有考友知道ACCA成绩有效期是多久呢?

发布时间:2021-06-05

有考友知道ACCA成绩有效期是多久呢?

最佳答案

ACCA考试分为F阶段和P阶段考试,F阶段成绩永久有效,P阶段要在7年内考完。P阶段这7年有效期到期后,从P阶段首次考过科目开始滚动失效,需要重新参加考试。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Explain THREE strategies that might be adopted in order to improve the future prospects of Diverse

Holdings Plc. (6 marks)

(ii) The forecast situation of Diverse Holdings Plc is not without its problems. KAL and OPL require the immediate attention

of management. The position of KAL is precarious to say the least. There is a choice of strategies for it:

(i) Outsource the manufacture of appliances

(ii) Set up a manufacturing operation overseas

(ii) Withdraw from the market.

Each alternative must be assessed. Whatever decision is taken it is unlikely to affect the other four subsidiaries.

PSL is also independent of the other subsidiaries. A strategic decision to widen its range of products and outlets must

surely help. Hence management should endeavour to find new markets for its products, which are separate and distinct

from those markets served by its appointed distributors.

21

In order to improve the prospects of OPL management need to adopt appropriate strategies since at the present time the

company appears to be in a high growth market but is unable to capture a reasonable market share. Perhaps the answer

lies in increased or more effective advertising of the endorsement of the product range by health and safety experts.

Management should endeavour to develop a strategy to integrate further its subsidiaries so that they can benefit from

each other and also derive as much synergy as possible from the acquisition of HTL.

It is of paramount importance that management ensure that sufficient funds are channelled into growing OFL and HTL,

which are both showing a rising trend in profitability. The group has depleted cash reserves which must to some extent

be attributable to the purchase of HTL. It is possible that the divestment of KAL would provide some much needed

funding.

(b) Write a letter to Joanne setting out the value added tax (VAT) registration requirements and advising on

whether or not she should or could register for VAT and if registered if she could recover the VAT suffered on

the consultancy fees and computer purchased in October 2005. (7 marks)

(b) [Joanne’s address] [Firm’s address]

Dear Joanne 5 February 2006

I am writing to you in order to set out the value added tax (VAT) issues you face on registering your trade, together with some

other aspects of VAT that are relevant to you.

Registration

VAT registration is compulsory once taxable supplies exceed £58,000. This turnover figure is based on the value of your

cumulative taxable supplies in the previous 12 months. You have an obligation to inform. Customs within 30 days of the end

of the month in which the annual limit is exceeded. Registration will become effective on the first day of the following month.

VAT registration is also required if there are reasonable grounds for believing that the taxable supplies in the following 30 days

will exceed £58,000. In such cases, notification is required by the end of that 30 day period with registration being effective

from the start of that period.

Based on your estimates of taxable supplies, you will exceed the annual limit in October 2006 when your cumulative turnover

will be £62,000. You will therefore have to inform. Customs by the end of November. Your registration will be effective as of

1 December 2006.

You also have the option of voluntarily registering prior to then in which case you will normally become registered from the

date you applied. This is useful where your sales are to VAT registered customers for whom the extra VAT would not be a cost.

You would then be able to recover VAT on your attributable costs. However, you will have to comply with the VAT

administrative requirements.

Recovery of pre-registration VAT

It is possible to claim the recovery of VAT incurred prior to registering for VAT. There are some conditions, however. The costs

of the goods or services must have been incurred for the purpose of the business and there are time limits. You have three

years from the effective date of registration to recover the VAT on fixed assets (such as your computer) but only six months in

the case of purchased services (such as the consultancy fees).

As a result, I would recommend that you apply for voluntary registration as soon as possible, as registering after 1 April 2006

will mean that you will be unable to reclaim the VAT on your consultancy fees.

I hope the above information is useful to you.

Yours sincerely,

A. Consultant.

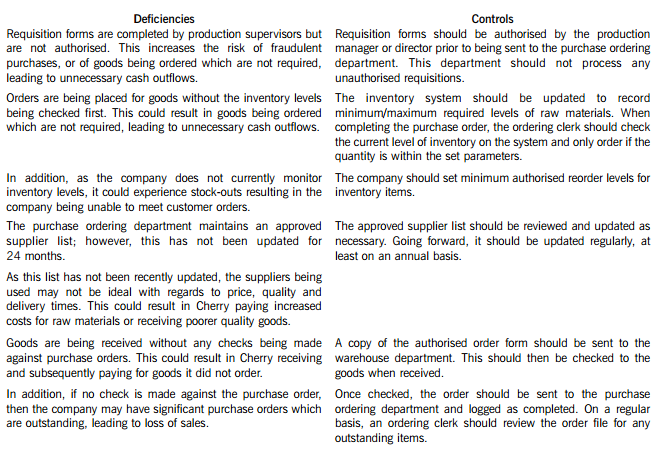

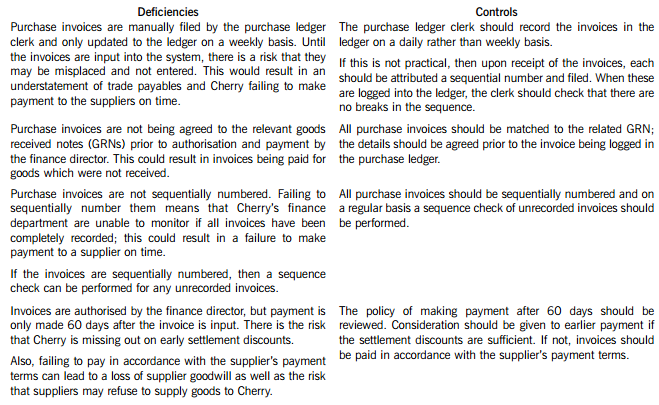

Cherry Blossom Co (Cherry) manufactures custom made furniture and its year end is 30 April. The company purchases its raw materials from a wide range of suppliers. Below is a description of Cherry’s purchasing system.

