好消息!ACCA是有奖学金的,符合条件的ACCAer快来申请

发布时间:2020-04-29

ACCA作为国际注册会计师,考试科目有13门之多,ACCA为了鼓励ACCA学员们有勇气考完,每年都会有一部分ACCA奖学金发放,那么具体的申请条件是什么样的呢?下面就跟51题库考试学习网一起来看看吧!

ACCA奖学金申请条件

1、你是已注册的ACCA学员。

2、本年度年费已缴纳。

3、没有其它欠费情况。

4、你已经完成F1-F3的三门考试,并且第一次考试的三门平均成绩在80分及以上。如果存在免考的情况,至少两门F阶段科目的成绩要在66分及以上。

ACCA奖学金申请文

如果你符合了ACCA奖学金申请条件,那么接下来你需要写一篇1000字左右的长文来申请奖学金。

申请者必须以这个题目为申请书的标题:\'How the award of a

Scholarship will help me to realise my full potential\'. (ACCA奖学金将如何帮助我发挥最大的潜力)

ACCA奖学金申请细节

1、要申请奖学金,除了申请书以外,还要附上Scholarship Submission form

2、申请书(Essay)的格式要求:

·必须是MS word或者相似word版本文件 ·最多1000字

·字号12,字体black font

·双倍行距 ·页边距2.5cm ·A4纸大小

·在每一页的最上方写明你的student registration number,书写日期以及页码 ·用英文写

·条理清晰、含义明确,Essay内容和题目相关 ·电子档,不能手写

3、申请书的递送有两种方式:

第一种:Email(推荐)

第二种:邮递

另外,51题库考试学习网还为大家分享关于ACCA机考的相关答疑,一起看看。

·参加机考的我是否在考场会获得一份纸质的考题?

不会,所有的题目都会显示在屏幕上。但是,如果你有需要的话,会发放给你一份草稿纸做简单的运算。

·整场考试中都会提供计时器吗?

计时器在屏幕上呈现考试的时长。计时器将会出现在你阅读考试操作指导期间,一旦阅读考试操作指南的时间到了或者你点击跳转至第一个考试屏,计时器将自动开启。考试计时

器将会在整场考试中出现在屏幕上。

·可否将自己的计算器带入考场?

可以,就像纸质考试一样学员可以使用自己的计算器,但是该计算器不能具有储存或者显示文本的功能。

·如果在考试中出现影响考试运行的任何技术问题(停电等),该怎么办?

和纸质考试一样,当影响ACCA考试的情况出现应急和例外政策将会启用。考试将会采用“脱机”形式,因此限制了技术故障

又到了与大家说再见的时候了,以上就是今天51题库考试学习网为大家分享的全部内容,如有其他疑问请继续关注51题库考试学习网!

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

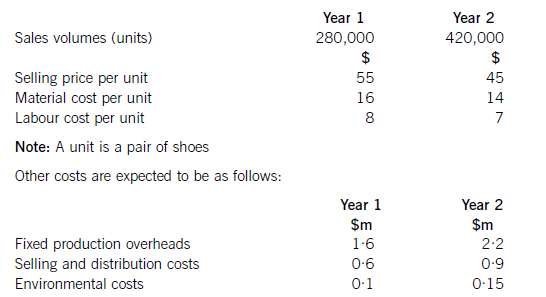

Shoe Co, a shoe manufacturer, has developed a new product called the ‘Smart Shoe’ for children, which has a built-in tracking device. The shoes are expected to have a life cycle of two years, at which point Shoe Co hopes to introduce a new type of Smart Shoe with even more advanced technology. Shoe Co plans to use life cycle costing to work out the total production cost of the Smart Shoe and the total estimated profit for the two-year period.

Shoe Co has spent $5·6m developing the Smart Shoe. The time spent on this development meant that the company missed out on the opportunity of earning an estimated $800,000 contribution from the sale of another product.

The company has applied for and been granted a ten-year patent for the technology, although it must be renewed each year at a cost of $200,000. The costs of the patent application were $500,000, which included $20,000 for the salary costs of Shoe Co’s lawyer, who is a permanent employee of the company and was responsible for preparing the application.

