2020年ACCA考试:会计师与企业基础练习题(2)

发布时间:2020-10-12

今天51题库考试学习网为大家带来2020年ACCA考试:会计师与企业基础练习题(2),希望对你们备考有所帮助,备考的小伙伴一起来看看吧。

2.1 Which of the following are meaningful

criteria for measuring the effectiveness of an appraisal scheme?

(i) Serious intent

(ii) Fairness

(iii) Efficiency

(iv) Co-operation

(v) Results

A (ii), (iii) and (v) only

B (iii) and (v) only

C (i), (ii), (iii) and (iv) only

D (i), (ii), (iii), (iv) and (v)

答案:C

2.2______ is the name given to gathering of

appraisals from the individual, superiors, subordinates, peers and co-workers

and customers. Which word or phrase correctly completes this sentence?

A Multi-source feedback

B Management by objectives

C Performance management

答案:A

2.3 Appraisal is a complex human relations

and political exercise. Which of the following is not necessarily a helpful

factor in the design of an appraisal scheme?

A The purpose of the system is positive and

clearly expressed

B There is reasonable standardisation

throughout the organisation

C Time is allowed for appraisee preparation

and appraiser training

D There is an implied link between

assessment and reward

答案:D

2.4 Which of the following is not a barrier

to effective appraisal?

A Appraisal is seen as a way of wrapping up

unfinished business for the year

B Appraisal is seen as conforming to Human

Resource procedures

C Appraisal is seen as an opportunity to

raise workplace problems and issues

D Appraisal is seen as an annual event

答案:C

2.5 Which one of the following criteria

would not be suitable for evaluating an appraisal system?

A Serious intent

B Fairness

C Bonuses awarded

答案:C

2.6 Which of the following is an advantage

to all employees of having a formal appraisal system?

A Suitable promotion candidates are

identified

B It provides a basis for medium- to

long-term HR planning

C Individual objectives are related to the

objectives of the whole organisation

D It provides a basis for reviewing

recruitment and selection decisions

答案:C

2.7 A sales team is assessed according to

the number of sales calls made, number of leads generated, and number and value

of sales made. Which appraisal technique is described in this example?

A Behavioural incident

B Rating scale

C Guided assessment

D Results-oriented

答案:D

今天的试题分享到此结束,预祝各位小伙伴顺利通过接下来的ACCA考试,如需查看更多ACCA考试试题,记得关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

Moonstar Co is a property development company which is planning to undertake a $200 million commercial property development. Moonstar Co has had some difficulties over the last few years, with some developments not generating the expected returns and the company has at times struggled to pay its finance costs. As a result Moonstar Co’s credit rating has been lowered, affecting the terms it can obtain for bank finance. Although Moonstar Co is listed on its local stock exchange, 75% of the share capital is held by members of the family who founded the company. The family members who are shareholders do not wish to subscribe for a rights issue and are unwilling to dilute their control over the company by authorising a new issue of equity shares. Moonstar Co’s board is therefore considering other methods of financing the development, which the directors believe will generate higher returns than other recent investments, as the country where Moonstar Co is based appears to be emerging from recession.

Securitisation proposals

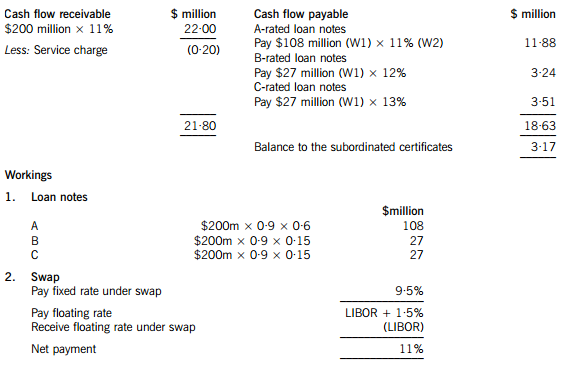

One of the non-executive directors of Moonstar Co has proposed that it should raise funds by means of a securitisation process, transferring the rights to the rental income from the commercial property development to a special purpose vehicle. Her proposals assume that the leases will generate an income of 11% per annum to Moonstar Co over a ten-year period. She proposes that Moonstar Co should use 90% of the value of the investment for a collateralised loan obligation which should be structured as follows:

