计的开篇,涉及诸多会计理念,有易混淆的知识点和图形,也是F2的考试重点,,今年sampling paper新题型中就有体现。

Cost Classification 的方法有很多,如果按部门职能(function)分类,可以分为生产成本和非生产成本(Production cost & Non-production cost);按本质分类,可以分为原料成本,人工成本和费用(Material cost, labor cost & Expense);根据成本是否需要分摊,又可以分为直接成本和间接成本(Direct cost & Indirect cost);按成本与产品数量的关系,可以分为固定成本和变动成本(Fixed cost & Variable cost)。

acca F2知识点:Material cost, labor cost & Expense

原料成本(Material cost)包括原料的购买成本,运输成本等。

人工成本(labor cost)是生产车间工人的工资,不包括办公室管理人员的工资。

费用(Expense)是除了原料和人工成本意外的生产成本,例如水电费,租金。

acca F2知识点:Production cost & Non-production cost

生产成本是发生在工厂车间的成本,例如Material cost, labor cost & Expense,是生产过程发生的成本。而非生产成本则发生在工厂车间以外的成本,例如办公室管理人员的工资,办公室的水电费,市场推广费用,利息费用,保险费用等。

如果一台设备(e.g.空调,电脑)放在车间,供工人使用,它的折旧费(depreciation)就是Production cost,如果把它移到财务部,它的折旧费就变成了Non-production cost。

acca F2知识点:Direct cost & Indirect cost

直接成本和间接成本是F2的核心概念,Direct cost是可以直接追溯到某类或某个产品身上,不需要分配到几种产品身上的成本,例如material cost。

间接成本(也叫overhead)是需要分配到不同产品身上的成本,比如水电费(只有一个水表或电表)需要分配到不同的产品;一个工人负责几种产品的生产,那么他的工资也是indirect cost。

acca F2知识点:Fixed cost & Variable cost

固定成本不随产量的变化而变化,即使产量为零,它的大小也不变,比如房屋租金,保安人员的基本工资。

变动成本是随着产量的增加而增加,产量为零,它为零,典型的例子是material cost,车间工人的计时工资和计件工资。

Stepped cost是一个特殊的例子,指在某一个特定的产量水平内,总成本是固定的,但是一旦超过这个产量,总成本就会跳到另一个固定水平。比如生活中的手机短信套餐,0-100条是固定的10元,如果你要使用101-200条,这需要付15元的套餐。

acca F2知识点:Avoidable cost & Unavoidable cost

如果不进行生产经营活动,有些成本是可以避免的,例如水电费,原料成本,人工费。

但是有些成本是不可以避免的,例如无法取消租赁合同的房屋租金。

acca F2知识点:Relevant cost & Irrelevant cost

相关成本是与决策(decision-making)相关的未来成本,例如评估某项投资是否可行,我们需要考虑利息成本,人工成本,机会成本等。不相关成本主要是过去已发生的成本而且无法补救(sunk cost)和Unavoidable cost,它与某项决策无关, 与某项经营活动无关。

acca F2知识点:Controllable cost & Uncontrollable cost

可控成本是在部门经理的职权或能力范围内进行增加或减少的成本,例如原材料的采购成本,人工成本,水电费等。不可控成本则是部门经理无法控制增减的成本,例如由公司总部摊派下来的费用,例如总经理的工资,总公司统一采购并分配下来的设备,报刊等。

以上就是51题库考试学习网给大家分享的全部信息,希望能够帮到大家!后续请持续关注51题库考试学习网,51题库考试学习网将会为大家持续更新最新、最热的考试资讯!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

Cherry Blossom Co (Cherry) manufactures custom made furniture and its year end is 30 April. The company purchases its raw materials from a wide range of suppliers. Below is a description of Cherry’s purchasing system.

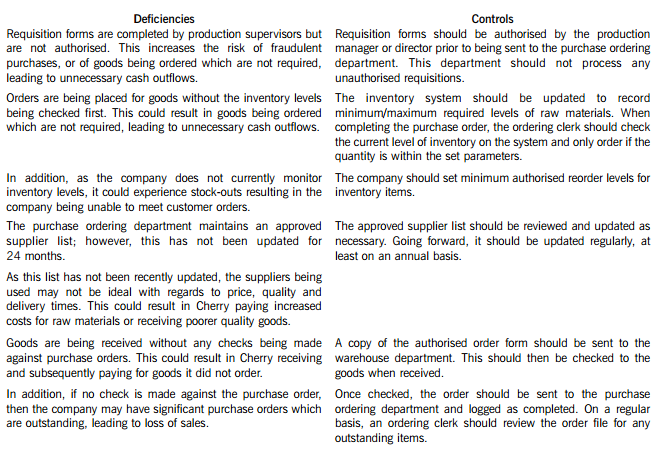

When production supervisors require raw materials, they complete a requisition form. and this is submitted to the purchase ordering department. Requisition forms do not require authorisation and no reference is made to the current inventory levels of the materials being requested. Staff in the purchase ordering department use the requisitions to raise sequentially numbered purchase orders based on the approved suppliers list, which was last updated 24 months ago. The purchasing director authorises the orders prior to these being sent to the suppliers.

