浙江省想要报考ACCA考试的萌新们,在报考之前你需要了解这些条件

发布时间:2020-01-09

众所周知,ACCA证书的含金量是十分高的,不仅仅国内认可,国际上也认可。据调查显示,目前持有ACCA证书的人尚且不多,而社会对这一部分人才的需求也是十分巨大的,因此使得越来越多的人来报考ACCA考试。对于这些尚未了解ACCA考试的萌新们,报考条件是什么呢?没关系,51题库考试学习网会一一解答萌新报名时的相关疑问:

(1)什么是ACCA?

ACCA全称为The Association of

Chartered Certified Accountants,是由国际性的会计师组织英国特许公认会计师公会设立的证书,国内也被称为国际注册会计师,是全球的财会金融领域的证书之一,更是国际认可的财务人员资格证书。

(2)ACCA考试科目内容

ACCA证书培养目标是培养综合性的高级财务管理人才。所以,对应试者的要求也是出奇的高的。ACCA证书一共包括13门考试科目,这些考试科目的设置从财务基础到高级的管理课程层层递进,由浅入深,即使是没有财务基础的人也能够轻松入门,授课内容和考试语言为英语,因此难度相对于本土证书的考试难度会有一定的提升。

(3)持有ACCA证书的就业前景

ACCA作为财会界含金量最高的证书之一,在全球企业中都有极高的认可度,在国内与超过400家认证雇主保持密切合作,使ACCA学员在就业时会获得优先录取的机会。这就是为什么近些年越来越多人来报考ACCA考试的原因,另外持有ACCA证书的学生进入四大会计师事务所时会被优先考虑,还会有除了工资外的Q-pay。目前中国ACCA人才缺口达到了20多万,所以ACCA学习人数正在逐步扩大,许多顶尖的财经院校也开始开设ACCA专业。

报考国际注册会计师的条件有哪些?

报名国际注册会计师ACCA考试,具备以下条件之一即可:

1)凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;

2)教育部认可的高等院校在校生,顺利完成大一的课程考试,即可报名成为ACCA的正式学员;

3)未符合1、2项报名资格的16周岁以上的申请者,也可以先申请参加FIA(Foundations in Accountancy)基础财务资格考试。在完成基础商业会计(FAB)、基础管理会计(FMA)、基础财务会计(FFA)3门课程,并完成ACCA基础职业模块,可获得ACCA商业会计师资格证书(Diploma

in Accounting and Business),资格证书后可豁免ACCAF1-F3三门课程的考试,直接进入技能课程的考试。

看完这些,各位萌新们是不是更加了解ACCA考试了呢?51题库考试学习网在这里提醒一下大家:2020年3月份即将迎来ACCA新的一季考试,有参加的ACCAer们就建议大家可以开始着手准备复习了哦;俗话说,机会是留给有准备的人的,早点备考多学一些知识才能去攻克更多的困难。最后,51题库考试学习网预祝大家考试通过,成功上岸,ACCAer们,加油~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(b) How might the marketing mix vary between the three channels Helen is considering using? (8 marks)

(b) The analysis of each of the market entry strategies has begun the process of identifying how the marketing mix of product,

price, place and promotion will vary significantly between the three outlets.

Product – here the nature of the product in terms of recipes and product range can be varied reasonably easily to meet the

demands of the outlet.

Price – again this will vary in significance between the three outlets with the greatest pressure coming from the supermarkets

and catering wholesalers. Margins may come under pressure with the supermarkets looking for a contribution to sales

promotions.

Promotion – here the issue of brand development is a crucial factor. Using her own brand, Helen can develop the product

range and extend the outlets she sells through.

Moonstar Co is a property development company which is planning to undertake a $200 million commercial property development. Moonstar Co has had some difficulties over the last few years, with some developments not generating the expected returns and the company has at times struggled to pay its finance costs. As a result Moonstar Co’s credit rating has been lowered, affecting the terms it can obtain for bank finance. Although Moonstar Co is listed on its local stock exchange, 75% of the share capital is held by members of the family who founded the company. The family members who are shareholders do not wish to subscribe for a rights issue and are unwilling to dilute their control over the company by authorising a new issue of equity shares. Moonstar Co’s board is therefore considering other methods of financing the development, which the directors believe will generate higher returns than other recent investments, as the country where Moonstar Co is based appears to be emerging from recession.

