快讯!关于了解CFA、ACCA、FRM、CPA4大金融证书,并且有哪些就业前景呢?

发布时间:2020-05-15

对于现在考证的人越来越多,有谁知道这些证书的就业前景怎么样呢?接下来就带领大家了解下吧!

目前金融行业内最为热门的CFA、ACCA、FRM、CPA4张金融证书,根据全球经济的加速发展,金融方面需要的人才也越来越多,头顶证书的光环,也会为人们的职场铺平道路。

考证人群其考试重点是国际最前沿的金融理论和技术,范围包括投资分析、投资组合管理、财务报表分析、企业财务、经济学、投资表现评估及专业道德操守。CFA资格证书被授予广泛的各个投资领域内的专业人员,包括基金经理、证券分析师、财务总监、投资顾问、投资银行家、交易员等等。

考试范围CFA考试内容分为三个不同级别,分别是Level I、Level II和Level III。考试在全球各地点统一举行,每个考生必须依次完成三个不同级别的考试。

CFA资格考试采用全英文,候选人除应掌握金融知识外,还必须具备良好的英文专业阅读能力。

顺利通过CFA课程,即是达到一种成就,能获得雇主、投资者和整个投资界的高度尊重。

随着CFA考试参考人数的不断增加,“投资管理与研究协会”自2003年起,将Level I考试由每年一次增加为每年两次,除了5月/6月在全球160个考点举行一次外,2003年12月将在包括新加坡、香港等考生较为集中的23个地区再举行一次。

因而,从2003年起Level I考生将有两次机会参加考试。中国内地已经开设考场,每年6月份的考点有北京、上海、广州、香港,12月份的考点有北京、上海、香港。

中国考生普遍觉得考试难度很大、费用高,全部考完至少需要2-3万人民币。

考试内容大致有:①伦理和职业标准;②财务会计;③数量技术;④经济学;⑤固定收益证券分析;⑥权益证券分析;⑦组合投资管理。就业前景雇佣CFA人士最多的世界著名机构包括:美林、高盛、摩根、花旗、普华永道等。

对高端金融人才存在着迫切的渴求:许多公司的在招聘时明确提出,要有工作经验,拥有专业证书人员优先,尤其是外资机构。由全球风险管理协会进行认证与考试。

根据难度有哪三大门槛呢?

门槛一:考试难度较大。考试科目全面,涵盖市场风险、信用风险、操作风险及公司治理等领域。而且涉及现代管理学、金融学、经济学、数量统计学等诸多学科,知识结构复杂。因此,考生需要经过严格的专业训练,否则将难以理解复杂的数量关系和业务及产品的风险性质。

门槛二:考试成本较高。知识范围广,教材和复习资料的阅读量约为1万页,考生在复习上投入的时间成本较大。

门槛三:获取资格不易。FRM认证考试的报考条件较为宽松,对报考者的学历、行业没有限制,在校大学生也可报考。但要想获得由GARP颁发的专业资格证书却要翻越重重关卡。

以上就是关于考试的全部内容了,如果想要了解更多关于考试的信息,大家可以来关注51题库考试学习网哦,51题库考试学习网每天会为大家更新和考试相关的内容的。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Explain what effect the acquisition of Di Rollo Co will have on the planning of your audit of the consolidated

financial statements of Murray Co for the year ending 31 March 2008. (10 marks)

(b) Effect of acquisition on planning the audit of Murray’s consolidated financial statements for the year ending 31 March

2008

Group structure

The new group structure must be ascertained to identify all entities that should be consolidated into the Murray group’s

financial statements for the year ending 31 March 2008.

Materiality assessment

Preliminary materiality for the group will be much higher, in monetary terms, than in the prior year. For example, if a % of

total assets is a determinant of the preliminary materiality, it may be increased by 10% (as the fair value of assets acquired,

including goodwill, is $2,373,000 compared with $21·5m in Murray’s consolidated financial statements for the year ended

31 March 2007).

The materiality of each subsidiary should be re-assessed, in terms of the enlarged group as at the planning stage. For

example, any subsidiary that was just material for the year ended 31 March 2007 may no longer be material to the group.

