你知道ACCA单科考试费用明细吗?

发布时间:2020-03-11

ACCA是(英国)特许公认会计师公会“The Association of Chartered Certified Accountants”的简称,由于其在全球范围内倡导和推广全球应用广泛的国际会计及审计准则IFRS&IAS,ACCA的持证人也常被称为“国际注册会计师”。

ACCA是最早进入中国的国际会计师组织,在中国已经有近30年的传播,得到业界广泛认可,ACCA证书在中国是“具有影响力的国际权威财经证书”!

对于备考ACCA的大军里,有不少的小伙伴不是很清楚ACCA考试费用并且对于ACCA各项的考试费用不是很了解,ACCA的考试费用并不是固定的,有部分想要接触的ACCA的人,因担心ACCA考试费用过高,害怕没有办法承担,那51题库考试学习网就带你们先来了解一下ACCA 单科考试费用是多少吧!

ACCA机考考试科目及费用:

科目:F1(FAB)、F2(FMA)、F3(FFA)、FA1、MA1、FA2、MA2

ACCA费用:机构中心费用不同、ACCA初次注册费用、ACCA年费、ACCA书费。

ACCA报名费用主要分为三个部分:

1、注册费

首先要注册成为ACCA的学员,此项有一个一次性的注册费用,注册费用为£79,可能会有调整。

2、年费

年费用为£112,可能会有调整。

年费这里需要特别注意的是:无论小伙伴在几月份注册ACCA或者是否参加ACCA考试,都将从注册后第二个自然年度的一月份开始缴纳年费,以保持学员身份、继续考试。

您如果没有在规定时间内及时付清所欠的任何费用(年费、免试费等)都将被除名。请您登录英文官网在MY ACCA中查看自己是否有任何欠费并及时支付。

说白了,ACCA考试费用完全可以看做自己对于自己的金钱投资,同样相信这个选择也*是正确超值的,不仅能为你自身增值充能,在你今后的职业生涯中还能起到决定性的作用,给你个人和生活带来巨大的改变。想要减少考试费用就要提前报名哟!不要错过的蕞佳考试时间!

好了以上就是51题库考试学习网为各位小伙伴带来的相关信息了,希望能给各位小伙伴带来帮助。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

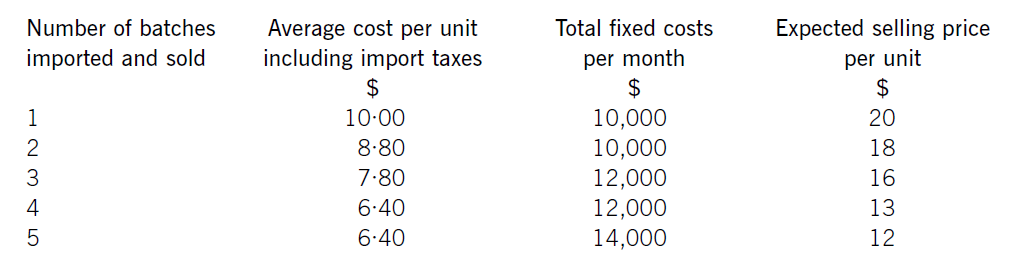

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion.

(c) Assuming that she will survive until July 2009, advise on the lifetime inheritance tax (IHT) planning

measures that could be undertaken by Debbie, quantifying the savings that can be made. (7 marks)

For this question you should assume that the rates and allowances for 2004/05 apply throughout.

(c) Debbie survives until July 2009

Debbie should consider giving away some of her assets to her children, while ensuring that she still has enough to live on.

Such gifts would be categorised as PETs. Although Debbie will not survive seven years (at which point the gifts would fall out

of Debbie’s estate for IHT purposes), taper relief will reduce the amount chargeable to IHT. If gifts were made prior to July

2005, 40% taper relief would be available.

It is important to remember that Debbie’s annual exemptions will reduce the value of any PET when assets are gifted. Debbie

has not used her annual exemption for the last two years, and so she can gift £6,000 (2 x £3,000) in the current tax year

as well as £3,000 per year in future tax years. Debbie could therefore give away £18,000, saving tax of £7,200 (£18,000

x 40%). Debbie can also make small exempt gifts of up to £250 per donee per year.

Debbie should consider making gifts to Allison’s children instead of Allison (using, for example, an accumulation &

maintenance trust). This would ensure that the gifts were excluded from Allison’s estate.

It does not make sense for Debbie to gift shares in Dee Limited, as these qualify for full business property relief and therefore

are not subject to IHT.

As Andrew is shortly to be married, Debbie could give up to £5,000 in consideration of his marriage. This would save £2,000

in IHT.

Expenditure out of normal income is also exempt from IHT. This is where the transferor is left with sufficient income to

maintain his/her usual standard of living. Broadly, you need to demonstrate evidence of a prior commitment, or a settled

pattern of expenditure.

If substantial gifts are made, the donees would be advised to consider taking out insurance policies on Debbie’s life to cover

the potential tax liabilities that may arise on PETs in the event of her early death.

2 Graeme, aged 57, is married to Catherine, aged 58. They work as medical consultants, and both are higher rate

taxpayers. Barry, their son, is aged 32. Graeme, Catherine and Barry are all UK resident, ordinarily resident and

domiciled. Graeme has come to you for some tax advice.

Graeme has invested in shares for some time, in particular shares in Thistle Dubh Limited. He informs you of the

following transactions in Thistle Dubh Limited shares:

(i) In December 1986, on the death of his grandmother, he inherited 10,000 £1 ordinary shares in Thistle Dubh

Limited, an unquoted UK trading company providing food supplies for sporting events. The probate value of the

shares was 360p per share.