The following information is also available for the next two years:

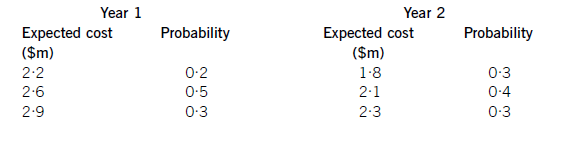

Shoe Co is still negotiating with marketing companies with regard to its advertising campaign, so is uncertain as to what the total marketing costs will be each year. However, the following information is available as regards the probabilities of the range of costs which are likely to be incurred:

Required:

Applying the principles of life cycle costing, calculate the total expected profit for Shoe Co for the two-year period.

(10 marks)

Totalsalesrevenue=(280,000x$55)+(420,000x$45)=$15·4m+18·9m=$34·3m.NoteTheexpectedprofithasbeencalculatedusinglifecyclecostingnotrelevantcosting.Hence,the$20,000salarycostincludedinpatentcostsshouldbeincludedinthelifecyclecost.Similarly,theopportunitycostof$800,000isnotincludedusinglifecyclecostingwhereasifrelevantcostingwasbeingusedtodecideonaparticularcourseofaction,theopportunitycostwouldbeincluded.Working1Expectedmarketingcostinyear1:(0·2x$2·2m)+(0·5x$2·6m)+(0·3x$2·9m)=$2·61mExpectedmarketingcostyear2:(0·3x$1·8m)+(0·4x$2·1m)+(0·3x$2·3m)=$2·07mTotalexpectedmarketingcost=$4·68m

(b) Explain the matters that should be considered when planning the nature and scope of the examination of

Cusiter Co’s forecast balance sheet and income statement as prepared for the bank. (7 marks)

(b) Matters to be considered

Tutorial note: Candidates at this level must appreciate that the matters to be considered when planning the nature and

scope of the examination are not the same matters to be considered when deciding whether or not to accept an

engagement. The scenario clearly indicates that the assignment is being undertaken by the current auditor rendering any

‘pre-engagement’/‘professional etiquette’ considerations irrelevant to answering this question.

This PFI has been prepared to show an external user, the bank, the financial consequences of Cusiter’s plans to help the bank

in making an investment decision. If Cusiter is successful in its loan application the PFI provides a management tool against

which the results of investing in the plant and equipment can be measured.

The PFI is unpublished rather than published. That is, it is prepared at the specific request of a third party, the bank. It will

not be published to users of financial information in general.

The auditor’s report on the PFI will provide only negative assurance as to whether the assumptions provide a reasonable basis

for the PFI and an opinion whether the PFI is:

■ properly prepared on the basis of the assumptions; and

■ presented in accordance with the relevant financial reporting framework.

The nature of the engagement is an examination to obtain evidence concerning:

■ the reasonableness and consistency of assumptions made;

■ proper preparation (on the basis of stated assumptions); and

■ consistent presentation (with historical financial statements, using appropriate accounting principles).

Such an examination is likely to take the form. of inquiry, analytical procedures and corroboration.

The period of time covered by the prospective financial information is two years. The assumptions for 2008 are likely to be

more speculative than for 2007, particularly in relation to the impact on earnings, etc of the investment in new plant and

equipment.

The forecast for the year to 31 December 2007 includes an element of historical financial information (because only part of

this period is in the future) hence actual evidence should be available to verify the first three months of the forecast (possibly

more since another three-month period will expire at the end of the month).

Cusiter management’s previous experience in preparing PFI will be relevant. For example, in making accounting estimates

(e.g. for provisions, impairment losses, etc) or preparing cash flow forecasts (e.g. in support of the going concern assertion).

The basis of preparation of the forecast. For example, the extent to which it comprises:

■ proforma financial information (i.e. historical financial information adjusted for the effects of the planned loan and capital

expenditure transaction);

■ new information and assumptions about future performance (e.g. the operating capacity of the new equipment, sales

generated, etc).

The nature and scope of any standards/guidelines under which the PFI has been prepared is likely to assist the auditor in

discharging their responsibilities to report on it. Also, ISAE 3400 The Examination of Prospective Financial Information,

establishes standards and provides guidance on engagements to examine and report on PFI including examination

procedures.

