如果你是山东省考生,教你几招,轻松让你在ACCA考试中保持专注!

发布时间:2020-01-10

不管是职场,生活,你都不可能在一长段时间内只专注一件事。而在面对ACCA考试有那么多门考试科目,怎样才能不手忙脚乱呢?因此,51题库考试学习网在这里教大家如何在考场中能够高度专注的考试,不会被其他琐事影响,从而影响考试成绩的小技巧。

首先,我们要消除一个思维误区。

人是不能进行真正的“多线程工作”的。你的大脑不可能像电脑那样,开着好几个后台,例如:一边放着音乐,一边让你聊微信,一边下载电影

你必须在某个时间段只专注一件事。

回想一下,你复习高数的时候,想着A考,看似是一心二用,但实际上你是复习了一会儿高数,然后想了一会儿A考,你努力把神思拉回来,又复习了一会儿高数,然后思维又切换到A考……

实际上你的大脑在某个时间点只集中在一件事情上,但因为它的重点在不停切换,造成了你大脑一片混沌,手忙脚乱的错觉。

有一个小实验是这样的:

所以复习效率低,也是因为你的思维在不停切换,浪费了大量不必要的时间。并且忙了大半天也没有任何一科有明显进展,这时沮丧挫败灰心自责一系列负面情绪都扑过来了,会让学习陷入恶性循环。

那到底要如何从容面对考试呢?

多线程任务,不是同时做多件事,而是将一个时间段划分好几份,来分配给不同任务。所以多线程学习的核心其实是任务管理。

我们只需要确定哪个时间段要做哪个任务,然后保证一段时间只做一件事。

比如上午集中复习高数,下午集中复习思修,晚上集中复习A考,甚至,也可以先集中复习期末,再专心复习A考。

这里51题库考试学习网提供几个方法:

1. 对时间进行规划。

比如3天以后要考思修,那么你就需要规划这3天,你每天要花多少时间来复(yu)习(xi)思修。你将每一科的计划按紧急程度列出来,写下每天每一科需要进行到什么进度。

这时你就有了每天的小目标。

2. 每天总结自己的进度条更新到哪里了。

建议还是要每天列出to do list,将目标尽量细化,然后在完成每个小任务之后打个勾。

这个习惯看上去非常鸡肋没用,其实超级有必要。这就像你在电脑上完成了一项工作,然后点击了保存。这样的仪式感会提醒我们,让我们的大脑更清楚:这件事已经做完了,可以松一口气不用再想它了。

3. 不一定要先做最紧急的事,先做最重要的事。

甚至,如果你的大脑坚持要每五分钟就从高数切换到思修,那建议你先背一会儿思修,将进度条拉长一点,消除你的焦虑以后再去安心刷高数。

4. 接受自己的不完美。

考A的同学一般都比较有上进心,对自己要求比较高。

一方面这是好事,能让你不断督促自己努力,进步;一方面这样的性格也容易让你苛责自己,产生自责感。所以经常会有同学,一遇到没有头绪的时候就开始心态崩坏,结局通常是越做越糟。

这里学姐要说的就是,偶尔发挥失常,进入状态困难是每个人都会出现的状况。如果遇到这种情况,不要轻易否定自己的能力。首先我们要相信自己可以应对,这样我们才能真正做到有条理,少出错。

如何保持长时间的专注?

除了手忙脚乱之外,很多同学还有一个问题,就是备考的时候忍不住玩手机。看书五分钟,聊八卦两小时,这种现象实在非常普遍。

很多狠人会采取最简单粗暴的方法:不带手机去图书馆。

但是如果我要查单词,信息检索,甚至要联络别人怎么办?况且以后大家工作要提高效率,也不可能使用关掉手机拒绝诱惑这种方法。

所以我们要如何在干扰的情况下,做到长时间的专注呢?

(1)先从能够快速集中注意力的事情做起。

备考时,每天在备考前抄一遍字帖。

一方面,这样难度不高又不那么吸引注意力的工作会让我的心静下来

ACCAer们也可以想想有什么类似的事情是可以让自己平静专注下来,又不容易沉迷的。在每天复习前先做一遍这件事,有一个良好的开端。

(2)尽量让手参与进来。

如果实在很难集中注意力,就采取抄书的方式。因为光看书,你很容易就跳过内容,尤其是那些很难的重点。而手写的速度慢,并且需要输出,所以你的大脑一定会对信息进行处理的。

但这个方法只在你发现心思非常浮躁的时候有效,大多数时候,你还是需要一边理解一边输出。

这时候就不要只是把内容照抄下来而已了。你需要做的,就是将书本上的重点语句换一种表达方式写下来。这时候你的大脑才会去主动思考。

此外,画思维导图也是很好的方法,寻找每个知识点之间的联系,并对下一节知识内容进行预期。

最后,提醒大家要适当地拒绝舒适。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

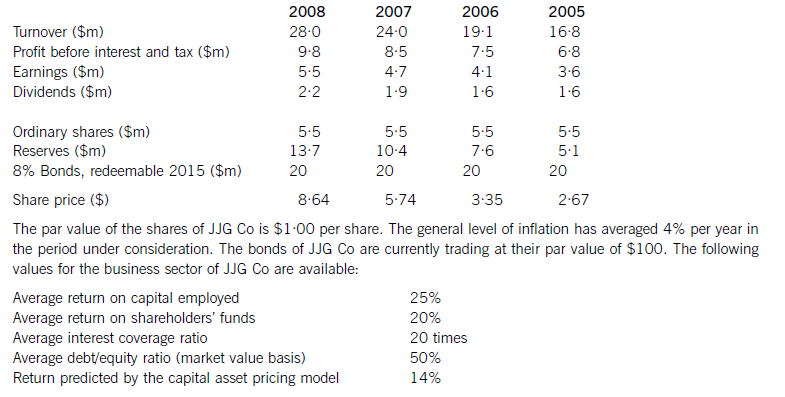

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion.