Securitisation proposals

One of the non-executive directors of Moonstar Co has proposed that it should raise funds by means of a securitisation process, transferring the rights to the rental income from the commercial property development to a special purpose vehicle. Her proposals assume that the leases will generate an income of 11% per annum to Moonstar Co over a ten-year period. She proposes that Moonstar Co should use 90% of the value of the investment for a collateralised loan obligation which should be structured as follows:

– 60% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 150 basis points

– 15% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 12%

– 15% of the collateral value to support a tranche of C-rated fixed rate loan notes offering investors 13%

– 10% of the collateral value to support a tranche as subordinated certificates, with the return being the excess of receipts over payments from the securitisation process

The non-executive director believes that there will be sufficient demand for all tranches of the loan notes from investors. Investors will expect that the income stream from the development to be low risk, as they will expect the property market to improve with the recession coming to an end and enough potential lessees to be attracted by the new development.

The non-executive director predicts that there would be annual costs of $200,000 in administering the loan. She acknowledges that there would be interest rate risks associated with the proposal, and proposes a fixed for variable interest rate swap on the A-rated floating rate notes, exchanging LIBOR for 9·5%.

However the finance director believes that the prediction of the income from the development that the non-executive director has made is over-optimistic. He believes that it is most likely that the total value of the rental income will be 5% lower than the non-executive director has forecast. He believes that there is some risk that the returns could be so low as to jeopardise the income for the C-rated fixed rate loan note holders.

Islamic finance

Moonstar Co’s chief executive has wondered whether Sukuk finance would be a better way of funding the development than the securitisation.

Moonstar Co’s chairman has pointed out that a major bank in the country where Moonstar Co is located has begun to offer a range of Islamic financial products. The chairman has suggested that a Mudaraba contract would be the most appropriate method of providing the funds required for the investment.

Required:

(a) Calculate the amounts in $ which each of the tranches can expect to receive from the securitisation arrangement proposed by the non-executive director and discuss how the variability in rental income affects the returns from the securitisation. (11 marks)

(b) Discuss the benefits and risks for Moonstar Co associated with the securitisation arrangement that the non-executive director has proposed. (6 marks)

(c) (i) Discuss the suitability of Sukuk finance to fund the investment, including an assessment of its appeal to potential investors. (4 marks)

(ii) Discuss whether a Mudaraba contract would be an appropriate method of financing the investment and discuss why the bank may have concerns about providing finance by this method. (4 marks)

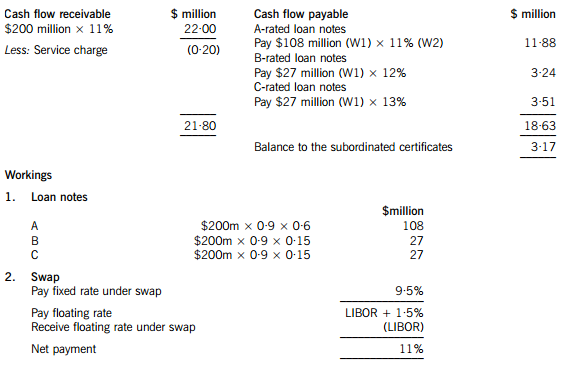

(a) An annual cash flow account compares the estimated cash flows receivable from the property against the liabilities within the securitisation process. The swap introduces leverage into the arrangement.

The holders of the certificates are expected to receive $3·17million on $18 million, giving them a return of 17·6%. If the cash flows are 5% lower than the non-executive director has predicted, annual revenue received will fall to $20·90 million, reducing the balance available for the subordinated certificates to $2·07 million, giving a return of 11·5% on the subordinated certificates, which is below the returns offered on the B and C-rated loan notes. The point at which the holders of the certificates will receive nothing and below which the holders of the C-rated loan notes will not receive their full income will be an annual income of $18·83 million (a return of 9·4%), which is 14·4% less than the income that the non-executive director has forecast.

