请注意:2020年3月ACCA考试结果公布了

发布时间:2020-04-11

虽然中国大陆由于新冠疫情影响,导致没有正常开展2020年3月份ACCA考试,但是其他国家和地区的三月ACCA考试都正常进行。下面随51题库考试学习网一起来了解一下这次考试的情况如何。

那这次ACCA考试通过率情况如何呢?

在本次考试中,全球共有68,247名学生参加了79,2174项考试。共有3,292名学生完成了他们的最后一门ACCA考试科目,正式成为ACCA会员。首选,我们来看下本考季各个科目的全球通过率情况:

ACCA Qualification Pass rate Applied Knowledge AB - Accountant in Business 82% FA - Financial Accounting 73% MA - Management Accounting 65% Applied Skills LW - Corporate and Business Law 83% TX - Taxation 46% FR - Financial Reporting 44% PM - Performance Management 35% FM - Financial Management 44% AA - Audit and Assurance 36% Strategic Professional - Essentials SBL - Strategic Business Leader 47% SBR - Strategic Business Reporting 51% Strategic Professional – Options AAA - Advanced Audit and Assurance 33% AFM - Advanced Financial Management 33% APM - Advanced Performance Management 32 ATX - Advanced Taxation 44% FOUNDATION LEVEL QUALIFICATIONS Pass rate ACCA Diploma in Financial and Management Accounting FA1 - Recording Financial transactions 75% MA1 - Management Information 74% ACCA Diploma in Financial and Management Accounting FA2 - Maintaining Financial Records 69% MA2 - Managing Costs and Finance 61% ACCA Diploma in Accounting and Business FAB - Accountant in Business 72% FFA - Financial Accounting 66% FMA - Management Accounting 62%

ACCA战略与发展执行董事艾伦·哈特菲尔德表示:“我们去年在计划2020年ACCA考试时间表的时候,没人会想到这次的COVID-19会成为自SARs和2008年全球金融危机以来最具破坏力的突发事件。自爆发以来,我们的首要任务是保护好ACCA学生、老师以及工作人员们的健康和安全。由于疫情大流行的蔓延,我们在2月份作出了一项重要的决定,取消了部分因疫情严重而导致政府封锁的国家和地区的3月考试。可以说,这次的ACCA考试所处的非常时间对于我们的学生来说是一个非常大的挑战,我们非常感激我们全球学生社区、教学工作者以及雇主合作伙伴在这个特殊时期对我们的理解和支持,也正是由于他们的帮助,使得这次考试能够安全有序的进行下去。

阿兰·哈特菲尔德赞扬学生的韧性,他继续说道:“我们知道,对于许多不确定下一步学习目标的学生来说,这是一个特别困难的时期。我们尊重那些想要遵守他们的学习计划的学生,也尊重那些希望能够把学习计划推迟到这次危机结束之后的学生。为此,我们已经准备了一些线上的学习资源资源,希望能够找到一些数字化的解决方案。”随着COVID-19大流行趋势的愈演愈烈,ACCA已经宣布取消包括英国、西欧和美洲的ACCA 6月份考试计划。这些取消考试的地区,我们会已经缴纳的考试费返还至学生的MyACCA账户,以便可以重新预定将来的考试,ACCA学生仍然可以灵活的调整自己的考试时间。同时,ACCA会密切关注全球疫情的发展情况,也暂时冻结了2020年9月ACCA的报名费用。

以上就是51题库考试学习网为大家分享的2020年3月ACCA考试结果的相关内容,不知道有没有帮助到你呢?还有疑问的小伙伴欢迎到51题库考试学习网咨询,我们会及时回复你的信息。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) Briefly discuss how stakeholder groups (other than management and employees) may be rewarded for ‘good’

performance. (4 marks)

(b) Good performance should result in improved profitability and therefore other stakeholder groups may be rewarded for ‘good

performance’ as follows:

– Shareholders may receive increased returns on equity in the form. of increased dividends and /or capital growth.

– Customers may benefit from improved quality of products and services, and possibly lower prices.

– Suppliers may benefit from increased volumes of purchases.

– Government will benefit from increased amounts of taxation.

