你知道财会类热度高的证书有哪些吗?

发布时间:2020-04-16

金融类证书和财会类证书有很多,热度较高的是哪几个证书呢?51题库考试学习网带领大家一起来了解一下。

一、FRM与CFA

FRM证书与其他国际证书一样,得到了国际、国内的高度认可。FRM金融风险管理师证书含金量高,在有些机构里,甚至是升职必备的金融证书。因此,不是金融专业的,想通过考试FRM证书转行金融行业,是可以的。不过,要注意补充金融基础知识哦。因为FRM不同于CFA,不涉及经济学和会计学知识。因此专业术语相对来说可能比较少一些,相对来说,它的学习内容更容易理解。

CFA和FRM并称为“金融双证”。很多人在考了FRM之后都会选择再战CFA。这两个证书与前面两个证书不同,大学生具备考试的资格,但是它们的条件也是相对的苛刻。

二、ACCA与CPA

ACCA,中文名称为特许公认会计师,被誉为国际财经领域通行证的国际注册会计师资格。在国际领域上,ACCA可有着十分高的认可度以及含金量,有着国际财会界通行证的美誉。

CPA是国内唯一具有签字权的最高级的注册会计师资格,是国内热度非常火热的考试,而且其证书含金量也非常高,对于持有CPA证书并注册成为注册会计师协会执业会员的人士,还具备唯一签字权的资质。

ACCA报考条件是非常宽泛,但是F阶段的考试有点难,尤其是F8,很多考生需要“二战”。虽然现在在中国市场上,ACCA应用没有CPA广,但是全球适用性,完全要完胜CPA。

有一些考CPA的同学疑惑,为什么要考ACCA,它的适用性完全没有CPA广,然后花费的考试费用也比较多。这些一部分人考CPA应该都是在中国境内工作的。从国内看,CPA在中国的实用性是要比ACCA强,但是国际上,却不如ACCA。通过ACCA考试,可以选择到国外担任相关企业的财务人员,要知道,取得ACCA证书的人士,在全球范围都获得企业的一致认可。

好了,上面就是关于金融财会领域热度较高的四个证书的简单介绍,还想了解更多信息,欢迎来51题库考试学习网留言。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Service quality; and (7 marks)

(ii) Quality of service is the totality of features and characteristics of the service package that bear upon its ability to satisfy

client needs. To some extent the number of complaints and the need to provide non-chargeable consultations associated

with the remedying of those complaints is indicative of a service quality problem that must be addressed. Hence this

problem needs to be investigated at the earliest opportunity. Assuming consultants could have otherwise undertaken

chargeable work, the revenue foregone as a consequence of the remedial consultations relating to commercial work

amounted to (180 x £1500) = £27,000. Client complaints received by HLP during the year amounted to 1·24% of

consultations undertaken by commercial advisors whereas none were budgeted. In contrast, competitor MAS received

135 complaints which coincided with the number of non-chargeable consultations undertaken by them. This may

indicate that MAS operate a policy of a remedial consultation in respect of all complaints received from clients.

With regard to the number of on-time consultations, HLP only achieved an on-time consultation percentage of 94·4%

which is far inferior to that of 99% achieved by competitor MAS. Also, HLP re-scheduled the appointment times of

1,620 (3%) of its total consultations whereas competitor MAS only re-scheduled 0·5% of its consultation times. The

percentage number of successful consultations provided by HLP and MAS was 85% and 95% respectively which

indicates that competitor MAS possesses a superior skills-base to that of HLP.

The most alarming statistic lies in the fact that HLP was subject to three successful legal actions for negligence. This

may not only account for the 150% increase in the cost of professional indemnity insurance premiums but may also

result in a loss of client confidence and precipitate a considerable fall in future levels of business should the claims

become much publicised.

