英国哪些学校可以免考ACCA,本文为你一一介绍!

发布时间:2020-05-02

虽然说ACCA考试有13门考试科目,但是ACCA较为人性化,给ACCA学员提供了一些免考政策,符合条件的学员可以申请ACCA的免考政策。那么如果想去英国上学的话,哪些学校可以免考ACCA呢?下面就跟51题库考试学习网一起来看看吧!

1、格拉斯哥大学(University

of Glasgow)

推荐专业:Bachelor(Hons)Accounting(Ordinary)/(Honours)Bachelor

of Accounting and Finance/Accountancy with Finance

格拉斯哥大学是苏格兰一所历史悠久的名牌大学,其学术活动至今已有长达六个世纪的历史,但是格拉斯哥大学开设的是最新的学术课程,采用的是现代教学方法。

格拉斯哥大学的会计金融专业在英国RAE评估中获得5 star,师资力量非常雄厚,有ACCA协会副会长,有三次获得诺贝尔奖提名的名人。

两个专业均可免考9门科目(F1-F9)

2、华威大学(University

of Warwick)

推荐专业:BSc Accounting and Finance

华威大学是英国排名前十的世界名校,商学院在欧洲久负盛名,同时拥有AACSB,EQUIS,AMBA三个权威组织的认证,而全英国拥有此荣誉的商学院不到1%;

在现代名牌大学质量评选中是唯一一所商务,会计与金融学都处于前三的商学院;在RAE的评选中也获得了5的最高分。其金融与会计专业位列全英前三。

另一显著特点是与金融界、商界有密切联系,因此在毕业生就业方面表现出色。

该专业可免考8门科目(F1-F4,F4-F6,F7,F9)

3、巴斯大学(University

of Bath)

推荐专业:BSc(Hons)Accounting and Finance;MSc

Accounting and Finance

巴斯大学成立于1966年,多年来,始终在独立评审机构编排的英国大学排行榜中名列前茅。会计与金融专业连续多年名列times英国大学该专业排名中的前五名位置。

专业名称虽然叫会计与金融专业,但是相对于别的学校的这个专业来说,金融的知识也不少,因此回国做会计或金融、投资等工作都没问题。

该专业本科课程:可免考6门科目(F1-F4,F7,F9)

该专业研究生课程:可免考5门科目(F1-F4,F7)

4、卡迪夫大学(CardiffUniversity)

推荐专业:BSc Accounting/Accounting and Finance

卡迪夫商学院不仅是该校最大的学院,更是欧洲最大的商学院之一。其会计和金融专业排名全英第8位,

在专业评估的Research quality指标中,卡迪夫获得4.3的最高分,而其他学校都难以望其项背。这主要归功于卡迪夫商学院极高的师资水平。

该院均是非常著名的教授与学者,有着精湛的专业知识和激情的教学态度,让商学院的学生们在学习和生活上都得到较大的收获。

该专业可免考8门科目(F1-F4,F5-F6,F8-F9)

5、斯特林大学(University

of Stirling)

推荐专业:Bachelor of Accountancy;MSc

International Accounting and Finance

斯特林大学会计与金融学专业属于该校经济和管理学院,长期以来,在传播世界经济文化和进行前沿学术研究上都享有很高的国际声誉。

本科专业可免考7门科目(F1-F4,F5,F7,F9)

研究生专业可免考6门科目(F1-F4,F7,F9)

因为篇幅过大,以上内容只是一小部分,如果想要了解更多关于ACCA的内容,可以多关注51题库考试学习网,这里有更多的考试资讯,你想知道的都在这!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

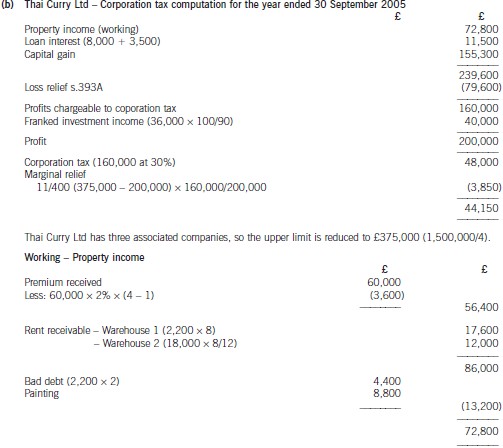

(b) Assuming that Thai Curry Ltd claims relief for its trading loss against total profits under s.393A ICTA 1988,calculate the company’s corporation tax liability for the year ended 30 September 2005. (10 marks)

(c) Explain how the introduction of an ERPS could impact on the role of management accountants. (5 marks)

(c) The introduction of ERPS has the potential to have a significant impact on the work of management accountants. The use of

ERPS causes a substantial reduction in the gathering and processing of routine information by management accountants.

Instead of relying on management accountants to provide them with information, managers are able to access the system to

obtain the information they require directly via a suitable electronic access medium.

ERPS integrate separate business functions in one system for the entire organisation and therefore co-ordination is usually

undertaken centrally by information management specialists who have a dual responsibility for the implementation and

operation of the system.