When the goods are received, the warehouse department verifies the quantity to the suppliers despatch note and checks that the quality of the goods received are satisfactory. They complete a sequentially numbered goods received note (GRN) and send a copy of the GRN to the finance department.

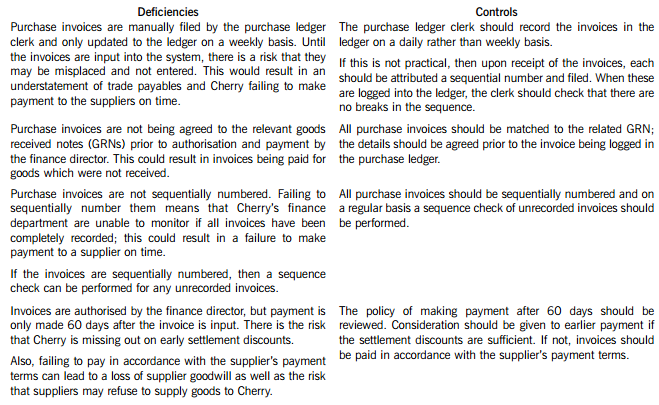

Purchase invoices are sent directly to the purchase ledger clerk, who stores them in a manual file until the end of each week. He then inputs them into the purchase ledger using batch controls and gives each invoice a unique number based on the supplier code. The invoices are reviewed and authorised for payment by the finance director, but the actual payment is only made 60 days after the invoice is input into the system.

Required:

In respect of the purchasing system of Cherry Blossom Co:

(i) Identify and explain FIVE deficiencies; and

(ii) Recommend a control to address each of these deficiencies.

Note: The total marks will be split equally between each part.

Cherry Blossom Co’s (Cherry) purchasing system deficiencies and controls

(c) Critically discuss the likely effectiveness of standard questionnaires sent to other auditors as a means of

obtaining information required. (5 marks)

(c) Likely effectiveness of standard questionnaires

Most group auditors obtain information from other auditors through questionnaires in the form. of yes/no requests and/or

detailed questions.

Standard yes/no questionnaires are widely used because, for example, they:

■ can be completed more quickly by someone already familiar with their form. and content;

■ facilitate summarisation of responses from other auditors by the group auditor.

However, a standard questionnaire may be less effective than a ‘bespoke’ one in that it is likely to ask unnecessary questions.

This may result in the other auditor finding the questions to be ‘not applicable’ and regarding completion of the questionnaire

as a form-filling exercise, rather than providing the group auditor with essential information.

Nevertheless, there is a danger that questionnaires that are not based on some standard form. may overlook or otherwise omit

some significant issues and therefore fail to alert the group auditor to a potential risk area.

Thus a balance needs to be struck between requesting enough information for the group auditor to form. their own view

without requesting meaningless ‘box-ticking’ questions that do not deal with the issues. Questionnaires that get longer and

longer are likely to lose their effectiveness especially if they are to be used in different locations/jurisdictions.

Questionnaires will cover a broad range of topics such as qualifications, competence/experience, compliance with ISAs (and

ISQC 1), audit findings, subsequent events, etc. Therefore there will be a tendency to length (completeness) rather than

quality (relevance).

In conclusion, questionnaires should:

■ avoid over-use of yes/no questions which may encourage laxity;

■ not ask for information that has already been provided or which is unnecessary; and

■ be adequately tailored.

(b) GHG has always used local labour to build and subsequently operate hotels. The directors of GHG are again

considering employing a local workforce not only to build the hotel but also to operate it on a daily basis.

Required:

Explain TWO ways in which the possibility of cultural differences might impact on the performance of a local

workforce in building and operating a hotel in Tomorrowland. (6 marks)

(b) The directors of GHG should be mindful that the effectiveness of a locally employed workforce within Tomorrowland will be

influenced by a number of factors including the following:

The availability of local skills

If Tomorrowland is a lower wage economy it is quite conceivable that a sufficient number of employees possessing the

requisite skills to undertake the construction of a large hotel cannot be found. If there are insufficient local resources then this

would necessitate the training of employees in all aspects of building construction. This will incur significant costs and time

and needs to be reflected in any proposed timetable for construction of the hotel. As far as the operation of the hotel is

concerned then staff will have to be recruited and trained which will again give rise to significant start-up costs. However, this

should not present the directors of GHG with such a major problem as that of training construction staff. Indeed, it is highly

probable that GHG would use its own staff in order to train new recruits.