This assessment will identify, for example:

– those entities requiring an audit visit; and

– those entities for which substantive analytical procedures may suffice.

As Di Rollo’s assets are material to the group Ross should plan to inspect the South American operations. The visit may

include a meeting with Di Rollo’s previous auditors to discuss any problems that might affect the balances at acquisition and

a review of the prior year audit working papers, with their permission.

Di Rollo was acquired two months into the financial year therefore its post-acquisition results should be expected to be

material to the consolidated income statement.

Goodwill acquired

The assets and liabilities of Di Rollo at 31 March 2008 will be combined on a line-by-line basis into the consolidated financial

statements of Murray and goodwill arising on acquisition recognised.

Audit work on the fair value of the Di Rollo brand name at acquisition, $600,000, may include a review of a brand valuation

specialist’s working papers and an assessment of the reasonableness of assumptions made.

Significant items of plant are likely to have been independently valued prior to the acquisition. It may be appropriate to plan

to place reliance on the work of expert valuers. The fair value adjustment on plant and equipment is very high (441% of

carrying amount at the date of acquisition). This may suggest that Di Rollo’s depreciation policies are over-prudent (e.g. if

accelerated depreciation allowed for tax purposes is accounted for under local GAAP).

As the amount of goodwill is very material (approximately 50% of the cash consideration) it may be overstated if Murray has

failed to recognise any assets acquired in the purchase of Di Rollo in accordance with IFRS 3 Business Combinations. For

example, Murray may have acquired intangible assets such as customer lists or franchises that should be recognised

separately from goodwill and amortised (rather than tested for impairment).

Subsequent impairment

The audit plan should draw attention to the need to consider whether the Di Rollo brand name and goodwill arising have

suffered impairment as a result of the allegations against Di Rollo’s former chief executive.

Liabilities

Proceedings in the legal claim made by Di Rollo’s former chief executive will need to be reviewed. If the case is not resolved

at 31 March 2008, a contingent liability may require disclosure in the consolidated financial statements, depending on the

materiality of amounts involved. Legal opinion on the likelihood of Di Rollo successfully defending the claim may be sought.

Provision should be made for any actual liabilities, such as legal fees.

Group (related party) transactions and balances

A list of all the companies in the group (including any associates) should be included in group audit instructions to ensure

that intra-group transactions and balances (and any unrealised profits and losses on transactions with associates) are

identified for elimination on consolidation. Any transfer pricing policies (e.g. for clothes manufactured by Di Rollo for Murray

and sales of Di Rollo’s accessories to Murray’s retail stores) must be ascertained and any provisions for unrealised profit

eliminated on consolidation.

It should be confirmed at the planning stage that inter-company transactions are identified as such in the accounting systems

of all companies and that inter-company balances are regularly reconciled. (Problems are likely to arise if new inter-company

balances are not identified/reconciled. In particular, exchange differences are to be expected.)

Other auditors

If Ross plans to use the work of other auditors in South America (rather than send its own staff to undertake the audit of Di

Rollo), group instructions will need to be sent containing:

– proforma statements;

– a list of group and associated companies;

– a statement of group accounting policies (see below);

– the timetable for the preparation of the group accounts (see below);

– a request for copies of management letters;

– an audit work summary questionnaire or checklist;

– contact details (of senior members of Ross’s audit team).

Accounting policies

Di Rollo may have material accounting policies which do not comply with the rest of the Murray group. As auditor to Di Rollo,

Ross will be able to recalculate the effect of any non-compliance with a group accounting policy (that Murray’s management

would be adjusting on consolidation).

Timetable

The timetable for the preparation of Murray’s consolidated financial statements should be agreed with management as soon

as possible. Key dates should be planned for:

– agreement of inter-company balances and transactions;

– submission of proforma statements;

– completion of the consolidation package;

– tax review of group accounts;

– completion of audit fieldwork by other auditors;

– subsequent events review;

– final clearance on accounts of subsidiaries;

– Ross’s final clearance of consolidated financial statements.

