零基础如何备考ACCA?

发布时间:2022-05-21

ACCA,国际注册会计师,具有国际性、实用性及低门槛等特征,在我国越来越受到关注。那么ACCA考试难吗?有专业限制吗?零基础该如何备考ACCA?许多零基础考生对于ACCA考试有着很多的疑问。接下就和51题库考试学习网一起看看吧!

首先,大家需要具备一定的英语水平。大家可以通过阅读往年考试试卷来判断自己是否具备读懂题目的能力,可能有些单词不认识,但是这个不影响,只要题干能看懂即可。备考中大家需要进行财会专业英语的学习。通常我们建议考生可以在大一就开始着手准备,因为大家刚经历过高考的洗礼,英语水平正处于一个最好的状态。而且语言本来就是靠积累的,不是一天两天就能有质的飞跃的,而是需要长时间的积累。

其次,大家先要对ACCA进行一个详细的了解,再结合自身实际做好合理的备考计划。由于初期阶段几门考试比较简单,大家可以开始看基础知识阶段的教材,同时提升自己专业英语的水平。专业英语水平的提升,既可以帮助大家拿到ACCA证书,也可以为将来到外企工作提供便利。

再次,由于大家是零基础考生,备考具备一定难度,需要做好心理准备并制定切实的合理的学习规划。备考可以采取英语教材和汉语知识点讲义结合的方式,要理论和实际相结合,以便快速掌握知识点。有条件的考生,也可以考虑报班学习,能够更大程度上减少自己的压力,在老师的指导下可以节省很多时间,避免走弯路。方案不必排得太满,万一工作比较忙,还能够互相调济。要严格按照计划实行,对自己高要求。此外,开始实行学习计划后的一个月或者半个月要做一次汇总,依据具体情况适度布局调整学习计划。

最后,对于一部分零基础考生来说,可以采取CPA与ACCA协同复习的形式,对于打算从事财会行业的考生来说,CPA也是至关重要的证书。CPA与ACCA知识点重合部分较多,但是难度也相对更大,胜在是汉语考试,对于零基础考生可以进行协同理解,以便快速进行知识点的掌握。

ACCA证书,属于考试难度相对适中,但是用处较多的证书,国内只有CPA才可以相媲美,但是难度却比CPA考试低很多,并被外企所看好。只要大家有坚持不懈的决心,并付出相应的努力,零基础也照样可以拿到ACCA证书。

以上就是今天51题库考试学习网为同学们分享的全部内容了,各位考生一定要好好利用时间备考,成功是为有准备的人准备的,希望每个努力的小伙伴都能取得最后的胜利,加油!后续51题库考试学习网还将为同学们更新ACCA考试的相关内容,请大家多多关注,谢谢!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

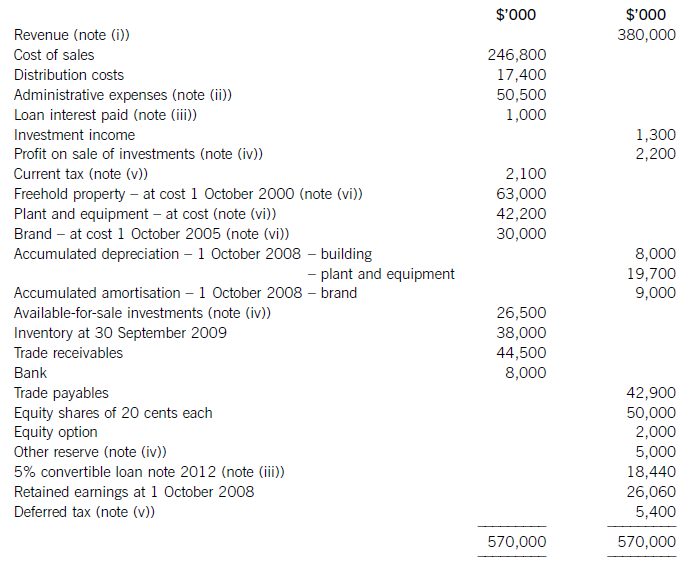

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

(b) Explain the advantages and the disadvantages of:

(i) the face to face interview between two people; (6 marks)

(b) (i) The face to face interview is the most common form. of interview. In this situation the candidate is interviewed by a single representative of the employing organisation.

The advantages of such interviews are that they establish an understanding between the participants, are cost effective for the organisation (only one member of the organisation’s staff is involved) and, because of the more personal nature, ensure that candidates feel comfortable.

The disadvantages are that the selection interview relies on the views and impression of a single interviewer that can be both subjective and biased. In addition, the interviewer may be selective in questioning and it is easier for the candidate to hide weaknesses or lack of ability.

