2020年四川省ACCA报名条件和考试科目是什么?

发布时间:2020-01-03

ACCA是来自英国的一个注册会计师资格,因为广泛地被全球范围内的各地区和雇主认可而备受关注。与国内的各大财会证书相比,ACCA有着极其独特之处,例如它的报名条件、考试科目等内容。

2020年ACCA考试报名条件:

- 1、教育部认可的高等院校在校生(本科在校),顺利完成大一的课程考试,即可报名成为ACCA的正式学员;

- 2、凡具有教育部承认的大专以上学历,即可报名成为ACCA的正式学员;

- 3、年满16周岁,可先注册成为FLQ学员,在获得商业会计证书后转为ACCA学员,并可豁免AB、MA、FA三门课程。

ACCA官方政策指出,要具备以下条件之一者,均可报名参加ACCA考试。那么,ACCA考试共有哪些科目呢?

|

课程类别 |

课程序号 |

课程名称(中) |

课程名称(英) |

|

知识课程 |

AB |

会计师与企业 |

Accountant in Business |

|

MA |

管理会计 |

Management Accounting |

|

|

FA |

财务会计 |

Financial Accounting |

|

|

技能课程 |

LW |

公司法与商法 |

Corporate and Business Law |

|

PM |

业绩管理 |

Performance Management |

|

|

TX |

税务 |

Taxation |

|

|

FR |

财务报告 |

Financial Reporting |

|

|

AA |

审计与认证业务 |

Audit and Assurance |

|

|

FM |

财务管理 |

Financial Management |

|

课程类别 |

课程序号 |

课程名称(中) |

课程名称(英) |

|

核心课程 |

SBL |

战略商业领袖 |

Strategic Business Leader |

|

SBR |

战略商业报告 |

Strategic Business Report |

|

|

选修课程 |

AFM |

高级财务管理 |

Advanced Financial Management (AFM) |

|

APM |

高级业绩管理 |

AdvancedPerformance Management (APM) |

|

|

ATX |

高级税务 |

Advanced Taxation (ATX) |

|

|

AAA |

高级审计与认证业务 |

Advanced Audit and Assurance (AAA) |

如需了解或想更快报考ACCA, 请持续关注51题库考试学习网,51题库考试学习网将会不定时更新关于ACCA考试的相关资讯。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

3 Assume that today’s date is 10 May 2005.

You have recently been approached by Fred Flop. Fred is the managing director and 100% shareholder of Flop

Limited, a UK trading company with one wholly owned subsidiary. Both companies have a 31 March year-end.

Fred informs you that he is experiencing problems in dealing with aspects of his company tax returns. The company

accountant has been unable to keep up to date with matters, and Fred also believes that mistakes have been made

in the past. Fred needs assistance and tells you the following:

Year ended 31 March 2003

The corporation tax return for this period was not submitted until 2 November 2004, and corporation tax of £123,500

was paid at the same time. Profits chargeable to corporation tax were stated as £704,300.

A formal notice (CT203) requiring the company to file a self-assessment corporation tax return (dated 1 February

2004) had been received by the company on 4 February 2004.

A detailed examination of the accounts and tax computation has revealed the following.

– Computer equipment totalling £50,000 had been expensed in the accounts. No adjustment has been made in

the tax computation.

– A provision of £10,000 was made for repairs, but there is no evidence of supporting information.

– Legal and professional fees totalling £46,500 were allowed in full without any explanation. Fred has

subsequently produced the following analysis:

Analysis of legal & professional fees

£

Legal fees on a failed attempt to secure a trading loan 15,000

Debt collection agency fees 12,800

Obtaining planning consent for building extension 15,700

Accountant’s fees for preparing accounts 14,000

Legal fees relating to a trade dispute 19,000

– No enquiry has yet been raised by the Inland Revenue.

– Flop Ltd was a large company in terms of the Companies Act definition for the year in question.

– Flop Ltd had taxable profits of £595,000 in the previous year.

Year ended 31 March 2004

The corporation tax return has not yet been submitted for this year. The accounts are late and nearing completion,

with only one change still to be made. A notice requiring the company to file a self-assessment corporation tax return

(CT203) dated 27 July 2004 was received on 1 August 2004. No corporation tax has yet been paid.

1 – The computation currently shows profits chargeable to corporation tax of £815,000 before accounting

adjustments, and any adjustments for prior years.