Tutorial note: The order of dates is illustrative rather than prescriptive.

(ii) the recent financial performance of Merton plc from a shareholder perspective. Clearly identify any

issues that you consider should be brought to the attention of the ordinary shareholders. (15 marks)

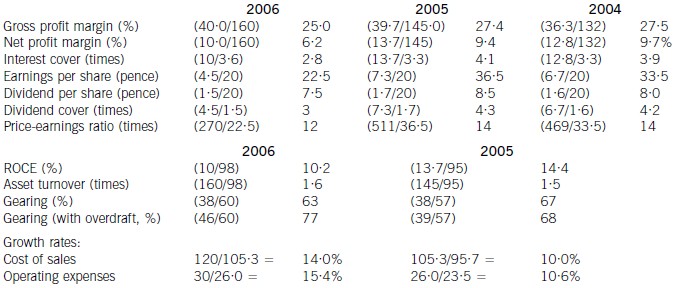

(ii) Discussion of financial performance

It is clear that 2006 has been a difficult year for Merton plc. There are very few areas of interest to shareholders where

anything positive can be found to say.

Profitability

Return on capital employed has declined from 14·4% in 2005, which compared favourably with the sector average of

12%, to 10·2% in 2006. Since asset turnover has improved from 1·5 to 1·6 in the same period, the cause of the decline

is falling profitability. Gross profit margin has fallen each year from 27·5% in 2004 to 25% in 2006, equal to the sector

average, despite an overall increase in turnover during the period of 10% per year. Merton plc has been unable to keep

cost of sales increases (14% in 2006 and 10% in 2005) below the increases in turnover. Net profit margin has declined

over the same period from 9·7% to 6·2%, compared to the sector average of 8%, because of substantial increases in

operating expenses (15·4% in 2006 and 10·6% in 2005). There is a pressing need here for Merton plc to bring cost

of sales and operating costs under control in order to improve profitability.

Gearing and financial risk

Gearing as measured by debt/equity has fallen from 67% (2005) to 63% (2006) because of an increase in

shareholders’ funds through retained profits. Over the same period the overdraft has increased from £1m to £8m and

cash balances have fallen from £16m to £1m. This is a net movement of £22m. If the overdraft is included, gearing

has increased to 77% rather than falling to 63%.

None of these gearing levels compare favourably with the average gearing for the sector of 50%. If we consider the large

increase in the overdraft, financial risk has clearly increased during the period. This is also evidenced by the decline in

interest cover from 4·1 (2005) to 2·8 (2006) as operating profit has fallen and interest paid has increased. In each year

interest cover has been below the sector average of eight and the current level of 2·8 is dangerously low.

Share price

As the return required by equity investors increases with increasing financial risk, continued increases in the overdraft

will exert downward pressure on the company’s share price and further reductions may be expected.

Investor ratios

Earnings per share, dividend per share and dividend cover have all declined from 2005 to 2006. The cut in the dividend

per share from 8·5 pence per share to 7·5 pence per share is especially worrying. Although in its announcement the

company claimed that dividend growth and share price growth was expected, it could have chosen to maintain the

dividend, if it felt that the current poor performance was only temporary. By cutting the dividend it could be signalling

that it expects the poor performance to continue. Shareholders have no guarantee as to the level of future dividends.

This view could be shared by the market, which might explain why the price-earnings ratio has fallen from 14 times to

12 times.

Financing strategy

Merton plc has experienced an increase in fixed assets over the last period of £10m and an increase in stocks and

debtors of £21m. These increases have been financed by a decline in cash (£15m), an increase in the overdraft (£7m)

and an increase in trade credit (£6m). The company is following an aggressive strategy of financing long-term

investment from short-term sources. This is very risky, since if the overdraft needed to be repaid, the company would

have great difficulty in raising the funds required.

