ACCA证书注册及领取知识!

发布时间:2019-07-20

2019年6月ACCA考试已经结束,很多小伙伴已经开始准备9月份的考试了,但是尽管已经考过ACCA一个科目或者几个科目很多小伙伴对于ACCA的证书注册地信息仍不了解,ACCA在哪注册?ACCA注册后究竟有什么用?ACCA可以领取哪些证书?这些知识点相信很多小伙伴都不是太了解吧,为此小编特地整理了如下内容。

一、ACCA注册简介

ACCA是"英国特许公认会计师公会(The Association of Chartered Certified Accountants)的简称,是世界上领先的专业会计师团体,也是国际学员最多、学员规模发展最快的专业会计师组织。ACCA会员资格得到欧盟立法以及许多国家公司法的承认。

英国特许公认会计师公会(The Association of Chartered

Certified Accountants)简称ACCA,成立于1904年,是世界上领先的专业会计师团体,也是国际学员最多、学员规模发展最快的专业会计师组织。ACCA总部设在伦敦,在美国洛杉矶、加拿大多伦多、澳大利亚悉尼建有分会,在世界上70多个城市均设有办事处。

ACCA为全世界有志投身于财务、会计以及管理领域的专才提供首选的资格认证,一贯坚持最高的标准,提高财会人员的专业素质,职业操守以及监管能力,并秉承为公众利益服务的原则。

在英国,英国立法许可ACCA会员从事审计、投资顾问和破产执行的工作。ACCA会员资格得到欧盟立法以及许多国家公司法的承认。ACCA在欧洲会计专家协会(FEE)、亚太会计师联合会(CAPA)和加勒比特许会计师协会(ICAC)等会计组织中起着非常重要的作用。在国际上,ACCA是国际会计准则理事会(IASB)的创始成员,也是国际会计师联合会(IFAC)的成员。

二、ACCA证书

其实,每个阶段完成后,ACCA官方协会都会颁发相应的证书鼓励ACCA考试小伙伴继续考下去,同时这些证书都可以帮助你找实习找工作、升职加薪、申请国外留学等等

商业会计证书

当学员完成Knowledge部分——Accounting

in Business, Management Accounting, Financial Accounting这三门考试,并且通过基础阶段道德测试,即可获得商业会计证书。如已免试,无法获得此证书。

高级商业会计证书

当学员完成Skill部分——LW, PM,

TX, FR, AA, FM六门考试,并且完成道德测试模块,即可获得高级商业会计证书。如全部免试将无法获得此证书。

牛津布鲁克斯大学学士学位

考完ACCA前9门可申请英国牛津布鲁克斯大学应用会计学学士学位,想要申请学位需要提前提交英语成绩证明,并且写一篇英文论文,通过后即可获得此学位。

牛津布鲁克斯大学硕士学位

13门全部通过以后将有机会申请牛津布鲁克斯大学MBA硕士学位,需要去英国学习答辩,论文答辩通过即可获得硕士学位。

ACCA会员证书

通过13门考试,即可获得ACCA准会员证书。累计三年工作经验,即可申请转为正式ACCA member。

综上所述就是关于ACCA注册信息以及证书领取的全部内容希望对于各位正在备考的小伙伴们有帮助,小编将持续更新ACCA相关资讯。

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(c) Maxwell Co is audited by Lead & Co, a firm of Chartered Certified Accountants. Leo Sabat has enquired as to

whether your firm would be prepared to conduct a joint audit in cooperation with Lead & Co, on the future

financial statements of Maxwell Co if the acquisition goes ahead. Leo Sabat thinks that this would enable your

firm to improve group audit efficiency, without losing the cumulative experience that Lead & Co has built up while

acting as auditor to Maxwell Co.

Required:

Define ‘joint audit’, and assess the advantages and disadvantages of the audit of Maxwell Co being conducted

on a ‘joint basis’. (7 marks)

(c) A joint audit is when two or more audit firms are jointly responsible for giving the audit opinion. This is very common in a

group situation where the principal auditor is appointed jointly with the auditor of a subsidiary to provide a joint opinion on

the subsidiary’s financial statements. There are several advantages and disadvantages in a joint audit being performed.

Advantages

It can be beneficial in terms of audit efficiency for a joint audit to be conducted, especially in the case of a new subsidiary.

In this case, Lead & Co will have built up an understanding of Maxwell Co’s business, systems and controls, and financial

statement issues. It will be time efficient for the two firms of auditors to work together in order for Chien & Co to build up

knowledge of the new subsidiary. This is a key issue, as Chien & Co need to acquire a thorough understanding of the

subsidiary in order to assess any risks inherent in the company which could impact on the overall assessment of risk within

the group. Lead & Co will be able to provide a good insight into the company, and advise Chien & Co of the key risk areas

they have previously identified.

