ACCA考试F3考试模拟试题(2020-08-13)

发布时间:2020-08-13

报考2020年ACCA考试的小伙伴们,大家都有在认真备考吗?为了帮助大家更好的备考,下面51题库考试学习网就给大家分享一个ACCA考试F3考试模拟试题,备考的小伙伴赶紧来练练吧。

1. What is the

total of the purchases day book?

A $880

B $823

C $1 ,033

D $958

答案:B

2. Smith Co has

the following transactions:

1 Purchase of goods on credit from T Rader:

$450

2 Return of goods purchased on credit last

month to T Rouble: $700

What are the correct ledger entries to record

these transactions?

A Dr

Purchases

$450

Dr Purchase

Returns $700

Cr

Cash

$450

Cr Trade

Payables

$700

B Dr Purchases

$450

Dr Trade

Payables

$700

Cr Purchase

Returns

$1,150

C Dr

Purchases

$450

Dr Trade

Payables

$250

Cr Purchase

Returns

$700

D Dr Purchase

Returns

$700

Dr

Purchases

$450

Cr Trade

Payables $1,150

答案:C

3. What is the

total of the sales day book?

A $544

B $589

C $534

D $579

答案:A

4. How is the

total of the purchases day book posted to the nominal ledger?

A Debit purchases, Credit cash

B Debit payables control, Credit purchases

C Debit cash, Credit purchases

D Debit purchases, Credit payables control

答案:D

5. Which one of

the following provides evidence that an item of expenditure on petty cash has

been approved or authorised?

A Petty cash voucher

B Record of the transaction in the petty

cash book

C Receipt for the expense

D Transfer of cash from the bank account

into petty cash

答案:A

以上是本次51题库考试学习网分享给大家的ACCA考试试题,备考的小伙伴抓紧时间练习一下吧。欲了解更多关于ACCA考试的试题,敬请关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

3 An organisation has decided to compare the benefits of promoting existing staff with those of appointing external

candidates and to assess whether the use of external recruitment consultants is appropriate.

Required:

(a) Describe the advantages of internal promotion. (5 marks)

3 All organisations rely upon their staff for success. However, recruitment of staff can be time consuming; a drain on resources and the necessary expertise may not exist within the organisation.

(a) Internal promotion describes the situation where an organisation has an explicit policy to promote from within and where there is a clear and transparent career structure. This is typical of many professional bodies, large organisations and public services.

The advantages of internal promotion are that it acts as a source of motivation, provides good general morale amongst employees and illustrates the organisation’s commitment to encouraging advancement. Recruitment is expensive and internal promotion is relatively inexpensive in terms of time, money and induction costs and since staff seeking promotion are known to the employer, training costs are minimised. Finally, the culture of the organisation is better understood by the individual.

2 The risk committee at Southern Continents Company (SCC) met to discuss a report by its risk manager, Stephanie

Field. The report focused on a number of risks that applied to a chemicals factory recently acquired by SCC in another

country, Southland. She explained that the new risks related to the security of the factory in Southland in respect of

burglary, to the supply of one of the key raw materials that experienced fluctuations in world supply and also an

environmental risk. The environmental risk, Stephanie explained, was to do with the possibility of poisonous

emissions from the Southland factory.

The SCC chief executive, Choo Wang, who chaired the risk committee, said that the Southland factory was important

to him for two reasons. First, he said it was strategically important to the company. Second, it was important because

his own bonuses depended upon it. He said that because he had personally negotiated the purchase of the Southland

factory, the remunerations committee had included a performance bonus on his salary based on the success of the

Southland investment. He told Stephanie that a performance-related bonus was payable when and if the factory

achieved a certain level of output that Choo considered to be ambitious. ‘I don’t get any bonus at all until we reach

a high level of output from the factory,’ he said. ‘So I don’t care what the risks are, we will have to manage them.’

Stephanie explained that one of her main concerns arose because the employees at the factory in Southland were not

aware of the importance of risk management to SCC. She said that the former owner of the factory paid less attention

to risk issues and so the staff were not as aware of risk as Stephanie would like them to be. ‘I would like to get risk

awareness embedded in the culture at the Southland factory,’ she said.

Choo Wang said that he knew from Stephanie’s report what the risks were, but that he wanted somebody to explain

to him what strategies SCC could use to manage the risks.

Required:

(a) Describe four strategies that can be used to manage risk and identify, with reasons, an appropriate strategy

for each of the three risks mentioned in the case. (12 marks)

(a) Risks at Southland and management strategies

Risk management strategies

There are four strategies for managing risk and these can be undertaken in sequence. In the first instance, the organisation

should ask whether the risk, once recognised, can be transferred or avoided.