(b) Benefits

The finance costs of the securitisation may be lower than the finance costs of ordinary loan capital. The cash flows from the commercial property development may be regarded as lower risk than Moonstar Co’s other revenue streams. This will impact upon the rates that Moonstar Co is able to offer borrowers.

The securitisation matches the assets of the future cash flows to the liabilities to loan note holders. The non-executive director is assuming a steady stream of lease income over the next 10 years, with the development probably being close to being fully occupied over that period.

The securitisation means that Moonstar Co is no longer concerned with the risk that the level of earnings from the properties will be insufficient to pay the finance costs. Risks have effectively been transferred to the loan note holders.

Risks

Not all of the tranches may appeal to investors. The risk-return relationship on the subordinated certificates does not look very appealing, with the return quite likely to be below what is received on the C-rated loan notes. Even the C-rated loan note holders may question the relationship between the risk and return if there is continued uncertainty in the property sector.

If Moonstar Co seeks funding from other sources for other developments, transferring out a lower risk income stream means that the residual risks associated with the rest of Moonstar Co’s portfolio will be higher. This may affect the availability and terms of other borrowing.

It appears that the size of the securitisation should be large enough for the costs to be bearable. However Moonstar Co may face unforeseen costs, possibly unexpected management or legal expenses.

(c) (i) Sukuk finance could be appropriate for the securitisation of the leasing portfolio. An asset-backed Sukuk would be the same kind of arrangement as the securitisation, where assets are transferred to a special purpose vehicle and the returns and repayments are directly financed by the income from the assets. The Sukuk holders would bear the risks and returns of the relationship.

The other type of Sukuk would be more like a sale and leaseback of the development. Here the Sukuk holders would be guaranteed a rental, so it would seem less appropriate for Moonstar Co if there is significant uncertainty about the returns from the development.

The main issue with the asset-backed Sukuk finance is whether it would be as appealing as certainly the A-tranche of the securitisation arrangement which the non-executive director has proposed. The safer income that the securitisation offers A-tranche investors may be more appealing to investors than a marginally better return from the Sukuk. There will also be costs involved in establishing and gaining approval for the Sukuk, although these costs may be less than for the securitisation arrangement described above.

(ii) A Mudaraba contract would involve the bank providing capital for Moonstar Co to invest in the development. Moonstar Co would manage the investment which the capital funded. Profits from the investment would be shared with the bank, but losses would be solely borne by the bank. A Mudaraba contract is essentially an equity partnership, so Moonstar Co might not face the threat to its credit rating which it would if it obtained ordinary loan finance for the development. A Mudaraba contract would also represent a diversification of sources of finance. It would not require the commitment to pay interest that loan finance would involve.

Moonstar Co would maintain control over the running of the project. A Mudaraba contract would offer a method of obtaining equity funding without the dilution of control which an issue of shares to external shareholders would bring. This is likely to make it appealing to Moonstar Co’s directors, given their desire to maintain a dominant influence over the business.

The bank would be concerned about the uncertainties regarding the rental income from the development. Although the lack of involvement by the bank might appeal to Moonstar Co's directors, the bank might not find it so attractive. The bank might be concerned about information asymmetry – that Moonstar Co’s management might be reluctant to supply the bank with the information it needs to judge how well its investment is performing.

(b) One of the hotels owned by Norman is a hotel complex which includes a theme park, a casino and a golf course,

as well as a hotel. The theme park, casino, and hotel were sold in the year ended 31 May 2008 to Conquest, a

public limited company, for $200 million but the sale agreement stated that Norman would continue to operate

and manage the three businesses for their remaining useful life of 15 years. The residual interest in the business

reverts back to Norman after the 15 year period. Norman would receive 75% of the net profit of the businesses

as operator fees and Conquest would receive the remaining 25%. Norman has guaranteed to Conquest that the

net minimum profit paid to Conquest would not be less than $15 million. (4 marks)

Norman has recently started issuing vouchers to customers when they stay in its hotels. The vouchers entitle the

customers to a $30 discount on a subsequent room booking within three months of their stay. Historical

experience has shown that only one in five vouchers are redeemed by the customer. At the company’s year end

of 31 May 2008, it is estimated that there are vouchers worth $20 million which are eligible for discount. The

income from room sales for the year is $300 million and Norman is unsure how to report the income from room

sales in the financial statements. (4 marks)

