如何帮助宁夏考生高效的学习ACCA考试?

发布时间:2020-01-10

2020年已经到来,第一次ACCAer们对考试已经了解了多少了呢?一点也不了解也不用担心,51题库考试学习网帮助大家收集到了一些关于考试的高效学习技巧,希望对备考的你有多帮助,现在且随51题库考试学习网,告诉你怎有哪些技巧吧:

复习的首要任务是巩固和加深对所学知识的理解和记忆。首先,要根据教材的知识体系确定好一个中心内容,把主要精力集中在教材的中心、重点和难点上,不真正搞懂,决不放松。其次,要及时巩固,防止遗忘。复习最好在遗忘之前,倘若在遗忘之后,效率就低了。复习还要经常,不能一曝十寒。

对于一个新人而言,刚刚学ACCA,肯定都在想:我是报班呢还是报班呢?报班的话该选择什么样的辅导班?其次,如果自学的话有没有希望?

首先,明确一点,无论是否报班学习,最终决定成败的还是自己。

其次ACCA学习是一个由浅入深、由简到难的过程。对于学习能力好的大神来说,选择自学也是没有问题的!但是这个过程会耗时耗力,难抓住重点,如果有高顿经验丰富的老师身经百战总结出来的重要知识点,将会如虎添翼!

最后自学备考ACCA的过程重在坚持,但是大多数人都会被周围的事情分散注意力而导致备考意志力不够坚定,最后的结果也很失败。而报高顿ACCA面授课,除了有专业讲师系统性的讲解,针对性的答疑,能遇到许多志同道合的小伙伴,互相鼓励,互相监督,更有负责的学管团队全程及时提醒沟通,帮你克服意志力薄弱的问题,早日全科通关。

学习acca是否有必要参加辅导班

根据每个人的基础来判别,有些基础比较好的考生,简单的科目完全自学,难点科目自己看看网课就可以顺利通过了;基础一般的同学大部分科目需要借助网课的帮助来通过考试;基础较差的同学可能就需要面授课老师来帮忙了。不管哪个级别的考生,基本上是不太可能不借助任何辅导通过的。

基础较差的考生参加ACCA辅导班跟着老师学习,会轻松很多,也会节省很多时间,自己自学不知道重点,遇到知识点要弄很久才弄明白,比较费劲。

所以考生们可以根据自己的情况来安排辅导的力度哦。

具体的备考步骤分为以下四步:

第一步是拿2-3套ACCA真题,自己扫一遍所有的题干,可以不看题目,然后用这几套真题总结一下出题的套路和重点的知识点。ACCA的考试中重要的知识点一定是每年都出的,用这几套完全可以总结出重要知识点。当然如果真的基础不错,可以拿一套真题先做一下,然后你就有动力去进行后续的复习了。

第二步是看书,不过是先根据课本的目录,给自己梳理出来一个框架图,然后结合第一步的总结,所有的重点都一目了然。

第三步就是看书了,ACCA的教材一般会分为16-18个章节,一个章节如果完全投入进去阅读,两个小时完全可以搞明白。更何况最开始还整理出来了重点,那么复习详略得当,这个时间是足够的。还要注意一下就是每个章节如果真题中有考到这个章节的知识点,BPP的教材是会给出提示的,务必保证每个章节在学习完做一道题,总结答题思路。

最后一步是真题,一具体就要做的真题数目决定。51题库考试学习网建议大家有时间就尽量多做题,虽然题海战术不算什么高端的战术,但它却是最有用的。用来检测知识点是否掌握,如果是重要知识点没掌握,务必要回去复习了。

总结必考题的答题套路,就想F7/P2的合并报表,一定有它必备的一些步骤一样,这些必考题一定有每年都要做的相同部分。

完全的考前模拟,看看考试的时候如何安排时间比较合理。

以上就是关于备考ACCA考试的相关经验分享,你Get到了吗?俗话说,好的开始是成功的一半,大家要积极地认真地备考ACCA考试哦,要相信你所付出的一定会得到结果的~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Advise Mr Fencer of the income tax implications of the proposed financing arrangements. (2 marks)

(ii) The income tax implications of the proposed financing arrangements

Mr Fencer has borrowed money from a UK bank in order to make a loan to Rapier Ltd, a close company. The interest

paid by Mr Fencer to the bank will be an allowable charge on income as long as he continues to hold more than 5% of

Rapier Ltd. Charges on income are deductible in arriving at an individual’s statutory total income.

