必看:2020太原理工大学考研成绩复核-考研成绩复核流程及注意事项

发布时间:2020-03-15

注意了,各位小伙伴注意了,2020考研成绩查询入口及查询方式公布了,当前很多院校陆续开展考研成绩复核工作,考生如对本人成绩有疑问,可在复核成绩申请时间内按照报考单位公布的成绩复核申请方式和相关要求提出成绩复核申请。现为大家分享“2020太原理工大学考研成绩复核-考研成绩复核流程及注意事项”内容,希望能给2020考研考生提供帮助,一起来看看吧。

太原理工大学2020考研成绩复核结果公告近期即将公布,请各位考研考生及时关注太原理工大学研究生院官网(http://www.gs.tyut.edu.cn/)。

如何进行考研成绩复核?考研成绩复核流程及注意事项如下:

一、考研成绩复核是什么?

查询成绩后,考生如对考试成绩有疑义,可申请成绩复核,但成绩复核一般只核查考生答卷是否有漏评、加分错、登分错,不重新评阅答卷;复核结果只向考生提供所复核科目成绩总分,根据国家教育部教学司[2007]28号文中有关试卷保密的规定,复核试卷时一般省教育考试院及该校研究生院组织专门人员负责对考生试卷进行复核,考生本人不得查阅答卷。

二、考研成绩复核门数

大家填写申请过程中要注意学校是否有复核门数的限制,如:华南理工规定每位考生申请复核成绩的科目不超过2门。填写超过2门的,只复核前两门。

三、考研成绩复核时间

成绩的复核时间都是由目标院校进行通知的,所以在成绩公布之后,通常会紧随着公布成绩复核通知,好好查看复核时间。一般需在规定日期内提交申请,1—5天不等。

四、成绩复核查询方式

成绩复核查询方式有四种:电子邮件、电话查询、考生本人亲自去报考院校查询和考生委托他人去报考去院校查询。成绩复核告知方式有:电话通知或官网公布,由于各院校成绩复核方式不同,具体查询及告知方式请前往院校官网查看。

五、成绩复核准备材料

准考证、身份证、成绩核查表(院校官网下载)等。此外,部分院校会按科次收取一定复核费用,一般在10元/科。

今天分享的内容到此结束,相信各位小伙伴都了解清楚了,查询之后不可因成绩理想就暗自欣喜,应该为后面的复试环节做足准备,最后一刻的胜利才是最终的胜利,加油!

下面小编为大家准备了 研究生入学 的相关考题,供大家学习参考。

The development,hundreds of years ago,of ship and cargo insurance was revolutionary.It marked the start of commercial insurance;protection against loss from fire and the perils of the high seas fostered global trade.But in the 21st century the value of companies consists less of solid objects,such as boats and buildings,than of intangible elements,such as intellectual property,data and reputation."Today the most valuable assets are more likely to be stored in the cloud than in a warehouse,"says Inga Beale,chief executive of Lloyd's of London.As the importance of intangibles has grown,so has companies'need to protect themselves against"intangible risks"of two types:damage to intangible assets(eg,reputational harm caused by a tweet or computer hack);or posed by them(say,physical damage or theft resulting from a cyberattack).Companies are not oblivious.Respondents to a survey last year by Aon,an insurance broker,ranked reputation as their top risk and cyber-risk as their fifth.But there is a big difference between how risk managers perceive such risks and how boards do.And if firms do seek insurance against some of these risks,insurers have not exactly been giving them too many novel products.Even when policies are labelled"innovative"it's usually to insure physical assets in the sharing economy rather than intangibles.But in a world where Airbnb,in effect the world's largest hotel chain,owns no hotels and Uber,its largest taxi firm,owns no cabs,such policies are of limited use.Those that do protect assets such as data,IP and reputation are often expensive and custom-made,and include strict exclusions and lrmits.Insurers'caution is understandable.Intangible risks are not only new and comple)c"They're a bit like not-yet-set jelly,"says Julia Graham of Airmic."Their shape constantly changes."Underwriters like to look at past data on events'frequency as well as clients'current exposure-which may be next to impossible when assessing the risk and impact of a cyberattack,or a scandal,which would have been very differently priced even a couple of years ago.But some underwriters are starting to come up with more suitable policies.One is parametric cover,which pays a fixed amount automatically after a defined event,such as a hack.The advantage of such policies is that they can provide cash quickly,meeting an immediate need after misfortune strikes.The downside is that these products tend to cover only a share of damages.Companies also have to do more to protect themselves.Just as insurance was only part of the answer to fire and maritime risk,it is only part of the answer to modern perils.Plenty of cyber-breaches could doubtless have been avoided if software had simply been kept up to date.Insurers need to catch up with the intangible age;but so do their clients.

In the last two paragraphs,the author suggests that

A.parametric cover performs quite well in assessing the costs of misfortune.

B.companies need to buy several types of insurance to protect themselves.

C.companies and insurers should work together to protect against intangible risks.

D.insurers should keep updating their software to protect the privacy of their clients.

答案:C

解析:

第六段指出:企业也须努力保护自己,保险只是现代风险的“部分答案”;保险商需跟上无形时代步伐,它们的客户(即企业)也应如此。可见作者认为企业和保险公司应共同防范无形风险,C.正确。[解题技巧]A.将第五段首句suitable policies断章取义为“参数化保险擅长评估不幸事件的成本”,但由下文可知,参数化保险采用的是“赔偿固定数额”,而不能“有效评估成本”,它只是一种“相对更合适的保险”。B.将第六段首句companies also have to do more to protect themselves(公司需更加努力保护自己免于无形风险)错误理解为“公司应购买多个险种”。D.将末段③句所述“企业做法——更新软件”张冠李戴为“保险公司做法”,并捏造出“保护客户隐私”这一无关信息。

髓海不足,则可导致( )

A.脑转耳鸣

B.目无所见

C.懈怠安卧

D.胫酸脚软

答案:A,B,C,D

解析:

“髓海不足,则脑转耳鸣,胫酸眩冒,目无所见,懈怠安卧。”

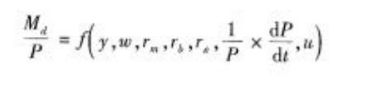

弗坦德曼现代货币数量论认为名义货币需求总量与收入正相关。()

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。