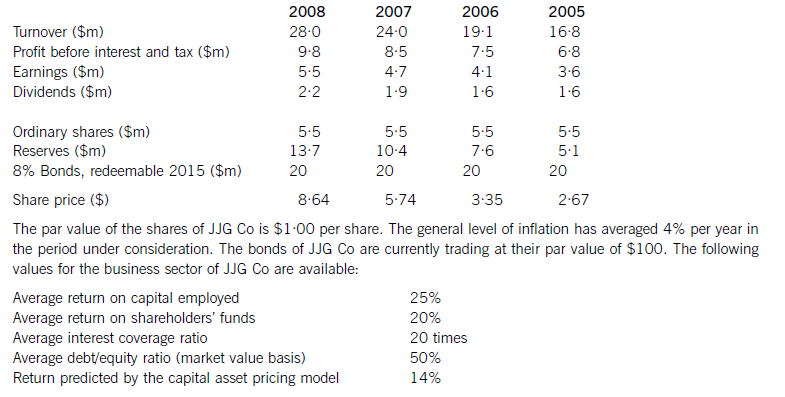

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion.

(b) Assess the benefits of the separation of the roles of chief executive and chairman that Alliya Yongvanich

argued for and explain her belief that ‘accountability to shareholders’ is increased by the separation of these

roles. (12 marks)

(b) Separation of the roles of CEO and chairman

Benefits of separation of roles

The separation of the roles of chief executive and chairman was first provided for in the UK by the 1992 Cadbury provisions

although it has been included in all codes since. Most relevant to the case is the terms of the ICGN clause s.11 and OECD

VI (E) both of which provide for the separation of these roles. In the UK it is covered in the combined code section A2.

The separation of roles offers the benefit that it frees up the chief executive to fully concentrate on the management of the

organisation without the necessity to report to shareholders or otherwise become distracted from his or her executive

responsibilities. The arrangement provides a position (that of chairman) that is expected to represent shareholders’ interests

and that is the point of contact into the company for shareholders. Some codes also require the chairman to represent the

interests of other stakeholders such as employees.

Having two people rather than one at the head of a large organisation removes the risks of ‘unfettered powers’ being

concentrated in a single individual and this is an important safeguard for investors concerned with excessive secrecy or

lack of transparency and accountability. The case of Robert Maxwell is a good illustration of a single dominating

executive chairman operating unchallenged and, in so doing, acting illegally. Having the two roles separated reduces

the risk of a conflict of interest in a single person being responsible for company performance whilst also reporting on

that performance to markets. Finally, the chairman provides a conduit for the concerns of non-executive directors who,

in turn, provide an important external representation of external concerns on boards of directors.

Tutorial note: Reference to codes other than the UK is also acceptable. In all cases, detailed (clause number) knowledge

of code provisions is not required.

Accountability and separation of roles

In terms of the separation of roles assisting in the accountability to shareholders, four points can be made.

The chairman scrutinises the chief executive’s management performance on behalf of the shareholders and will be

involved in approving the design of the chief executive’s reward package. It is the responsibility of the chairman to hold

the chief executive to account on shareholders’ behalfs.

Shareholders have an identified person (chairman) to hold accountable for the performance of their investment. Whilst

day-to-day contact will normally be with the investor relations department (or its equivalent) they can ultimately hold

the chairman to account.

The presence of a separate chairman ensures that a system is in place to ensure NEDs have a person to report to outside the

executive structure. This encourages the freedom of expression of NEDs to the chairman and this, in turn, enables issues to

be raised and acted upon when necessary.

The chairman is legally accountable and, in most cases, an experienced person. He/she can be independent and more

dispassionate because he or she is not intimately involved with day-to-day management issues.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-05-03

- 2020-04-25

- 2020-04-24

- 2020-04-14

- 2020-01-09

- 2020-01-10

- 2020-04-22

- 2020-01-31

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-04-21

- 2020-01-10

- 2019-03-16

- 2020-04-18

- 2020-01-02

- 2020-01-30

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-04-07

- 2020-01-10

- 2020-01-09

- 2020-04-19

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-03-27

- 2020-01-10