不得不知道的ACCA证书的含金量高不高!

发布时间:2020-05-13

小伙伴们看过来呀!关注51题库考试学习网,有更多考试相关信息等你来查阅!今天51题库考试学习网为大家带来关于ACCA证书的含金量高不高的最新消息,快跟着51题库考试学习网一起来了解详细内容吧!

拥有ACCA证书的优势

★ 01证书含金量高

ACCA的课程设置涉及财务、审计、税务、管理及经营战略等方面的专业知识,其课程内容丰富,各课程之间联系紧密且其难度阶梯设置合理,使学员能在循序渐进的学习过程中,稳固基础知识的同时,不断提升自己的分析能力和战略思维,向企业高层和管理层的道路上迈进。

ACCA的课程体系是根据市场对人才的需求点来设计和开发的,特别注重培养学员的分析能力和在复杂条件下的决策、判断能力,使得学员学成后能适应各种商业环境。对ACCA课程的学习使学员不仅拥有系统的专业理论知识,还能拥有相对成熟的实践操作能力,这也让众多企业对具有ACCA证书资格的求职者更加青睐。

★ 02 升职加薪有底气

在步入工作岗位后大家都希望自己能够升职加薪,但并不是每个人都能够幸运的做到。就算你有了丰富的工作经验和工作能力,没有一个能拿得出手的证明,始终是没有底气去和老板提升职加薪的问题。从现在的就业趋势中我们能够看得出,很多工作岗位并不缺人,高学历的求职者也是多不胜数。唯一能够让企业对你青睐有加的就是自己拥有一些真正有含金量的证书。

★ 03 个人能力及专业素养的体现

想要取得ACCA并非是那么简单的事情,在ACCA备考中既需要在专业阶段掌握大量的理论知识,又需要在综合阶段学会如何解决具体的问题及知识的合理运用。近几年也能够看出ACCA考试已经越来越接近实务化。

正因为ACCA的难度大,才让它的含金量越来越高。能从百万人当中脱颖而出的人才,不仅仅代表其具有了专业的理论知识,更是个人毅力和学习能力的体现。

★ 04 职业道路更加宽阔

如果你之前从事的是会计相关的工作,那么当你拥有ACCA证书后就可以尝试着去事务所做一做审计的工作,不需要再去做出纳记账等繁琐的底层工作。如今金融财会行业待遇高是大家有目共睹的,如果您从事和会计无关的工作,想要转行进入财会行业,ACCA证书也是最好具备的。

★ 05 高薪就业

据官方的调查显示,ACCA会员的年薪集中在10万至80万之间,部分会员的年薪更是达到了100万到150万,远高于市场上普通财务人员的收入,并超过研究生以及MBA毕业生的平均年收入。此外,ACCA会员们的加薪的空间也很大,有数据显示,有63%的ACCA学员与准会员在工作一到二年获得加薪,其中,更有超过三分之二人数加薪幅度在6%以上。

★ 06 认可度广

ACCA会员资格在国际上受到广泛认可,全球有超过7571家“认可雇主企业”,其中更是有包括四大会计师事务所、联合利华、飞利浦、中国银行、阿里巴巴等各行业的领军企业。因此在求职过程中,ACCA持证学员都将拥有无比巨大的发展机遇和竞争优势。

希望本篇文章能够帮助到你们,如果还遇到其他不能解决的问题,要及时反馈给51题库考试学习网,我们会尽快帮您解决。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) the recent financial performance of Merton plc from a shareholder perspective. Clearly identify any

issues that you consider should be brought to the attention of the ordinary shareholders. (15 marks)

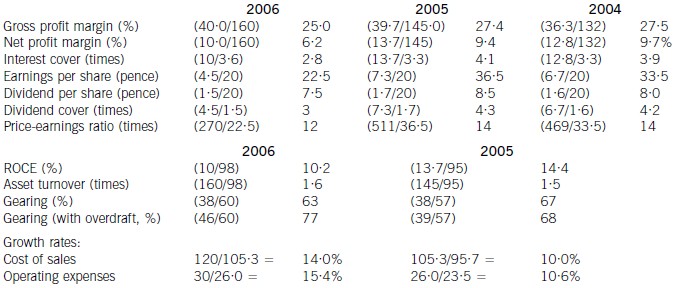

(ii) Discussion of financial performance

It is clear that 2006 has been a difficult year for Merton plc. There are very few areas of interest to shareholders where

anything positive can be found to say.

Profitability

Return on capital employed has declined from 14·4% in 2005, which compared favourably with the sector average of

12%, to 10·2% in 2006. Since asset turnover has improved from 1·5 to 1·6 in the same period, the cause of the decline

is falling profitability. Gross profit margin has fallen each year from 27·5% in 2004 to 25% in 2006, equal to the sector

average, despite an overall increase in turnover during the period of 10% per year. Merton plc has been unable to keep

cost of sales increases (14% in 2006 and 10% in 2005) below the increases in turnover. Net profit margin has declined

over the same period from 9·7% to 6·2%, compared to the sector average of 8%, because of substantial increases in

operating expenses (15·4% in 2006 and 10·6% in 2005). There is a pressing need here for Merton plc to bring cost

of sales and operating costs under control in order to improve profitability.

Gearing and financial risk

Gearing as measured by debt/equity has fallen from 67% (2005) to 63% (2006) because of an increase in

shareholders’ funds through retained profits. Over the same period the overdraft has increased from £1m to £8m and

cash balances have fallen from £16m to £1m. This is a net movement of £22m. If the overdraft is included, gearing

has increased to 77% rather than falling to 63%.