Mr Fencer will receive interest from Rapier Ltd net of 20% income tax. The gross amount of interest will be subject to

income tax at either 10%, 20% or 40% depending on whether the income falls into Mr Fencer’s starting rate, basic rate

or higher rate tax band. Mr Fencer will obtain a tax credit for the 20% income tax suffered at source.

2 Benny Korere has been employed as the sales director of Golden Tan plc since 1994. He earns an annual salary of

£32,000 and is provided with a petrol-driven company car which has a CO2 emission rate of 187g/km and had a

list price when new of £22,360. In August 2003, when he was first provided with the car, Benny paid the company

£6,100 towards the capital cost of the car. Golden Tan plc does not pay for any of Benny’s private petrol and he is

also required to pay his employer £18 per month as a condition of being able to use the car for private purposes.

On 1 December 2006 Golden Tan plc notified Benny that he would be made redundant on 28 February 2007. On

that day the company will pay him his final month’s salary together with a payment of £8,000 in lieu of the three

remaining months of his six-month notice period in accordance with his employment contract. In addition the

company will pay him £17,500 in return for agreeing not to work for any of its competitors for the six-month period

ending 31 August 2007.

On receiving notification of his redundancy, Benny immediately contacted Joe Egmont, the managing director of

Summer Glow plc, who offered him a senior management position leading the company’s expansion into Eastern

Europe. Summer Glow plc is one of Golden Tan plc’s competitors and one of the most innovative companies in the

industry, although not all of its strategies have been successful.

Benny has agreed to join Summer Glow plc on 1 September 2007 for an annual salary of £39,000. On the day he

joins the company, Summer Glow plc will grant him an option to purchase 10,000 ordinary shares in the company

for £2·20 per share under an unapproved share option scheme. Benny can exercise the option once he has been

employed for six months but must hold the shares for at least a year before he sells them.

The new job will require Benny to spend a considerable amount of time in London. Summer Glow plc has offered

Benny the exclusive use of a flat that the company purchased on 1 June 2003 for £165,000; the flat is currently

rented out. The flat will be made available from 1 September 2007. The company will pay all of the utility bills

relating to the flat as well as furnishing and maintaining it. Summer Glow plc has also suggested that if Benny would

rather live in a more central part of the city, the company could sell the existing flat and buy a more centrally located

one, of the same value, with the proceeds.

On 15 March 2007 Benny intends to sell 5,800 shares in Mahana plc, a quoted company, for £24,608. His

transactions in the company’s shares have been as follows:

£

June 1988 Purchased 8,400 shares 6,744

February 1996 Sale of rights nil paid 610

January 2005 Purchased 1,300 shares 2,281

The sale of rights, nil paid, was not treated as a part disposal of Benny’s holding in Mahana plc.

Benny’s shareholding in Mahana plc represents less than 1% of the company’s issued ordinary share capital. He will

not make any other capital disposals in 2006/07.

In addition to his employment income, Benny receives rental income of £4,000 (net of deductible expenses) each

year. He normally submits his tax return in August but he has not yet prepared his return for 2005/06. He expects

to be very busy in December and January and is planning to prepare his tax return in late February 2007.

Required:

(a) Calculate Benny’s employment income for 2006/07. (4 marks)