(b) Using the information provided in the case scenario, strategically evaluate the performance of the company

up to 2004, indicating any areas of particular concern. (20 marks)

(b) Essentially, Universal is a one product or service company selling its services into two main customer segments in the housing

market. From the performance information provided in Table 1, the company has achieved impressive rates of growth over

the 2001–4 period and this growth has come almost exclusively from private house owners. Universal is in the replacement

market. Its customers are looking to replace existing roofing systems with low maintenance/high attractiveness Universal

systems. To date growth has been exclusively within one region and been achieved by growing the area served through

investment in showrooms and depots.

Universal has chosen to grow its business through a differentiation focus strategy. It has identified a niche not served by the

major PVC doors and windows installers and poorly served by small independent installers. The value chain analysis

discussed above has shown the ways in which Universal has successfully distinguished itself from its competitors. Growth

has been through increasing its market penetration of one particular region. Such is the size of the private house owner market

and the lack of effective competition that the company has achieved a significant share of the market in its particular region.

However, in national terms, with 1% of the available market, Universal is a small operator. What is clear from the sales figures

is that as the firm grows bigger the relative rate of growth inevitably slows down, so that by 2004 it has an annual growth of

27% – still impressive by most companies standards. The move into supplying the commercial housing market has been

successful, but the share of total sales seems to have stabilised at around 5%. Universal clearly is finding it difficult to commit

sufficient new resources to this sector while coping with the growth from the domestic housing sector. Direct labour and other

direct costs seem to be a reasonable proportion of sales and predictably grow with the number of installation teams. Overall,

the gross margin, which sustains sales, marketing and overhead expenses, is moving in the right direction with a gross margin

of 52·6% achieved in 2004.

Labour, not surprisingly in a service business, consumes a considerable amount of costs. If one combines the direct labour

with the commission costs of sales canvassers and representatives together with salaries to staff in head office, one is in a

business where well over 50% of costs are attributable to people. Equally important is the fact that over 80% of the staff

employed by Universal is paid by results. This has significant consequences for the structure of reward systems and the

training and development of staff looking to maximise their incomes through either their individual or team performance.

Clearly, Universal sees no incompatibility between a reward system dominated by payments by results and the delivery of a

quality service differentiating it from its competitors.

Marketing has grown considerably over the period and reflects the recruitment of Mick Hendry as Sales and Marketing Director

in 2002. The marketing and sales model is very much one influenced by the one used by large PVC installers of doors and

windows. Here there is a heavy emphasis on direct selling techniques supported by increasing levels of advertising. Universal

sells to its customers directly and therefore avoids the costs and channel complications of using third parties to provide its

services. In many ways the direct selling techniques used are a very well established way of reaching the customer. Elements

of the marketing mix may be influenced by changes in communication technology, but the nature of the service requires

effective face-to-face contact with the customer. Sales to private house owners using credit generates significant finance

commission and is an important source of extra margin to Universal. Often in businesses depending on significant amounts

of credit sales the sales representative receives significant reward for selling a finance arrangement to the customer.

In terms of net profit achieved, 2001 and 2002 represents a significant change and, as argued in the scenario, this reflects

the recruitment of the Sales and Marketing Director. The achievement of this ‘step change’ in sales required commensurate

increases in most costs, but it is the significant increase in sales costs that explains the losses experienced in 2002. Sales

costs as a proportion of total sales rose from 14% in 2001 to almost 34% in 2002.

Particularly significant is the increase in sales commissions paid. The detailed changes in the way commission is paid is not

given in the case scenario, but it seems likely to reflect the previous experience of the Sales and Marketing Director in a closely

related industry. Similar levels of sales costs are incurred in 2003 and 2004 but the increase in sales, improvement in gross

margin and slower rate of growth in commissions paid explain the improved return on sales from –6·7% in 2002 to 4·2%

in 2003 and 5·8% in 2004.

Equally significant is the growth in showrooms and depots to support the growth in sales. Each additional facility costs in the

order of £30K with significant additions to costs in terms of staff and stock. Overall the performance of Universal over the

2001–2004 period is of a company achieving high rates of growth, incurring significant costs in so doing and moving into

modest levels of profit over the period. Its cost structure reflects the service it provides and the staff and reward systemsenabling the service to be provided.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-09-04

- 2021-02-13

- 2020-10-10

- 2020-09-04

- 2020-10-18

- 2020-10-10

- 2020-10-10

- 2022-05-20

- 2021-05-30

- 2021-05-29

- 2022-05-20

- 2020-09-05

- 2021-05-29

- 2021-02-13

- 2020-10-10

- 2021-02-13

- 2019-12-29

- 2020-10-21

- 2021-05-29

- 2022-05-21

- 2020-09-04

- 2022-05-19

- 2020-10-21

- 2020-10-10

- 2020-10-10

- 2021-02-13

- 2020-10-21

- 2019-12-29

- 2020-09-05

- 2020-09-05