A further financing issue relates to redemption of the existing debentures. The 10% debentures are due to be redeemed

in two years’ time and Merton plc will need to find £13m in order to do this. It does not appear that this sum can be

raised internally. While it is possible that refinancing with debt paying a lower rate of interest may be possible, the low

level of interest cover may cause concern to potential providers of debt finance, resulting in a higher rate of interest. The

Finance Director of Merton plc needs to consider the redemption problem now, as thought is currently being given to

raising a substantial amount of new equity finance. This financing choice may not be available again in the near future,

forcing the company to look to debt finance as a way of effecting redemption.

Overtrading

The evidence produced by the financial analysis above is that Merton plc is showing some symptoms of overtrading

(undercapitalisation). The board are suggesting a rights issue as a way of financing an expansion of business, but it is

possible that a rights issue will be needed to deal with the overtrading problem. This is a further financing issue requiring

consideration in addition to the redemption of debentures mentioned earlier.

Conclusion

Ordinary shareholders need to be aware of the following issues.

1. Profitability has fallen over the last year due to poor cost control

2. A substantial increase in the overdraft over the last year has caused gearing to increase

3. It is possible that the share price will continue to fall

4. The dividend cut may warn of continuing poor performance in the future

5. A total of £13m of debentures need redeeming in two year’s time

6. A large amount of new finance is needed for working capital and debenture redemption

Appendix: Analysis of key ratios and financial information

(ii) Describe the procedures to verify the number of serious accidents in the year ended 30 November 2007.

(4 marks)

(ii) Procedures to verify the number of serious accidents during 2007 could include the following:

Tutorial note: procedures should focus on the completeness of the disclosure as it is in the interest of Sci-Tech Co to

understate the number of serious accidents.

– Review the accident log book and count the total number of accidents during the year

– Discuss the definition of ‘serious accident’ with the directors and clarify exactly what criteria need to be met to

satisfy the definition

– For serious accidents identified:

? review HR records to determine the amount of time taken off work

? review payroll records to determine the financial amount of sick pay awarded to the employee

? review correspondence with the employee regarding the accident.

Tutorial note: the above will help to clarify that the accident was indeed serious.

– Review board minutes where the increase in the number of serious accidents has been discussed

– Review correspondence with Sci-Tech Co’s legal advisors to ascertain any legal claims made against the company

due to accidents at work

– Enquire as to whether any health and safety visits have been conducted during the year by regulatory bodies, and

review any documentation or correspondence issued to Sci-Tech Co after such visits.

Tutorial note: it is highly likely that in a regulated industry such as pharmaceutical research, any serious accident

would trigger a health and safety inspection from the appropriate regulatory body.

– Discuss the level of accidents with representatives of Sci-Tech Co’s employees to reach an understanding as to

whether accidents sometimes go unreported in the accident log book.

This scenario summarises the development of a company called Rock Bottom through three phases, from its founding in 1965 to 2008 when it ceased trading.

Phase 1 (1965–1988)

In 1965 customers usually purchased branded electrical goods, largely produced by well-established domestic companies, from general stores that stocked a wide range of household products. However, in that year, a recent university graduate, Rick Hein, established his first shop specialising solely in the sale of electrical goods. In contrast to the general stores, Rick Hein’s shop predominantly sold imported Japanese products which were smaller, more reliable and more sophisticated than the products of domestic competitors. Rick Hein quickly established a chain of shops, staffed by young people who understood the capabilities of the products they were selling. He backed this up with national advertising in the press, an innovation at the time for such a specialist shop. He branded his shops as ‘Rock Bottom’, a name which specifically referred to his cheap prices, but also alluded to the growing importance of

rock music and its influence on product sales. In 1969, 80% of sales were of music centres, turntables, amplifiers and speakers, bought by the newly affluent young. Rock Bottom began increasingly to specialise in selling audio equipment.