The planned nature and scope of the examination is likely to take into account the time and fee budgets for the assignments

as adjusted for any ‘overlap’ with audit work. For example, the examination of the PFI is likely to draw on the auditor’s

knowledge of the business obtained in auditing the financial statements to 31 December 2006. Analytical procedures carried

out in respect of the PFI may provide evidence relevant to the 31 December 2007 audit.

4 David Silvester is the founder and owner of a recently formed gift packaging company, Gift Designs Ltd. David has

spotted an opportunity for a new type of gift packaging. This uses a new process to make waterproof cardboard and

then shapes and cuts the card in such a way to produce a container or vase for holding cut flowers. The containers

can be stored flat and in bulk and then simply squeezed to create the flowerpot into which flowers and water are then

put. The potential market for the product is huge. In the UK hospitals alone there are 200,000 bunches of flowers

bought each year for patients. David’s innovative product does away with the need for hospitals to provide and store

glass vases. The paper vases are simple, safe and hygienic. He has also identified two other potential markets; firstly,

the market for fresh flowers supplied by florists and secondly, the corporate gift market where clients such as car

dealers present a new owner with an expensive bunch of flowers when the customer takes delivery of a new car. The

vase can be printed using a customer’s design and logo and creates an opportunity for real differentiation and impact

at sales conferences and other high profile PR events.

David anticipates a rapid growth in Gift Designs as its products become known and appreciated. The key question is

how quickly the company should grow and the types of funding needed to support its growth and development. The

initial financial demands of the business have been quite modest but David has estimated that the business needs

£500K to support its development over the next two years and is uncertain as to the types of funding best suited to

a new business as it looks to grow rapidly. He understands that business risk and financial risk is not the same thing

and is looking for advice on how he should organise the funding of the business. He is also aware of the need to avoid

reliance on friends and family for funding and to broaden the financial support for the business. Clearly the funding

required would also be affected by the activities David decides to carry out himself and those activities better provided

by external suppliers.

Required:

(a) Provide David with a short report on the key issues he should take into account when developing a strategy

for funding Gift Designs’ growth and development. (10 marks)

(a) To: David Silvester

From:

Funding strategy for Gift Designs Ltd

Clearly, you have identified a real business opportunity and face both business and financial risks in turning the opportunity

into reality. One possible model you can use is that of the product life cycle which as a one-product firm is effectively the life

cycle for the company. Linking business risk to financial risk is important – in the early stages of the business the business

risk is high and the high death rate amongst new start-ups is well publicised and, consequently, there is a need to go for low

financial risk. Funding the business is essentially deciding the balance between debt and equity finance, and equity offers the

low risk that you should be looking for. As the firm grows and develops so the balance between debt and equity will change.

A new business venture like this could in Boston Box terms be seen as a problem child with a non-existent market share but

high growth potential. The business risks are very high and consequently the financial risks taken should be very low and

avoid taking on large amounts of debt with a commitment to service the debt.

You need to take advantage of investors who are willing to accept the risks associated with a business start-up – venture

capitalists and business angels accept the risks associated with putting equity capital in but may expect a significant share

in the ownership of the business. This they will seek to realise once the business is successfully established. As the business

moves into growth and then maturity so the business risks will reduce and access to debt finance becomes feasible and cost

effective. In maturity the business should be able to generate significant retained earnings to finance further development.

Dividend policy will also be affected by the stage in the life cycle that the business has reached.

Yours,

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-04-18

- 2020-04-20

- 2020-01-09

- 2020-05-12

- 2019-07-19

- 2020-01-09

- 2020-04-11

- 2019-07-19

- 2020-01-09

- 2020-01-09

- 2020-04-04

- 2020-05-05

- 2020-04-04

- 2019-10-03

- 2020-01-09

- 2020-04-28

- 2020-05-14

- 2020-05-15

- 2020-05-20

- 2020-02-04

- 2019-07-19

- 2020-01-09

- 2020-01-30

- 2020-04-22

- 2020-05-20

- 2020-01-09

- 2020-01-09

- 2020-09-04

- 2020-03-20

- 2020-01-31