4 (a) The purpose of ISA 250 Consideration of Laws and Regulations in an Audit of Financial Statements is to

establish standards and provide guidance on the auditor’s responsibility to consider laws and regulations in an

audit of financial statements.

Explain the auditor’s responsibilities for reporting non-compliance that comes to the auditor’s attention

during the conduct of an audit. (5 marks)

4 CLEEVES CO

(a) Reporting non-compliance

Non-compliance refers to acts of omission or commission by the entity being audited, either intentional or unintentional, that

are contrary to the prevailing laws or regulations.

To management

Regarding non-compliance that comes to the auditor’s attention the auditor should, as soon as practicable, either:

■ communicate with those charged with governance; or

■ obtain audit evidence that they are appropriately informed.

However, the auditor need not do so for matters that are clearly inconsequential or trivial and may reach agreement1 in

advance on the nature of such matters to be communicated.

If in the auditor’s judgment the non-compliance is believed to be intentional and material, the auditor should communicate

the finding without delay.

If the auditor suspects that members of senior management are involved in non-compliance, the auditor should report the

matter to the next higher level of authority at the entity, if it exists (e.g. an audit committee or a supervisory board). Where

no higher authority exists, or if the auditor believes that the report may not be acted upon or is unsure as to the person to

whom to report, the auditor would consider seeking legal advice.

To the users of the auditor’s report on the financial statements

If the auditor concludes that the non-compliance has a material effect on the financial statements, and has not been properly

reflected in the financial statements, the auditor expresses a qualified (i.e. ‘except for disagreement’) or an adverse opinion.

If the auditor is precluded by the entity from obtaining sufficient appropriate audit evidence to evaluate whether or not noncompliance

that may be material to the financial statements has (or is likely to have) occurred, the auditor should express a

qualified opinion or a disclaimer of opinion on the financial statements on the basis of a limitation on the scope of the audit.

Tutorial note: For example, if management denies the auditor access to information from which he would be able to assess

whether or not illegal dumping had taken place (and, if so, the extent of it).

If the auditor is unable to determine whether non-compliance has occurred because of limitations imposed by circumstances

rather than by the entity, the auditor should consider the effect on the auditor’s report.

Tutorial note: For example, if new legal requirements have been announced as effective but the detailed regulations are not

yet published.

To regulatory and enforcement authorities

The auditor’s duty of confidentiality ordinarily precludes reporting non-compliance to a third party. However, in certain

circumstances, that duty of confidentiality is overridden by statute, law or by courts of law (e.g. in some countries the auditor

is required to report non-compliance by financial institutions to the supervisory authorities). The auditor may need to seek

legal advice in such circumstances, giving due consideration to the auditor’s responsibility to the public interest.

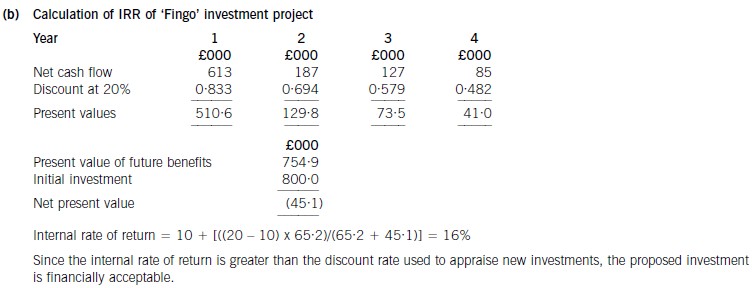

(b) Calculate the internal rate of return of the proposed investment and comment on your findings. (5 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-08-12

- 2020-01-10

- 2020-10-18

- 2021-01-06

- 2019-03-20

- 2019-03-20

- 2020-09-05

- 2020-09-05

- 2020-08-12

- 2020-09-05

- 2019-01-05

- 2019-03-20

- 2021-04-07

- 2019-01-05

- 2019-01-05

- 2021-04-04

- 2020-08-12

- 2021-01-07

- 2021-01-06

- 2021-01-08

- 2020-01-10

- 2021-01-06

- 2020-01-10

- 2021-01-08

- 2020-10-18

- 2021-04-04

- 2020-08-12

- 2020-01-10

- 2020-01-10

- 2019-03-20