Norman has obtained a significant amount of grant income for the development of hotels in Europe. The grants

have been received from government bodies and relate to the size of the hotel which has been built by the grant

assistance. The intention of the grant income was to create jobs in areas where there was significant

unemployment. The grants received of $70 million will have to be repaid if the cost of building the hotels is less

than $500 million. (4 marks)

Appropriateness and quality of discussion (2 marks)

Required:

Discuss how the above income would be treated in the financial statements of Norman for the year ended

31 May 2008.

(b) Property is sometimes sold with a degree of continuing involvement by the seller so that the risks and rewards of ownership

have not been transferred. The nature and extent of the buyer’s involvement will determine how the transaction is accounted

for. The substance of the transaction is determined by looking at the transaction as a whole and IAS18 ‘Revenue’ requires

this by stating that where two or more transactions are linked, they should be treated as a single transaction in order to

understand the commercial effect (IAS18 paragraph 13). In the case of the sale of the hotel, theme park and casino, Norman

should not recognise a sale as the company continues to enjoy substantially all of the risks and rewards of the businesses,

and still operates and manages them. Additionally the residual interest in the business reverts back to Norman. Also Norman

has guaranteed the income level for the purchaser as the minimum payment to Conquest will be $15 million a year. The

transaction is in substance a financing arrangement and the proceeds should be treated as a loan and the payment of profits

as interest.

The principles of IAS18 and IFRIC13 ‘Customer Loyalty Programmes’ require that revenue in respect of each separate

component of a transaction is measured at its fair value. Where vouchers are issued as part of a sales transaction and are

redeemable against future purchases, revenue should be reported at the amount of the consideration received/receivable less

the voucher’s fair value. In substance, the customer is purchasing both goods or services and a voucher. The fair value of the

voucher is determined by reference to the value to the holder and not the cost to the issuer. Factors to be taken into account

when estimating the fair value, would be the discount the customer obtains, the percentage of vouchers that would be

redeemed, and the time value of money. As only one in five vouchers are redeemed, then effectively the hotel has sold goods

worth ($300 + $4) million, i.e. $304 million for a consideration of $300 million. Thus allocating the discount between the

two elements would mean that (300 ÷ 304 x $300m) i.e. $296·1 million will be allocated to the room sales and the balance

of $3·9 million to the vouchers. The deferred portion of the proceeds is only recognised when the obligations are fulfilled.

The recognition of government grants is covered by IAS20 ‘Accounting for government grants and disclosure of government

assistance’. The accruals concept is used by the standard to match the grant received with the related costs. The relationship

between the grant and the related expenditure is the key to establishing the accounting treatment. Grants should not be

recognised until there is reasonable assurance that the company can comply with the conditions relating to their receipt and

the grant will be received. Provision should be made if it appears that the grant may have to be repaid.

There may be difficulties of matching costs and revenues when the terms of the grant do not specify precisely the expense

towards which the grant contributes. In this case the grant appears to relate to both the building of hotels and the creation of

employment. However, if the grant was related to revenue expenditure, then the terms would have been related to payroll or

a fixed amount per job created. Hence it would appear that the grant is capital based and should be matched against the

depreciation of the hotels by using a deferred income approach or deducting the grant from the carrying value of the asset

(IAS20). Additionally the grant is only to be repaid if the cost of the hotel is less than $500 million which itself would seem

to indicate that the grant is capital based. If the company feels that the cost will not reach $500 million, a provision should

be made for the estimated liability if the grant has been recognised.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-01-03

- 2019-01-17

- 2020-01-10

- 2020-01-09

- 2020-04-16

- 2019-01-06

- 2020-01-10

- 2020-01-09

- 2020-04-14

- 2020-01-03

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-01-10

- 2020-01-03

- 2020-01-03

- 2021-08-21

- 2020-01-10

- 2020-01-10

- 2020-02-23

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-02-23

- 2020-01-10

- 2020-01-03

- 2021-05-22

- 2020-02-26

- 2019-01-06