(ii) In March 1992, he took up a rights issue, buying one share for every two held. The price paid for the rights

shares was £10 per share.

(iii) In October 1999, the company underwent a reorganisation, and the ordinary shares were split into two new

classes of ordinary share – ‘T’ shares and ‘D’ shares, each with differing rights. Graeme received two ‘T’ and three

‘D’ shares for each original Thistle Dubh Limited share held. The market values for the ‘T’ shares and the ‘D’

shares on the date of reorganisation were 135p and 405p per share respectively.

(iv) On 1 May 2005, Graeme sold 12,000 ‘T’ shares. The market values for the ‘T’ shares and the ‘D’ shares on that

day were 300p and 600p per share respectively.

(v) In October 2005, Graeme sold all of his ‘D’ shares for £85,000.

(vi) The current market value of ‘T’ shares is 384p per share. The shares remain unquoted.

Graeme and Catherine have owned a holiday cottage in a remote part of the UK for many years. In recent years, they

have used the property infrequently, as they have taken their holidays abroad and the cottage has been let out as

furnished holiday accommodation.

Graeme and Catherine are now considering selling the UK country cottage and purchasing a holiday villa abroad.

Initially they plan to let this villa out on a furnished basis, but following their anticipated retirement, would expect to

occupy the property for a significant part of the year themselves, possibly moving to live in the villa permanently.

Required:

(a) Calculate the total chargeable gains arising on Graeme’s disposals of ‘T’ and ‘D’ ordinary shares in May and

October 2005 respectively. (7 marks)

(b) You are the manager responsible for the audit of Poppy Co, a manufacturing company with a year ended

31 October 2008. In the last year, several investment properties have been purchased to utilise surplus funds

and to provide rental income. The properties have been revalued at the year end in accordance with IAS 40

Investment Property, they are recognised on the statement of financial position at a fair value of $8 million, and

the total assets of Poppy Co are $160 million at 31 October 2008. An external valuer has been used to provide

the fair value for each property.

Required:

(i) Recommend the enquiries to be made in respect of the external valuer, before placing any reliance on their

work, and explain the reason for the enquiries; (7 marks)

(b) (i) Enquiries in respect of the external valuer

Enquiries would need to be made for two main reasons, firstly to determine the competence, and secondly the objectivity

of the valuer. ISA 620 Using the Work of an Expert contains guidance in this area.

Competence

Enquiries could include:

– Is the valuer a member of a recognised professional body, for example a nationally or internationally recognised

institute of registered surveyors?

– Does the valuer possess any necessary licence to carry out valuations for companies?

– How long has the valuer been a member of the recognised body, or how long has the valuer been licensed under

that body?

– How much experience does the valuer have in providing valuations of the particular type of investment properties

held by Poppy Co?

– Does the valuer have specific experience of evaluating properties for the purpose of including their fair value within

the financial statements?

– Is there any evidence of the reputation of the valuer, e.g. professional references, recommendations from other

companies for which a valuation service has been provided?

– How much experience, if any, does the valuer have with Poppy Co?

Using the above enquiries, the auditor is trying to form. an opinion as to the relevance and reliability of the valuation

provided. ISA 500 Audit Evidence requires that the auditor gathers evidence that is both sufficient and appropriate. The

auditor needs to ensure that the fair values provided by the valuer for inclusion in the financial statements have been

arrived at using appropriate knowledge and skill which should be evidenced by the valuer being a member of a

professional body, and, if necessary, holding a licence under that body.

It is important that the fair values have been arrived at using methods allowed under IAS 40 Investment Property. If any

other valuation method has been used then the value recognised in the statement of financial position may not be in

accordance with financial reporting standards. Thus it is important to understand whether the valuer has experience

specifically in providing valuations that comply with IAS 40, and how many times the valuer has appraised properties

similar to those owned by Poppy Co.

In gauging the reliability of the fair value, the auditor may wish to consider how Poppy Co decided to appoint this

particular valuer, e.g. on the basis of a recommendation or after receiving references from companies for which

valuations had previously been provided.

It will also be important to consider how familiar the valuer is with Poppy Co’s business and environment, as a way to

assess the reliability and appropriateness of any assumptions used in the valuation technique.

Objectivity

Enquiries could include:

– Does the valuer have any financial interest in Poppy Co, e.g. shares held directly or indirectly in the company?

– Does the valuer have any personal relationship with any director or employee of Poppy Co?

– Is the fee paid for the valuation service reasonable and a fair, market based price?

With these enquiries, the auditor is gaining assurance that the valuer will perform. the valuation from an independent

point of view. If the valuer had a financial interest in Poppy Co, there would be incentive to manipulate the valuation in

a way best suited to the financial statements of the company. Equally if the valuer had a personal relationship with a

senior member of staff at Poppy Co, the valuer may feel pressured to give a favourable opinion on the valuation of the

properties.

The level of fee paid is important. It should be commensurate with the market rate paid for this type of valuation. If the

valuer was paid in excess of what might be considered a normal fee, it could indicate that the valuer was encouraged,

or even bribed, to provide a favourable valuation.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-04-22

- 2020-04-09

- 2020-05-10

- 2020-02-01

- 2020-03-13

- 2020-01-09

- 2021-04-23

- 2020-02-02

- 2020-05-09

- 2020-03-21

- 2020-01-09

- 2019-12-27

- 2020-03-10

- 2020-05-16

- 2020-01-07

- 2019-07-19

- 2020-03-21

- 2020-03-28

- 2020-01-09

- 2020-01-01

- 2019-12-30

- 2020-04-05

- 2020-01-09

- 2020-04-18

- 2020-01-09

- 2020-05-08

- 2019-12-28

- 2020-01-09

- 2019-07-19

- 2019-12-31