– A company owing Flop Ltd £50,000 (excluding VAT) has gone into liquidation, and it is unlikely that any of this

money will be paid. The money has been outstanding since 3 September 2003, and the bad debt will need to

be included in the accounts.

1 Fred also believes there are problems in relation to the company’s VAT administration. The VAT return for the quarter

ended 31 March 2005 was submitted on 5 May 2005, and VAT of £24,000 was paid at the same time. The previous

return to 31 December 2004 was also submitted late. In addition, no account has been made for the VAT on the bad

debt. The VAT return for 30 June 2005 may also be late. Fred estimates the VAT liability for that quarter to be £8,250.

Required:

(a) (i) Calculate the revised corporation tax (CT) payable for the accounting periods ending 31 March 2003

and 2004 respectively. Your answer should include an explanation of the adjustments made as a result

of the information which has now come to light. (7 marks)

(ii) State, giving reasons, the due payment date of the corporation tax (CT) and the filing date of the

corporation tax return for each period, and identify any interest and penalties which may have arisen to

date. (8 marks)

(a) Calculation of corporation tax

Year ended 31 March 2003

Corporation tax payable

There are three adjusting items:.

(i) The computers are capital items, as they have an enduring benefit. These need to be added back in the Schedule D

Case I calculation, and capital allowances claimed instead. The company is not small or medium by Companies Act

definitions and therefore no first year allowances are available. Allowances of £12,500 (50,000 x 25%) can be claimed,

leaving a TWDV of £37,500.

(ii) The provision appears to be general in nature. In addition there is insufficient information to justify the provision and it

should be disallowed until such times as it is released or utilised.

(iii) Costs relating to trading loan relationships are allowable, as are costs relating to the trade (debt collection, trade disputes

and accounting work). Costs relating to capital items (£5,700) are not allowable so will have to be added back.

Total profit chargeable to corporation tax is therefore £704,300 + 50,000 – 12,500 + 10,000 + 5,700 = 757,500. There are two associates, and therefore the 30% tax rate starts at £1,500,000/2 = £750,000. Corporation tax payable is 30% x£757,500 = £227,250.

Payment date

Although the rate of tax is 30% and the company ‘large’, quarterly payments will not apply, as the company was not large in the previous year. The due date for payment of tax is therefore nine months and one day after the end of the tax accounting period (31 March 2003) i.e. 1 January 2004.

Filing date

This is the later of:

– 12 months after the end of the period of account: 31 March 2004

– 3 months after the date of the notice requiring the return 1 May 2004

i.e. 1 May 2004.

(c) What changes to Churchill’s existing marketing mix will be needed to achieve the three strategic goals?

(15 marks)

(c) Each of the strategic goals will have a profound impact on the marketing mix as it currently exists. As each goal affects the

market position of Churchill developing an appropriate marketing mix will be the key to successful implementation of the

overall growth strategy. The product, the brand and the reputation it creates are at the heart of the company’s marketing

strategy. Their focus on the premium segment of the market seems a sensible one and one which allows a small family-owned

business to survive and grow slowly. Evidence suggests this is a luxury indulgence market reflecting changing consumer tastes

and lifestyles. Managing the product range will be a major marketing activity. While the core products may develop an almost

timeless quality there will be a need to respond to the product innovations introduced by its much larger competitors. The

company’s emphasis on the quality of its products resulting from the quality of its ingredients is at the heart of its competitive

advantage. Growing the product range will also bring the danger of under performing products and a consequent need to

divest such products. Packaging is likely to be a key part of the products’ appeal and will be an area where constant innovation

is important.

Pricing raises a number of issues. Why is Churchill’s core product priced at £1 less than its immediate competition? What is

the basis on which Churchill prices this product? Each of the methods of pricing has its advantages and disadvantages. Using

cost plus may create an illusion of security in that all costs are covered, but at the same time raises issues as to whether

relevant costs have been included and allocated. Should the company price in anticipation of cost reductions as volume

increases? Should the basis for pricing be what your competitors are charging? As a luxury product one would assume that

its demand is relatively price inelastic: a significant increase in price e.g. £1 would lead to only a small reduction in quantity

demanded. Certainly, profit margins would be enhanced to help provide the financial resources the company needs if it is to

grow. One interesting issue on pricing is the extent to which it is pursuing a price skimming or price penetration policy –

evidence from the scenario suggests more of a price skimming policy in line with the luxury nature of the product.

