在宁夏,ACCA考试通过了你不这样做你还是不能拿到证书

发布时间:2020-01-08

近些年,随着各式各样的考试风靡全国以来,ACCA证书也是从众多资格证书里脱颖而出,逐渐映入大众的眼帘。了解它的人称之为“金饭碗”,那么有些通过所以ACCA考试全部科目的小伙伴就来咨询51题库考试学习网,成绩通过之后,证书是怎么样领取呢?是等待官方邮寄过来?还是自己去申请领证呢?这些疑问51题库考试学习网会为大家逐一解决,请大家耐心地往下看哟~

首先要恭喜你成为了ACCA准会员了,当你通过14门ACCA考试的那一科开始,你就成为准会员了。但是需要注意的是从准会员并不是会员,想从准会员到ACCA会员,这些事情你必须要做:

1.ACCA每年2月份和8月份会分别公布12月份和6月份的考试成绩。每一个通过ACCA全部考试的学员随后会收到ACCA英国总部邮寄的《ACCA会员或准会员申请手册》(一般收到时间是3月初和9月初)。每人必须根据自身的情况,如是否满足ACCA相关工作经验要求,向ACCA英国申请成为会员或准会员。

2.ACCA总部收到学员申请后,不论是申请会员和准会员,都会给学员颁发ACCA准会员证书,以确认学员成功通过所有考试。

3.对于申请会员的学员,要求如实填写会员申请手册,并总结平时记录的STR(Student Training Record)中的主要工作经历和取得的工作能力,填入申请手册(在递交会员申请表时,可以暂时不提交STR,但是,一旦ACCA英国总部通知需要提交STR,以便了解更详细的信息完成评估,学员需要再补交STR)。ACCA英国总部会对学员所填的工作记录进行评估和并与其监督人联系进行核查,确认无误后,则批准其成为ACCA会员,一般这个过程需要两个月的时间。

4.如果学员在规定的时间内没有收到以上申请手册,可以直接登陆ACCA全球官网下载。

5.对于暂时未满足工作经验的准会员,可以在条件满足的任何时间向ACCA递交ACCA会员申请表。

完成了以上所有步骤之后,你就算是成功申请ACCA会员了,只需要等待官方发送证书即可。

都说,阳光总在风雨后,当你拿到通过自己努力获得的证书时,那份喜悦肯定是独一无二的,那一刻你也明白了自己的努力是值得的;所以,为了那一天的到来,各位ACCAer们加油复习,早日完成目标~

下面小编为大家准备了 ACCA考试 的相关考题,供大家学习参考。

(ii) Analyse why moving to a ‘no frills’ low-cost strategy would be inappropriate for ONA.

Note: requirement (b) (ii) includes 3 professional marks (16 marks)

(ii) ‘No frills’ low-cost budget airlines are usually associated with the following characteristics. Each of these characteristics

is considered in the context of Oceania National Airlines (ONA).

– Operational economies of scale

Increased flight frequency brings operational economies and is attractive to both business and leisure travellers. In

the international sector where ONA is currently experiencing competition from established ‘no frills’ low-cost budget

airlines ONA has, on average, one flight per day to each city. It would have to greatly extend its flight network, flight

frequency and the size of its aircraft fleet if it planned to become a ‘no frills’ carrier in this sector. This fleet

expansion appears counter to the culture of an organisation that has expanded very gradually since its formation.

Table 1 shows only three aircraft added to the fleet in the period 2004–2006. It is likely that the fleet size would

have to double for ONA to become a serious ‘no frills’ operator in the international sector. In the regional sector, the

flight density, an average of three flights per day, is more characteristic of a ‘no frills’ airline. However, ONA would

have to address the relatively low utilisation of its aircraft (see Tables 1 and 2) and the cost of maintenance

associated with a relatively old fleet of aircraft.

– Reduced costs through direct sales

On-line booking is primarily aimed at eliminating commission sales (usually made through travel agents). ‘No frills’

low-cost budget airlines typically achieve over 80% of their sales on-line. The comparative figure for ONA (see

Table 2) is 40% for regional sales and 60% for international sales, compared with an average of 84% for their

competitors. Clearly a major change in selling channels would have to take place for ONA to become a ‘no frills’

low-cost budget airline. It is difficult to know whether this is possible. The low percentage of regional on-line sales

seems to suggest that the citizens of Oceania may be more comfortable buying through third parties such as travel

agents.

