在校大学生只有应届毕业生能考ACCA吗?

发布时间:2020-02-26

近年来ACCA考试热度不断上升,每年的报名人数都在增加,同时在网上也有一些网友在询问考试报名的相关信息。比如,在校大学生是否只有应届毕业生能考ACCA。鉴于此,51题库考试学习网在下面为大家带来2020年ACCA考试报名条件的相关信息,以供参考。

ACCA考试报名条件较低,报名方式灵活,对报考人员的专业、学历并无严格限制,满足年龄要求的在校大学生都能报考。报名参加ACCA考试,要具备以下条件之一:

1)凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;(教育部承认的学历除了全日制,还包括成考、自考等,小伙伴们要注意区分)

2)教育部认可的高等院校在校生,顺利完成所有课程考试,即可报名成为ACCA的正式学员;(51题库考试学习网提醒:未完成所有课程考试的在校大学生也可以通过其他途径报考ACCA考试)

对于学历不满足要求的考生,可通过以下途径报考。

3)未符合以上报名资格的申请者,而年龄在21岁以上,可循成年考生(MSER)途径申请入会。(学历符合要求的考生,没有年龄限制)该途径允许学员作为ACCA校外进修生,在两年内通过F2和F3两门课程,便能以正式学员的身份继续考其他科目。(这种途径进入的考生,在通过F2、F3课程之后,仍然要按照正常考试模块顺序参加考试)

4)如果是未符合1、2项报名资格的申请者,也可以先申请参加CAT资格考试。考生在获得CAT资格证书后可豁免ACCAF1-F3三门课程的考试,直接进入技能课程的考试。后续考试需要正常的模块顺序进行。

注意,注册报名随时都可以进行,但注册时间的早晚,决定了第一次参加考试的时间。一般而言,每年7月31日前注册,有资格参加同年12月份的考试;12月15日前注册,有资格参加翌年6月份考试。另外,小伙伴们如果准备不够好,即使能够报名当年的ACCA考试,也别急于报考哦。

以上就是关于ACCA考试报名条件的相关情况。51题库考试学习网提醒:报名条件中的在校大学生为本科生,请各位小伙伴注意。最后,51题库考试学习网预祝准备参加2020年ACCA考试的小伙伴都能顺利通过。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

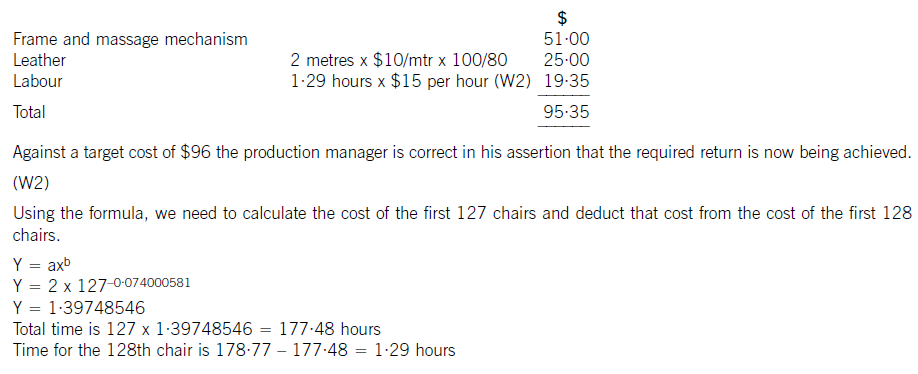

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

(W1)

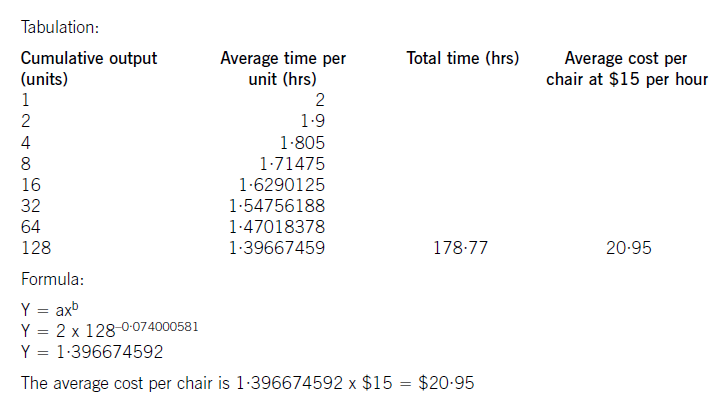

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

(c) The cost of the 128th chair will be:

(c) Excluding the number of complaints by patients, identify and briefly explain THREE quantitative

non-financial performance measures that could be used to assess the ‘quality of service’ provided by the

Dental Health Partnership. (3 marks)

(c) In order to assess the quality of patient care provided by the Dental Health Partnership the following performance measures

might be used:

– The percentage of ‘on time’ treatment of those patients who arrived prior to their appointment time would provide an

indication regarding the effectiveness of the scheduling of appointments by the Dental Health Partnership.

– the percentage of patient appointments which were re-arranged at the request of the Dental Health Partnership.

Rearranged appointments represent the provision of a lower level of service provision to clients who may, as a result,

switch to an alternative dental practice.

– the percentage of patients who return for treatment after their first appointment would provide an indication that they

were satisfied with the service they received.

– the percentage of patients who were able to gain an appointment at their preferred date and time is an indication of the

availability of the service to clients.

