ACCA考试F1考试试题练习及答案(2)

发布时间:2020-08-16

备考ACCA考试,好的学习方法很重要,但是练习也很重要,下面51题库考试学习网就给大家分享一些,ACCA考试F1考试试题,备考的小伙伴赶紧来练练手吧。

1. When analysing

the current situation in a business, a consultant will review the general

environment surrounding it. Which of the following would not be included in

this analysis?

A New legislation coming into effect in six

months\' time

B Activities of overseas competitors

C Interest rates

D Independence of the non-executive

directors

答案:D

2. How might the

purchasing manager work closely with the accounting function?

A Processing expense claims

B Seeking prompt payment from customers

C Managing the prompt payment of suppliers

D Recording staff salaries

答案:C

3.Many organisations are described as

bureaucratic. When the team, was first coined, bureaucracy was

regarded as being highly efficient and

there are still cases where a bureaucratic approach is appropriate. However,

bureaucracy has some undesirable features. Can you identify three from the list

below?

(i) It relies on the expertise of its

members – not through standardised skills but by the importance

of the mix of skills

(ii) Committees and reports slow down the

decision-making process

(iii) Innovation is difficult

(iv) Over-prescriptive rules produce a

simplistic approach to problems

A (i), (ii) and (iii)

B (i), (iii) and (iv)

C (ii), (iii) and (iv)

D (i), (ii) and (iv)

答案:C

4. Mr Warner, your

department manager, is weighing up the benefits and disadvantages of

off-the-shelf

packages that have been customised so that

they fit the organisation\'s specific requirements. From his

list below can you identify two

disadvantages of customisation?

(i) It may delay delivery of the software

(ii) The user is dependent on the supplier

for maintenance of the package

(iii) The company will not be able to buy

\'add-ons\' to the basic package

(iv) It may introduce bugs that do not

exist in the standard version

A (i) and (ii)

B (i) and (iii)

C (i) and (iv)

D (ii) and (iii)

答案:C

5.In the short run, firms will continue to

supply customers provided that they cover

A Fixed costs

B Marginal costs

C Variable costs

答案:C

以上是本次51题库考试学习网分享给大家的ACCA考试试题,备考的小伙伴抓紧时间练习一下吧。欲了解更多关于ACCA考试的试题,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Briefly describe the way in which a ‘person specification’ differs from a ‘job description’. (3 marks)

Part (b):

The difference between a person specification and a job description is that a person specification sets out the qualities of an ideal

candidate whereas a job description defines the duties and responsibilities of the job.

(ii) the recent financial performance of Merton plc from a shareholder perspective. Clearly identify any

issues that you consider should be brought to the attention of the ordinary shareholders. (15 marks)

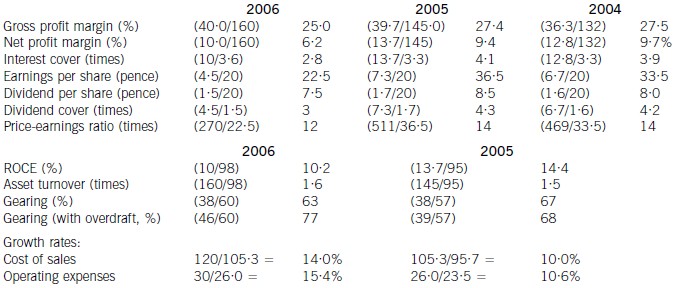

(ii) Discussion of financial performance

It is clear that 2006 has been a difficult year for Merton plc. There are very few areas of interest to shareholders where

anything positive can be found to say.

Profitability

Return on capital employed has declined from 14·4% in 2005, which compared favourably with the sector average of

12%, to 10·2% in 2006. Since asset turnover has improved from 1·5 to 1·6 in the same period, the cause of the decline

is falling profitability. Gross profit margin has fallen each year from 27·5% in 2004 to 25% in 2006, equal to the sector

average, despite an overall increase in turnover during the period of 10% per year. Merton plc has been unable to keep

cost of sales increases (14% in 2006 and 10% in 2005) below the increases in turnover. Net profit margin has declined

over the same period from 9·7% to 6·2%, compared to the sector average of 8%, because of substantial increases in

operating expenses (15·4% in 2006 and 10·6% in 2005). There is a pressing need here for Merton plc to bring cost

of sales and operating costs under control in order to improve profitability.