– Reduced customer service

‘No frills’ low-cost budget airlines usually do not offer customer services such as free meals, free drinks and the

allocation of passengers to specific seats. ONA prides itself on its in-flight customer service and this was one of the

major factors that led to its accolade as Regional Airline of the Year. To move to a ‘no frills’ strategy, ONA would

have to abandon a long held tradition of excellent customer service. This would require a major cultural change

within the organisation. It would also probably lead to disbanding the award winning (Golden Bowl) catering

department and the redundancies of catering staff could prove difficult to implement in a heavily unionised

organisation.

Johnson, Scholes and Whittington have suggested that if an organisation is to ‘achieve competitive advantage through

a low price strategy then it has two basic choices. The first is to try and identify a market segment which is unattractive

(or inaccessible) to competitors and in this way avoid competitive pressures to erode price.’ It is not possible for ONA to

pursue this policy in the international sector because of significant competition from established continental ‘no frills’

low-cost budget airlines. It may be a candidate strategy for the regional sector, but the emergence of small ‘no frills’ lowcost

budget airlines in these countries threaten this. Many of these airlines enter the market with very low overheads

and use the ‘no frills’ approach as a strategy to gain market share before progressing to alternative strategies.

Secondly, a ‘no frills’ strategy depends for its success on margin. Johnson, Scholes and Whittington suggest that ‘in the

long run, a low price strategy cannot be pursued without a low-cost base’. Evidence from the scenario suggests that ONA

does not have a low cost base. It continues to maintain overheads (such as a catering department) that its competitors

have either disbanded or outsourced. More fundamentally (from Table 2), its flight crew enjoy above average wages and

the whole company is heavily unionised. The scenario acknowledges that the company pays above industry salaries and

offers excellent benefits such as a generous non-contributory pension. Aircraft utilisation and aircraft age also suggest a

relatively high cost base. The aircraft are older than their competitors and presumably incur greater maintenance costs.

ONA’s utilisation of its aircraft is also lower than its competitors. It seems highly unlikely that ONA can achieve the

changes required in culture, cost base and operations required for it to become a ‘no frills’ low-cost budget airline. Other

factors serve to reinforce this. For example:

– Many ‘no frills’ low-cost budget airlines fly into airports that offer cheaper taking off and landing fees. Many of these

airports are relatively remote from the cities they serve. This may be acceptable to leisure travellers, but not to

business travellers – ONA’s primary market in the regional sector.

– Most ‘no frills’ low-cost budget airlines have a standardised fleet leading to commonality and familiarity in

maintenance. Although ONA has a relatively small fleet it is split between three aircraft types. This is due to

historical reasons. The Boeing 737s and Airbus A320s appear to be very similar aircraft. However, the Boeings

were inherited from OceaniaAir and the Airbuses from Transport Oceania.

In conclusion, the CEO’s decision to reject a ‘no frills’ strategy for ONA appears to be justifiable. It would require major

changes in structure, cost and culture that would be difficult to justify given ONA’s current position. Revolution is the

term used by Baligan and Hope to describe a major rapid strategic change. It is associated with a sudden transformation

required to react to extreme pressures on the organisation. Such an approach is often required when the company is

facing a crisis and needs to quickly change direction. There is no evidence to support the need for a radical

transformation. This is why the CEO brands the change to a ‘no frills’ low-cost budget airline as ‘unnecessary’. The

financial situation (Table 3) is still relatively healthy and there is no evidence of corporate predators. It can be argued

that a more incremental approach to change would be beneficial, building on the strengths of the organisation and the

competencies of its employees. Moving ONA to a ‘no frills’ model would require seismic changes in cost and culture. If

ONA really wanted to move into this sector then they would be better advised to start afresh with a separate brand andairline and to concentrate on the regional sector where it has a head start over many of its competitors.

Shoe Co, a shoe manufacturer, has developed a new product called the ‘Smart Shoe’ for children, which has a built-in tracking device. The shoes are expected to have a life cycle of two years, at which point Shoe Co hopes to introduce a new type of Smart Shoe with even more advanced technology. Shoe Co plans to use life cycle costing to work out the total production cost of the Smart Shoe and the total estimated profit for the two-year period.