Note: Candidates were only required to discuss three measures.

(b) Comment (with relevant calculations) on the performance of the business of Quicklink Ltd and Celer

Transport during the year ended 31 May 2005 and, insofar as the information permits, its projected

performance for the year ending 31 May 2006. Your answer should specifically consider:

(i) Revenue generation per vehicle

(ii) Vehicle utilisation and delivery mix

(iii) Service quality. (14 marks)

difference will reduce in the year ending 31 May 2006 due to the projected growth in sales volumes of the Celer Transport

business. The average mail/parcels delivery of mail/parcels per vehicle of the Quicklink Ltd part of the business is budgeted

at 12,764 which is still 30·91% higher than that of the Celer Transport business.

As far as specialist activities are concerned, Quicklink Ltd is budgeted to generate average revenues per vehicle amounting to

£374,850 whilst Celer Transport is budgeted to earn an average of £122,727 from each of the vehicles engaged in delivery

of processed food. It is noticeable that all contracts with major food producers were renewed on 1 June 2005 and it would

appear that there were no increases in the annual value of the contracts with major food producers. This might have been

the result of a strategic decision by the management of the combined entity in order to secure the future of this part of the

business which had been built up previously by the management of Celer Transport.

Each vehicle owned by Quicklink Ltd and Celer Transport is in use for 340 days during each year, which based on a

365 day year would give an in use % of 93%. This appears acceptable given the need for routine maintenance and repairs

due to wear and tear.

During the year ended 31 May 2005 the number of on-time deliveries of mail and parcel and industrial machinery deliveries

were 99·5% and 100% respectively. This compares with ratios of 82% and 97% in respect of mail and parcel and processed

food deliveries made by Celer Transport. In this critical area it is worth noting that Quicklink Ltd achieved their higher on-time

delivery target of 99% in respect of each activity whereas Celer Transport were unable to do so. Moreover, it is worth noting

that Celer Transport missed their target time for delivery of food products on 975 occasions throughout the year 31 May 2005

and this might well cause a high level of customer dissatisfaction and even result in lost business.

It is interesting to note that whilst the businesses operate in the same industry they have a rather different delivery mix in

terms of same day/next day demands by clients. Same day deliveries only comprise 20% of the business of Quicklink Ltd

whereas they comprise 75% of the business of Celer Transport. This may explain why the delivery performance of Celer

Transport with regard to mail and parcel deliveries was not as good as that of Quicklink Ltd.

The fact that 120 items of mail and 25 parcels were lost by the Celer Transport business is most disturbing and could prove

damaging as the safe delivery of such items is the very substance of the business and would almost certainly have resulted

in a loss of customer goodwill. This is an issue which must be addressed as a matter of urgency.

The introduction of the call management system by Quicklink Ltd on 1 June 2004 is now proving its worth with 99% of calls

answered within the target time of 20 seconds. This compares favourably with the Celer Transport business in which only

90% of a much smaller volume of calls were answered within a longer target time of 30 seconds. Future performance in this

area will improve if the call management system is applied to the Celer Transport business. In particular, it is likely that the

number of abandoned calls will be reduced and enhance the ‘image’ of the Celer Transport business.

(b) Explain the corporation tax and value added tax (VAT) implications of the following aspects of the proposed

restructuring of the Rapier Ltd group.

(i) The immediate tax implications of the restructuring. (6 marks)

(b) The tax implications of the proposed restructuring of the Rapier Ltd group

(i) Immediate implications

Corporation tax

Rapier Ltd and its subsidiaries are in a capital gains group as Rapier Ltd owns at least 75% of the ordinary share capital

of each of the subsidiary companies. Any non-exempt items of plant and machinery owned by the subsidiaries will

therefore be transferred to Rapier Ltd at no gain, no loss.

No taxable credit or allowable debit will arise on the transfer of the subsidiaries’ goodwill to Rapier Ltd because the

companies are in a capital gains group.

The trading losses brought forward in Dirk Ltd will be transferred with the trade to Rapier Ltd as the effective ownership

of the three trades will not change (Rapier Ltd owns the subsidiaries which own the trades and, following the

restructuring, will own the three trades directly). The losses will be restricted to being offset against the future trading

profits of the Dirk trade only.

There will be no balancing adjustments in respect of the plant and machinery transferred to Rapier Ltd. Writing down

allowances will be claimed by the subsidiaries in respect of the year ending 30 June 2007 and by Rapier Ltd in respect

of future periods.

Value added tax (VAT)

No VAT should be charged on the sales of the businesses to Rapier Ltd as they are outside the scope of VAT. This is

because the trades are to be transferred as going concerns to a VAT registered person with no significant break in trading.

Switch Ltd must notify HM Revenue and Customs by 30 July 2007 that it has ceased to make taxable supplies.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-01

- 2019-01-06

- 2020-02-23

- 2020-01-10

- 2020-01-10

- 2020-02-15

- 2020-02-26

- 2020-02-23

- 2020-01-10

- 2021-09-13

- 2020-01-10

- 2019-01-17

- 2020-01-10

- 2020-01-10

- 2020-02-26

- 2020-01-09

- 2020-01-09

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2019-01-06

- 2020-01-10

- 2020-02-28

- 2020-01-10

- 2020-01-10

- 2020-01-09

- 2020-02-23

- 2020-02-26

- 2020-09-05

- 2020-01-10