Transference means passing the risk on to another party which, in practice means an insurer or a business partner in another

part of the supply chain (such as a supplier or a customer).

Avoidance means asking whether or not the organisation needs to engage in the activity or area in which the risk is incurred.

If it is decided that the risk cannot be transferred nor avoided, it might be asked whether or not something can be done to

reduce or mitigate the risk. This might mean, for example, reducing the expected return in order to diversify the risk or

re-engineer a process to bring about the reduction.

Risk sharing involves finding a party that is willing to enter into a partnership so that the risks of a venture might be spread

between the two parties. For example an investor might be found to provide partial funding for an overseas investment in

exchange for a share of the returns.

Finally, an organisation might accept or retain the risk, believing there to be no other feasible option. Such retention should

be accepted when the risk characteristics are clearly known (the possible hazard, the probability of the risk materialising and

the return expected as a consequence of bearing the risk).

Risks in the case and strategy

There are three risks to the Southland factory described in the case.

Risk to the security of the factory in Southland. This risk could be transferred. The transference of this risk would be through

insurance where an insurance company will assume the potential liability on payment, by SCC, of an appropriate insurance

premium.

Risk to the supply of one of the key raw materials that experienced fluctuations in world supply. This risk will probably have

to be accepted although it may be possible, with redesigning processes, to reduce the risk.

If the raw material is strategically important (i.e. its use cannot be substituted or reduced), risk acceptance will be the only

possible strategy. If products or process can be redesigned to substitute or replace its use in the factory, the supply risk can

be reduced.

The environmental risk that concerned a possibility of a poisonous emission can be reduced by appropriate environmental

controls in the factory. This may require some process changes such as inventory storage or amendments to internal systems

to ensure that the sources of emissions can be carefully monitored.

Tutorial note: the strategies for the individual risks identified in the case are not the only appropriate responses and other

strategies are equally valid providing they are supported with adequate explanation.

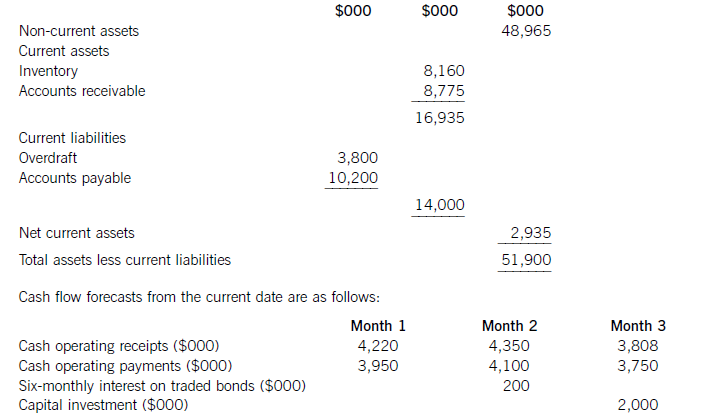

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action.

(10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced.

(8 marks)