On the practical side, it seems that Maxwell Co is a significant addition to the group, as it is expected to increase operating

facilities by 40%. If Chien & Co were appointed as sole auditors to Maxwell Co it may be difficult for the audit firm to provide

adequate resources to conduct the audit at the same time as auditing the other group companies. A joint audit will allow

sufficient resources to be allocated to the audit of Maxwell Co, assuring the quality of the opinion provided.

If there is a tight deadline, as is common with the audit of subsidiaries, which should be completed before the group audit

commences, then having access to two firms’ resources should enable the audit to be completed in good time.

The audit should also benefit from an improvement in quality. The two audit firms may have different points of view, and

would be able to discuss contentious issues throughout the audit process. In particular, the newly appointed audit team will

have a ‘fresh pair of eyes’ and be able to offer new insight to matters identified. It should be easier to challenge management

and therefore ensure that the auditors’ position is taken seriously.

Tutorial note: Candidates may have referred to the recent debate over whether joint audits increase competition in the

profession. In particular, joint audits have been proposed as a way for ‘mid tier’ audit firms to break into the market of

auditing large companies and groups, which at the moment is monopolised by the ‘Big 4’. Although this does not answer

the specific question set, credit will be awarded for demonstration of awareness of this topical issue.

Disadvantages

For the client, it is likely to be more expensive to engage two audit firms than to have the audit opinion provided by one firm.

From a cost/benefit point of view there is clearly no point in paying twice for one opinion to be provided. Despite the audit

workload being shared, both firms will have a high cost for being involved in the audit in terms of senior manager and partner

time. These costs will be passed on to the client within the audit fee.

The two audit firms may use very different audit approaches and terminology. This could make it difficult for the audit firms

to work closely together, negating some of the efficiency and cost benefits discussed above. Problems could arise in deciding

which firm’s method to use, for example, to calculate materiality, design and pick samples for audit procedures, or evaluate

controls within the accounting system. It may be impossible to reconcile two different methods and one firm’s methods may

end up dominating the audit process, which then eliminates the benefit of a joint audit being conducted. It could be time

consuming to develop a ‘joint’ audit approach, based on elements of each of the two firms’ methodologies, time which

obviously would not have been spent if a single firm was providing the audit.

There may be problems for the two audit firms to work together harmoniously. Lead & Co may feel that ultimately they will

be replaced by Chien & Co as audit provider, and therefore could be unwilling to offer assistance and help.

Potentially, problems could arise in terms of liability. In the event of litigation, because both firms have provided the audit

opinion, it follows that the firms would be jointly liable. The firms could blame each other for any negligence which was

discovered, making the litigation process more complex than if a single audit firm had provided the opinion. However, it could

be argued that joint liability is not necessarily a drawback, as the firms should both be covered by professional indemnity

insurance.

Big Cheese Chairs (BCC) manufactures and sells executive leather chairs. They are considering a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