Hein also developed a high public profile. He dressed unconventionally and performed a number of outrageous stunts that publicised his company. He also encouraged the managers of his stores to be equally outrageous. He rewarded their individuality with high salaries, generous bonus schemes and autonomy. Many of the shops were extremely successful, making their managers (and some of their staff) relatively wealthy people.

However, by 1980 the profitability of the Rock Bottom shops began to decline significantly. Direct competitors using a similar approach had emerged, including specialist sections in the large general stores that had initially failed to react to the challenge of Rock Bottom. The buying public now expected its electrical products to be cheap and reliable.

Hein himself became less flamboyant and toned down his appearance and actions to satisfy the banks who were becoming an increasingly important source of the finance required to expand and support his chain of shops.

Phase 2 (1989–2002)

In 1988 Hein considered changing the Rock Bottom shops into a franchise, inviting managers to buy their own shops (which at this time were still profitable) and pursuing expansion though opening new shops with franchisees from outside the company. However, instead, he floated the company on the country’s stock exchange. He used some of the capital raised to expand the business. However, he also sold shares to help him throw the ‘party of a lifetime’ and to purchase expensive goods and gifts for his family. Hein became Chairman and Chief Executive Officer (CEO) of the newly quoted company, but over the next thirteen years his relationship with his board and shareholders became increasingly difficult. Gradually new financial controls and reporting systems were put in place. Most of the established managers left as controls became more centralised and formal. The company’s performance was solid but unspectacular. Hein complained that ‘business was not fun any more’. The company was legally required to publish directors’ salaries in its annual report and the generous salary package enjoyed by the Chairman and CEO increasingly became an issue and it dominated the 2002 Annual General Meeting (AGM). Hein was embarrassed by its publication and the discussion it led to in the national media. He felt that it was an infringement of his privacy and

civil liberties.

Phase 3 (2003–2008)

In 2003 Hein found the substantial private equity investment necessary to take Rock Bottom private again. He also used all of his personal fortune to help re-acquire the company from the shareholders. He celebrated ‘freeing Rock Bottom from its shackles’ by throwing a large celebration party. Celebrities were flown in from all over the world to attend. However, most of the new generation of store managers found Hein’s style. to be too loose and unfocused. He became rude and angry about their lack of entrepreneurial spirit. Furthermore, changes in products and how they were purchased meant that fewer people bought conventional audio products from specialist shops. The reliability of these products now meant that they were replaced relatively infrequently. Hein, belatedly, started to consider selling via an Internet site. Turnover and profitability plummeted. In 2007 Hein again considered franchising the company,but he realised that this was unlikely to be successful. In early 2008 the company ceased trading and Hein himself,now increasingly vilified and attacked by the press, filed for personal bankruptcy.

Required:

(a) Analyse the reasons for Rock Bottom’s success or failure in each of the three phases identified in the

scenario. Evaluate how Rick Hein’s leadership style. contributed to the success or failure of each phase.

(18 marks)

(b) Rick Hein considered franchising the Rock Bottom brand at two points in its history – 1988 and 2007.

Explain the key factors that would have made franchising Rock Bottom feasible in 1988, but would have

made it ‘unlikely to be successful’ in 2007. (7 marks)

(a) The product life cycle model suggests that a product passes through six stages: introduction, development, growth, shakeout,

maturity and decline. The first Rock Bottom phase appears to coincide with the introduction, development and growth periods

of the products offered by the company. These highly specified, high quality products were new to the country and were

quickly adopted by a certain consumer segment (see below). The life cycle concept also applies to services, and the innovative

way in which Rock Bottom sold and marketed the products distinguished the company from potential competitors. Not only

were these competitors still selling inferior and older products but their retail methods looked outdated compared with Rock Bottom’s bright, specialist shops. Rock Bottom’s entry into the market-place also exploited two important changes in the

external environment. The first was the technological advance of the Japanese consumer electronics industry. The second

was the growing economic power of young people, who wished to spend their increasing disposable income on products that

allowed them to enjoy popular music. Early entrants into an industry gain experience of that industry sooner than others. This

may not only be translated into cost advantages but also into customer loyalty that helps them through subsequent stages of

the product’s life cycle. Rock Bottom enjoyed the advantages of a first mover in this industry.