(a)Whenconsideringthefinancingofworkingcapital,itisusefultodividecurrentassetsintofluctuatingcurrentassetsandpermanentcurrentassets.Fluctuatingcurrentassetsrepresentchangesinthelevelofcurrentassetsduetotheunpredictabilityofbusinessactivity.Permanentcurrentassetsrepresentthecorelevelofinvestmentincurrentassetsneededtosupportagivenlevelofturnoverorbusinessactivity.Asturnoverorlevelofbusinessactivityincreases,thelevelofpermanentcurrentassetswillalsoincrease.Thisrelationshipcanbemeasuredbytheratioofturnovertonetcurrentassets.Thefinancingchoiceasfarasworkingcapitalisconcernedisbetweenshort-termandlong-termfinance.Short-termfinanceismoreflexiblethanlong-termfinance:anoverdraft,forexample,isusedbyabusinessorganisationastheneedarisesandvariableinterestischargedontheoutstandingbalance.Short-termfinanceisalsomoreriskythanlong-termfinance:anoverdraftfacilitymaybewithdrawn,orashort-termloanmayberenewedonlessfavourableterms.Intermsofcost,thetermstructureofinterestratessuggeststhatshort-termdebtfinancehasalowercostthanlong-termdebtfinance.Thematchingprinciplesuggeststhatlong-termfinanceshouldbeusedforlong-terminvestment.Applyingthisprincipletoworkingcapitalfinancing,long-termfinanceshouldbematchedwithpermanentcurrentassetsandnon-currentassets.Afinancingpolicywiththisobjectiveiscalleda‘matchingpolicy’.HGRCoisnotusingthisfinancingpolicy,sinceofthe$16,935,000ofcurrentassets,$14,000,000or83%isfinancedfromshort-termsources(overdraftandtradepayables)andonly$2,935,000or17%isfinancedfromalong-termsource,inthiscaseequityfinance(shareholders’funds)ortradedbonds.ThefinancingpolicyorapproachtakenbyHGRCotowardsthefinancingofworkingcapital,whereshort-termfinanceispreferred,iscalledanaggressivepolicy.Relianceonshort-termfinancemakesthisriskierthanamatchingapproach,butalsomoreprofitableduetothelowercostofshort-termfinance.Followinganaggressiveapproachtofinancingcanleadtoovertrading(undercapitalisation)andthepossibilityofliquidityproblems.(b)Bankbalanceinthreemonths’timeifnoactionistaken:Workings:ReductioninaccountsreceivabledaysCurrentaccountsreceivabledays=(8,775/49,275)x365=65daysReductionindaysoversixmonths=65–53=12daysMonthlyreduction=12/6=2daysEachreceivablesdayisequivalentto8,775,000/65=$135,000(Alternatively,eachreceivablesdayisequivalentto49,275,000/365=$135,000)Monthlyreductioninaccountsreceivable=2x135,000=$270,000ReductionininventorydaysCurrentinventorydays=(8,160/37,230)x365=80daysEachinventorydayisequivalentto8,160,000/80=$102,000(Alternatively,eachinventoryday=37,230,000/365=$102,000)Monthlyreductionininventory=102,000x2=$204,000OverdraftinterestcalculationsMonthlyoverdraftinterestrate=1·06171/12=1·005or0·5%Ifnoactionistaken:Period1interest=3,800,000x0·005=$19,000Period2interest=3,549,000x0·005=$17,745or$18,000Period3interest=3,517,000x0·005=$17,585or$18,000Ifactionistaken:Period1interest=3,800,000x0.005=$19,000Period2interest=3,075,000x0.005=$15,375or$15,000Period3interest=2,566,000x0.005=$12,830or$13,000DiscussionIfnoactionistaken,thecashflowforecastshowsthatHGRCowillexceeditsoverdraftlimitof$4millionby$1·48millioninthreemonths’time.Ifthefinancedirector’sproposalsareimplemented,thereisapositiveeffectonthebankbalance,buttheoverdraftlimitisstillexceededinthreemonths’time,althoughonlyby$47,000ratherthanby$1·47million.Ineachofthethreemonthsfollowingthat,thecontinuingreductioninaccountsreceivabledayswillimprovethebankbalanceby$270,000permonth.Withoutfurtherinformationonoperatingreceiptsandpayments,itcannotbeforecastwhetherthebankbalancewillreturntolessthanthelimit,orevencontinuetoimprove.Themainreasonfortheproblemwiththebankbalanceisthe$2millioncapitalexpenditure.Purchaseofnon-currentassetsshouldnotbefinancedbyanoverdraft,butalong-termsourceoffinancesuchasequityorbonds.Ifthecapitalexpenditurewereremovedfromtheareaofworkingcapitalmanagement,theoverdraftbalanceattheendofthreemonthswouldbe$3·48millionifnoactionweretakenand$2·05millionifthefinancedirector’sproposalswereimplemented.GiventhatHGRCohasalmost$50millionofnon-currentassetsthatcouldpossiblybeusedassecurity,raisinglong-termdebtthrougheitherabankloanorabondissueappearstobesensible.Assumingabondinterestrateof10%peryear,currentlong-termdebtintheform.oftradedbondsisapproximately($200mx2)/0·1=$4m,whichismuchlessthantheamountofnoncurrentassets.AsuitablecourseofactionforHGRCotofollowwouldthereforebe,firstly,toimplementthefinancedirector’sproposalsand,secondly,tofinancethecapitalexpenditurefromalong-termsource.Considerationcouldalsobegiventousingsomelong-termdebtfinancetoreducetheoverdraftandtoreducethelevelofaccountspayable,currentlystandingat100days.(c)Whencreditisgrantedtoforeigncustomers,twoproblemsmaybecomeespeciallysignificant.First,thelongerdistancesoverwhichtradetakesplaceandthemorecomplexnatureoftradetransactionsandtheirelementsmeansforeignaccountsreceivableneedmoreinvestmentthantheirdomesticcounterparts.Longertransactiontimesincreaseaccountsreceivablebalancesandhencetheleveloffinancingandfinancingcosts.Second,theriskofbaddebtsishigherwithforeignaccountsreceivablethanwiththeirdomesticcounterparts.Inordertomanageandreducecreditrisks,therefore,exportersseektoreducetheriskofbaddebtandtoreducethelevelofinvestmentinforeignaccountsreceivable.Manyforeigntransactionsareon‘openaccount’,whichisanagreementtosettletheamountoutstandingonapredetermineddate.Openaccountreflectsagoodbusinessrelationshipbetweenimporterandexporter.Italsocarriesthehighestriskofnon-payment.Onewaytoreduceinvestmentinforeignaccountsreceivableistoagreeearlypaymentwithanimporter,forexamplebypaymentinadvance,paymentonshipment,orcashondelivery.Thesetermsoftradeareunlikelytobecompetitive,however,anditismorelikelythatanexporterwillseektoreceivecashinadvanceofpaymentbeingmadebythecustomer.Onewaytoacceleratecashreceiptsistousebillfinance.Billsofexchangewithasignedagreementtopaytheexporteronanagreedfuturedate,supportedbyadocumentaryletterofcredit,canbediscountedbyabanktogiveimmediatefunds.Thisdiscountingiswithoutrecourseifbillsofexchangehavebeencountersignedbytheimporter’sbank.Documentarylettersofcreditareapaymentguaranteebackedbyoneormorebanks.Theycarryalmostnorisk,providedtheexportercomplieswiththetermsandconditionscontainedintheletterofcredit.Theexportermustpresentthedocumentsstatedintheletter,suchasbillsoflading,shippingdocuments,billsofexchange,andsoon,whenseekingpayment.Aseachsupportingdocumentrelatestoakeyaspectoftheoveralltransaction,lettersofcreditgivesecuritytotheimporteraswellastheexporter.Companiescanalsomanageandreduceriskbygatheringappropriateinformationwithwhichtoassessthecreditworthinessofnewcustomers,suchasbankreferencesandcreditreports.Insurancecanalsobeusedtocoversomeoftherisksassociatedwithgivingcredittoforeigncustomers.Thiswouldavoidthecostofseekingtorecovercashduefromforeignaccountsreceivablethroughaforeignlegalsystem,wheretheexportercouldbeatadisadvantageduetoalackoflocalorspecialistknowledge.Exportfactoringcanalsobeconsidered,wheretheexporterpaysforthespecialistexpertiseofthefactorasawayofreducinginvestmentinforeignaccountsreceivableandreducingtheincidenceofbaddebts.