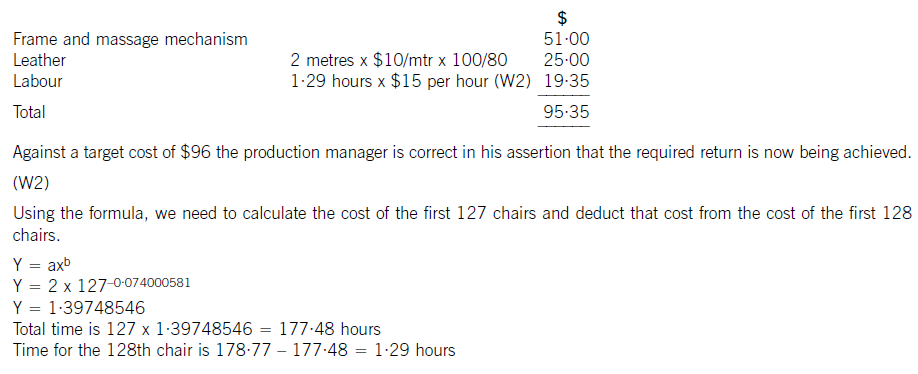

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

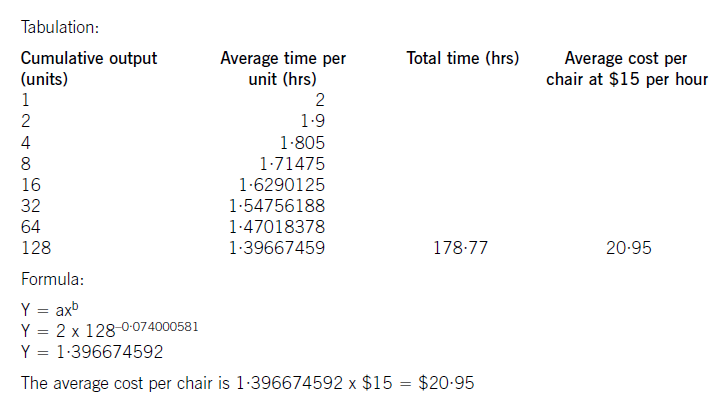

(W1)

The cost of the labour can be calculated using learning curve principles. The formula can be used or a tabular approach would

also give the average cost of 128 chairs. Both methods are acceptable and shown here.

(b) To reduce the cost gap various methods are possible (only four are needed for full marks)

– Re-design the chair to remove unnecessary features and hence cost

– Negotiate with the frame. supplier for a better cost. This may be easier as the volume of sales improve as suppliers often

are willing to give discounts for bulk buying. Alternatively a different frame. supplier could be found that offers a better

price. Care would be needed here to maintain the required quality

– Leather can be bought from different suppliers or at a better price also. Reducing the level of waste would save on cost.

Even a small reduction in waste rates would remove much of the cost gap that exists

– Improve the rate of learning by better training and supervision

– Employ cheaper labour by reducing the skill level expected. Care would also be needed here not to sacrifice quality or

push up waste rates.

(c) The cost of the 128th chair will be:

(d) What criteria would you use to assess whether Universal is an ‘excellent’ company? (5 marks)

(d) One of the most widely used models to identify excellence is that of Peters and Waterman developed in their research into

excellent American companies. Interestingly, they agreed with Leavitt in that the companies identified as excellent, whether

they were manufacturers or service businesses, could be seen as offering an excellent service to their customers. This required

them to understand what their customers really valued and then put in place the resources, competences and decision making

processes that delivered the desired attributes. Excellence was positively associated with innovation. Using their checklist of

excellent attributes, Universal could see to be excellent in the following ways:

A bias for action – there is evidence to suggest that both Matthew and Simon are action orientated. They showed an admirable

willingness to experiment and develop a service that added significant value to the customer experience.

Hands-on, value driven – again, the commitment to deliver a quality service – one that they are totally familiar with and able

to deliver themselves – suggests that this value is communicated and shared with staff. The use of self employed installers

and sales people make this commitment particularly important.

Close to the customer – all the evidence points to a real and deep understanding of customer needs. The opportunity for the

business stems from the poor customer service provided by their small competitors. Systems are designed to achieve the ‘no

surprises’ service, which leads to significant levels of customer recommendation and advocacy.

Autonomy and entrepreneurship – there is evidence of a strong belief that individuals and teams should be encouraged to

compete with one another, but not in ways that compromise the quality of the service delivered.

Simple form. – lean staff – Universal is a small functionally managed firm. There is no evidence of creating a large

headquarters, since managers are closely involved with the day-to-day management of their function.

Productivity through people – people are key to the service provided and there is recognition that teams are crucial to the

firm’s growth and success.

Simultaneous loose-tight properties – more difficult to identify in a small company, but there is clearly commitment to shared

values and giving people the freedom to achieve results within this value framework.

These measures of excellence again show the importance of ‘hard’ and ‘soft’ factors in achieving outstanding performance.

An alternative interpretation is to see these attributes as critical success factors, which if achieved, are clearly linked to key

performance indicators. Universal’s growth shows the link between strategy and the qualities needed to achieve this growth.

The ubiquitous balanced scorecard could also be used to measure four key criteria of company performance and

benchmarking the company against the major installers could also provide evidence of excellence. The recent gaining of a

government award for Universal’s contribution to inner city job creation is also a useful indicator of all round excellence.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-09

- 2020-01-09

- 2020-01-09

- 2019-07-20

- 2020-01-09

- 2020-09-04

- 2020-01-09

- 2020-01-09

- 2020-02-27

- 2019-07-20

- 2020-01-09

- 2020-04-22

- 2019-07-20

- 2020-02-29

- 2020-02-29

- 2019-07-20

- 2020-03-04

- 2020-01-09

- 2020-02-29

- 2019-07-20

- 2019-07-20

- 2020-05-20

- 2020-09-04

- 2020-09-04

- 2020-01-09

- 2020-01-09

- 2020-02-29

- 2020-09-04

- 2020-01-09

- 2021-05-23