山东省ACCA考试成绩查询时间

发布时间:2021-01-07

山东的考生们一直有在持续关注ACCA考试,尤其想知道考试成绩查询是什么时候,查询需要怎么操作,想了解情况的考生们,一定要看下去哦。

2020年12月ACCA考试成绩预计2021年1月18日左右公布,在此分享几点成绩查询后考生们比较关注的几点事项,以便大家查阅!

ACCA考试成绩合格标准:ACCA考试每科满分为100分,50分合格。ACCA考试不会控制一定的考试通过率,因此每门考试只要满足50分及以上即算作通过考试。

ACCA证书申请:

1、通过ACCA专业资格大纲13门课程的考试(其中9门根据学员的教育和专业背景可申请不同程度的免试);

2、完成职业道德与专业技能模块(EPSM);

3、至少三年的相关工作经验。

ACCA证书申请流程:

1、 符合会员的必要条件”3E”的准会员可以填写《ACCA会员申请表》。《ACCA会员申请表》可以直接登陆ACCA网站下载。对于暂时未满足会员的必要条件的准会员,可以在条件满足的任何时间向ACCA递交ACCA会员申请表;

2、 ACCA总部将对会员申请材料进行审核,完全符合条件者将被批准成为ACCA会员,并会收到ACCA英国总部颁发的ACCA会员证书。一般这个过程需要两个月的时间;成为会员约五年后,经申请和资格审查,可以成为资深会员(FCCA)。

3、 ACCA每年2月份和8月份会分别公布上一年12月份和本年6月份的考试成绩。每一个通过ACCA全部考试的学员随后会收到ACCA英国总部颁发的ACCA准会员证书,以确认学员成功通过所有考试。(一般收到时间是3月初和9月初)。

ACCA官方公布的以下情况下之一者,可以申请复议:

(1)参加了考试,并提交了答卷,却通知缺席考试;

(2)缺席考试,却收到考试成绩;

(3)对考试成绩有异议。

如果符合以上情况之一,ACCA学员必须在考试成绩发布日后的15个工作日内提出查卷申请。如果成绩有误,会在下次报考截止日期前收到改正后的成绩。

ACCA继续教育:为保持并更新专业知识和技能,ACCA要求所有会员必须每年参加累计不少于40学时的继续教育。

现在考生们都清楚什么时候查询成绩了吧,关注51题库考试学习网,获得更多资讯哦。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Discuss whether gains and losses that have been reported initially in one section of the performance

statement should be ‘recycled’ in a later period in another section and whether only ‘realised’ gains and

losses should be included in such a statement. (9 marks)

(ii) Recycling is an issue for both the current performance statements and the single statement. Recycling occurs where an

item of financial performance is reported in more than one accounting period because the nature of the item has in some

way changed. It raises the question as to whether gains and losses originally reported in one section of the statement

should be reported in another section at a later date. An example would be gains/losses on the retranslation of the net

investment in an overseas subsidiary. These gains could be reported annually on the retranslation of the subsidiary and

then again when the subsidiary was sold.

The main arguments for recycling to take place are as follows:

1. when unrealised items become realised they should be shown again

2. when uncertain measurements become certain they should be reported again

3. all items should be shown in operating or financing activities at some point in time as all items of performance are

ultimately part of operating or financing activities of an entity.

There is no conceptual justification for recycling. Once an item has been recognised in a statement of financial

performance it should not be recognised again in a future period in a different part of that statement. Once an item is

recognised in the statement there is an assumption that it can be reliably measured and therefore it should be recognised

in the appropriate section of the statement with no reason to show it again.

Gains and losses should not be based on the notion of realisation. Realisation may have been a critical event historically

but given the current financial exposures of many entities, such a principle has limited value. A realised gain reflects the

same economic gain as an unrealised gain. Items should be classified in the performance statement on the basis of

characteristics which are more useful than realisation. The effect of realisation is explained better in the cash flow

statement. Realisation means different things in different countries. In Europe and Asia it refers to the amount of

distributable profits but in the USA it refers to capital maintenance. The amount of distributable profits is not an

accounting but a legal issue, and therefore realisation should not be the overriding determinant of the reporting of gains

and losses.

An alternative view could be that an unrealised gain is more subjective than a realised gain. In many countries, realised

gains are recognised for distribution purposes because of their certainty because this gives more economic stability to

the payment of dividends.

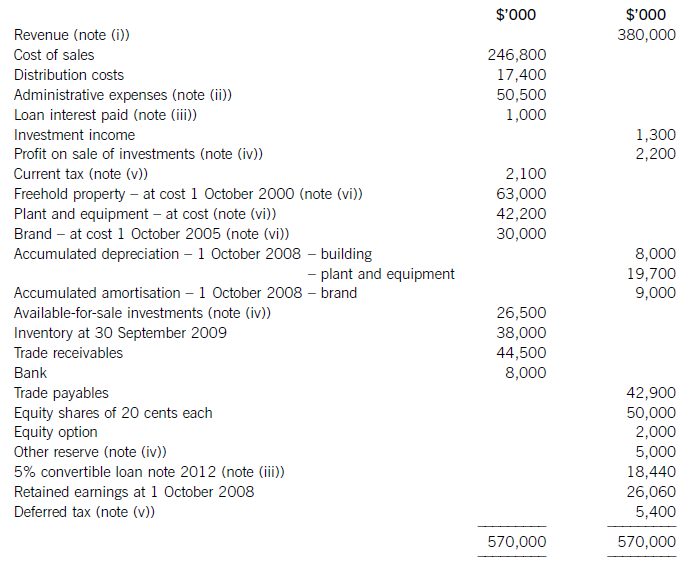

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

(c) Using sensitivity analysis, estimate by what percentage the life cycle of the Snowballer would need to change

before the recommendation in (a) above is varied. (4 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-10-19

- 2020-04-01

- 2021-04-04

- 2020-10-18

- 2020-09-05

- 2021-04-04

- 2020-10-19

- 2020-01-10

- 2020-08-12

- 2019-03-20

- 2020-01-10

- 2020-09-05

- 2021-04-07

- 2020-02-23

- 2020-01-10

- 2021-01-08

- 2020-09-05

- 2019-03-20

- 2021-04-04

- 2019-03-20

- 2020-01-10

- 2020-10-18

- 2020-02-23

- 2019-03-20

- 2020-01-10

- 2020-09-05

- 2020-08-12

- 2021-01-07

- 2020-01-10

- 2020-09-05