Gearing and financial risk

Gearing as measured by debt/equity has fallen from 67% (2005) to 63% (2006) because of an increase in

shareholders’ funds through retained profits. Over the same period the overdraft has increased from £1m to £8m and

cash balances have fallen from £16m to £1m. This is a net movement of £22m. If the overdraft is included, gearing

has increased to 77% rather than falling to 63%.

None of these gearing levels compare favourably with the average gearing for the sector of 50%. If we consider the large

increase in the overdraft, financial risk has clearly increased during the period. This is also evidenced by the decline in

interest cover from 4·1 (2005) to 2·8 (2006) as operating profit has fallen and interest paid has increased. In each year

interest cover has been below the sector average of eight and the current level of 2·8 is dangerously low.

Share price

As the return required by equity investors increases with increasing financial risk, continued increases in the overdraft

will exert downward pressure on the company’s share price and further reductions may be expected.

Investor ratios

Earnings per share, dividend per share and dividend cover have all declined from 2005 to 2006. The cut in the dividend

per share from 8·5 pence per share to 7·5 pence per share is especially worrying. Although in its announcement the

company claimed that dividend growth and share price growth was expected, it could have chosen to maintain the

dividend, if it felt that the current poor performance was only temporary. By cutting the dividend it could be signalling

that it expects the poor performance to continue. Shareholders have no guarantee as to the level of future dividends.

This view could be shared by the market, which might explain why the price-earnings ratio has fallen from 14 times to

12 times.

Financing strategy

Merton plc has experienced an increase in fixed assets over the last period of £10m and an increase in stocks and

debtors of £21m. These increases have been financed by a decline in cash (£15m), an increase in the overdraft (£7m)

and an increase in trade credit (£6m). The company is following an aggressive strategy of financing long-term

investment from short-term sources. This is very risky, since if the overdraft needed to be repaid, the company would

have great difficulty in raising the funds required.

A further financing issue relates to redemption of the existing debentures. The 10% debentures are due to be redeemed

in two years’ time and Merton plc will need to find £13m in order to do this. It does not appear that this sum can be

raised internally. While it is possible that refinancing with debt paying a lower rate of interest may be possible, the low

level of interest cover may cause concern to potential providers of debt finance, resulting in a higher rate of interest. The

Finance Director of Merton plc needs to consider the redemption problem now, as thought is currently being given to

raising a substantial amount of new equity finance. This financing choice may not be available again in the near future,

forcing the company to look to debt finance as a way of effecting redemption.

Overtrading

The evidence produced by the financial analysis above is that Merton plc is showing some symptoms of overtrading

(undercapitalisation). The board are suggesting a rights issue as a way of financing an expansion of business, but it is

possible that a rights issue will be needed to deal with the overtrading problem. This is a further financing issue requiring

consideration in addition to the redemption of debentures mentioned earlier.

Conclusion

Ordinary shareholders need to be aware of the following issues.

1. Profitability has fallen over the last year due to poor cost control

2. A substantial increase in the overdraft over the last year has caused gearing to increase

3. It is possible that the share price will continue to fall

4. The dividend cut may warn of continuing poor performance in the future

5. A total of £13m of debentures need redeeming in two year’s time

6. A large amount of new finance is needed for working capital and debenture redemption

Appendix: Analysis of key ratios and financial information

(b) State, with reasons, the principal additional information that should be made available for your review of

Robson Construction Co. (8 marks)

(b) Principal additional information

■ Any service contracts with the directors or other members of the management team (e.g. the quantity surveyor). These

may contain ‘exit’ or other settlement terms in the event that their services are no longer required after a takeover/buyout.

■ Prior period financial statements (to 30 June 2005) disclosing significant accounting policies and the key assumptions

concerning the future (and other key sources of estimation uncertainty) that have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities in the year to 30 June 2006.

For example, concerning:

– the outcome on the Sarwar dispute;

– estimates for guarantees/claims for rectification;

– assumptions made in estimating costs to completion (e.g. for increases in costs of materials or labour).

Tutorial note: Under IAS 1 ‘Presentation of Financial Statements’ the judgements made by management that have the

most significant effect on amounts recognised in financial statements (other than those involving estimations) should

also be disclosed.

■ The most recent management accounts and cash flow forecasts to assess the quality of management information being

used for decision-making and control. In particular, in providing Robson with the means of keeping its cash flows within

its overdraft limit.

Tutorial note: Note that Prescott has substantial cash resources. Therefore Robson’s lack of finance might be a reason

why its management are interested in selling the business.