– 60% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 150 basis points

– 15% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 12%

– 15% of the collateral value to support a tranche of C-rated fixed rate loan notes offering investors 13%

– 10% of the collateral value to support a tranche as subordinated certificates, with the return being the excess of receipts over payments from the securitisation process

The non-executive director believes that there will be sufficient demand for all tranches of the loan notes from investors. Investors will expect that the income stream from the development to be low risk, as they will expect the property market to improve with the recession coming to an end and enough potential lessees to be attracted by the new development.

The non-executive director predicts that there would be annual costs of $200,000 in administering the loan. She acknowledges that there would be interest rate risks associated with the proposal, and proposes a fixed for variable interest rate swap on the A-rated floating rate notes, exchanging LIBOR for 9·5%.

However the finance director believes that the prediction of the income from the development that the non-executive director has made is over-optimistic. He believes that it is most likely that the total value of the rental income will be 5% lower than the non-executive director has forecast. He believes that there is some risk that the returns could be so low as to jeopardise the income for the C-rated fixed rate loan note holders.

Islamic finance

Moonstar Co’s chief executive has wondered whether Sukuk finance would be a better way of funding the development than the securitisation.

Moonstar Co’s chairman has pointed out that a major bank in the country where Moonstar Co is located has begun to offer a range of Islamic financial products. The chairman has suggested that a Mudaraba contract would be the most appropriate method of providing the funds required for the investment.

Required:

(a) Calculate the amounts in $ which each of the tranches can expect to receive from the securitisation arrangement proposed by the non-executive director and discuss how the variability in rental income affects the returns from the securitisation. (11 marks)

(b) Discuss the benefits and risks for Moonstar Co associated with the securitisation arrangement that the non-executive director has proposed. (6 marks)

(c) (i) Discuss the suitability of Sukuk finance to fund the investment, including an assessment of its appeal to potential investors. (4 marks)

(ii) Discuss whether a Mudaraba contract would be an appropriate method of financing the investment and discuss why the bank may have concerns about providing finance by this method. (4 marks)

(a) An annual cash flow account compares the estimated cash flows receivable from the property against the liabilities within the securitisation process. The swap introduces leverage into the arrangement.

The holders of the certificates are expected to receive $3·17million on $18 million, giving them a return of 17·6%. If the cash flows are 5% lower than the non-executive director has predicted, annual revenue received will fall to $20·90 million, reducing the balance available for the subordinated certificates to $2·07 million, giving a return of 11·5% on the subordinated certificates, which is below the returns offered on the B and C-rated loan notes. The point at which the holders of the certificates will receive nothing and below which the holders of the C-rated loan notes will not receive their full income will be an annual income of $18·83 million (a return of 9·4%), which is 14·4% less than the income that the non-executive director has forecast.

(b) Benefits

The finance costs of the securitisation may be lower than the finance costs of ordinary loan capital. The cash flows from the commercial property development may be regarded as lower risk than Moonstar Co’s other revenue streams. This will impact upon the rates that Moonstar Co is able to offer borrowers.

The securitisation matches the assets of the future cash flows to the liabilities to loan note holders. The non-executive director is assuming a steady stream of lease income over the next 10 years, with the development probably being close to being fully occupied over that period.

The securitisation means that Moonstar Co is no longer concerned with the risk that the level of earnings from the properties will be insufficient to pay the finance costs. Risks have effectively been transferred to the loan note holders.

Risks

Not all of the tranches may appeal to investors. The risk-return relationship on the subordinated certificates does not look very appealing, with the return quite likely to be below what is received on the C-rated loan notes. Even the C-rated loan note holders may question the relationship between the risk and return if there is continued uncertainty in the property sector.

If Moonstar Co seeks funding from other sources for other developments, transferring out a lower risk income stream means that the residual risks associated with the rest of Moonstar Co’s portfolio will be higher. This may affect the availability and terms of other borrowing.