ERPS perform. routine tasks that not so long ago were seen as an essential part of the daily routines of management

accountants, for example perpetual inventory valuation. Therefore if the value of the role of management accountants is not

to be diminished then it is of necessity that management accountants should seek to expand their roles within their

organisations.

The management accountant will also control and audit the ERPS data input and analysis. Hence the implementation of ERPS

provides the management accountant with an opportunity to change the emphasis of their role from information gathering

and processing to that of the role of advisers and internal consultants to their organisations. This new role will require

management accountants to be involved in interpreting the information generated from the ERPS and to provide business

support for all levels of management within an organisation.

(b) Explain the meaning of Stephanie’s comment: ‘I would like to get risk awareness embedded in the culture

at the Southland factory.’ (5 marks)

Embedded risk

Risk awareness is the knowledge of the nature, hazards and probabilities of risk in given situations. Whilst management will

typically be more aware than others in the organisation of many risks, it is important to embed awareness at all levels so as

to reduce the costs of risk to an organisation and its members (which might be measured in financial or non-financial terms).

In practical terms, embedding means introducing a taken-for-grantedness of risk awareness into the culture of an organisation

and its internal systems. Culture, defined in Handy’s terms as ‘the way we do things round here’ underpins all risk

management activity as it defines attitudes, actions and beliefs.

The embedding of risk awareness into culture and systems involves introducing risk controls into the process of work and the

environment in which it takes place. Risk awareness and risk mitigation become as much a part of a process as the process

itself so that people assume such measures to be non-negotiable components of their work experience. In such organisational

cultures, risk management is unquestioned, taken for granted, built into the corporate mission and culture and may be used

as part of the reward system.

Tutorial note: other meaningful definitions of culture in an organisational context are equally acceptable.

(c) In April 2006, Keffler was banned by the local government from emptying waste water into a river because the

water did not meet minimum standards of cleanliness. Keffler has made a provision of $0·9 million for the

technological upgrading of its water purifying process and included $45,000 for the penalties imposed in ‘other

provisions’. (5 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Keffler Co for the year ended

31 March 2006.

NOTE: The mark allocation is shown against each of the three issues.

(c) Ban on emptying waste water

(i) Matter

■ $0·9m provision for upgrading the process represents 45% PBT and is very material. This provision is also

material to the balance sheet (2·7% of total assets).

■ The provision for penalties is immaterial (2·2% PBT and 0·1% total assets).

■ The ban is an adjusting post balance sheet event in respect of the penalties (IAS 10). It provides evidence that at

the balance sheet date Keffler was in contravention of local government standards. Therefore it is correct (in

accordance with IAS 37) that a provision has been made for the penalties. As the matter is not material inclusion

in ‘other provisions’ is appropriate.

■ However, even if Keffler has a legal obligation to meet minimum standards, there is no obligation for upgrading the

purifying process at 31 March 2006 and the $0·9m provision should be written back.

■ If the provision for upgrading is not written back the audit opinion should be qualified ‘except for’ (disagreement).

■ Keffler does not even have a contingent liability for upgrading the process because there is no present obligation to

do so. The obligation is to stop emptying unclean water into the river. Nor is there a possible obligation whose

existence will be confirmed by an uncertain future event not wholly within Keffler’s control.

Tutorial note: Consider that Keffler has alternatives wholly within its control. For example, it could ignore the ban

and incur fines, or relocate/close this particular plant/operation or perhaps dispose of the water by alternative

means.

■ The need for a technological upgrade may be an indicator of impairment. Management should have carried out

an impairment test on the carrying value of the water purifying process and recognised any impairment loss in the

profit for the year to 31 March 2006.

■ Management’s intention to upgrade the process is more appropriate to an environmental responsibility report (if

any).

■ Whether there is any other information in documents containing financial statements.

(ii) Audit evidence

■ Penalty notices of fines received to confirm amounts and period/dates covered.

■ After-date payment of fines agreed to the cash book.

■ A copy of the ban and any supporting report on the local government’s findings.

■ Minutes of board meetings at which the ban was discussed confirming management’s intentions (e.g. to upgrade

the process).

Tutorial note: This may be disclosed in the directors’ report and/or as a non-adjusting post balance sheet event.

■ Any tenders received/costings for upgrading.

Tutorial note: This will be relevant if, for example, capital commitment authorised (by the board) but not

contracted for at the year end are disclosed in the notes to the financial statements.

■ Physical inspection of the emptying point at the river to confirm that Keffler is not still emptying waste water into

it (unless the upgrading has taken place).

Tutorial note: Thereby incurring further penalties.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-05-23

- 2020-01-03

- 2020-01-10

- 2020-02-21

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2021-06-30

- 2020-04-09

- 2020-05-07

- 2020-01-10

- 2020-01-10

- 2020-04-20

- 2020-01-10

- 2020-01-29

- 2020-01-10

- 2019-11-28

- 2020-01-09

- 2020-02-20

- 2020-02-21

- 2020-02-21

- 2020-01-10

- 2020-01-30

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-04-29

- 2020-01-10