(iii) State any disadvantages to the relief in (i) that Sharon should be aware of, and identify and describe

another relief that she might use. (4 marks)

(iii) There are several disadvantages to incorporation relief as follows:

1. The requirement to transfer all business assets to the company means that it will not be possible to leave behind

certain assets, such as the property. This might lead to a double tax charge (sale of the property, then extraction

of sale proceeds) at a future date.

2. Taper relief is lost on the transfer of the business. This means that any disposal of chargeable business assets (the

shares) within two years of the incorporation will lead to a higher chargeable gain, as the full rate of business asset

taper relief will not be available.

3. The relief does not eliminate the tax charge, it merely defers the payment of tax until some future event. The

deferred gain will become taxable when Sharon sells her shares in the company.

Gift relief could be used instead of incorporation relief. The assets would be gifted to the company for no consideration,

with the base cost of the assets to the company being reduced by the deferred gain arising. Unlike incorporation relief,

gift relief applies to individual assets used in a trade and not to an entire business. This is particularly useful if the

transferor wishes to retain some assets, such as property outside the company, as not all assets have to be transferred.

Note: If the business was non-trading, incorporation relief would still be available, but gift relief would not. However,

this restriction should not apply to Sharon and gift relief remains an option in this case.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-08

- 2020-08-13

- 2020-08-05

- 2020-10-08

- 2020-08-13

- 2020-08-13

- 2020-08-13

- 2020-08-13

- 2020-10-11

- 2020-08-13

- 2020-10-08

- 2020-08-13

- 2020-10-08

- 2020-08-13

- 2020-10-08

- 2020-10-08

- 2020-10-11

- 2020-08-05

- 2020-10-08

- 2020-08-13

- 2020-10-11

- 2020-08-13

- 2020-08-13

- 2020-10-11

- 2020-08-13

- 2020-08-13

- 2020-08-13

- 2020-10-11

- 2019-03-21

- 2020-08-13