When production supervisors require raw materials, they complete a requisition form. and this is submitted to the purchase ordering department. Requisition forms do not require authorisation and no reference is made to the current inventory levels of the materials being requested. Staff in the purchase ordering department use the requisitions to raise sequentially numbered purchase orders based on the approved suppliers list, which was last updated 24 months ago. The purchasing director authorises the orders prior to these being sent to the suppliers.

When the goods are received, the warehouse department verifies the quantity to the suppliers despatch note and checks that the quality of the goods received are satisfactory. They complete a sequentially numbered goods received note (GRN) and send a copy of the GRN to the finance department.

Purchase invoices are sent directly to the purchase ledger clerk, who stores them in a manual file until the end of each week. He then inputs them into the purchase ledger using batch controls and gives each invoice a unique number based on the supplier code. The invoices are reviewed and authorised for payment by the finance director, but the actual payment is only made 60 days after the invoice is input into the system.

Required:

In respect of the purchasing system of Cherry Blossom Co:

(i) Identify and explain FIVE deficiencies; and

(ii) Recommend a control to address each of these deficiencies.

Note: The total marks will be split equally between each part.

Cherry Blossom Co’s (Cherry) purchasing system deficiencies and controls

(b) Discuss the view that fair value is a more relevant measure to use in corporate reporting than historical cost.

(12 marks)

(b) The main disagreement over a shift to fair value measurement is the debate over relevance versus reliability. It is argued that

historical cost financial statements are not relevant because they do not provide information about current exchange values

for the entity’s assets which to some extent determine the value of the shares of the entity. However, the information provided

by fair values may be unreliable because it may not be based on arm’s-length transactions. Proponents of fair value

accounting argue that this measurement is more relevant to decision makers even if it is less reliable and would produce

balance sheets that are more representative of a company’s value. However it can be argued that relevant information that is

unreliable is of no use to an investor. One advantage of historical cost financial information is that it produces earnings

numbers that are not based on appraisals or other valuation techniques. Therefore, the income statement is less likely to be

subject to manipulation by management. In addition, historical cost balance sheet figures comprise actual purchase prices,

not estimates of current values that can be altered to improve various financial ratios. Because historical cost statements rely

less on estimates and more on ‘hard’ numbers, it can be said that historical cost financial statements are more reliable than

fair value financial statements. Furthermore, fair value measurements may be less reliable than historical costs measures

because fair value accounting provides management with the opportunity to manipulate the reported profit for the period.

Developing reliable methods of measuring fair value so that investors trust the information reported in financial statements is

critical.

Fair value measurement could be said to be more relevant than historical cost as it is based on market values and not entity

specific measurement on initial recognition, so long as fair values can be reliably measured. Generally the fair value of the

consideration given or received (effectively historical cost) also represents the fair value of the item at the date of initial

recognition. However there are many cases where significant differences between historical cost and fair value can arise on

initial recognition.

Historical cost does not purport to measure the value received. It cannot be assumed that the price paid can be recovered in

the market place. Hence the need for some additional measure of recoverable value and impairment testing of assets.

Historical cost can be an entity specific measurement. The recorded historical cost can be lower or higher than its fair value.

For example the valuation of inventory is determined by the costing method adopted by the entity and this can vary from

entity to entity. Historical cost often requires the allocation of costs to an asset or liability. These costs are attributed to assets,

liabilities and expenses, and are often allocated arbitrarily. An example of this is self constructed assets. Rules set out in

accounting standards help produce some consistency of historical cost measurements but such rules cannot improve

representational faithfulness.

Another problem with historical cost arises as regards costs incurred prior to an asset being recognised. Historical costs

recorded from development expenditure cannot be capitalised if they are incurred prior to the asset meeting the recognition

criteria in IAS38 ‘Intangible Assets’. Thus the historical cost amount does not represent the fair value of the consideration

given to create the asset.

The relevance of historical cost has traditionally been based on a cost/revenue matching principle. The objective has been to

expense the cost of the asset when the revenue to which the asset has contributed is recognised. If the historical cost of the

asset differs from its fair value on initial recognition then the matching process in future periods becomes arbitrary. The

measurement of assets at fair value will enhance the matching objective. Historical cost may have use in predicting future

net reported income but does not have any necessary implications for future cash flows. Fair value does embody the market’s

expectations for those future cash flows.

However, historical cost is grounded in actual transaction amounts and has existed for many years to the extent that it is

supported by practical experience and familiarity. Historical cost is accepted as a reliable measure especially where no other

relevant measurement basis can be applied.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2021-04-23

- 2021-03-12

- 2021-12-31

- 2021-04-17

- 2021-03-10

- 2021-03-11

- 2021-03-10

- 2021-03-10

- 2021-06-20

- 2021-04-14

- 2021-03-10

- 2021-04-15

- 2021-05-27

- 2021-04-23

- 2021-03-11

- 2021-01-01

- 2021-03-12

- 2021-01-04

- 2021-03-11

- 2021-04-16

- 2021-05-20

- 2021-06-02

- 2021-03-13

- 2021-03-11

- 2021-02-15

- 2021-03-12

- 2021-12-31

- 2021-03-12

- 2021-06-29

- 2021-03-11