■ A copy of the signed bank agreement for the overdraft facility (and any other agreements with finance providers). Any

breaches in debt covenants might result in penalties of contingent liabilities that Prescott would have to bear if it acquired

Robson.

■ The standard terms of contracts with customers for construction works. In particular, for:

– guarantees given (e.g. for rectification under warranty);

– penalty clauses (e.g. in the event of overruns or non-completion);

– disclaimers (including conditions for invoking force majeure).

Prescott will want to make some allowance for settlement of liabilities arising on contracts already completed/in-progress

when offering a price for Robson.

Tutorial note: A takeover might excuse Robson from fulfilling a contract.

■ Legal/correspondence files dealing with matters such as the claims of the residents of the housing development and

Robson’s claim against Sarwar Services Co. Also, fee notes rendered by Robson’s legal advisers showing the costs

incurred on matters referred to them.

■ Robson’s insurer’s ‘cover note’ to determine Robson’s exposure to claims for rectification work, damages, injuries to

employees, etc.

■ The quantity surveyor’s working papers for the last quarterly count (presumably at 31 March 2006) and the latest

available rolling budgets. Particular attention should be given to loss-making contracts and contracts that have not been

started. (Prescott might seek to settle rather than fulfil them.) The pattern of taking profits on contracts will be of

interest, for example, to determine the accuracy of the quantity surveyor’s estimates.

Tutorial note: A regular pattern of taking too much profit too soon might be due to underestimating costs to completion

or be evidence of cost overruns due to rectification.

■ Type and frequency of constructions undertaken. Prescott is interested in the building and refurbishment of hotels and

leisure facilities. Robson’s experience in this area may not be extensive.

■ Non-current asset register showing location of plant and equipment so that some test checking on physical existence

might be undertaken (if an agreed-upon-procedure).

(b) (i) Explain the matters you should consider to determine whether capitalised development costs are

appropriately recognised; and (5 marks)

(b) (i) Materiality

The net book value of capitalised development costs represent 7% of total assets in 2007 (2006 – 7·7%), and is

therefore material. The net book value has increased by 13%, a significant trend.

The costs capitalised during the year amount to $750,000. If it was found that the development cost had been

inappropriately capitalised, the cost should instead have been expensed. This would reduce profit before tax by

$750,000, representing 42% of the year’s profit. This is highly material. It is therefore essential to gather sufficient

evidence to support the assertion that development costs should be recognised as an asset.

In 2007, $750,000 capitalised development costs have been incurred, when added to $160,000 research costs

expensed, total research and development costs are $910,000 which represents 20·2% of total revenue, again

indicating a high level of materiality for this class of transaction.

Relevant accounting standard

Development costs should only be capitalised as an intangible asset if the recognition criteria of IAS 38 Intangible Assets

have been demonstrated in full:

– Intention to complete the intangible asset and use or sell it

– Technical feasibility and ability to use or sell

– Ability to generate future economic benefit

– Availability of technical, financial and other resources to complete

– Ability to measure the expenditure attributable to the intangible asset.

Research costs must be expensed, as should development costs which do not comply with the above criteria. The

auditors must consider how Sci-Tech Co differentiates between research and development costs.

There is risk that not all of the criteria have been demonstrated, especially due to the subjective nature of the

development itself:

– Pharmaceutical development is highly regulated. If the government does not license the product then the product

cannot be sold, and economic benefits will therefore not be received.

– Market research should justify the commercial viability of the product. The launch of a rival product to Flortex

means that market share is likely to be much lower than anticipated, and the ability to sell Flortex is reduced. This

could mean that Flortex will not generate an overall economic benefit if future sales will not recover the research

and development costs already suffered, and yet to be suffered, prior to launch. The existence of the rival product

could indicate that Flortex is no longer commercially viable, in which case the capitalised development costs

relating to Flortex should be immediately expensed.

– The funding on which development is dependent may be withdrawn, indicating that there are not adequate

resources to complete the development of the products. Sci-Tech has failed to meet one of its required key

performance indicators (KPI) in the year ended 30 November 2007, as products valued at 0·8% revenue have

been donated to charity, whereas the required KPI is 1% revenue.

Given that there is currently a breach of the target KPIs, this is likely to result in funding equivalent to 25% of

research and development expenditure being withdrawn. If Sci-Tech Co is unable to source alternative means of

finance, then it would seem that adequate resources may not be available to complete the development of new

products.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16

- 2020-08-16