It appears that the size of the securitisation should be large enough for the costs to be bearable. However Moonstar Co may face unforeseen costs, possibly unexpected management or legal expenses.

(c) (i) Sukuk finance could be appropriate for the securitisation of the leasing portfolio. An asset-backed Sukuk would be the same kind of arrangement as the securitisation, where assets are transferred to a special purpose vehicle and the returns and repayments are directly financed by the income from the assets. The Sukuk holders would bear the risks and returns of the relationship.

The other type of Sukuk would be more like a sale and leaseback of the development. Here the Sukuk holders would be guaranteed a rental, so it would seem less appropriate for Moonstar Co if there is significant uncertainty about the returns from the development.

The main issue with the asset-backed Sukuk finance is whether it would be as appealing as certainly the A-tranche of the securitisation arrangement which the non-executive director has proposed. The safer income that the securitisation offers A-tranche investors may be more appealing to investors than a marginally better return from the Sukuk. There will also be costs involved in establishing and gaining approval for the Sukuk, although these costs may be less than for the securitisation arrangement described above.

(ii) A Mudaraba contract would involve the bank providing capital for Moonstar Co to invest in the development. Moonstar Co would manage the investment which the capital funded. Profits from the investment would be shared with the bank, but losses would be solely borne by the bank. A Mudaraba contract is essentially an equity partnership, so Moonstar Co might not face the threat to its credit rating which it would if it obtained ordinary loan finance for the development. A Mudaraba contract would also represent a diversification of sources of finance. It would not require the commitment to pay interest that loan finance would involve.

Moonstar Co would maintain control over the running of the project. A Mudaraba contract would offer a method of obtaining equity funding without the dilution of control which an issue of shares to external shareholders would bring. This is likely to make it appealing to Moonstar Co’s directors, given their desire to maintain a dominant influence over the business.

The bank would be concerned about the uncertainties regarding the rental income from the development. Although the lack of involvement by the bank might appeal to Moonstar Co's directors, the bank might not find it so attractive. The bank might be concerned about information asymmetry – that Moonstar Co’s management might be reluctant to supply the bank with the information it needs to judge how well its investment is performing.

(c) Define ‘market risk’ for Mr Allejandra and explain why Gluck and Goodman’s market risk exposure is

increased by failing to have an effective audit committee. (5 marks)

(c) Market risk

Definition of market risk

Market risks are those arising from any of the markets that a company operates in. Most common examples are those risks

from resource markets (inputs), product markets (outputs) or capital markets (finance).

[Tutorial note: markers should exercise latitude in allowing definitions of market risk. IFRS 7, for example, offers a technical

definition: ‘Market risk is the risk that the fair value or cash flows of a financial instrument will fluctuate due to changes in

market prices. Market risk reflects interest rate risk, currency risk, and other price risks’.]

Why non-compliance increases market risk

The lack of a fully compliant committee structure (such as having a non-compliant audit committee) erodes investor

confidence in the general governance of a company. This will, over time, affect share price and hence company value. Low

company value will threaten existing management (possibly with good cause in the case of Gluck and Goodman) and make

the company a possible takeover target. It will also adversely affect price-earnings and hence market confidence in Gluck and

Goodman’s shares. This will make it more difficult to raise funds from the stock market.

(b) You are the audit manager of Jinack Co, a private limited liability company. You are currently reviewing two

matters that have been left for your attention on the audit working paper file for the year ended 30 September

2005:

(i) Jinack holds an extensive range of inventory and keeps perpetual inventory records. There was no full

physical inventory count at 30 September 2005 as a system of continuous stock checking is operated by

warehouse personnel under the supervision of an internal audit department.

A major systems failure in October 2005 caused the perpetual inventory records to be corrupted before the

year-end inventory position was determined. As data recovery procedures were found to be inadequate,

Jinack is reconstructing the year-end quantities through a physical count and ‘rollback’. The reconstruction

exercise is expected to be completed in January 2006. (6 marks)

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Jinack Co for the year ended 30 September 2005 and, where appropriate, the year ending

30 September 2006.

NOTE: The mark allocation is shown against each of the matters.