None of these gearing levels compare favourably with the average gearing for the sector of 50%. If we consider the large

increase in the overdraft, financial risk has clearly increased during the period. This is also evidenced by the decline in

interest cover from 4·1 (2005) to 2·8 (2006) as operating profit has fallen and interest paid has increased. In each year

interest cover has been below the sector average of eight and the current level of 2·8 is dangerously low.

Share price

As the return required by equity investors increases with increasing financial risk, continued increases in the overdraft

will exert downward pressure on the company’s share price and further reductions may be expected.

Investor ratios

Earnings per share, dividend per share and dividend cover have all declined from 2005 to 2006. The cut in the dividend

per share from 8·5 pence per share to 7·5 pence per share is especially worrying. Although in its announcement the

company claimed that dividend growth and share price growth was expected, it could have chosen to maintain the

dividend, if it felt that the current poor performance was only temporary. By cutting the dividend it could be signalling

that it expects the poor performance to continue. Shareholders have no guarantee as to the level of future dividends.

This view could be shared by the market, which might explain why the price-earnings ratio has fallen from 14 times to

12 times.

Financing strategy

Merton plc has experienced an increase in fixed assets over the last period of £10m and an increase in stocks and

debtors of £21m. These increases have been financed by a decline in cash (£15m), an increase in the overdraft (£7m)

and an increase in trade credit (£6m). The company is following an aggressive strategy of financing long-term

investment from short-term sources. This is very risky, since if the overdraft needed to be repaid, the company would

have great difficulty in raising the funds required.

A further financing issue relates to redemption of the existing debentures. The 10% debentures are due to be redeemed

in two years’ time and Merton plc will need to find £13m in order to do this. It does not appear that this sum can be

raised internally. While it is possible that refinancing with debt paying a lower rate of interest may be possible, the low

level of interest cover may cause concern to potential providers of debt finance, resulting in a higher rate of interest. The

Finance Director of Merton plc needs to consider the redemption problem now, as thought is currently being given to

raising a substantial amount of new equity finance. This financing choice may not be available again in the near future,

forcing the company to look to debt finance as a way of effecting redemption.

Overtrading

The evidence produced by the financial analysis above is that Merton plc is showing some symptoms of overtrading

(undercapitalisation). The board are suggesting a rights issue as a way of financing an expansion of business, but it is

possible that a rights issue will be needed to deal with the overtrading problem. This is a further financing issue requiring

consideration in addition to the redemption of debentures mentioned earlier.

Conclusion

Ordinary shareholders need to be aware of the following issues.

1. Profitability has fallen over the last year due to poor cost control

2. A substantial increase in the overdraft over the last year has caused gearing to increase

3. It is possible that the share price will continue to fall

4. The dividend cut may warn of continuing poor performance in the future

5. A total of £13m of debentures need redeeming in two year’s time

6. A large amount of new finance is needed for working capital and debenture redemption

Appendix: Analysis of key ratios and financial information

(ii) Audit work on after-date bank transactions identified a transfer of cash from Batik Co. The audit senior has

documented that the finance director explained that Batik commenced trading on 7 October 2005, after

being set up as a wholly-owned foreign subsidiary of Jinack. No other evidence has been obtained.

(4 marks)

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Jinack Co for the year ended 30 September 2005 and, where appropriate, the year ending

30 September 2006.

NOTE: The mark allocation is shown against each of the matters.

(ii) Wholly-owned foreign subsidiary

■ The cash transfer is a non-adjusting post balance sheet event. It indicates that Batik was trading after the balance

sheet date. However, that does not preclude Batik having commenced trading before the year end.

■ The finance director’s oral representation is wholly insufficient evidence with regard to the existence (or otherwise)

of Batik at 30 September 2005. If it existed at the balance sheet date its financial statements should have been

consolidated (unless immaterial).

■ The lack of evidence that might reasonably be expected to be available (e.g. legal papers, registration payments,

etc) suggests a limitation on the scope of the audit.

■ If such evidence has been sought but not obtained then the limitation is imposed by the entity (rather than by

circumstances).

■ Whilst the transaction itself may not be material, the information concerning the existence of Batik may be material

to users and should therefore be disclosed (as a non-adjusting event). The absence of such disclosure, if the

auditor considered necessary, would result in a qualified ‘except for’, opinion.

Tutorial note: Any matter that is considered sufficiently material to be worthy of disclosure as a non-adjusting

event must result in such a qualified opinion if the disclosure is not made.

■ If Batik existed at the balance sheet date and had material assets and liabilities then its non-consolidation would

have a pervasive effect. This would warrant an adverse opinion.

■ Also, the nature of the limitation (being imposed by the entity) could have a pervasive effect if the auditor is

suspicious that other audit evidence has been withheld. In this case the auditor should disclaim an opinion.

(b) Assuming that the income from the sale of the books is not treated as trading income, calculate Bob’s taxable

income and gains for all relevant tax years, using any loss reliefs in the most tax-efficient manner. Your

answer should include an explanation of the loss reliefs available and your reasons for using (or not using)

them. (12 marks)

Assume that the rates and allowances for 2004/05 apply throughout this part of the question.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-31

- 2020-01-10

- 2020-05-20

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-02-20

- 2020-01-10

- 2020-01-09

- 2020-01-30

- 2020-01-10

- 2020-08-16

- 2021-07-22

- 2020-01-09

- 2020-01-01

- 2020-01-10

- 2020-01-09

- 2020-05-15

- 2020-01-09

- 2020-04-22

- 2020-01-10

- 2020-04-19

- 2020-01-09

- 2020-03-19

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-03-14

- 2020-04-30