(b) Comment (with relevant calculations) on the performance of the business of Quicklink Ltd and Celer

Transport during the year ended 31 May 2005 and, insofar as the information permits, its projected

performance for the year ending 31 May 2006. Your answer should specifically consider:

(i) Revenue generation per vehicle

(ii) Vehicle utilisation and delivery mix

(iii) Service quality. (14 marks)

difference will reduce in the year ending 31 May 2006 due to the projected growth in sales volumes of the Celer Transport

business. The average mail/parcels delivery of mail/parcels per vehicle of the Quicklink Ltd part of the business is budgeted

at 12,764 which is still 30·91% higher than that of the Celer Transport business.

As far as specialist activities are concerned, Quicklink Ltd is budgeted to generate average revenues per vehicle amounting to

£374,850 whilst Celer Transport is budgeted to earn an average of £122,727 from each of the vehicles engaged in delivery

of processed food. It is noticeable that all contracts with major food producers were renewed on 1 June 2005 and it would

appear that there were no increases in the annual value of the contracts with major food producers. This might have been

the result of a strategic decision by the management of the combined entity in order to secure the future of this part of the

business which had been built up previously by the management of Celer Transport.

Each vehicle owned by Quicklink Ltd and Celer Transport is in use for 340 days during each year, which based on a

365 day year would give an in use % of 93%. This appears acceptable given the need for routine maintenance and repairs

due to wear and tear.

During the year ended 31 May 2005 the number of on-time deliveries of mail and parcel and industrial machinery deliveries

were 99·5% and 100% respectively. This compares with ratios of 82% and 97% in respect of mail and parcel and processed

food deliveries made by Celer Transport. In this critical area it is worth noting that Quicklink Ltd achieved their higher on-time

delivery target of 99% in respect of each activity whereas Celer Transport were unable to do so. Moreover, it is worth noting

that Celer Transport missed their target time for delivery of food products on 975 occasions throughout the year 31 May 2005

and this might well cause a high level of customer dissatisfaction and even result in lost business.

It is interesting to note that whilst the businesses operate in the same industry they have a rather different delivery mix in

terms of same day/next day demands by clients. Same day deliveries only comprise 20% of the business of Quicklink Ltd

whereas they comprise 75% of the business of Celer Transport. This may explain why the delivery performance of Celer

Transport with regard to mail and parcel deliveries was not as good as that of Quicklink Ltd.

The fact that 120 items of mail and 25 parcels were lost by the Celer Transport business is most disturbing and could prove

damaging as the safe delivery of such items is the very substance of the business and would almost certainly have resulted

in a loss of customer goodwill. This is an issue which must be addressed as a matter of urgency.

The introduction of the call management system by Quicklink Ltd on 1 June 2004 is now proving its worth with 99% of calls

answered within the target time of 20 seconds. This compares favourably with the Celer Transport business in which only

90% of a much smaller volume of calls were answered within a longer target time of 30 seconds. Future performance in this

area will improve if the call management system is applied to the Celer Transport business. In particular, it is likely that the

number of abandoned calls will be reduced and enhance the ‘image’ of the Celer Transport business.

4 A properly conducted appraisal interview is fundamental in ensuring the success of an organisation’s performance

appraisal system.

Required:

(a) Describe three approaches to conducting the appraisal interview. (5 marks)

4 Appraisal systems are central to human resource management and understanding the difficulties of such schemes and the correct

approach to them is necessary if the appraisal process is to be successful and worthwhile.

(a) The manager conducting the interview might base it on one of three approaches.

The Tell and Sell Method. The manager explains to the employee being appraised how the appraisal assessment is to be undertaken and gains acceptance of the evaluation and improvement plan from the employee. Human resource skills are important with this approach in order for the manager to be able to provide constructive criticism and to motivate the employee.

The Tell and Listen Method. The manager invites the employee to respond to the way that the interview is to be conducted.This approach requires counselling skills and encouragement to allow the employee to participate fully in the interview. A particular feature of this approach is the encouragment of feedback from the employee.

The Problem Solving Method. With this method the manager takes a more helpful approach and concentrates on the work problems of the employee, who is encouraged to think through his or her problems and to provide their own intrinsic motivation.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-04-22

- 2020-01-09

- 2020-05-20

- 2020-02-18

- 2020-01-10

- 2020-04-18

- 2020-04-30

- 2020-02-06

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-04-24

- 2020-02-02

- 2020-03-11

- 2020-04-14

- 2020-01-10

- 2020-01-10

- 2020-03-26

- 2020-01-09

- 2020-01-10

- 2020-04-15

- 2020-01-09

- 2019-12-06

- 2020-01-09

- 2020-01-10

- 2020-05-03

- 2019-01-04

- 2020-03-30

- 2020-04-23

- 2020-01-10