(b) Implications for the auditor’s report

(i) Corruption of perpetual inventory records

■ The loss of data (of physical inventory quantities at the balance sheet date) gives rise to a limitation on scope.

Tutorial note: It is the records of the asset that have been destroyed – not the physical asset.

■ The systems failure in October 2005 is clearly a non-adjusting post balance sheet event (IAS 10). If it is material

(such that non-disclosure could influence the economic decisions of users) Jinack should disclose:

– the nature of the event (i.e. systems failure); and

– an estimate of its financial effect (i.e. the cost of disruption and reconstruction of data to the extent that it is

not covered by insurance).

Tutorial note: The event has no financial effect on the realisability of inventory, only on its measurement for the

purpose of reporting it in the financial statements.

■ If material this disclosure could be made in the context of explaining how inventory has been estimated at

30 September 2005 (see later). If such disclosure, that the auditor considers to be necessary, is not made, the

audit opinion should be qualified ‘except for’ disagreement (over lack of disclosure).

Tutorial note: Such qualifications are extremely rare since management should be persuaded to make necessary

disclosure in the notes to the financial statements rather than have users’ attention drawn to the matter through

a qualification of the audit opinion.

■ The limitation on scope of the auditor’s work has been imposed by circumstances. Jinack’s accounting records

(for inventory) are inadequate (non-existent) for the auditor to perform. tests on them.

■ An alternative procedure to obtain sufficient appropriate audit evidence of inventory quantities at a year end is

subsequent count and ‘rollback’. However, the extent of ‘roll back’ testing is limited as records are still under

reconstruction.

■ The auditor may be able to obtain sufficient evidence that there is no material misstatement through a combination

of procedures:

– testing management’s controls over counting inventory after the balance sheet date and recording inventory

movements (e.g. sales and goods received);

– reperforming the reconstruction for significant items on a sample basis;

– analytical procedures such as a review of profit margins by inventory category.

■ ‘An extensive range of inventory’ is clearly material. The matter (i.e. systems failure) is not however pervasive, as

only inventory is affected.

■ Unless the reconstruction is substantially completed (i.e. inventory items not accounted for are insignificant) the

auditor cannot determine what adjustment, if any, might be determined to be necessary. The auditor’s report

should then be modified, ‘except for’, limitation on scope.

■ However, if sufficient evidence is obtained the auditor’s report should be unmodified.

■ An ‘emphasis of matter’ paragraph would not be appropriate because this matter is not one of significant

uncertainty.

Tutorial note: An uncertainty in this context is a matter whose outcome depends on future actions or events not

under the direct control of Jinack.

2006

■ If the 2005 auditor’s report is qualified ‘except for’ on grounds of limitation on scope there are two possibilities for

the inventory figure as at 30 September 2005 determined on completion of the reconstruction exercise:

(1) it is not materially different from the inventory figure reported; or

(2) it is materially different.

■ In (1), with the limitation now removed, the need for qualification is removed and the 2006 auditor’s report would

be unmodified (in respect of this matter).

■ In (2) the opening position should be restated and the comparatives adjusted in accordance with IAS 8 ‘Accounting

Policies, Changes in Accounting Estimates and Errors’. The 2006 auditor’s report would again be unmodified.

Tutorial note: If the error was not corrected in accordance with IAS 8 it would be a different matter and the

auditor’s report would be modified (‘except for’ qualification) disagreement on accounting treatment.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-18

- 2020-10-18

- 2019-03-10

- 2020-10-12

- 2020-08-14

- 2020-08-14

- 2020-10-18

- 2020-08-14

- 2020-10-18

- 2020-08-14

- 2020-08-14

- 2020-10-18

- 2020-08-14

- 2020-08-14

- 2020-08-14

- 2020-10-12

- 2020-08-14

- 2019-03-09

- 2020-10-18

- 2019-01-05

- 2020-08-14

- 2020-08-14

- 2020-10-18

- 2020-08-14

- 2020-10-12

- 2020-10-18

- 2020-08-14

- 2020-10-12

- 2020-10-18

- 2019-01-05