Attitudes to work

The prevailing culture within Tomorrowland will have a profound impact on attitudes to work of its population. Attitudes to

hours of work, timekeeping and absenteeism vary from culture to culture. For example, as regards hours of work in the

construction industry in countries which experience very hot climates, work is often suspended during the hottest part of each

day and recommenced several hours later when temperatures are much cooler. The directors of GHG need to recognise that

climatic conditions not only affect the design of a building but also its construction.

A potentially sensitive issue within regarding the use of local labour in the construction of the hotel lies in the fact that national

holidays and especially religious holidays need to be observed and taken into consideration in any proposed timetable for

construction of the hotel. As regards the operation of a hotel then consideration needs to be given to the different cultures

from which the guests come. For example, this will require a detailed consideration of menus to be offered. However, it might

well be the case that the local population might be unwilling to prepare dishes comprising ingredients which are unacceptable

to their culture due to, for example, religious beliefs.

(Note: other relevant factors would be acceptable.)

(b) Draft a report as at today’s date advising Cutlass Inc on its proposed activities. The report should cover the

following issues:

(i) The rate at which the profits of Cutlass Inc will be taxed. This section of the report should explain:

– the company’s residency position and what Ben and Amy would have to do in order for the company

to be regarded as resident in the UK under the double tax treaty;

– the meaning of the term ‘permanent establishment’ and the implications of Cutlass Inc having a

permanent establishment in Sharpenia;

– the rate at which the profits of Cutlass Inc will be taxed on the assumption that it is resident in the

UK under the double tax treaty and either does or does not have a permanent establishment in

Sharpenia. (9 marks)

(b) Report to the management of Razor Ltd

To The management of Razor Ltd

From Tax advisers

Date 6 June 2007

Subject The proposed activities of Cutlass Inc

(i) Rate of tax on profits of Cutlass Inc

When considering the manner in which the profits of Cutlass Inc will be taxed it must be recognised that the system of

corporation tax in Sharpenia is the same as that in the UK.

The profits of Cutlass Inc will be subject to corporation tax in the country in which it is resident or where it has a

permanent establishment. It is desirable for the profits of Cutlass Inc to be taxed in the UK rather than in Sharpenia as

the rate of corporation tax in the UK on annual profits of £120,000 will be 19% whereas in Sharpenia the rate of tax

would be 38%.

Residency of Cutlass Inc

Cutlass Inc will be resident in Sharpenia, because it is incorporated there. However, it will also be resident in the UK if

it is centrally managed and controlled from the UK. For this to be the case, Amy and Ben should hold the company’s

board meetings in the UK.

Under the double tax treaty between the UK and Sharpenia, a company resident in both countries is treated as being

resident in the country where it is effectively managed and controlled. For Cutlass Inc to be treated as UK resident under

the treaty, Amy and Ben would need to ensure that all key management and commercial decisions are made in the UK

and not in Sharpenia.

Permanent establishment

A permanent establishment is a fixed place of business, including an office, factory or workshop, through which the

business of an enterprise is carried on. A permanent establishment will also exist in a country if contracts in the

company’s name are habitually concluded there.

The trading profits of Cutlass Inc will be taxable in Sharpenia if they are derived from a permanent establishment in

Sharpenia even if it can be established that Cutlass Inc is UK resident under the double tax treaty.

Double taxation

If Cutlass Inc is UK resident but has a permanent establishment in Sharpenia, its trading profits will be subject to

corporation tax in both the UK and Sharpenia with double tax relief available in the UK. The double tax relief will be the

lower of the UK tax and the Sharpenian tax on the trading profits. Accordingly, as the rate of tax is higher in Sharpenia

than it is in the UK, there will be no UK tax to pay on the company’s trading profits and the rate of tax on the profits

would be the rate in Sharpenia, i.e. 38%.

If Cutlass Inc is UK resident and does not have a permanent establishment in Sharpenia, its profits will be taxable in

the UK at the rate of 19% and not in Sharpenia.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-02-14

- 2020-10-12

- 2021-02-13

- 2021-02-14

- 2020-10-12

- 2020-09-05

- 2020-10-12

- 2021-02-13

- 2021-02-13

- 2020-10-12

- 2020-09-05

- 2020-09-05

- 2021-02-13

- 2019-03-17

- 2020-10-12

- 2020-10-12

- 2020-10-12

- 2020-10-12

- 2020-10-12

- 2021-02-13

- 2020-09-05

- 2020-10-12

- 2020-10-12

- 2020-10-12

- 2021-02-13

- 2021-02-13

- 2020-10-12

- 2021-02-14

- 2020-10-12

- 2021-02-13