Place is an equally important issue – the vertical integration strategy of the company has led to company-owned shops being

the main way customers can buy the product. At the same time, this distribution strategy has led to Churchill’s sales being

largely confined to one region in the UK – although it is the most populous. If Churchill has a desire to grow, does it do this

through expanding the number of company owned and franchised outlets or look for other channels of distribution in

particular the increasingly dominant supermarket chains? Each distribution strategy will have significant implications for other

elements in the marketing mix and for the resources and capabilities required in the company.

Finally, promotion is an interesting issue for the company. The relatively recent appointment of a sales and marketing director

perhaps reflects a need to balance the previous dominance of the manufacturing side of the business. Certainly there is

evidence to suggest that John Churchill is not convinced of the need to advertise. There are some real concerns about how

the brand is developed and promoted. Certainly sponsorship is now seen as a key part of the firm’s promotional strategy. The

company has a good reputation but customer access to the product is fairly limited. Overall there is scope for the company

to critically review its marketing mix and implement a very different mix if it wants to grow.

The four Ps above are very much the ‘hard’ elements in the marketing mix and Churchill in its desire to grow will need toensure that the ‘softer’ elements of people, physical evidence and processes are aligned to its ambitious strategy.

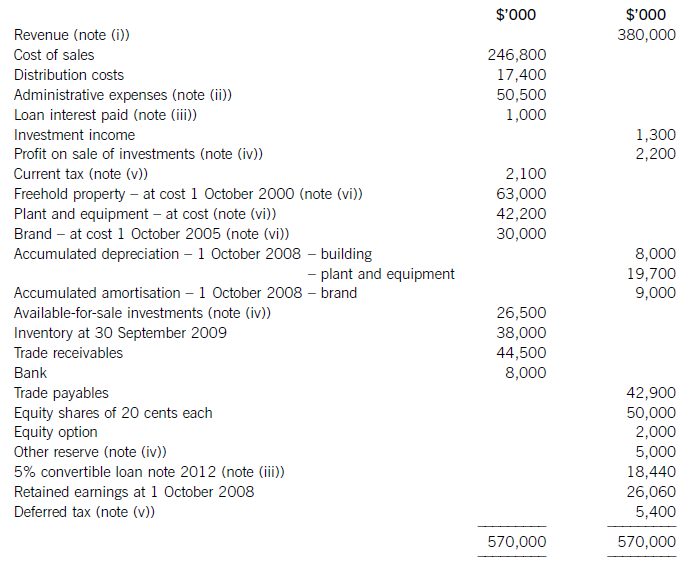

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities.

Additionally the directors wish to know how the provision for deferred taxation would be calculated in the following

situations under IAS12 ‘Income Taxes’:

(i) On 1 November 2003, the company had granted ten million share options worth $40 million subject to a two

year vesting period. Local tax law allows a tax deduction at the exercise date of the intrinsic value of the options.

The intrinsic value of the ten million share options at 31 October 2004 was $16 million and at 31 October 2005

was $46 million. The increase in the share price in the year to 31 October 2005 could not be foreseen at

31 October 2004. The options were exercised at 31 October 2005. The directors are unsure how to account

for deferred taxation on this transaction for the years ended 31 October 2004 and 31 October 2005.

(ii) Panel is leasing plant under a finance lease over a five year period. The asset was recorded at the present value

of the minimum lease payments of $12 million at the inception of the lease which was 1 November 2004. The

asset is depreciated on a straight line basis over the five years and has no residual value. The annual lease

payments are $3 million payable in arrears on 31 October and the effective interest rate is 8% per annum. The

directors have not leased an asset under a finance lease before and are unsure as to its treatment for deferred

taxation. The company can claim a tax deduction for the annual rental payment as the finance lease does not

qualify for tax relief.

(iii) A wholly owned overseas subsidiary, Pins, a limited liability company, sold goods costing $7 million to Panel on

1 September 2005, and these goods had not been sold by Panel before the year end. Panel had paid $9 million

for these goods. The directors do not understand how this transaction should be dealt with in the financial

statements of the subsidiary and the group for taxation purposes. Pins pays tax locally at 30%.