Hein’s leadership style. appears to have been consistent with contemporary society and more than acceptable to his young

target market. As an entrepreneur, his charismatic leadership was concerned with building a vision for the organisation and

then energising people to achieve it. The latter he achieved through appointing branch managers who reflected, to some

degree, his own style. and approach. His willingness to delegate considerable responsibility to these leaders, and to reward

them well, was also relatively innovative. The shops were also staffed by young people who understood the capabilities of the

products they were selling. It was an early recognition that intangible resources of skills and knowledge were important to the

organisation.

In summary, in the first phase Rock Bottom’s organisation and Hein’s leadership style. appear to have been aligned with

contemporary society, the customer base, employees and Rock Bottom’s position in the product/service life cycle.

The second phase of the Rock Bottom story appears to reflect the shakeout and maturity phases of the product life cycle. The

entry of competitors into the market is a feature of the growth stage. However, it is in the shakeout stage that the market

becomes saturated with competitors. The Rock Bottom product and service approach is easily imitated. Hein initially reacted

to these new challenges by a growing maturity, recognising that outrageous behaviour might deter the banks from lending to

him. However, the need to raise money to fund expansion and a latent need to realise (and enjoy) his investment led to the

company being floated on the country’s stock exchange. This, eventually, created two problems.

The first was the need for the company to provide acceptable returns to shareholders. This would have been a new challenge

for Hein. He would have to not only maintain dividends to external shareholders, but he would also have to monitor and

improve the publicly quoted share price. In an attempt to establish an organisation that could deliver such value, changes

were made in the organisational structure and style. Most of the phase 1 entrepreneur-style. managers left. This may have

been inevitable anyway as Rock Bottom would have had problems continuing with such high individual reward packages in

a maturing market. However, the new public limited organisation also demanded managers who were more transactional

leaders, focusing on designing systems and controlling performance. This style. of management was alien to Rick’s approach.

The second problem was the need for the organisation to become more transparent. The publishing of Hein’s financial details

was embarrassing, particularly as his income fuelled a life-style. that was becoming less acceptable to society. What had once

appeared innovative and amusing now looked like an indulgence. The challenge now was for Hein to change his leadership

style. to suit the new situation. However, he ultimately failed to do this. Like many leaders who have risen to their position

through entrepreneurial ability and a dominant spirit, the concept of serving stakeholders rather than ordering them around

proved too difficult to grasp. The sensible thing would have been to leave Rock Bottom and start afresh. However, like many

entrepreneurs he was emotionally attached to the company and so he persuaded a group of private equity financiers to help

him buy it back. Combining the roles of Chairman and Chief Executive Officer (CEO) is also controversial and likely to attract

criticism concerning corporate governance.

In summary, in the second phase of Hein’s leadership he failed to change his approach to reflect changing social values, a

maturing product/service market-place and the need to serve new and important stakeholders in the organisation. He clearly

saw the public limited company as a ‘shackle’ on his ambition and its obligations an infringement of his personal privacy.

It can be argued that Hein took Rock Bottom back into private ownership just as the product life cycle moved into its decline

stage. The product life cycle is a timely reminder that any product or service has a finite life. Forty years earlier, as a young

man, Hein was in touch with the technological and social changes that created a demand for his product and service.

However, he had now lost touch with the forces shaping the external environment. Products have now moved on. Music is

increasingly delivered through downloaded files that are then played through computers (for home use) or MP3s (for portable

use). Even where consumers use traditional electronic equipment, the reliability of this equipment means that it is seldom

replaced. The delivery method, through specialised shops, which once seemed so innovative is now widely imitated and

increasingly, due to the Internet, less cost-effective. Consumers of these products are knowledgeable buyers and are only

willing to purchase, after careful cost and delivery comparisons, through the Internet. Hence, Hein is in a situation where he

faces more competition to supply products which are used and replaced less frequently, using a sales channel that is

increasingly uncompetitive. Consequently, Hein’s attempt to re-vitalise the shops by using the approach he adopted in phase

1 of the company was always doomed to failure. This failure was also guaranteed by the continued presence of the managers

appointed in phase 2 of the company. These were managers used to tight controls and targets set by centralised management.