Shoe Co has spent $5·6m developing the Smart Shoe. The time spent on this development meant that the company missed out on the opportunity of earning an estimated $800,000 contribution from the sale of another product.

The company has applied for and been granted a ten-year patent for the technology, although it must be renewed each year at a cost of $200,000. The costs of the patent application were $500,000, which included $20,000 for the salary costs of Shoe Co’s lawyer, who is a permanent employee of the company and was responsible for preparing the application.

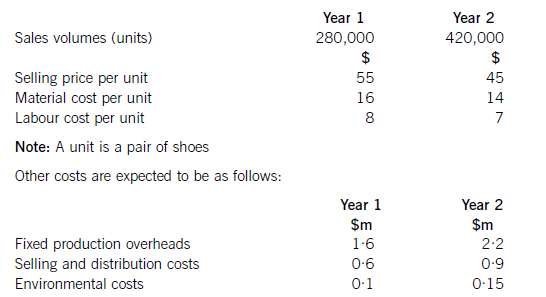

The following information is also available for the next two years:

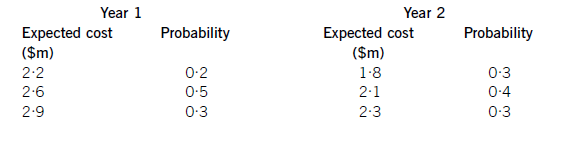

Shoe Co is still negotiating with marketing companies with regard to its advertising campaign, so is uncertain as to what the total marketing costs will be each year. However, the following information is available as regards the probabilities of the range of costs which are likely to be incurred:

Required:

Applying the principles of life cycle costing, calculate the total expected profit for Shoe Co for the two-year period.

(10 marks)

Totalsalesrevenue=(280,000x$55)+(420,000x$45)=$15·4m+18·9m=$34·3m.NoteTheexpectedprofithasbeencalculatedusinglifecyclecostingnotrelevantcosting.Hence,the$20,000salarycostincludedinpatentcostsshouldbeincludedinthelifecyclecost.Similarly,theopportunitycostof$800,000isnotincludedusinglifecyclecostingwhereasifrelevantcostingwasbeingusedtodecideonaparticularcourseofaction,theopportunitycostwouldbeincluded.Working1Expectedmarketingcostinyear1:(0·2x$2·2m)+(0·5x$2·6m)+(0·3x$2·9m)=$2·61mExpectedmarketingcostyear2:(0·3x$1·8m)+(0·4x$2·1m)+(0·3x$2·3m)=$2·07mTotalexpectedmarketingcost=$4·68m

6 Charles and Jane Miro, aged 31 and 34 years respectively, have been married for ten years and have two children

aged six and eight years. Charles is a teacher but for the last five years he has stayed at home to look after their

children. Jane works as a translator for Speak Write Ltd.

Speak Write Ltd was formed and began trading on 6 April 2006. It provides translation services to universities. Jane,

who ceased employment with Barnham University to found the company, owns 100% of its ordinary share capital

and is its only employee.

Speak Write Ltd has translated documents for four different universities since it began trading. Its biggest client is

Barnham University which represents 70% of the company’s gross income. It is estimated that the company’s gross

fee income for its first 12 months of trading will be £110,000. Speak Write Ltd usually agrees fixed fees in advance

with its clients although it charges for some projects by reference to the number of days taken to do the work. None

of the universities makes any payment to Speak Write Ltd in respect of Jane being on holiday or sick.

All of the universities insist that Jane does the work herself. Jane carries out the work for three of the universities in

her office at home using a computer and specialised software owned by Speak Write Ltd. The work she does for

Barnham University is done in the university’s library on one of its computers as the documents concerned are too

delicate to move.

The first set of accounts for Speak Write Ltd will be drawn up for the year ending 5 April 2007. It is estimated that

the company’s tax adjusted trading profit for this period will be £52,500. This figure is after deducting Jane’s salary

of £4,000 per month and the related national insurance contributions but before any adjustments required by the

application of the personal service companies (IR 35) legislation. The company has no other sources of income or

capital gains.

Jane has not entered into any communication with HM Revenue and Customs (HMRC) with respect to the company

and wants to know:

– When the corporation tax computation should be submitted and when the tax is due.