(iv) Nails, a limited liability company, is a wholly owned subsidiary of Panel, and is a cash generating unit in its own

right. The value of the property, plant and equipment of Nails at 31 October 2005 was $6 million and purchased

goodwill was $1 million before any impairment loss. The company had no other assets or liabilities. An

impairment loss of $1·8 million had occurred at 31 October 2005. The tax base of the property, plant and

equipment of Nails was $4 million as at 31 October 2005. The directors wish to know how the impairment loss

will affect the deferred tax provision for the year. Impairment losses are not an allowable expense for taxation

purposes.

Assume a tax rate of 30%.

Required:

(b) Discuss, with suitable computations, how the situations (i) to (iv) above will impact on the accounting for

deferred tax under IAS12 ‘Income Taxes’ in the group financial statements of Panel. (16 marks)

(The situations in (i) to (iv) above carry equal marks)

(b) (i) The tax deduction is based on the option’s intrinsic value which is the difference between the market price and exercise

price of the share option. It is likely that a deferred tax asset will arise which represents the difference between the tax

base of the employee’s service received to date and the carrying amount which will effectively normally be zero.

The recognition of the deferred tax asset should be dealt with on the following basis:

(a) if the estimated or actual tax deduction is less than or equal to the cumulative recognised expense then the

associated tax benefits are recognised in the income statement

(b) if the estimated or actual tax deduction exceeds the cumulative recognised compensation expense then the excess

tax benefits are recognised directly in a separate component of equity.

As regards the tax effects of the share options, in the year to 31 October 2004, the tax effect of the remuneration expensewill be in excess of the tax benefit.

The company will have to estimate the amount of the tax benefit as it is based on the share price at 31 October 2005.

The information available at 31 October 2004 indicates a tax benefit based on an intrinsic value of $16 million.

As a result, the tax benefit of $2·4 million will be recognised within the deferred tax provision. At 31 October 2005,

the options have been exercised. Tax receivable will be 30% x $46 million i.e. $13·8 million. The deferred tax asset

of $2·4 million is no longer recognised as the tax benefit has crystallised at the date when the options were exercised.

For a tax benefit to be recognised in the year to 31 October 2004, the provisions of IAS12 should be complied with as

regards the recognition of a deferred tax asset.

(ii) Plant acquired under a finance lease will be recorded as property, plant and equipment and a corresponding liability for

the obligation to pay future rentals. Rents payable are apportioned between the finance charge and a reduction of the

outstanding obligation. A temporary difference will effectively arise between the value of the plant for accounting

purposes and the equivalent of the outstanding obligation as the annual rental payments qualify for tax relief. The tax

base of the asset is the amount deductible for tax in future which is zero. The tax base of the liability is the carrying

amount less any future tax deductible amounts which will give a tax base of zero. Thus the net temporary differencewill be:

(iii) The subsidiary, Pins, has made a profit of $2 million on the transaction with Panel. These goods are held in inventory

at the year end and a consolidation adjustment of an equivalent amount will be made against profit and inventory. Pins

will have provided for the tax on this profit as part of its current tax liability. This tax will need to be eliminated at the

group level and this will be done by recognising a deferred tax asset of $2 million x 30%, i.e. $600,000. Thus any

consolidation adjustments that have the effect of deferring or accelerating tax when viewed from a group perspective will

be accounted for as part of the deferred tax provision. Group profit will be different to the sum of the profits of the

individual group companies. Tax is normally payable on the profits of the individual companies. Thus there is a need

to account for this temporary difference. IAS12 does not specifically address the issue of which tax rate should be used

calculate the deferred tax provision. IAS12 does generally say that regard should be had to the expected recovery or

settlement of the tax. This would be generally consistent with using the rate applicable to the transferee company (Panel)

rather than the transferor (Pins).

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-10

- 2020-04-14

- 2020-08-05

- 2020-02-26

- 2020-02-26

- 2020-09-05

- 2021-01-16

- 2020-01-03

- 2020-02-23

- 2019-01-06

- 2020-01-09

- 2020-01-09

- 2020-01-09

- 2020-01-10

- 2020-01-03

- 2019-01-06

- 2020-01-09

- 2020-01-10

- 2020-01-03

- 2019-01-17

- 2020-02-15

- 2020-01-09

- 2020-01-09

- 2020-02-23

- 2020-01-09

- 2020-01-01

- 2019-01-17

- 2020-01-09

- 2020-01-03

- 2020-02-26