To suddenly be let loose was not what they wanted and Hein appears to have reacted to their inability to act entrepreneurially

with anger and abuse. Hein’s final acts of reinvention concerned the return to a hedonistic, conspicuous life style. that he had

enjoyed in the early days of the company. He probably felt that this was possible now that he did not have the reporting

requirements of the public limited company. However, he had failed to recognise significant changes in society. He celebrated

the freeing of ‘Rock Bottom from its shackles’ by throwing a large celebration party. Celebrities were flown in from all over the

world to attend. It seems inevitable that the cost and carbon footprint of such an event would now attract criticism.

Finally, in summary, Hein’s approach and leadership style. in phase 3 became increasingly out of step with society’s

expectations, customers’ requirements and employees’ expectations. However, unlike phase 2, Hein was now free of the

responsibilities and controls of professional management in a public limited company. This led him to conspicuous activities

that further devalued the brand, meaning that its demise was inevitable.

(b) At the end of the first phase Hein still had managers who were entrepreneurial in their outlook. It might have been attractive

for them to become franchisees, particularly as this might be a way of protecting their income through the more challenging

stages of the product and service life cycle that lay ahead. However, by the time Hein came to look at franchising again (phase

3), the managers were unlikely to be of the type that would take up the challenge of running a franchise. These were

managers used to meeting targets within the context of centrally determined policies and budgets within a public limited

company. Hein would have to make these employees redundant (at significant cost) and with no certainty that he could find

franchisees to replace them.

At the end of phase 1, Rock Bottom was a strong brand, associated with youth and innovation. First movers often retain

customer loyalty even when their products and approach have been imitated by new aggressive entrants to the market. A

strong brand is essential for a successful franchise as it is a significant part of what the franchisee is buying. However, by the

time Hein came to look at franchising again in phase 3, the brand was devalued by his behaviour and incongruent with

customer expectations and sales channels. For example, it had no Internet sales channel. If Hein had developed Rock Bottom

as a franchise it would have given him the opportunity to focus on building the brand, rather than financing the expansion

of the business through the issue of shares.

At the end of phase 1, Rock Bottom was still a financially successful company. If it had been franchised at this point, then

Hein could have realised some of his investment (through franchise fees) and used some of this to reward himself, and the

rest of the money could have been used to consolidate the brand. Much of the future financial risk would have been passed

to the franchisees. There would have been no need to take Rock Bottom public and so suffer the scrutiny associated with a

public limited company. However, by the time Hein came to look at franchising again in phase 3, most of the shops were

trading at a loss. He saw franchising as a way of disposing of the company in what he hoped was a sufficiently well-structured

way. In effect, it was to minimise losses. It seems highly unlikely that franchisees would have been attracted by investing in

something that was actually making a loss. Even if they were, it is unlikely that the franchise fees (and hence the money

immediately realised) would be very high.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-04-05

- 2021-07-23

- 2020-02-19

- 2020-01-10

- 2020-01-10

- 2020-04-21

- 2020-01-10

- 2020-01-10

- 2020-03-07

- 2020-01-10

- 2019-07-20

- 2020-05-03

- 2020-08-15

- 2020-01-09

- 2020-04-23

- 2020-03-14

- 2021-04-24

- 2021-09-13

- 2019-01-11

- 2020-01-10

- 2020-05-08

- 2020-01-10

- 2020-02-20

- 2020-03-07

- 2020-01-29

- 2020-03-11

- 2020-02-05

- 2020-04-23

- 2020-05-21

- 2020-04-15