– When the corporation tax computation can be regarded as having been agreed by HMRC.

Charles and Jane have requested a meeting to discuss the family’s finances. In particular, they wish to consider the

shortfall in the family’s annual income and any other related issues if Jane were to die. Their mortgage is covered

by a term assurance policy but neither of them have made any pension contributions or carried out any other long

term financial planning.

Jane has estimated that her annual after tax income from Speak Write Ltd, on the assumption that she extracts all of

the company’s profits, will be £58,000. Charles owns two investment properties that together generate after tax

income of £8,500. He estimates that he could earn £28,000 after tax if he were to return to work.

The couple’s annual surplus income, after payment of all household expenditure including mortgage payments of

£900 per month, is £21,000. Charles and Jane have no other sources of income.

Required:

(a) Write a letter to Jane setting out:

(i) the arguments that HMRC could put forward, based only on the facts set out above, in support of

applying the IR 35 legislation to Speak Write Ltd; and

(ii) the additional income tax and national insurance contributions that would be payable, together with

their due date of payment, if HMRC applied the IR 35 legislation to all of the company’s income in

2006/07. (11 marks)

4 (a) Router, a public limited company operates in the entertainment industry. It recently agreed with a television

company to make a film which will be broadcast on the television company’s network. The fee agreed for the

film was $5 million with a further $100,000 to be paid every time the film is shown on the television company’s

channels. It is hoped that it will be shown on four occasions. The film was completed at a cost of $4 million and

delivered to the television company on 1 April 2007. The television company paid the fee of $5 million on

30 April 2007 but indicated that the film needed substantial editing before they were prepared to broadcast it,

the costs of which would be deducted from any future payments to Router. The directors of Router wish to

recognise the anticipated future income of $400,000 in the financial statements for the year ended 31 May

2007. (5 marks)

Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.

(a) Under IAS18 ‘Revenue’, revenue on a service contract is recognised when the outcome of the transaction can be measured

reliably. For revenue arising from the rendering of services, provided that all of the following criteria are met, revenue should

be recognised by reference to the stage of completion of the transaction at the balance sheet date (the percentage-ofcompletion

method) (IAS18 para 20):

(a) the amount of revenue can be measured reliably;

(b) it is probable that the economic benefits will flow to the seller;

(c) the stage of completion at the balance sheet date can be measured reliably; and

(d) the costs incurred, or to be incurred, in respect of the transaction can be measured reliably.

When the above criteria are not met, revenue arising from the rendering of services should be recognised only to the extent

of the expenses recognised that are recoverable. Because the only revenue which can be measured reliably is the fee for

making the film ($5 million), this should therefore be recognised as revenue in the year to 31 May 2007 and matched against

the cost of the film of $4 million. Only when the television company shows the film should any further amounts of $100,000

be recognised as there is an outstanding ‘performance’ condition in the form. of the editing that needs to take place before the

television company will broadcast the film. The costs of the film should not be carried forward and matched against

anticipated future income unless they can be deemed to be an intangible asset under IAS 38 ‘Intangible Assets’. Additionally,

when assessing revenue to be recognised in future years, the costs of the editing and Router’s liability for these costs should

be assessed.

声明:本文内容由互联网用户自发贡献自行上传,本网站不拥有所有权,未作人工编辑处理,也不承担相关法律责任。如果您发现有涉嫌版权的内容,欢迎发送邮件至:contact@51tk.com 进行举报,并提供相关证据,工作人员会在5个工作日内联系你,一经查实,本站将立刻删除涉嫌侵权内容。

- 2020-01-08

- 2019-07-20

- 2020-01-08

- 2020-01-08

- 2019-12-06

- 2019-07-20

- 2020-01-08

- 2020-01-08

- 2019-07-20

- 2019-07-20

- 2020-01-03

- 2020-01-08

- 2019-07-20

- 2020-09-04

- 2020-01-08

- 2019-07-20

- 2020-01-08

- 2020-01-08

- 2020-02-29

- 2019-07-20

- 2020-01-08

- 2020-02-29

- 2020-01-08

- 2020-01-08

- 2019-07-20

- 2019-07-20

- 2020-01-08

- 2020-02-29

- 2020-01-08

- 2020-02-29