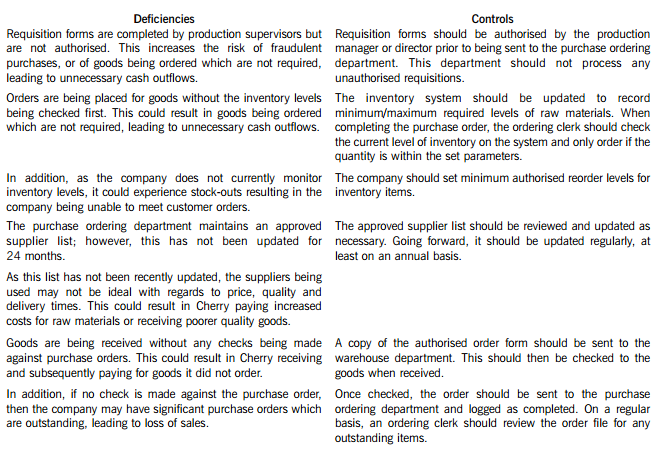

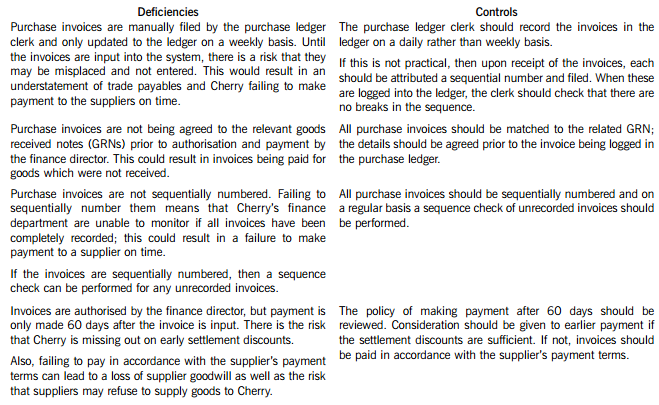

Cherry Blossom Co (Cherry) manufactures custom made furniture and its year end is 30 April. The company purchases its raw materials from a wide range of suppliers. Below is a description of Cherry’s purchasing system.

When production supervisors require raw materials, they complete a requisition form. and this is submitted to the purchase ordering department. Requisition forms do not require authorisation and no reference is made to the current inventory levels of the materials being requested. Staff in the purchase ordering department use the requisitions to raise sequentially numbered purchase orders based on the approved suppliers list, which was last updated 24 months ago. The purchasing director authorises the orders prior to these being sent to the suppliers.

When the goods are received, the warehouse department verifies the quantity to the suppliers despatch note and checks that the quality of the goods received are satisfactory. They complete a sequentially numbered goods received note (GRN) and send a copy of the GRN to the finance department.

Purchase invoices are sent directly to the purchase ledger clerk, who stores them in a manual file until the end of each week. He then inputs them into the purchase ledger using batch controls and gives each invoice a unique number based on the supplier code. The invoices are reviewed and authorised for payment by the finance director, but the actual payment is only made 60 days after the invoice is input into the system.

Required:

In respect of the purchasing system of Cherry Blossom Co:

(i) Identify and explain FIVE deficiencies; and

(ii) Recommend a control to address each of these deficiencies.

Note: The total marks will be split equally between each part.

Cherry Blossom Co’s (Cherry) purchasing system deficiencies and controls

(d) Explain the term ‘environmental management accounting’ and the benefits that may accrue to organisations

which adopt it. (4 marks)

(d) Environmental management accounting (EMA) involves the generation and analysis of both financial and non-financial

information in order to support internal environmental management processes. It is complementary to the conventional

management accounting approach, with the aim to develop appropriate mechanisms that assist the management of

organisations in the identification and allocation of environmentally related costs.

Organisations that alter their management accounting practices to incorporate environmental concerns will have greater

awareness of the impact of environment-related activities on their profit and loss accounts and balance sheets. This is because

conventional management accounting systems tend to attribute many environmental costs to general overhead accounts with

the result that they are ‘hidden’ from management. It follows that organisations which adopt EMA are more likely to identify

and take advantage of cost reduction and other improvement opportunities. A concern with environmental costs will also

reduce the chances of employing incorrect pricing of products and services and taking the wrong options in terms of mix and

development decisions. This in turn may lead to enhanced customer value whilst reducing the risk profile attaching to

investments and other decisions which have long term consequences.

Reputational risk will also be reduced as a consequence of adopting (EMA) since management will be seen to be acting in

an environmentally responsible manner. Organisations can learn from the Shell Oil Company whose experience in the much

publicised Brent Spar incident cost the firm millions in terms of lost revenues as a result of a consumer boycott.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-02-19

- 2020-01-29

- 2020-01-10

- 2020-04-11

- 2020-01-09

- 2020-02-02

- 2020-01-09

- 2019-02-15

- 2020-01-09

- 2020-01-10

- 2020-02-19

- 2020-05-09

- 2020-01-10

- 2020-05-14

- 2020-01-09

- 2020-05-06

- 2020-01-01

- 2020-05-06

- 2020-02-02

- 2020-04-11

- 2020-03-04

- 2020-05-13

- 2020-01-10

- 2020-01-10

- 2020-04-21

- 2020-04-07

- 2020-05-21

- 2020-01-09

- 2020-01-09