云南省考生注意:2020年ACCA国际会计师考试准考证打印预计时间

发布时间:2020-01-09

目前,距离2020年3月份的ACCA考试已经仅剩下2个月左右的时间了,近期不少萌新ACCAer来咨询51题库考试学习网,想知道ACCA考试今年3月份准考证打印的时间以及打印的步骤是什么?那么接下来,51题库考试学习网就这一问题为大家解答相关的困惑,“老手”ACCAer也可以看一下,看看是否和记忆中的打印流程是一样的呢?

目前2020年3月份的ACCA考试打印的通道暂未开通,但近些年,准考证的打印流程变化其实不大的,因此大家可以借鉴一下2019年12月份的打印流程,差别不算很大的。

ACCA考试准考证打印流程:

1.打开ACCA英国官网:http://www.uk.accaglobal.com/,点击右上角的MY

ACCA

2.在登录界面,Username处输入ACCA学员号、Password处输入密码,进行登录

3.登录后点击左侧的Docket。

4.点击 Access you docket。

5.这时会弹出一个调查页面,请按上课情况进行选择:(主要是以学员的学习方式来进行选择的)

(1)周末/寒暑假上面授的学员:请在Part time -face to face后面的Other-Provider填写Beijing ZBCT International

Financial Education co. , Ltd-guangzhou,点击SAVE & CONFIRM后会自动跳转下载准考证;

(2)方向班(周一到周五在学校上课)的学员请在Full time -face to face后面的Learning Provider 选择你学校的名字;如果选项里没有你的学校,请在后面的Other-Provider 填写学校的英文名,点击 SAVE & CONFIRM后会自动跳转下载准考证;

(3)网课的学员请在Distance/Online learning后面的Other-Provider填写Beijing ZBCT International Financial Education co. , Ltd-guangzhou,点击 SAVE & CONFIRM后会自动跳转下载准考证;

以上历年来ACCA准考证打印的流程,若与上面描述的内容有误差,建议参考ACCA官网,一切以官网发布的消息为主。

准考证是考试必备的验证自己身份的东西,因此考生要重视准考证的打印,不要等到临近考试的时候才发现准考证没有打印而导致没有成功参加考试,这样就得不偿失了。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Explain, with reasons, the relief available in respect of the fall in value of the shares in All Over plc,

identify the years in which it can be claimed and state the time limit for submitting the claim.

(3 marks)

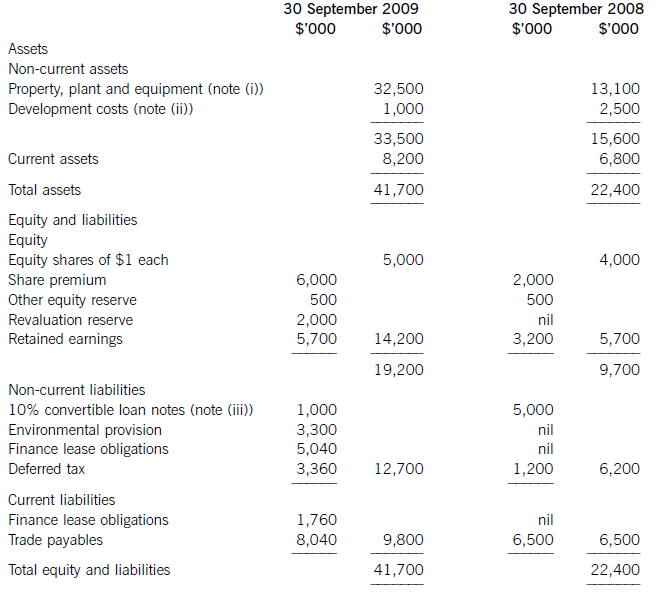

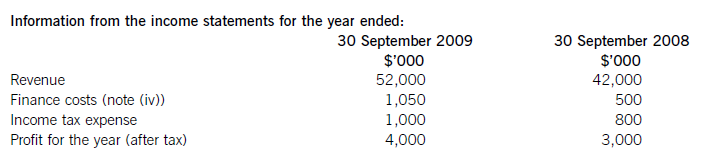

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

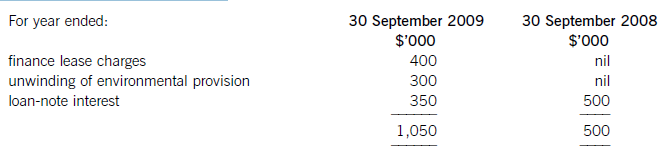

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced.

(ii) Division C is considering a decision to lower its selling price to customers external to the group to $95

per kilogram. If implemented, this decision is expected to increase sales to external customers to

70,000 kilograms.

Required:

For BOTH the current selling price of CC of $105 per kilogram and the proposed selling price of $95

per kilogram, prepare a detailed analysis of revenue, costs and net profits of BAG.

Note: in addition, comment on other considerations that should be taken into account before this selling

price change is implemented. (6 marks)

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-01-08

- 2020-01-10

- 2020-01-10

- 2020-01-10

- 2020-09-04

- 2020-01-10

- 2020-01-09

- 2021-01-03

- 2020-01-08

- 2020-02-22

- 2020-08-14

- 2020-01-08

- 2020-01-08

- 2021-01-03

- 2020-08-14

- 2020-08-14

- 2020-01-08

- 2020-01-08

- 2020-01-09

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-08

- 2020-01-09

- 2020-01-10

- 2020-01-09